Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

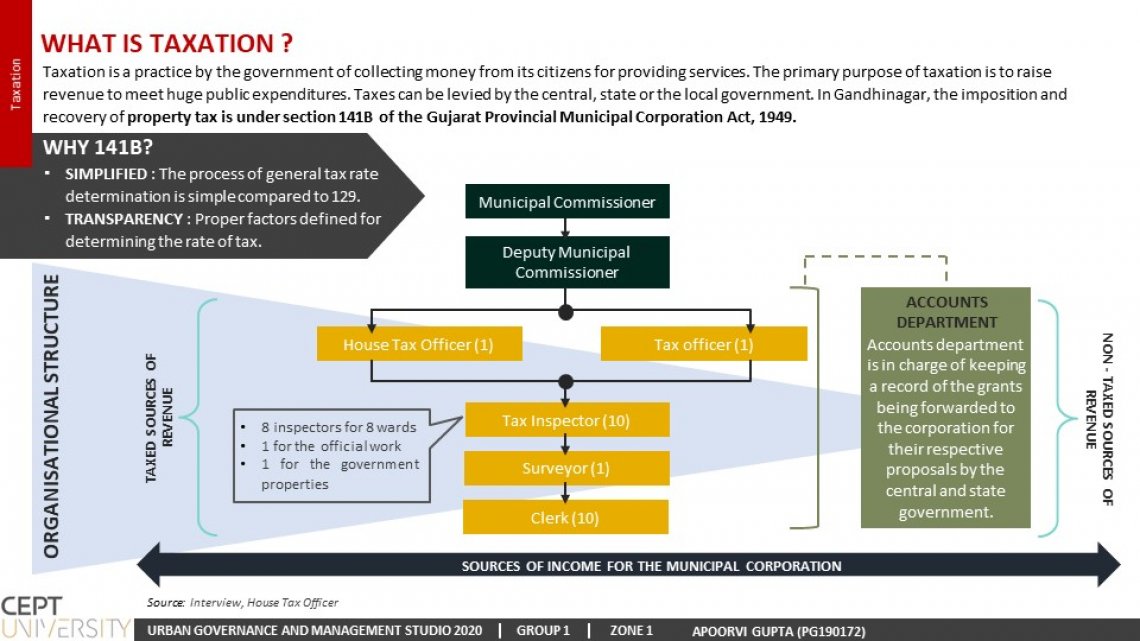

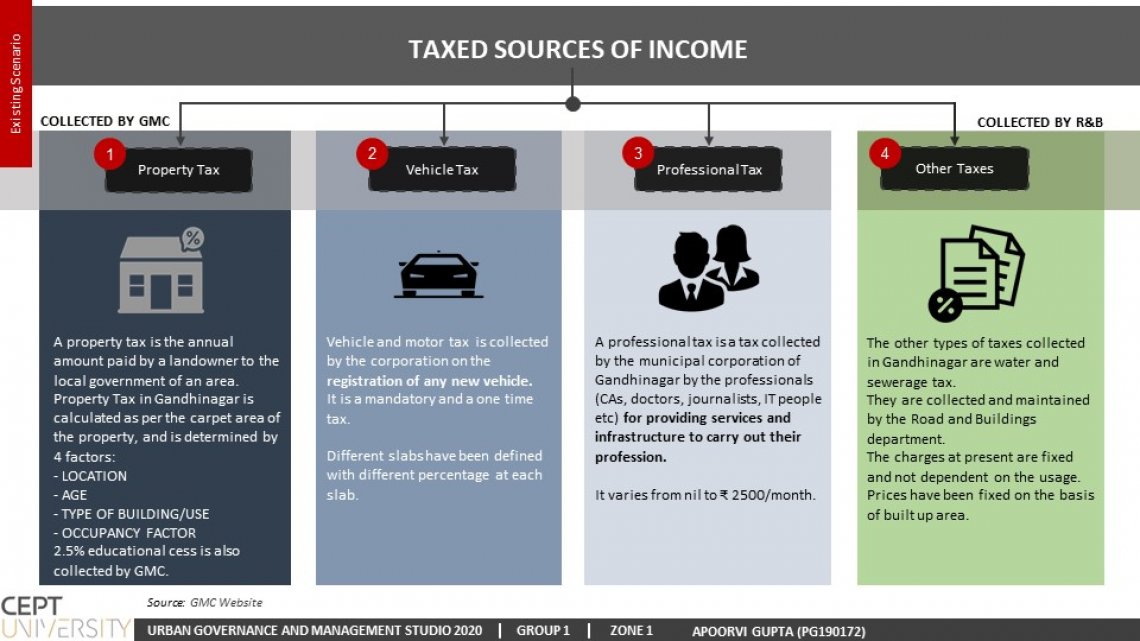

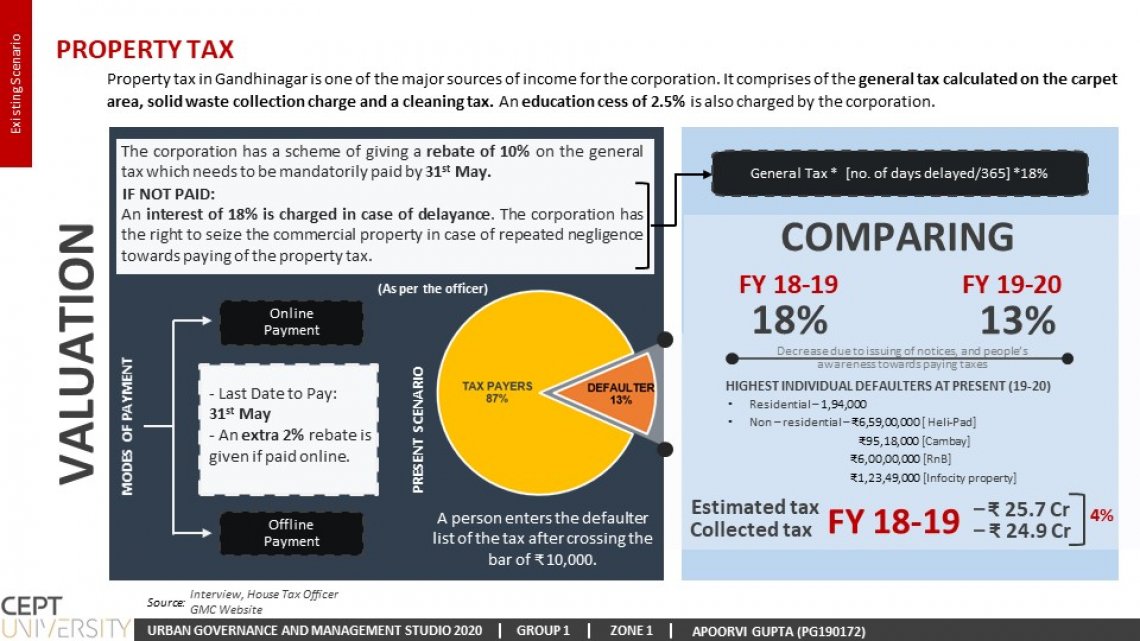

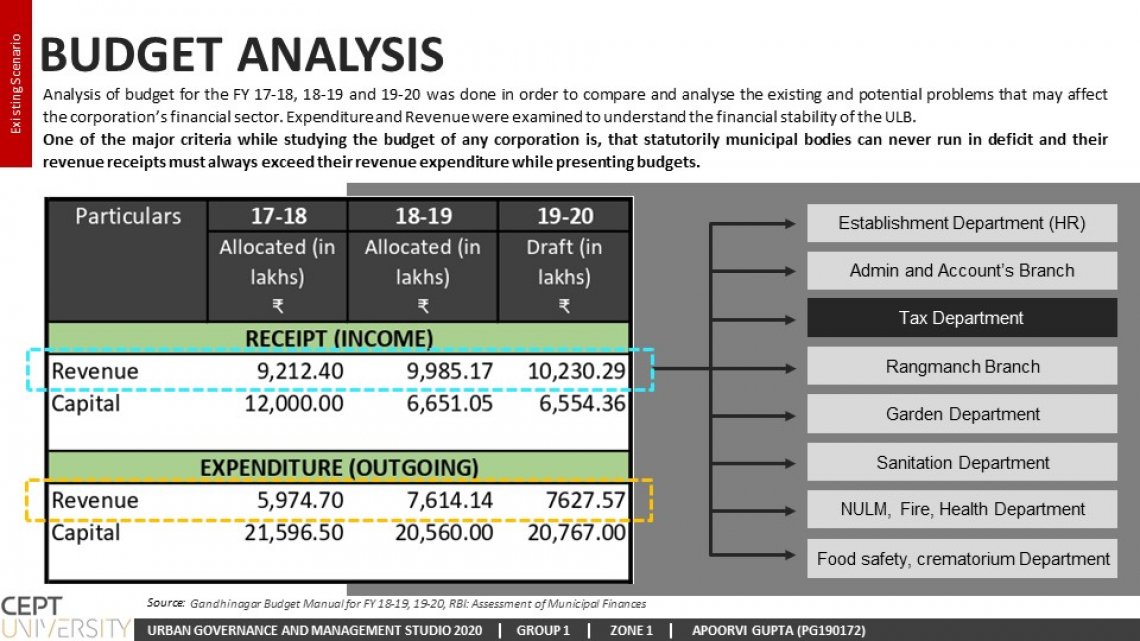

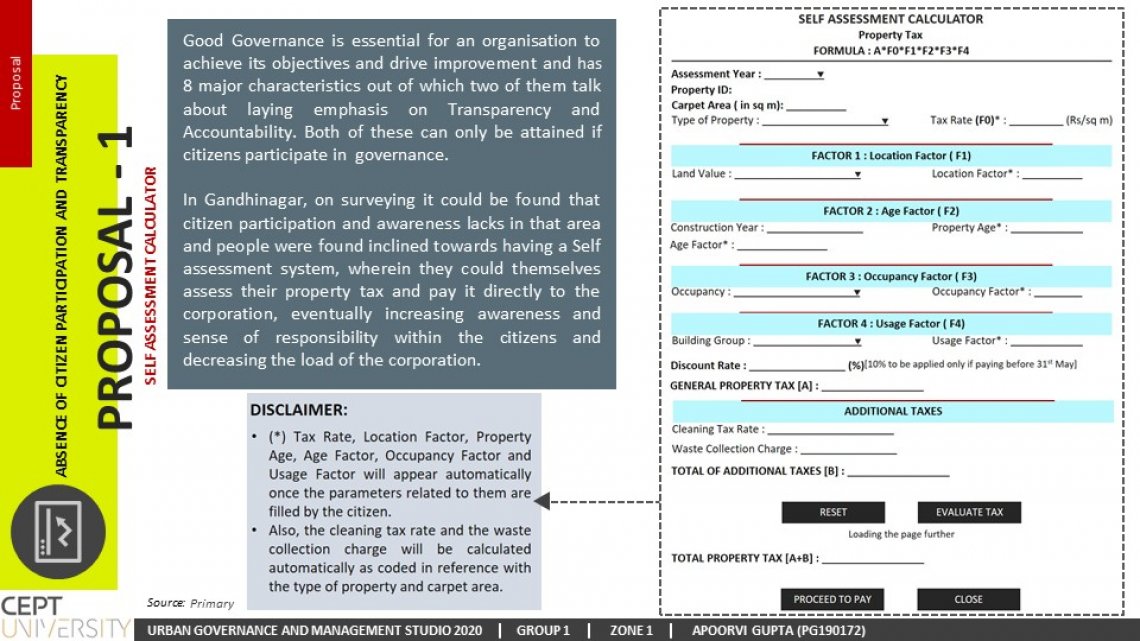

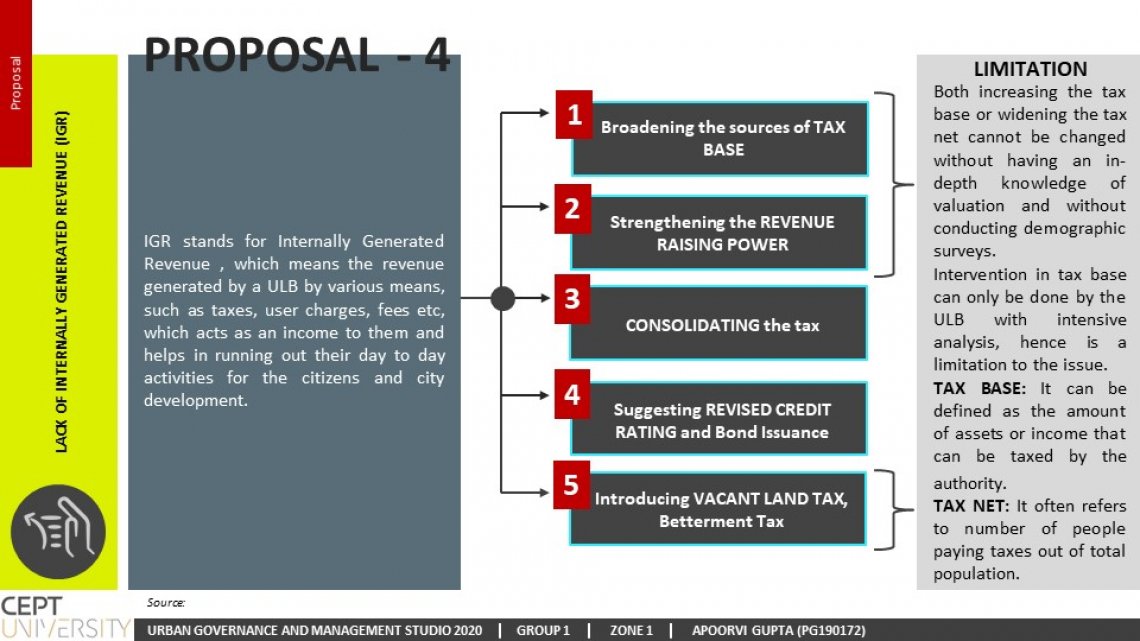

Property tax is the major source of revenue for municipal bodies of the country and is essential for the growth and development of the country. A tax can be defined as a compulsory exaction of money by public authority for public purposes enforceable by the law. Different cities have different methods and formulas for calculating the annual value of the property which is estimated to contribute to 0.2% of the annual GDP of the country. This number is significantly large in many other countries (not more than 3%) compared to India. In India, the municipal corporation of a particular area assesses and imposes the property tax annually or semi annually, and late payment can attract a fine in the form of interest on the amount due, which can be up to 2% per month. The tax amount is based on the area, construction, property size, building etc.

Property tax comprises taxes like lighting tax, water tax and drainage tax. The primary purpose of taxation is to raise revenue to meet huge public expenditures. These taxes are a source of revenue which finance the activities of local government. It is also important to note that the onus of paying property tax is with the owner, and not the occupant of the property.