Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

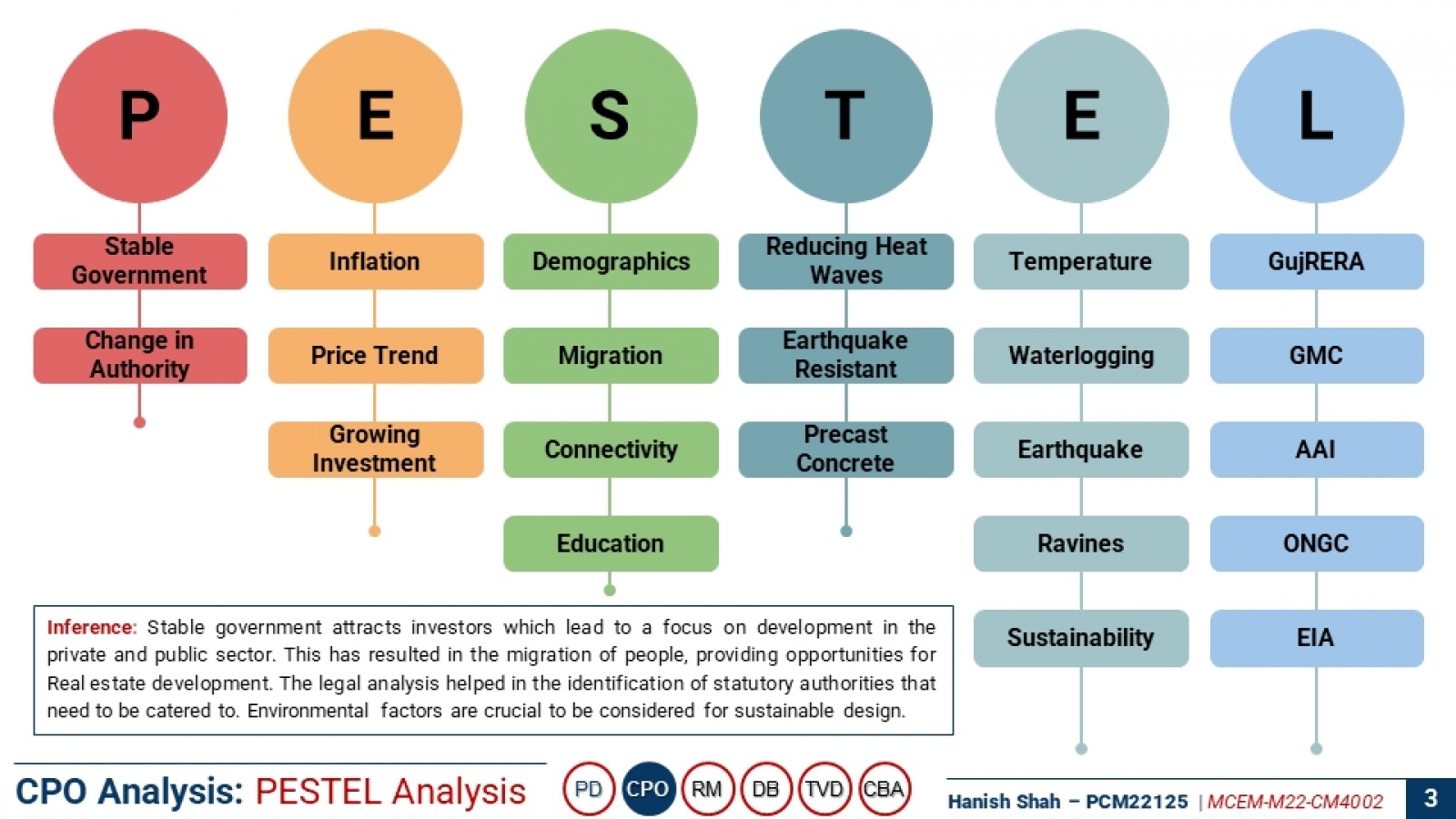

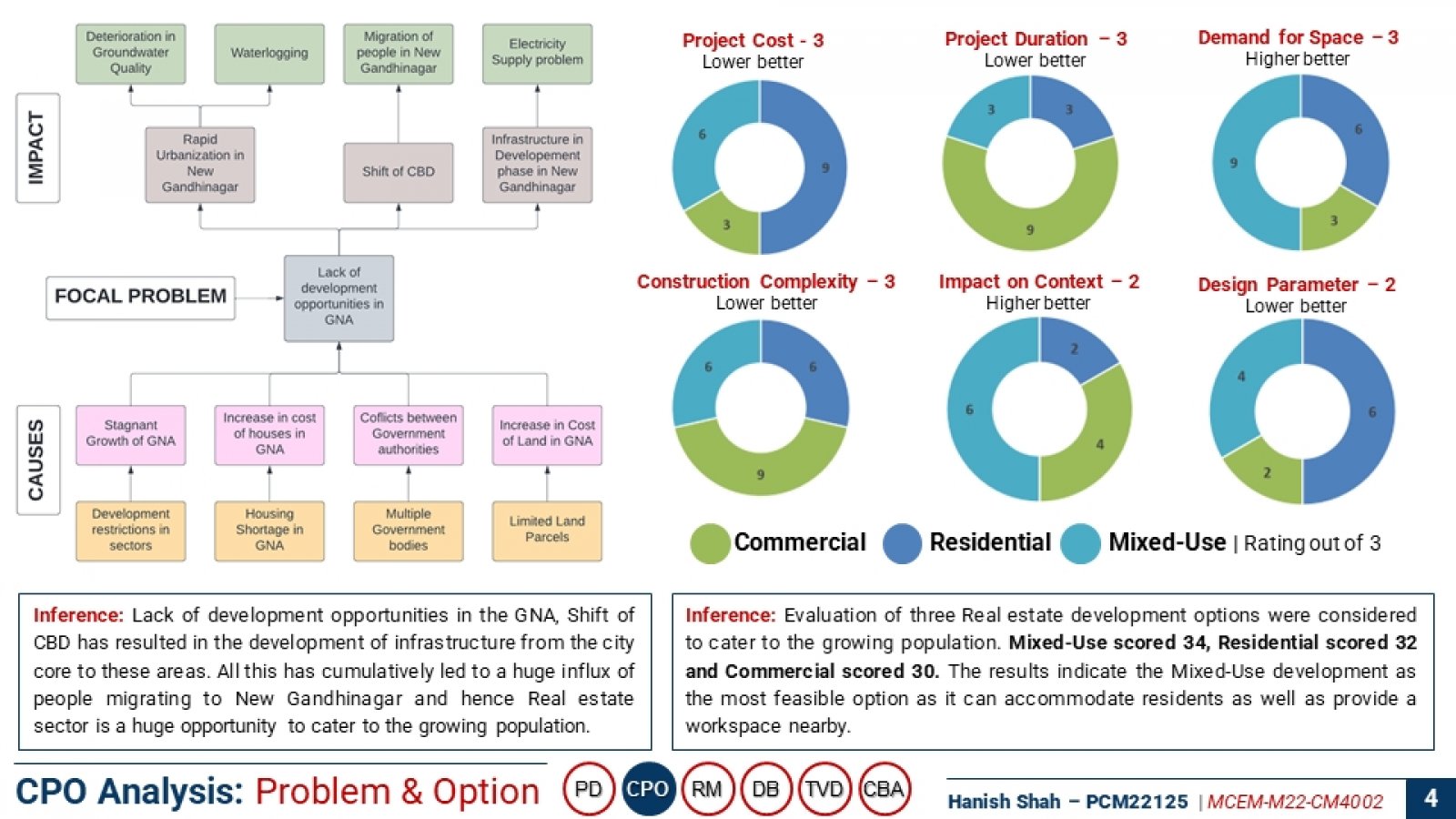

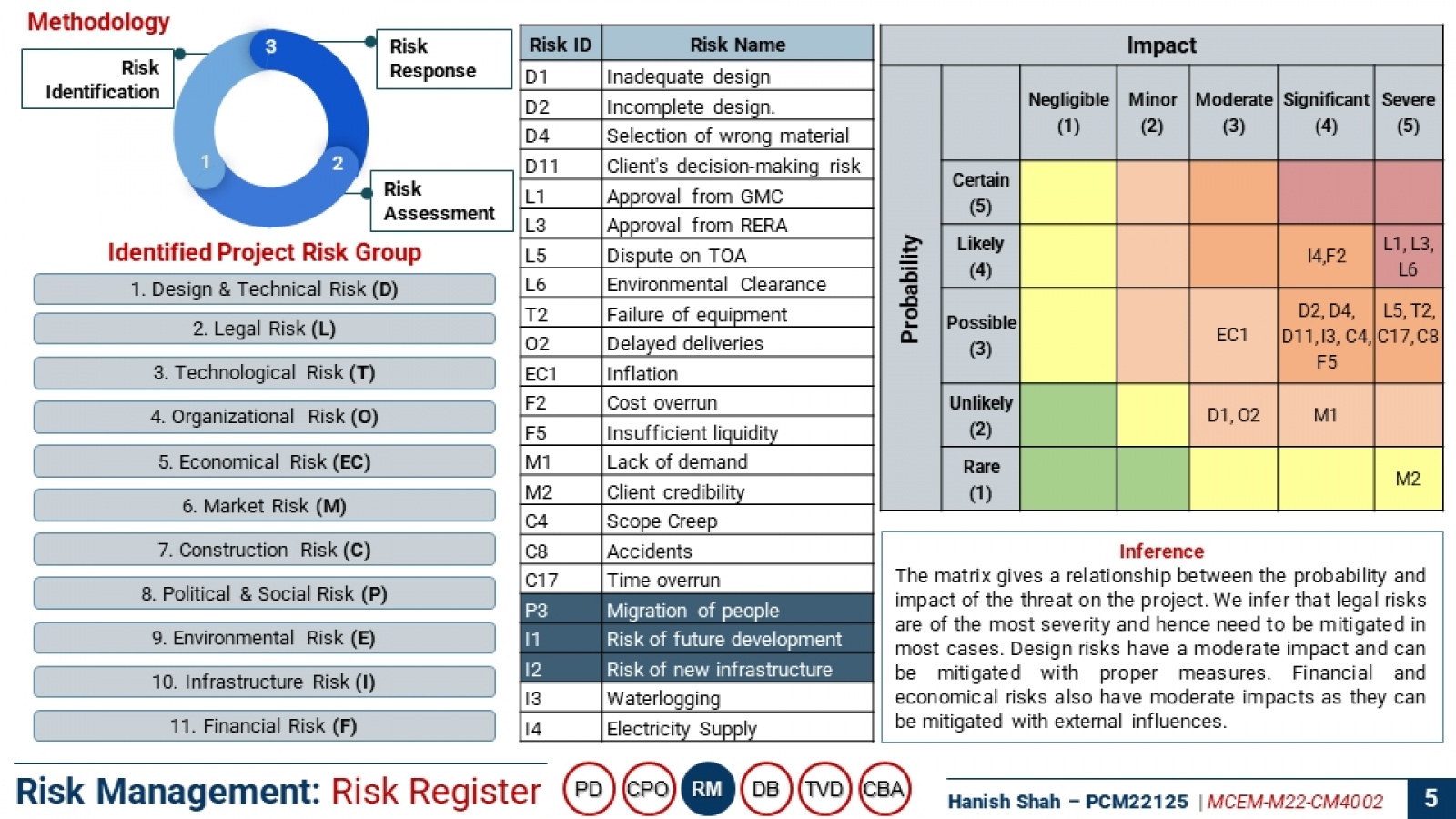

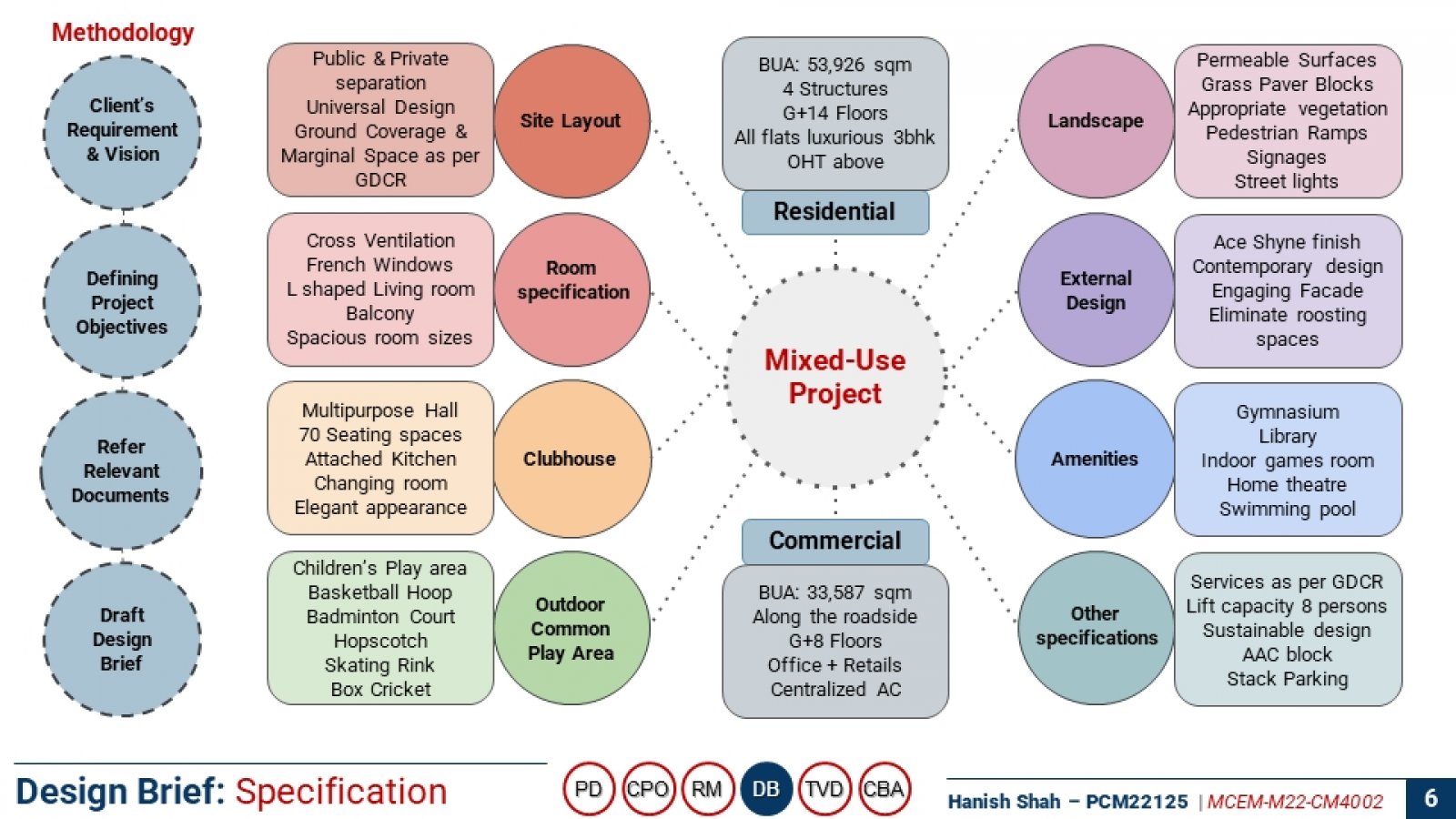

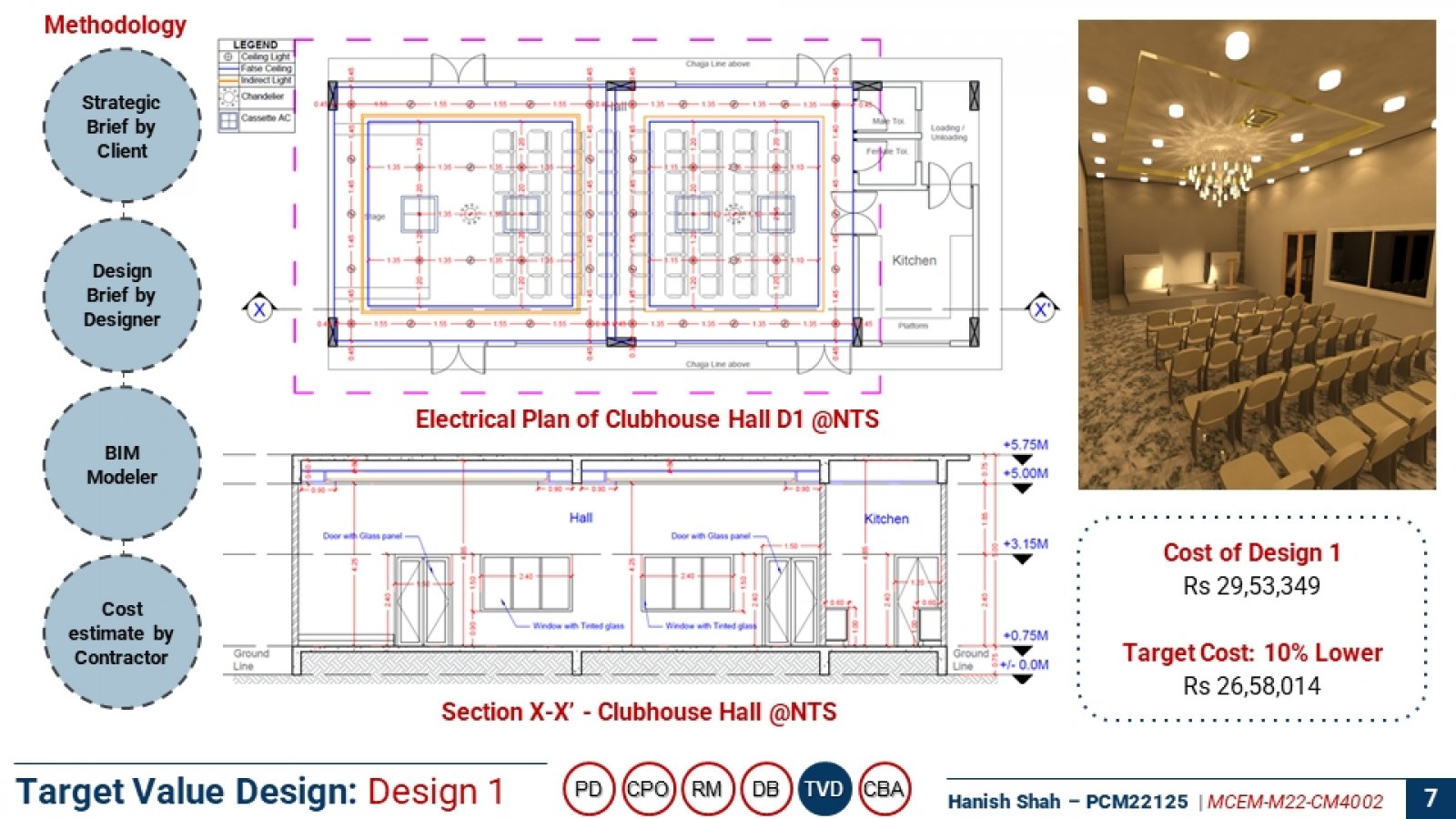

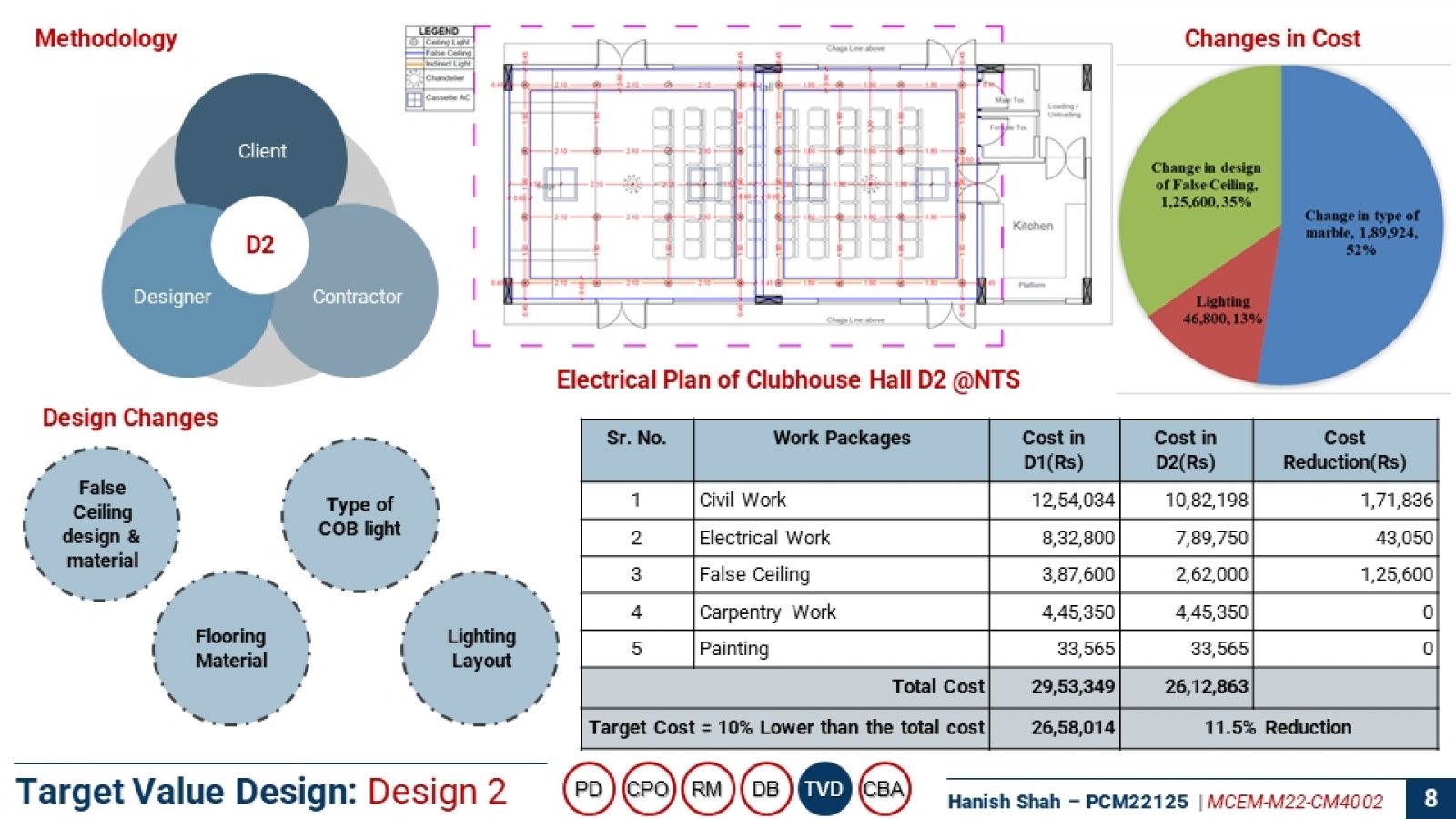

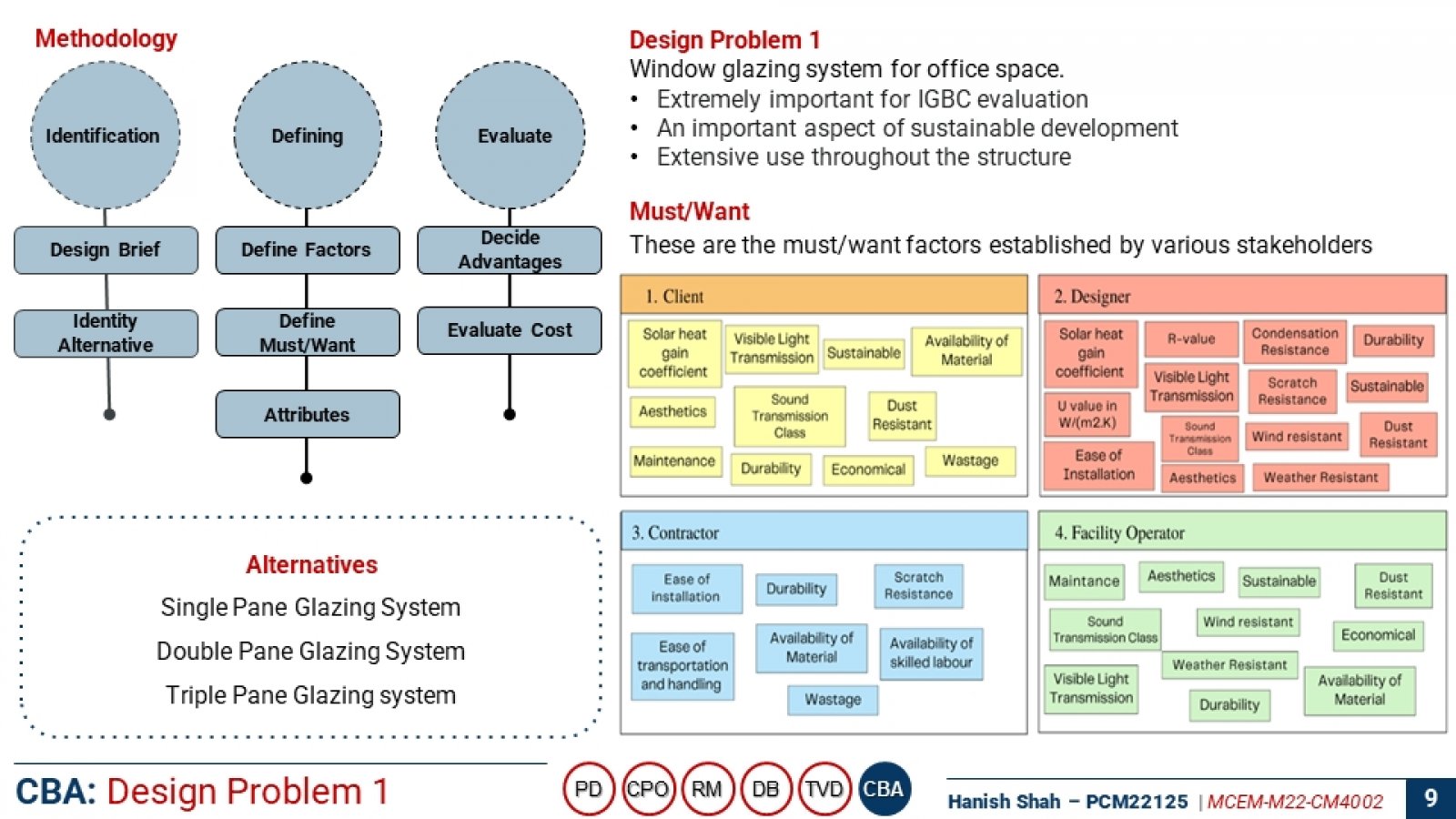

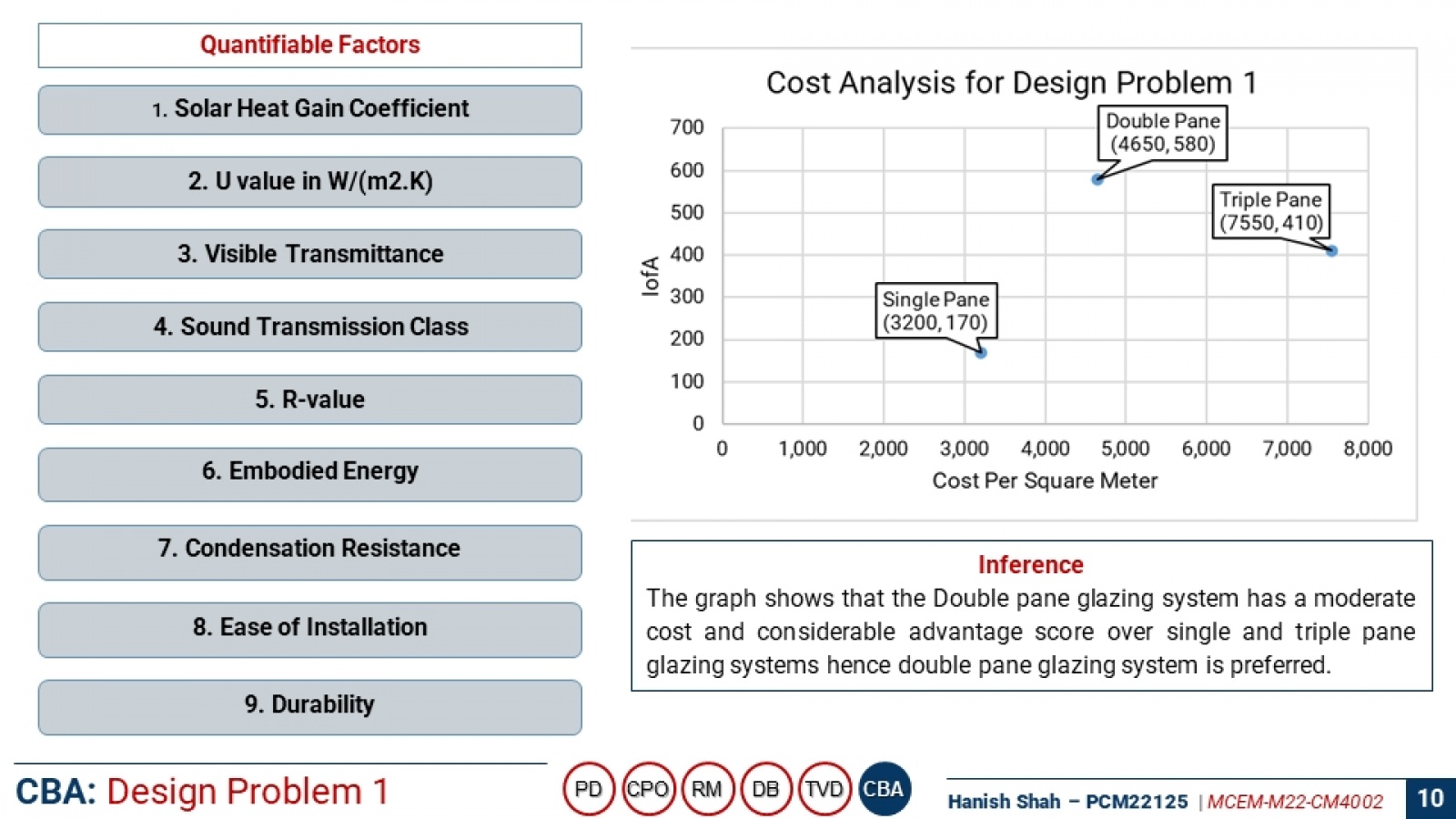

The Construction Project Formulation and Appraisal Studio of Semester I of Masters in Construction Engineering and Management aim to study various aspects of a construction project by conducting an exhaustive study about various stages of a project life cycle. The project undertaken for the current study is a mixed-use real estate project spread over a plot area of 14,068 sqm with a total built-up area of 87,513 sqm. This work aims to study various aspects of a construction project by conducting an exhaustive study of various stages of a project life cycle. The project undertaken for the current study is a mixed-use real estate project spread over a plot area of 14,068 sqm with a total built-up area of 87,513 sqm. The project aims to create a high-end residential and commercial space. For the study in CPO analysis, the focal problem identified is the lack of development opportunities in the Gandhinagar notified area and the focus of the real estate sector in the Twin City belt. The CPO analysis further served as a basis for identifying stakeholders and risks. Several matrices were derived to manage the stakeholders and cater to the risks. Methods for efficient designing and selection of materials for key elements such as exterior paint finish or glazing system are also addressed in the report for providing the clients with the most optimum resources for construction. The design brief is further devised for understanding the complete scope of work which included four Residential towers and 2 Commercial structures. A project schedule consisting of a work breakdown structure and milestones for the project is generated for minimum cost overrun. The work packages identified from WBS are utilized to derive an overall cost of the project which is 418 Cr including the land cost. The procurement strategy for a contractor is a labour plus part material contract which is selected considering the client's efficiency and work packages identified. A financial analysis conducted for various cases of debt-equity ratio suggested the suitable debt-equity ratio for the current project is 45/55 with an IRR of 24%.