Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

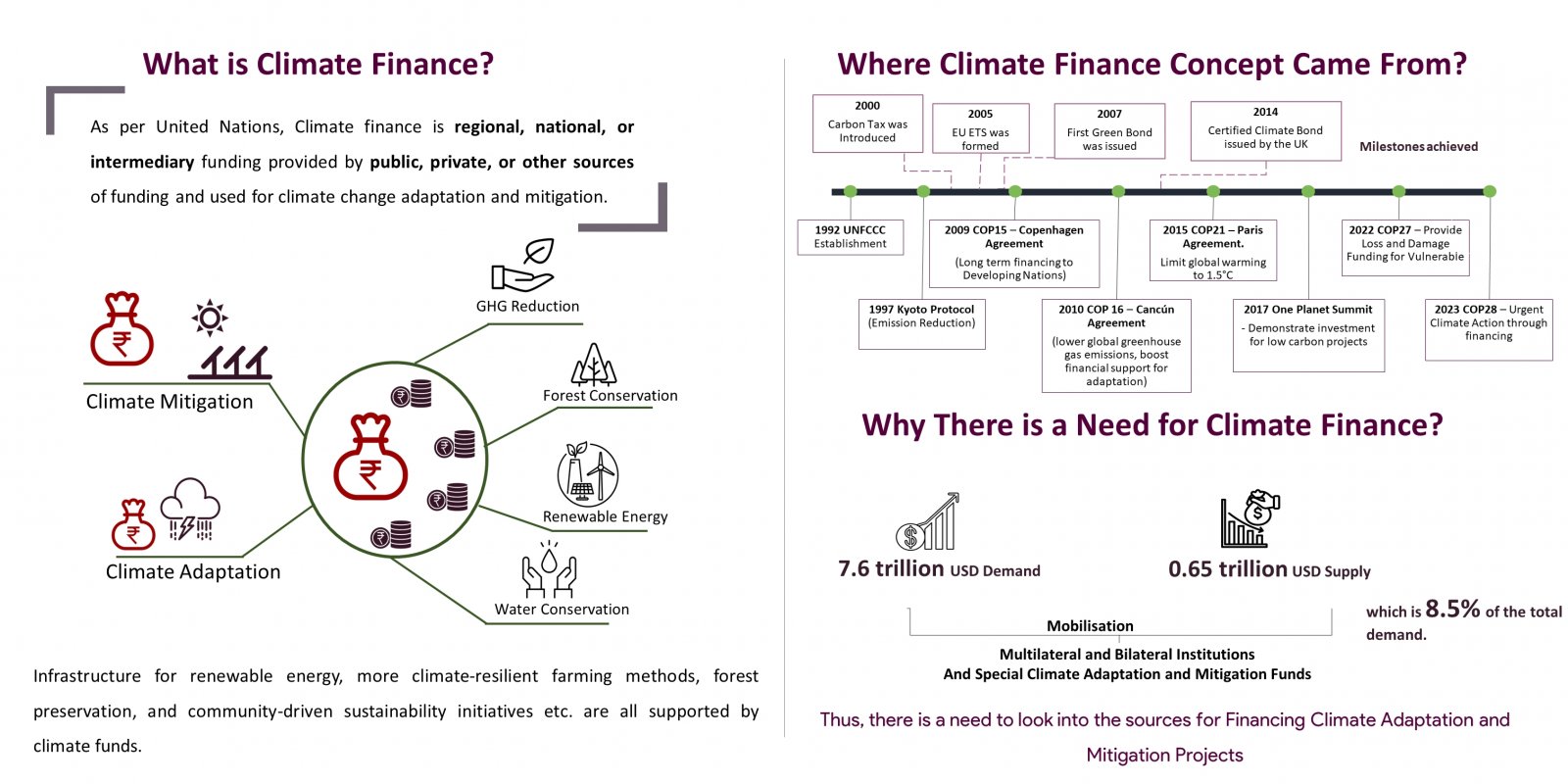

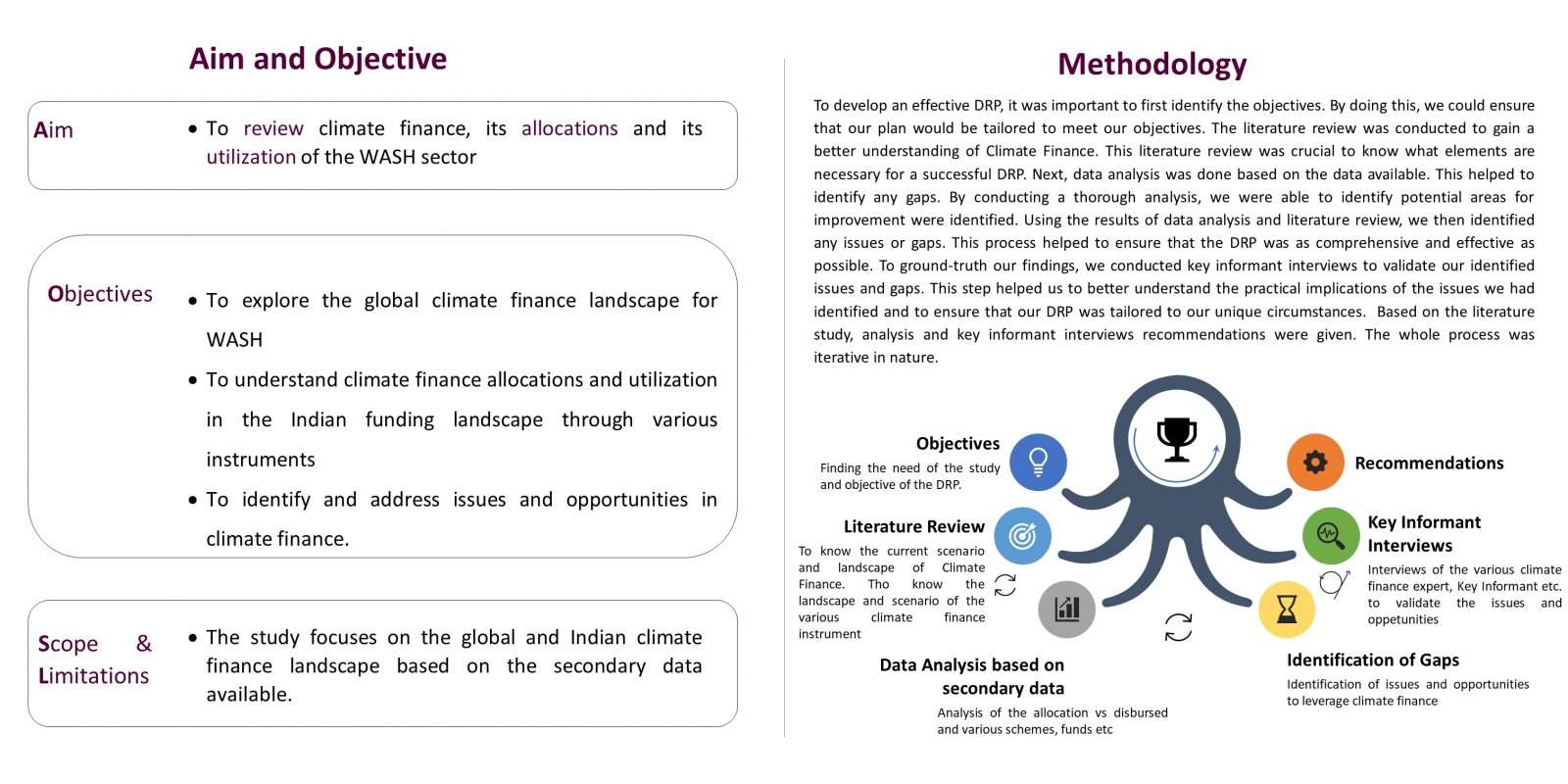

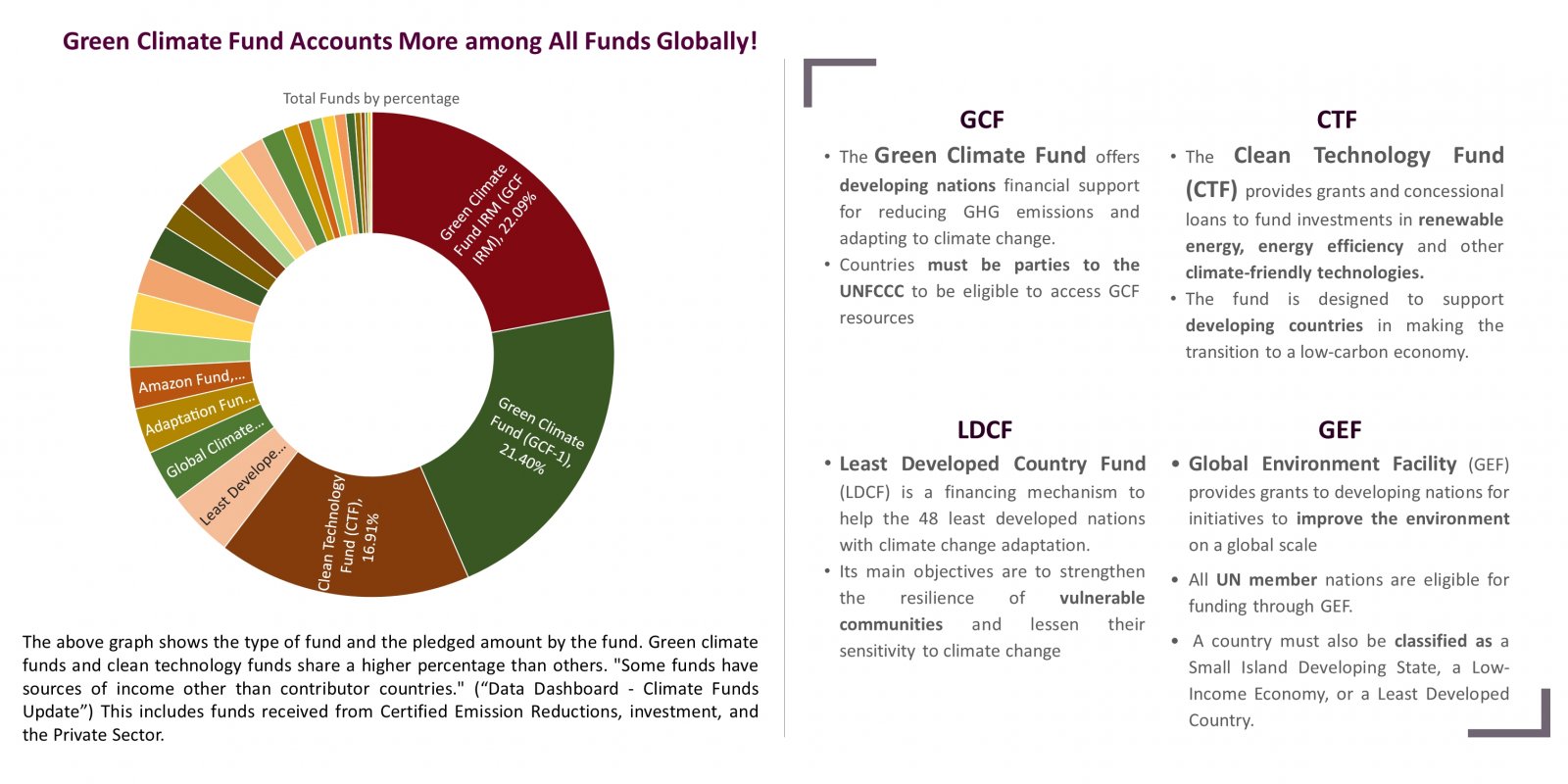

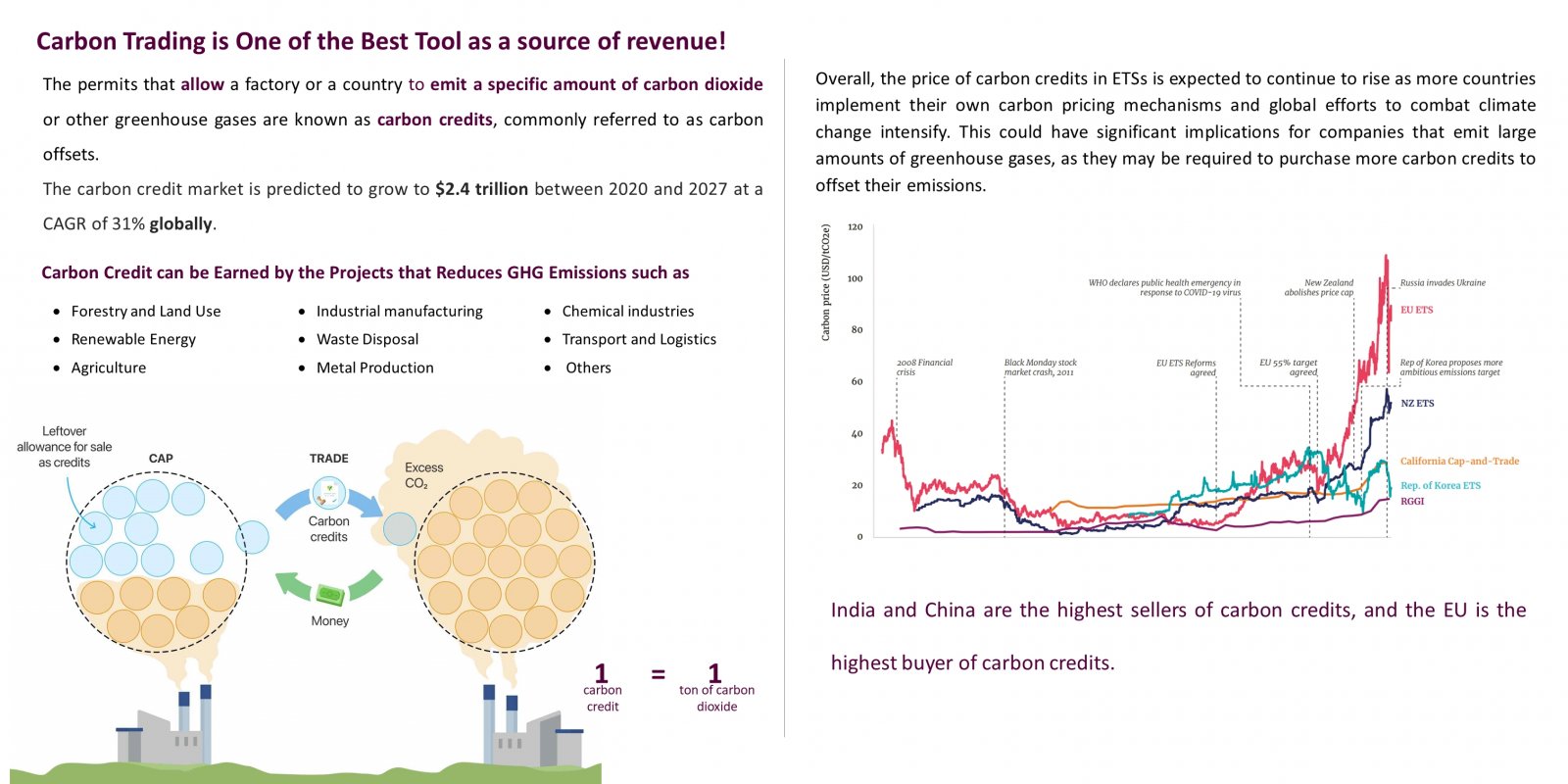

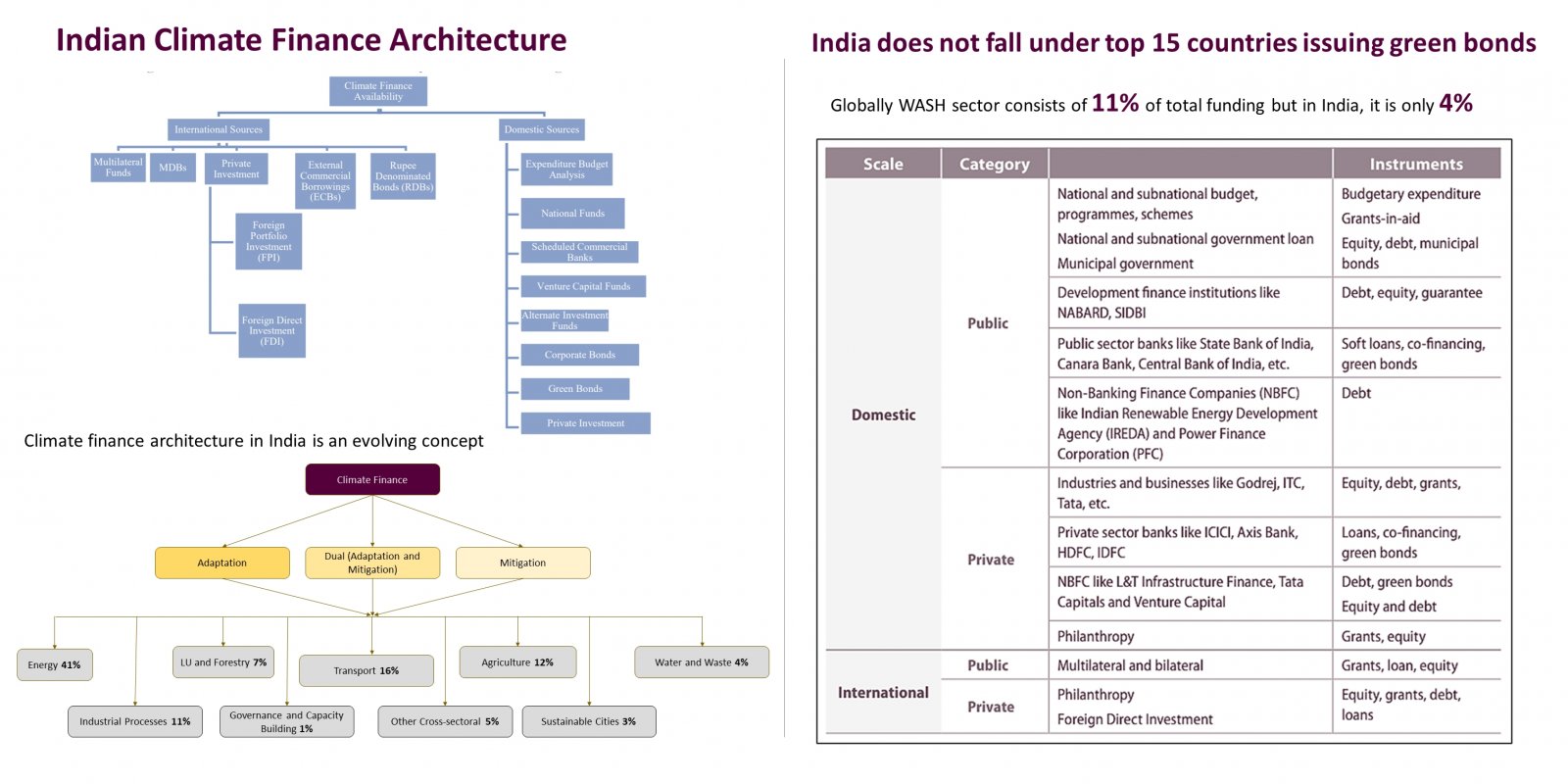

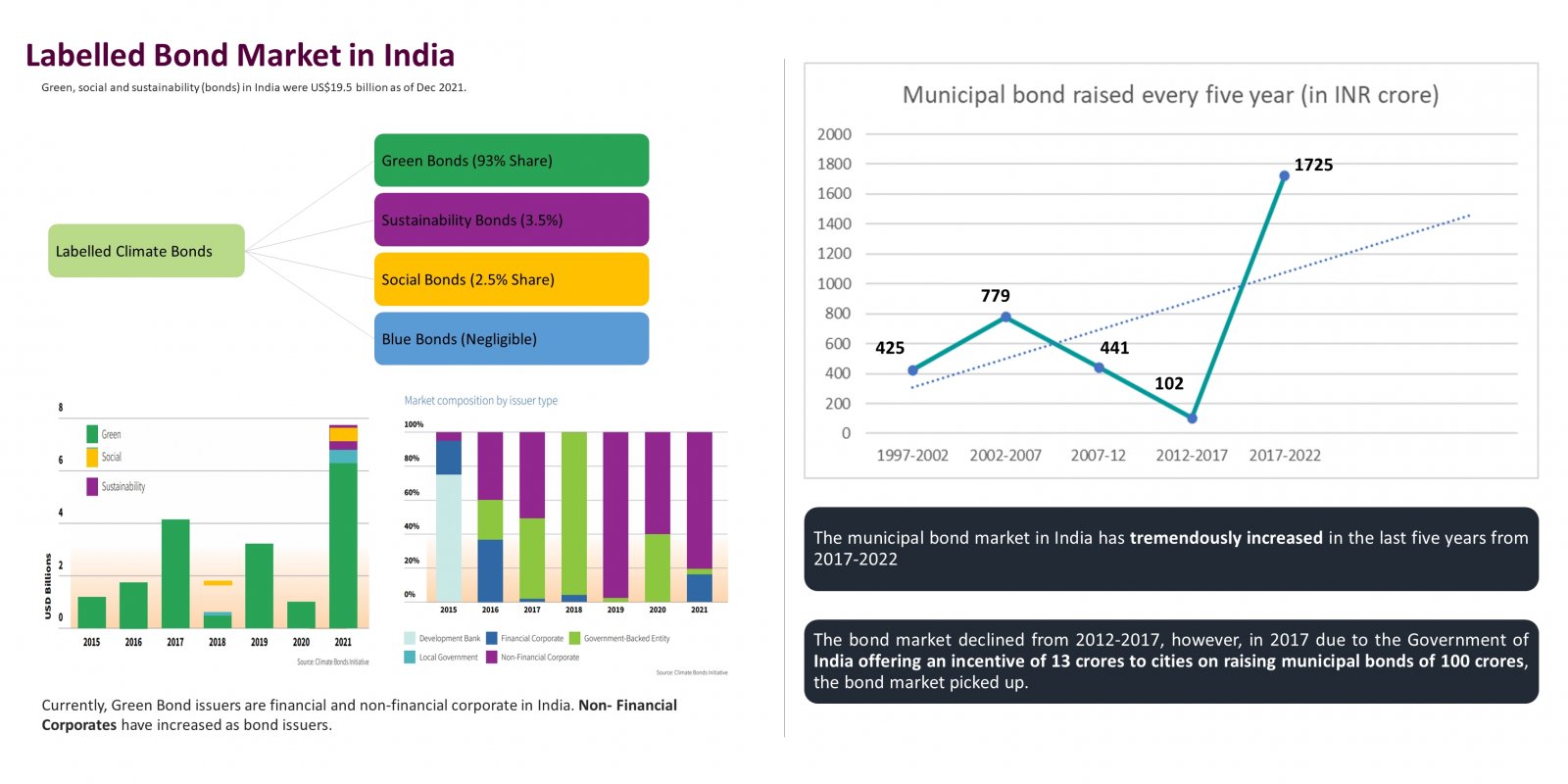

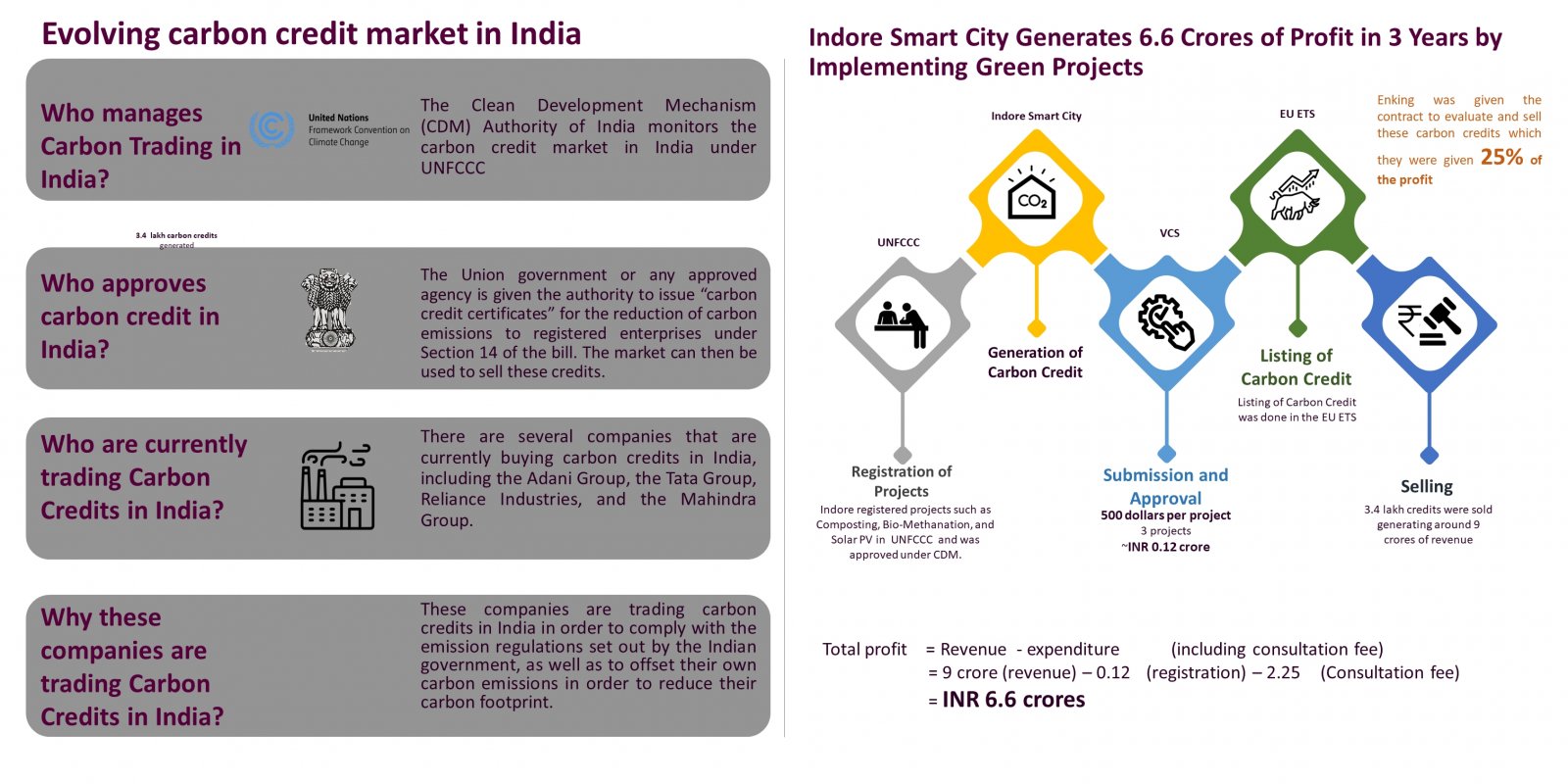

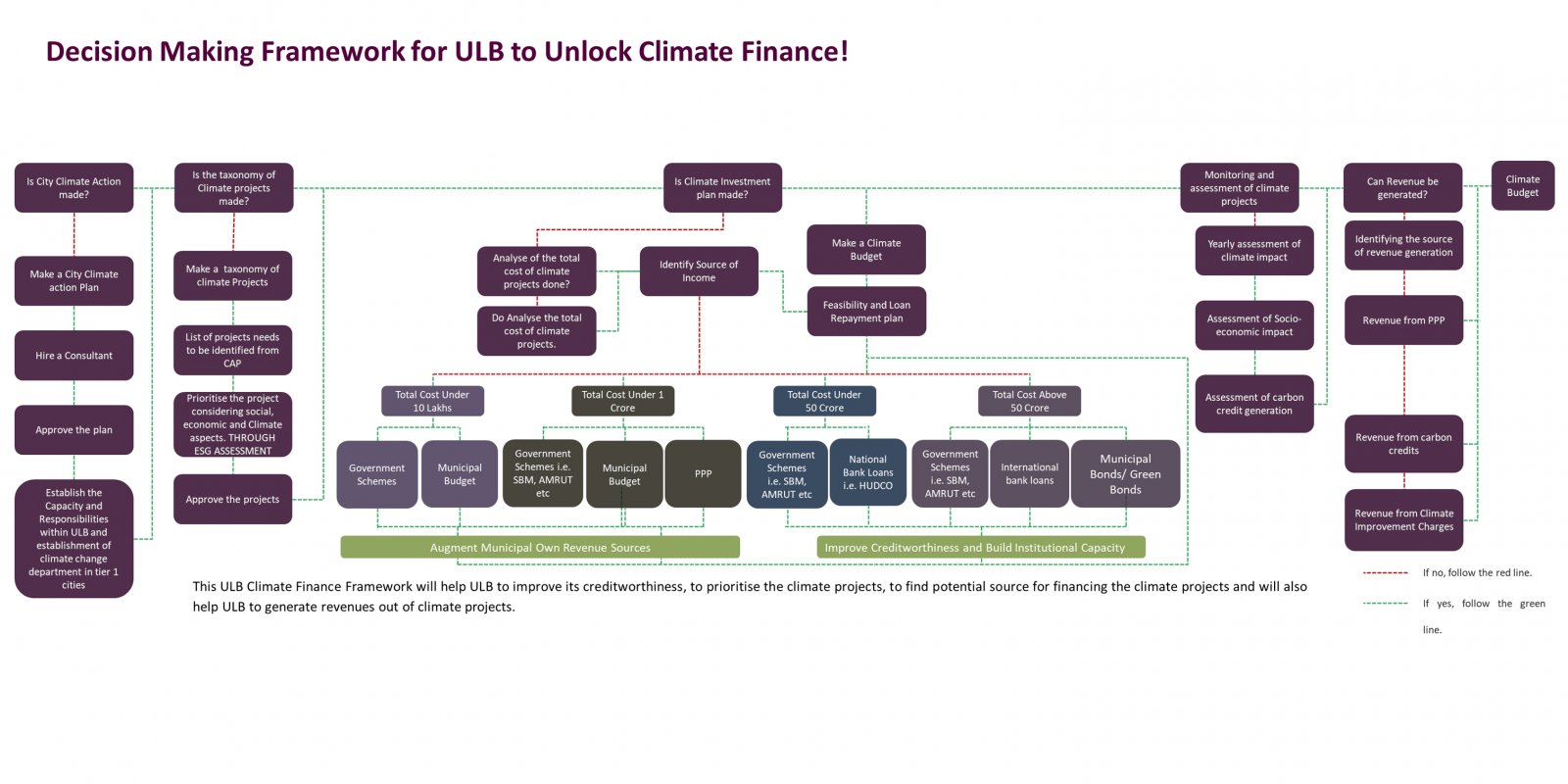

It is estimated that additional $0.9 billion to $2.3 billion annually will be required to ensure that new water and sanitation infrastructure is climate resilient. These investments, which is insignificant, account for about 1% of the baseline infrastructure investment requirements and will cut the risk of damage to new infrastructure by 50%. Although there is a significant amount of climate financing is available for climate projects, most of the funds go to the energy sector, and there isn't much funding available for the WASH sector. Cities need funding or a source of financing for their climate projects to implement the adaptation, mitigation, and resilient projects. While the WASH sector receives 11% of climate finance globally, it only receives 5% in India. To finance climate projects, it is necessary to investigate various climate finance sources. The DRP investigates landscape of global finance architecture, the different financing options available for to fund climate resilient projects, captures funding instruments like green bonds, municipal bonds, carbon credit and funding allocated through government grants, missions, and programs. The DRP is based on secondary desk-based research. While exploring the climate finance instruments it was found that there is a huge potential and a growing environment for the municipal and green bond globally and in India. The Government of India has taken various initiatives to create an enabling market for climate finance. There are many schemes, programmes and missions which fund the projects for urban development of the cities, and a certain share is utilised for climate resilient projects while adhering to the objectives of the schemes, however, this remains unaccountable in the overall monitoring. There is a huge potential for the carbon trading market in India but there is a need of structured policy, framework, and awareness for the carbon markets to bloom domestically. Climate finance can be further boosted by climate investment frameworks, plans and clearly defined taxonomy of projects.

View Additional Work