Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

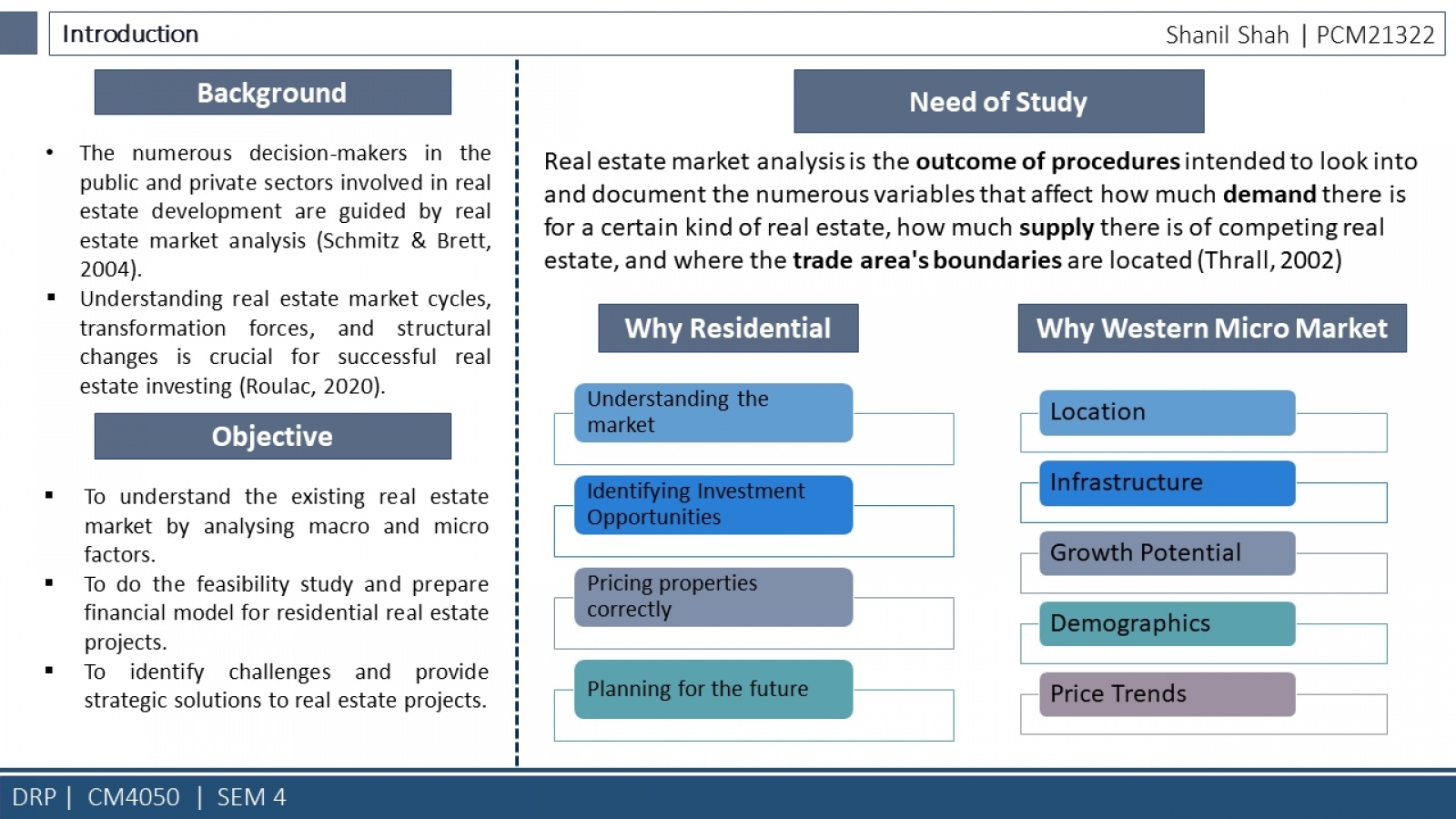

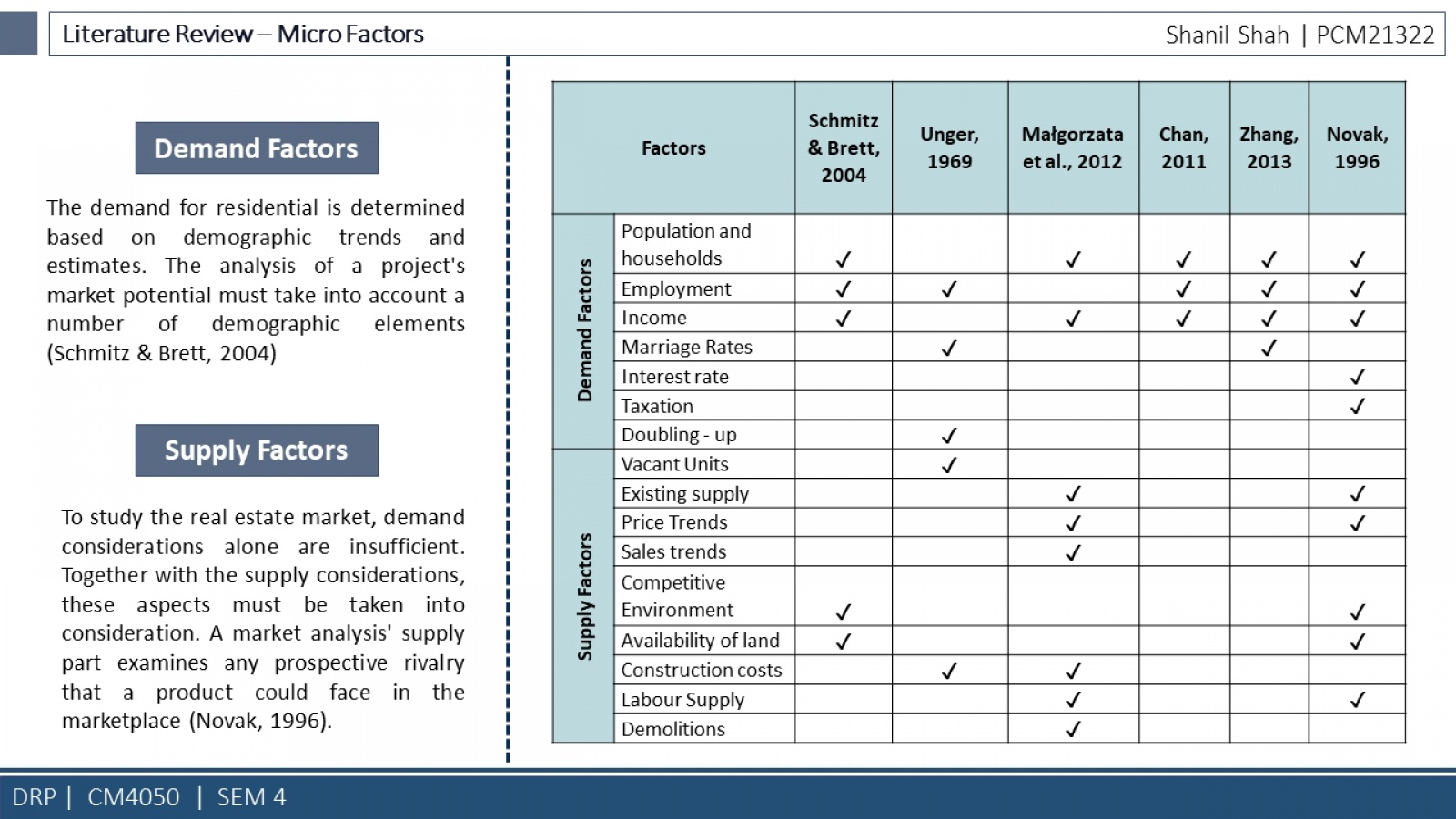

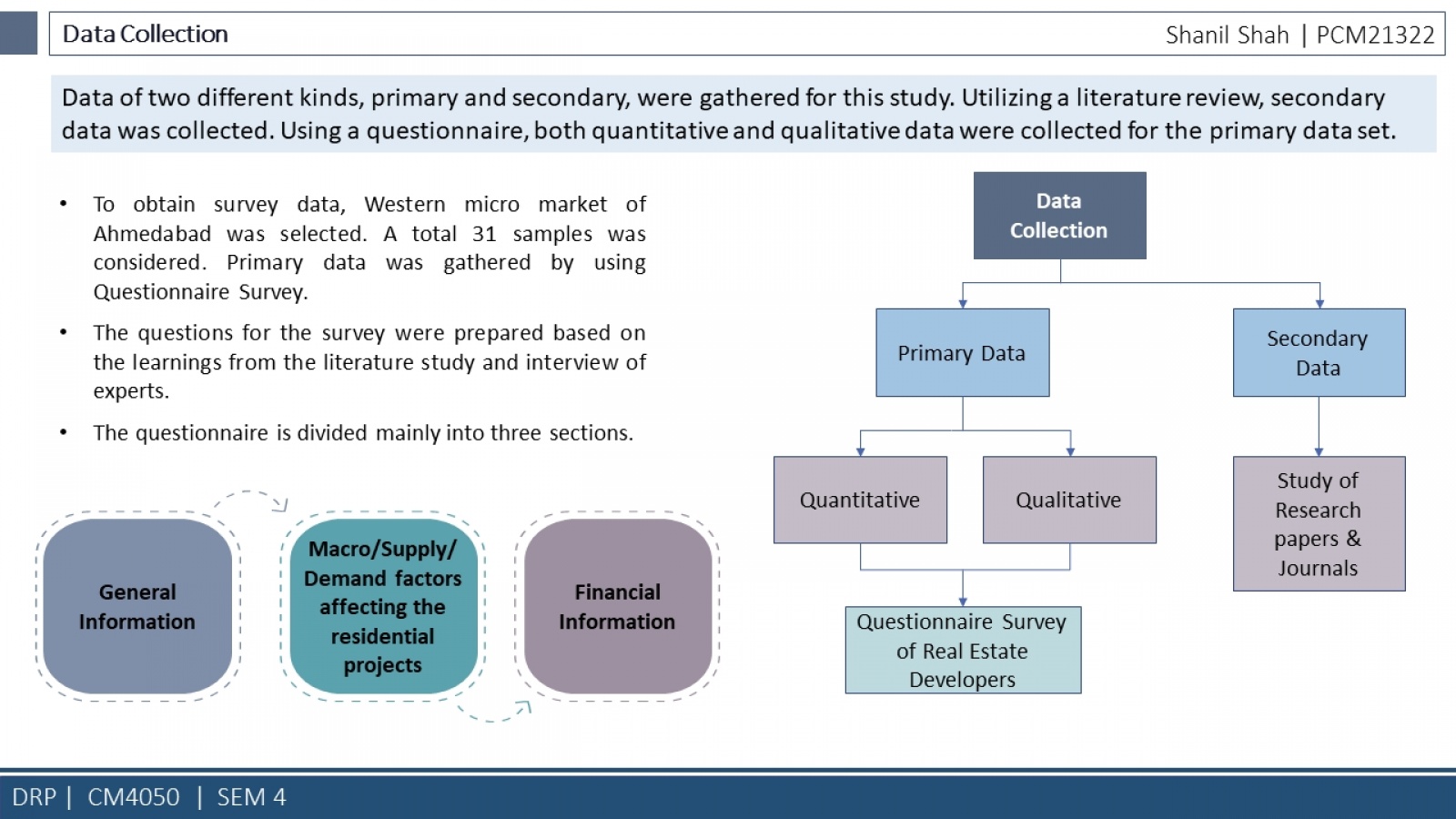

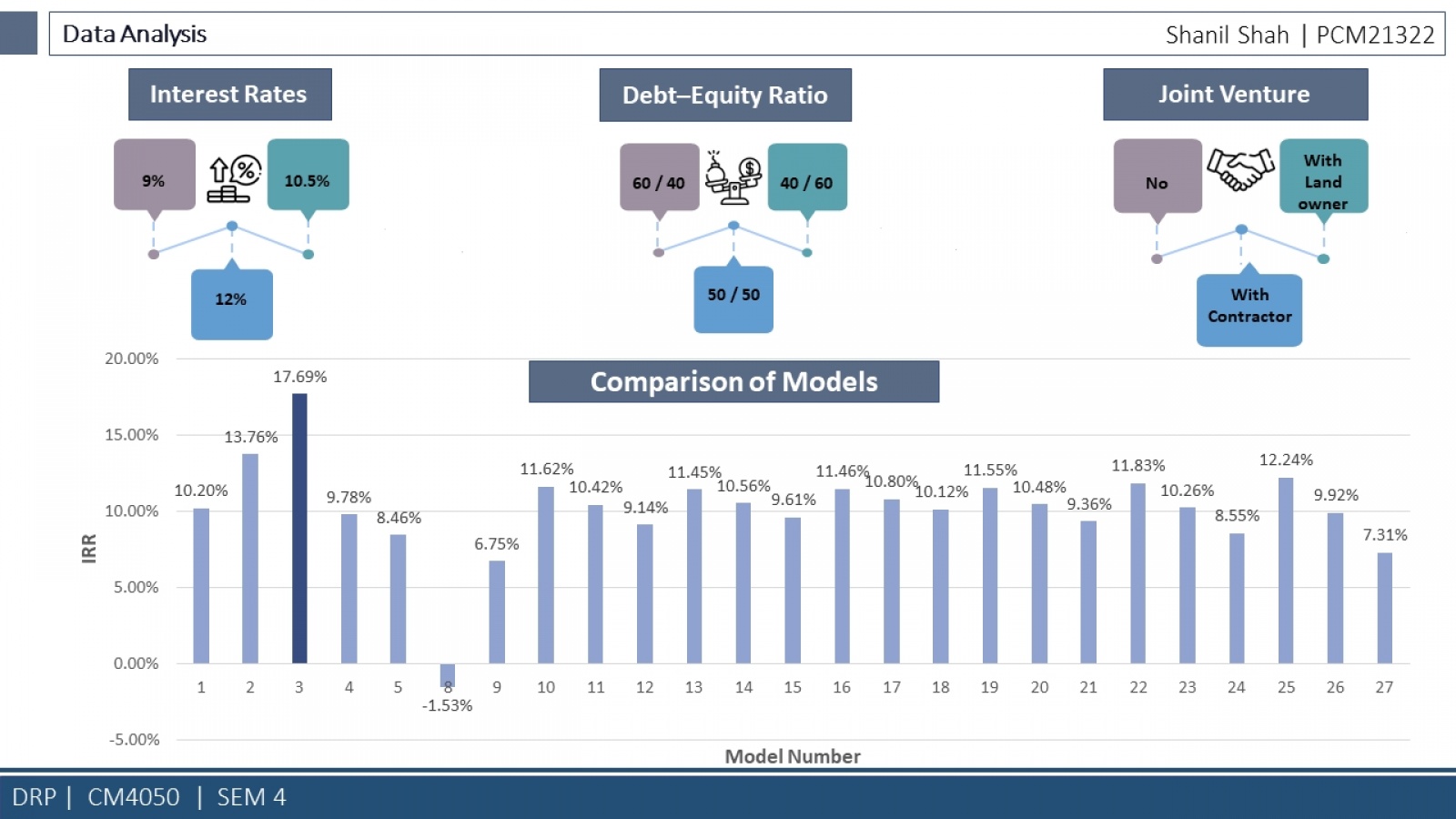

Real estate residential projects are significant investments that require a comprehensive financial model to evaluate their financial feasibility and profitability. The success of such projects depends on several factors, including market demand, construction costs, financing options, and revenue projections. However, the lack of a reliable financial model can result in poor decision-making and increased risk. Therefore, this research aims to develop a financial model that can aid real estate developers and investors in making informed decisions about project selection, financing options, and risk management. The study will utilize a combination of qualitative and quantitative methods, including a review of relevant literature, case studies, and financial analysis techniques, to build the model. The financial model will be based on industry best practices and will incorporate sensitivity analysis to assess the impact of changing market conditions and project variables on the financial feasibility of the project. By providing a comprehensive financial model, this research will contribute to the field of real estate finance and improve the financial performance of real estate residential projects. The model can assist in evaluating the viability of projects and identifying potential risks and opportunities. Furthermore, the research will discuss the limitations and challenges of the model to provide a realistic perspective on its implementation. Overall, this research aims to improve the financial performance of real estate residential projects by providing a reliable and accurate financial model that can assist in decision-making.