Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

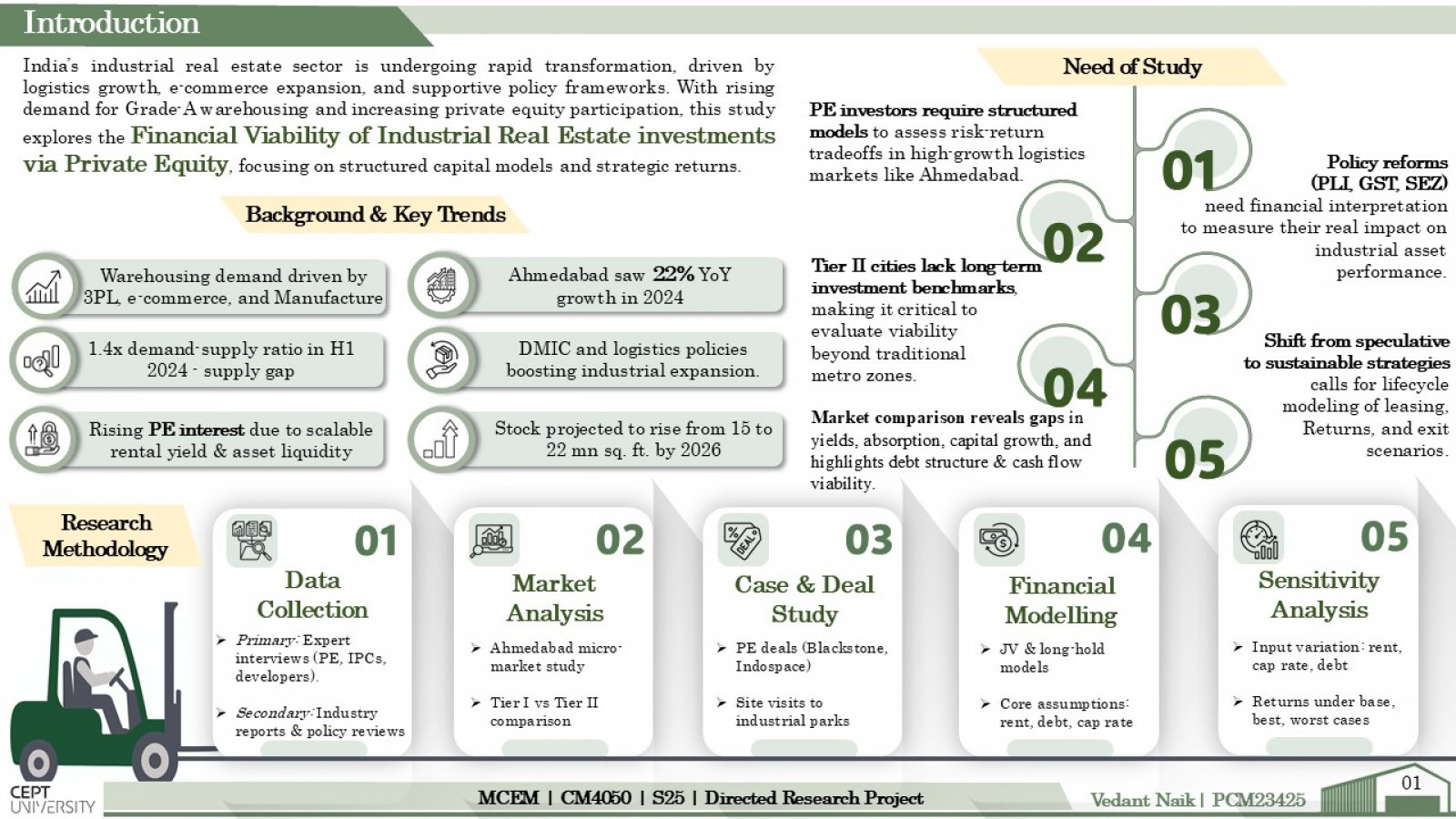

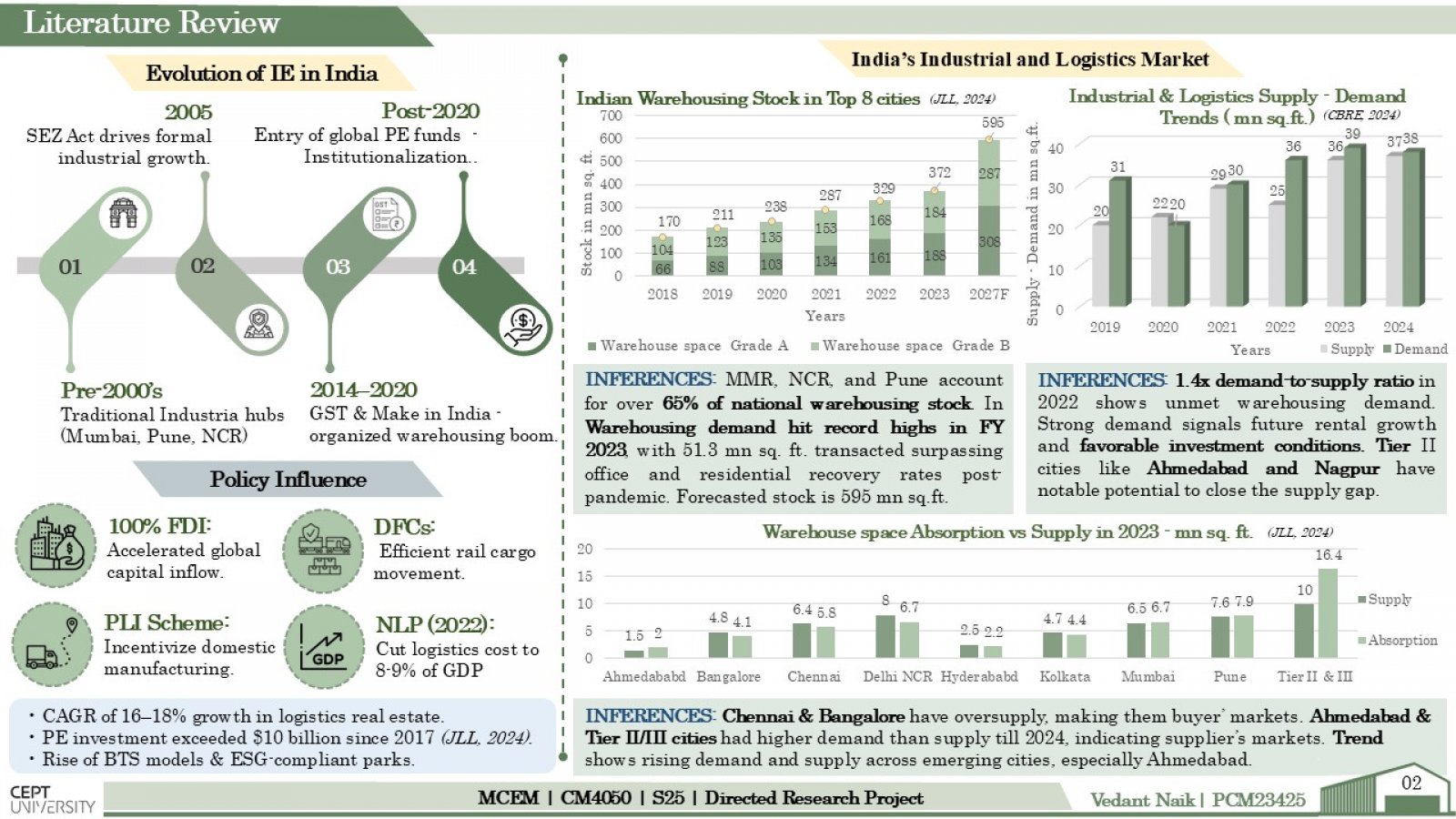

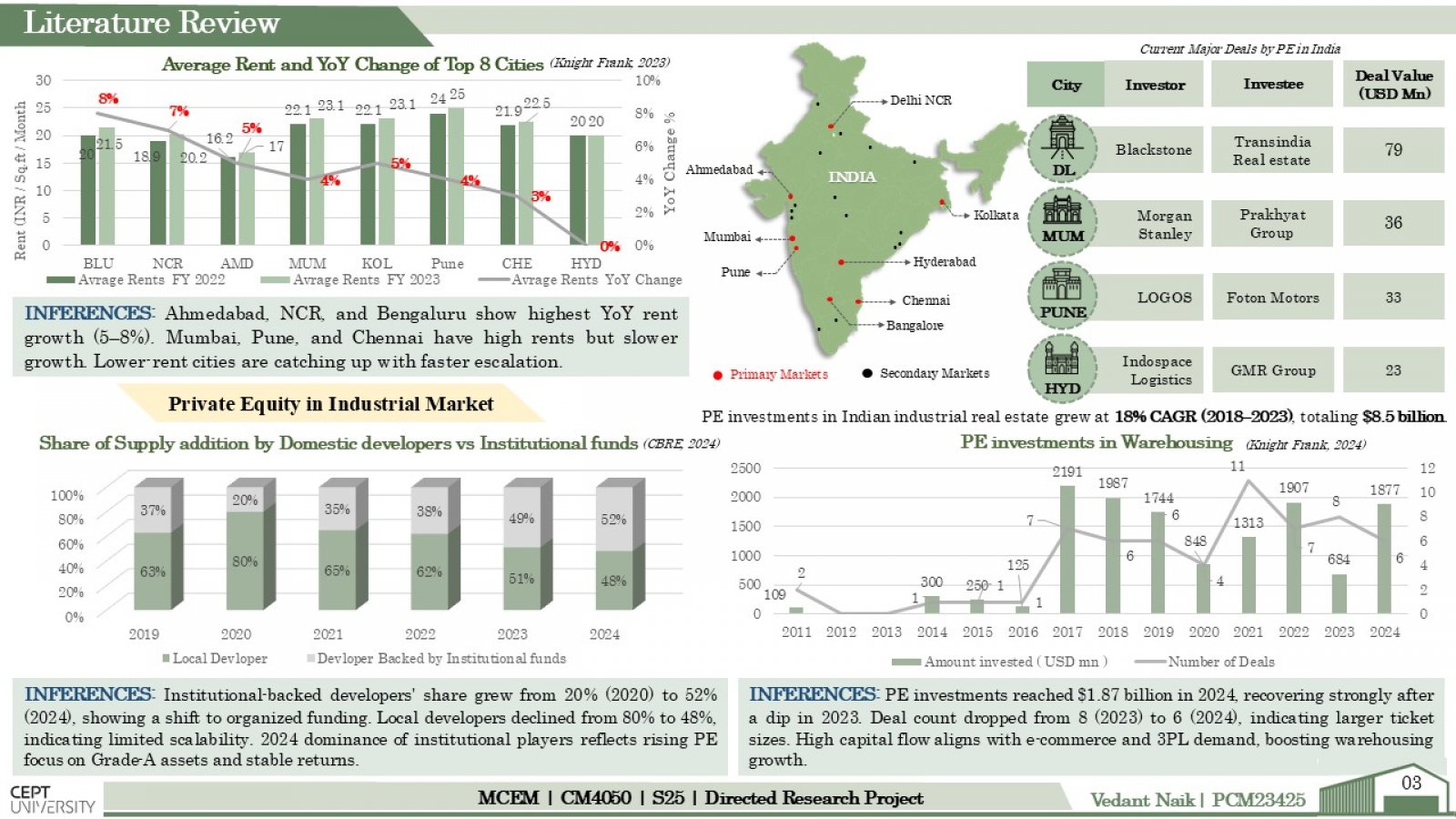

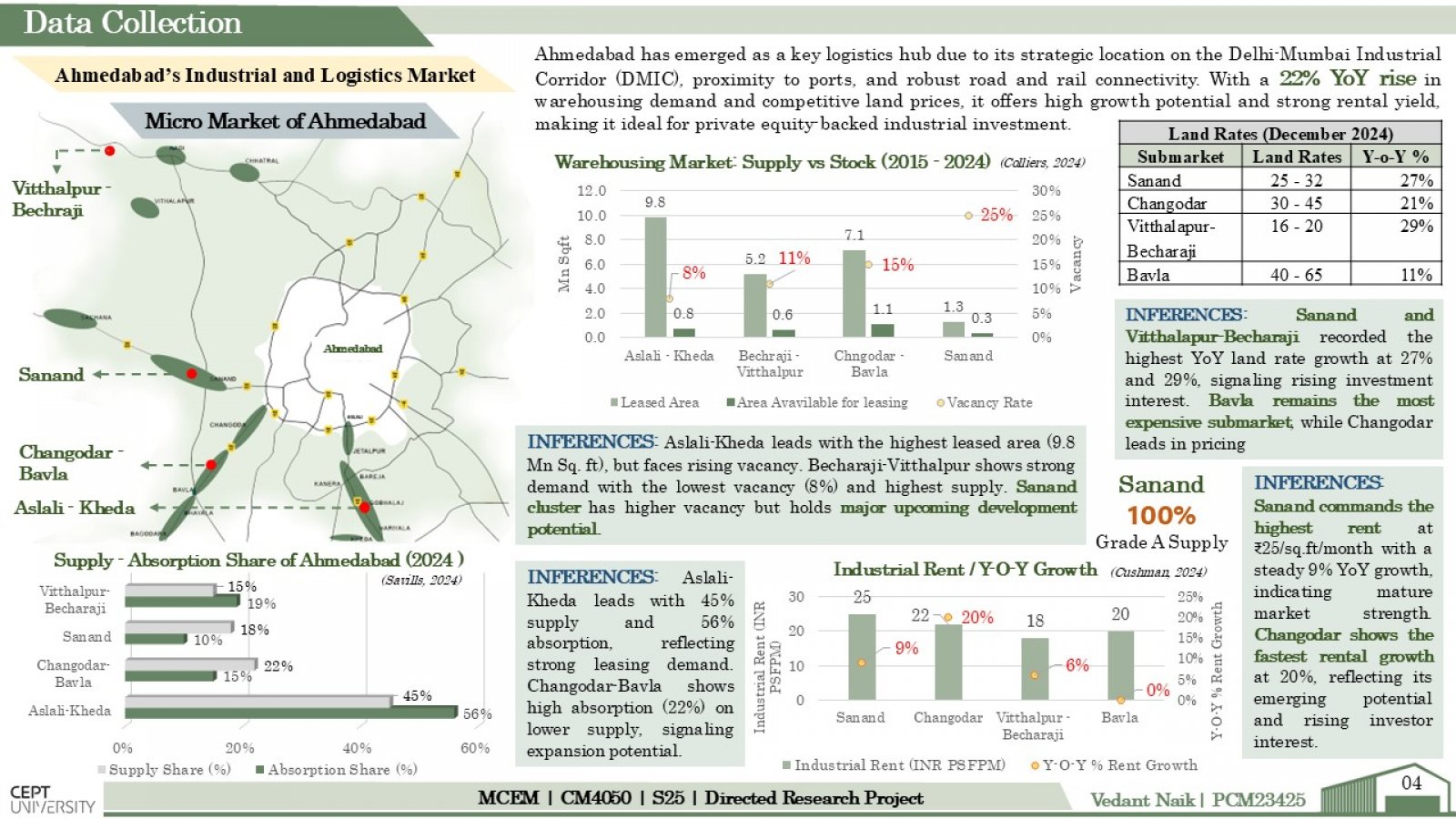

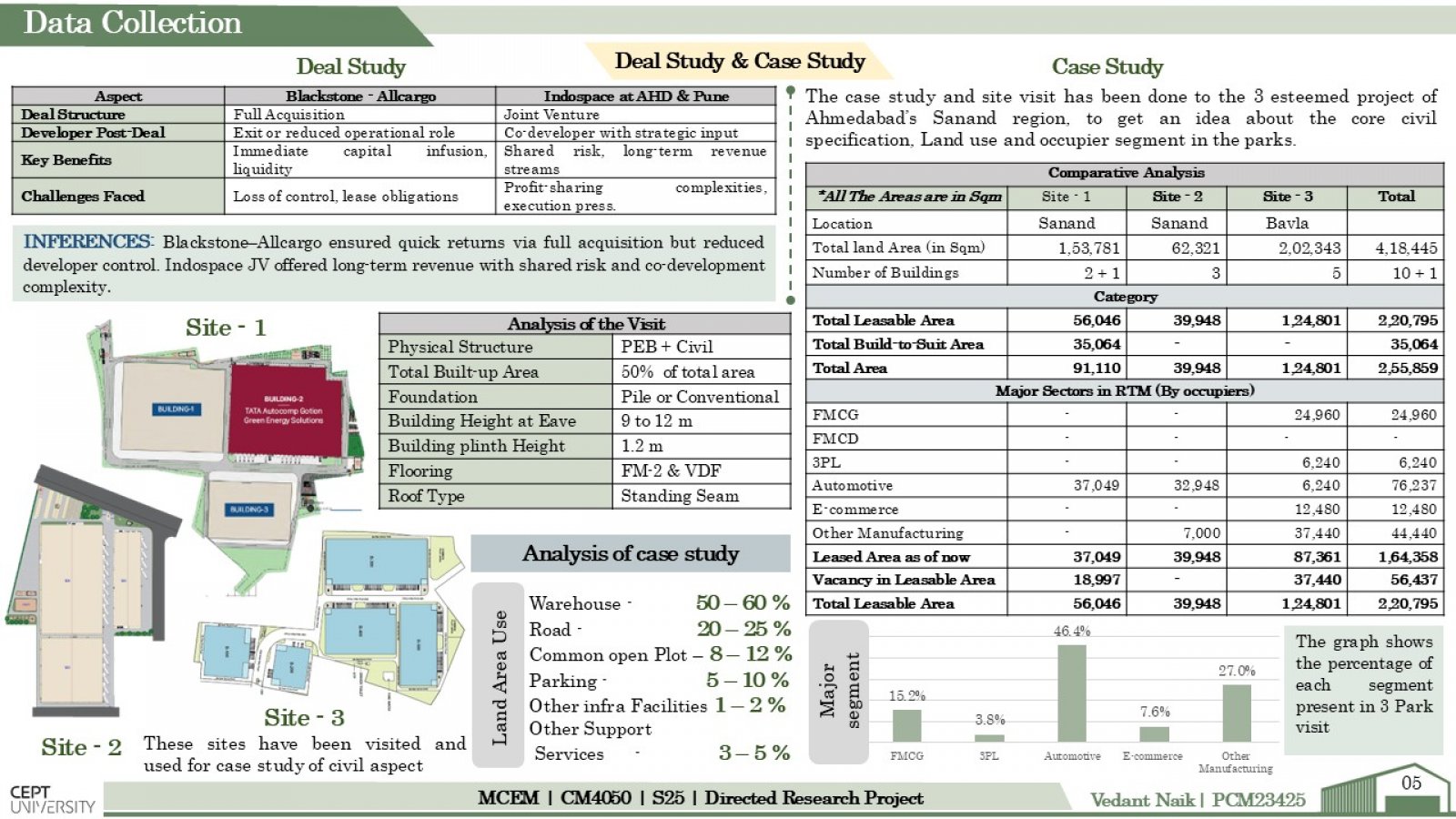

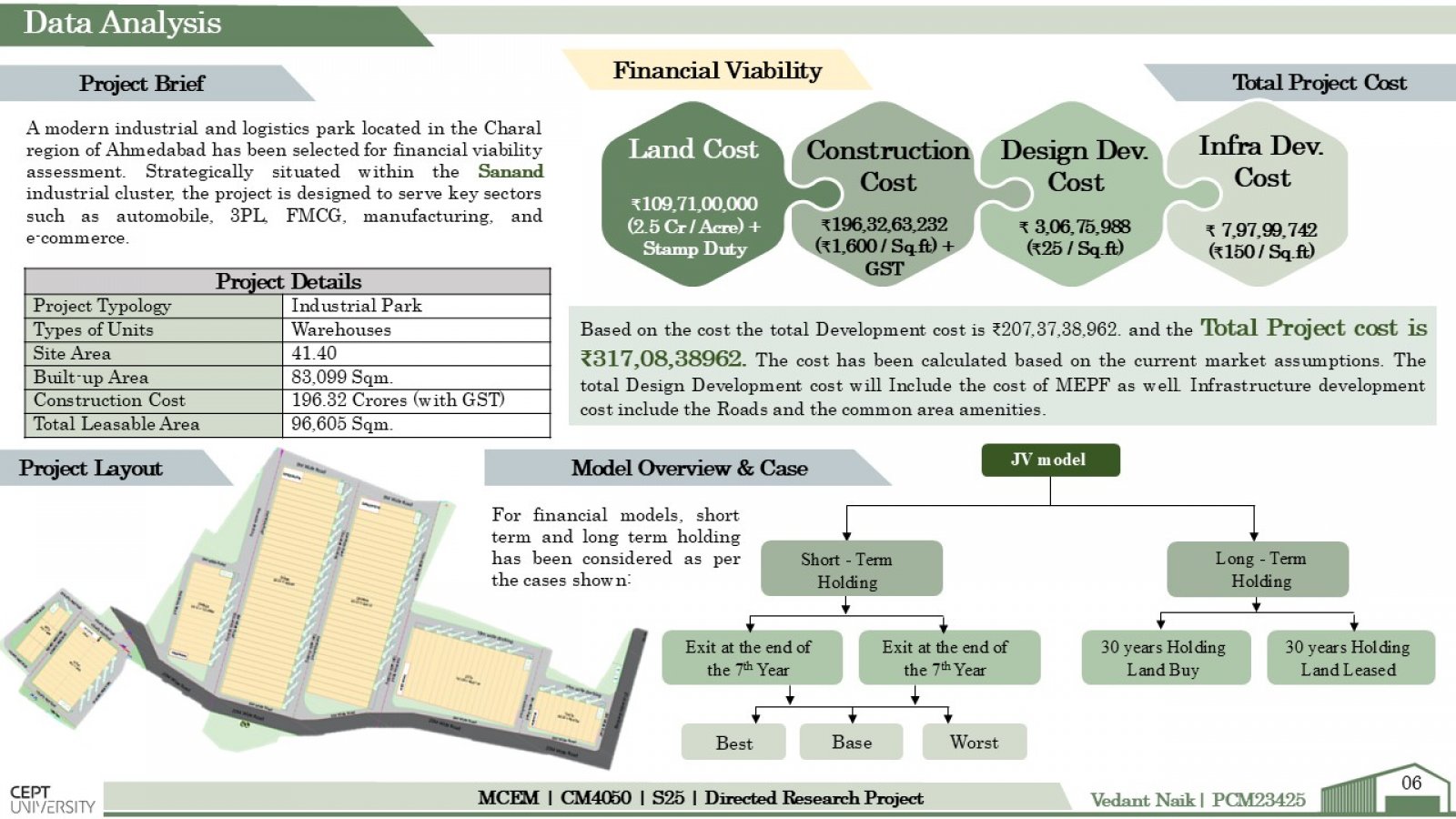

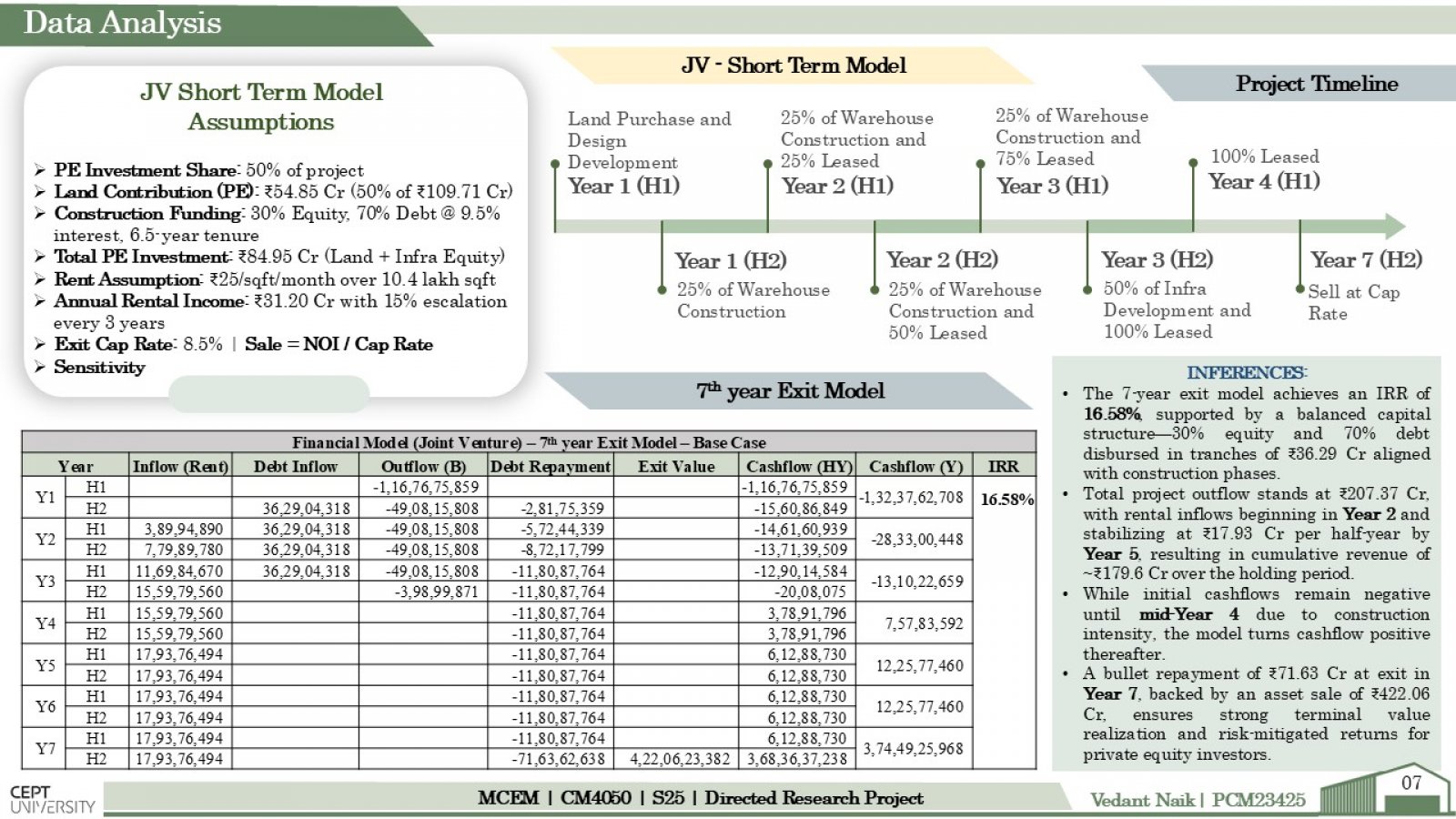

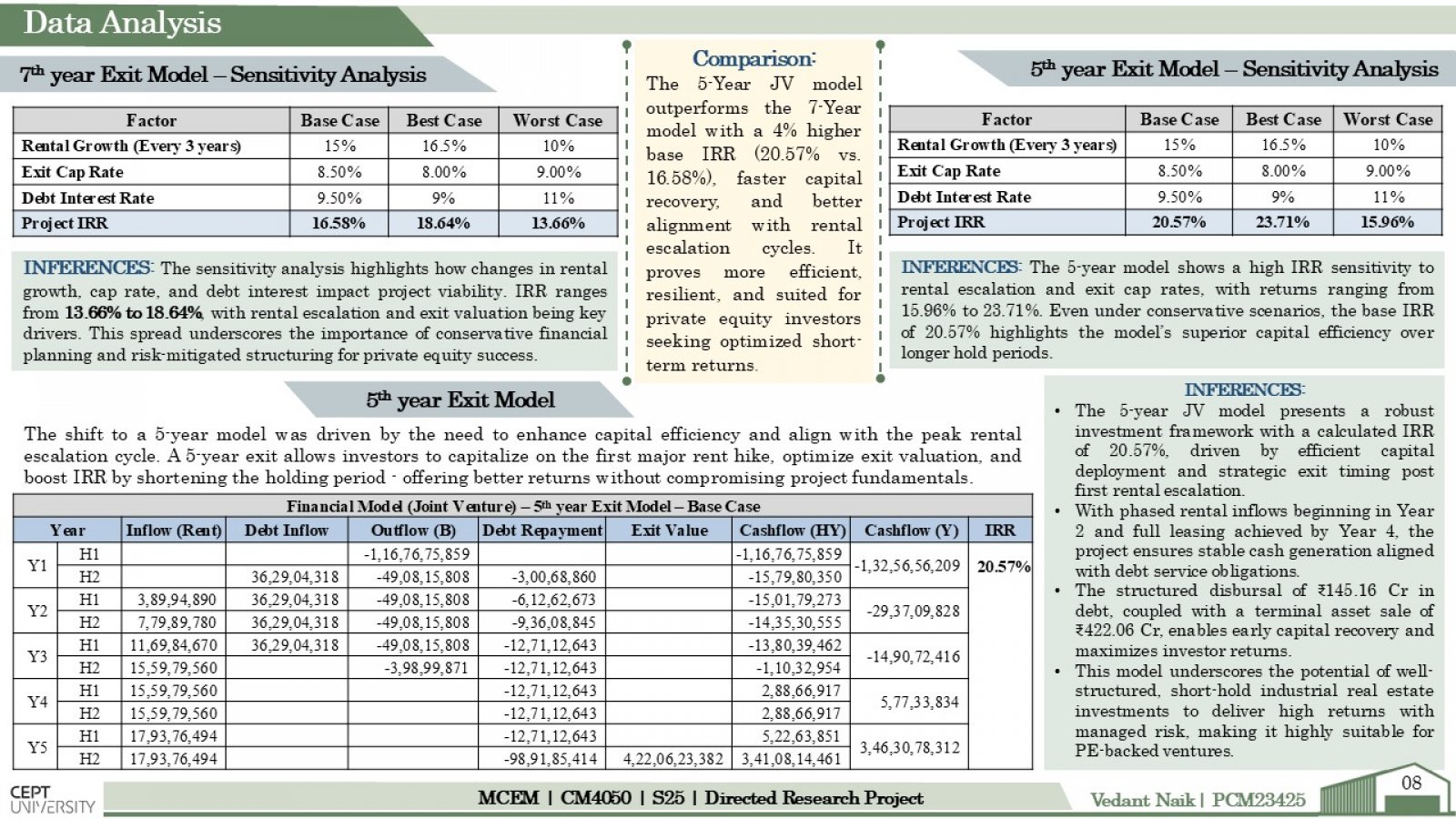

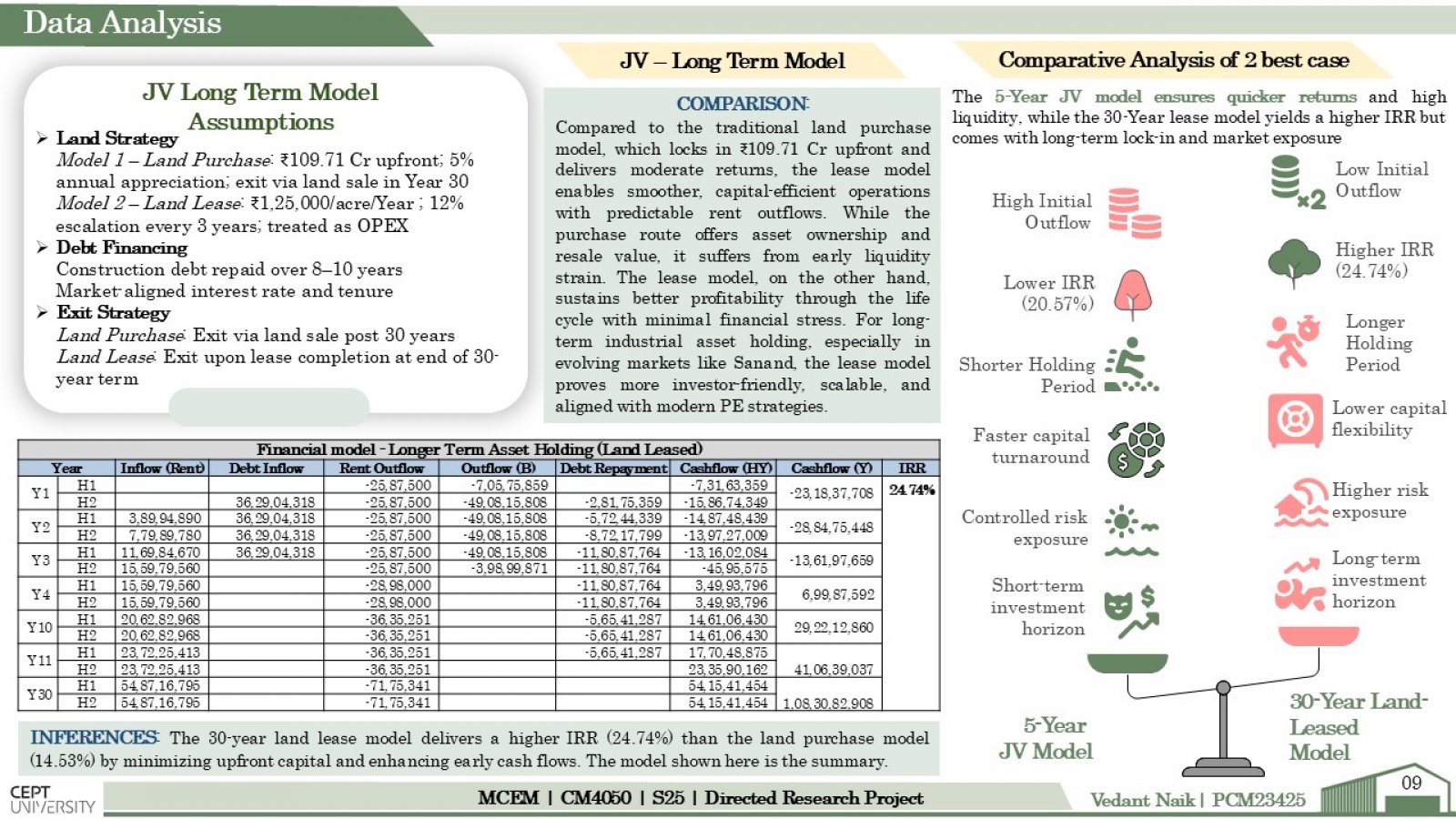

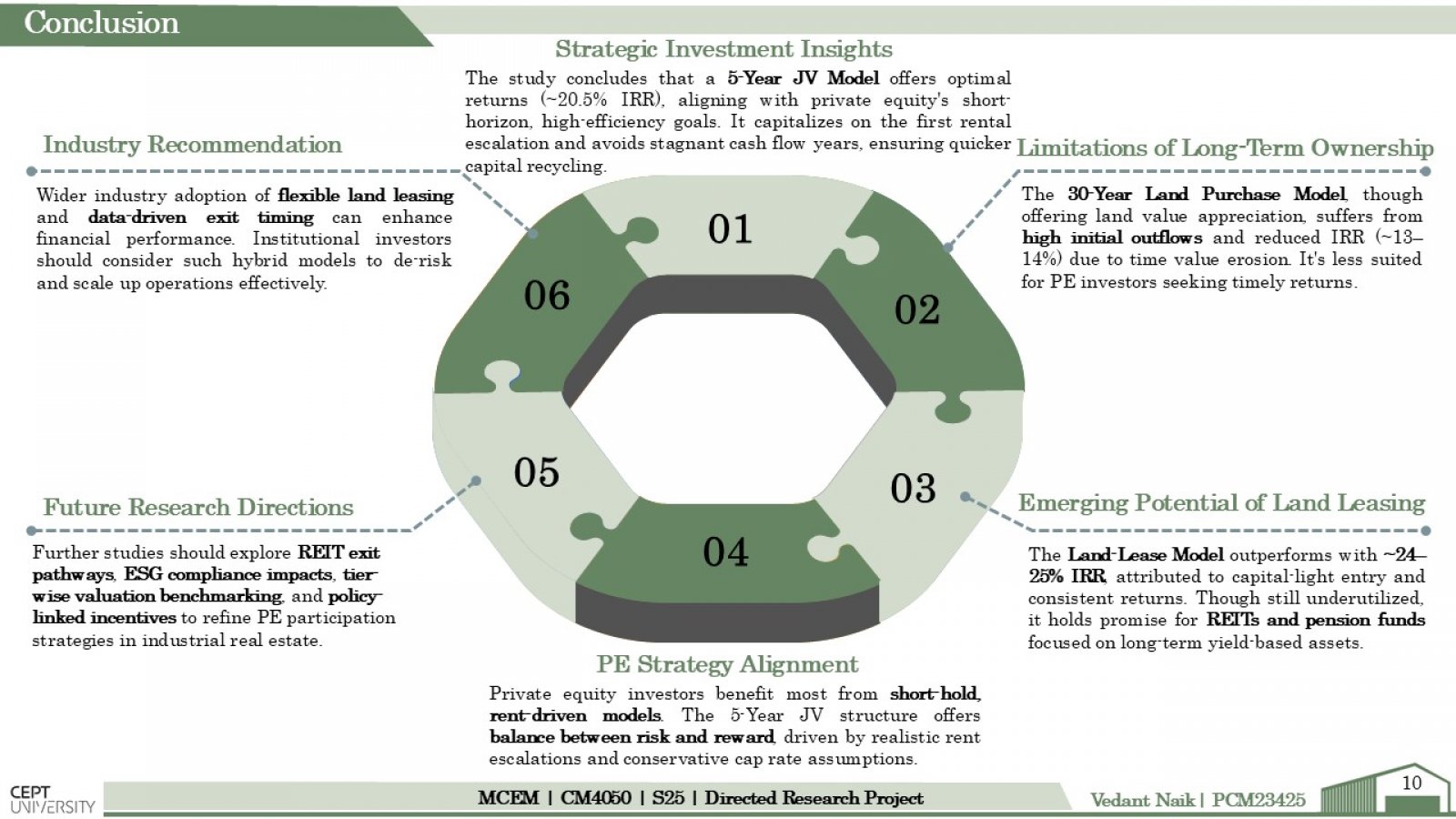

This Detailed Research Project, titled “Assessment of Industrial Real Estate Financial Viability via Private Equity,” analyzes the potential of India’s industrial and logistics real estate sector, focusing on private equity participation. It examines the full design-to-exit lifecycle of built-to-lease assets, exploring joint ventures, AIFs, and structured exits. Through financial modeling and sensitivity analysis on rental growth, cap rates, and debt, the research evaluates 5- and 7-year exit scenarios. The study concludes that phased JV models with efficient capital structuring and realistic assumptions offer scalable, de-risked investment strategies for private equity in India’s evolving logistics landscape.

View Additional Work