Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

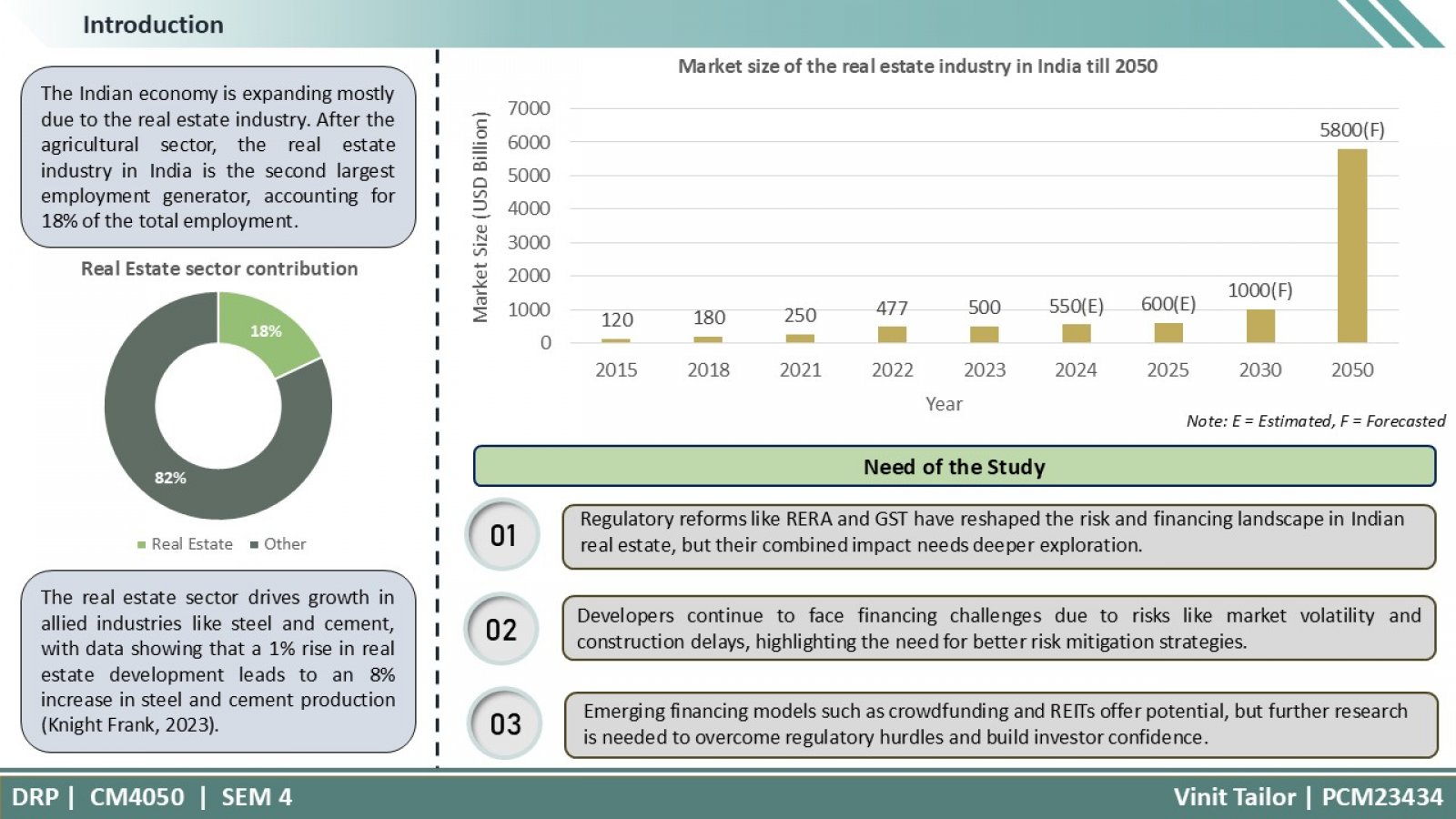

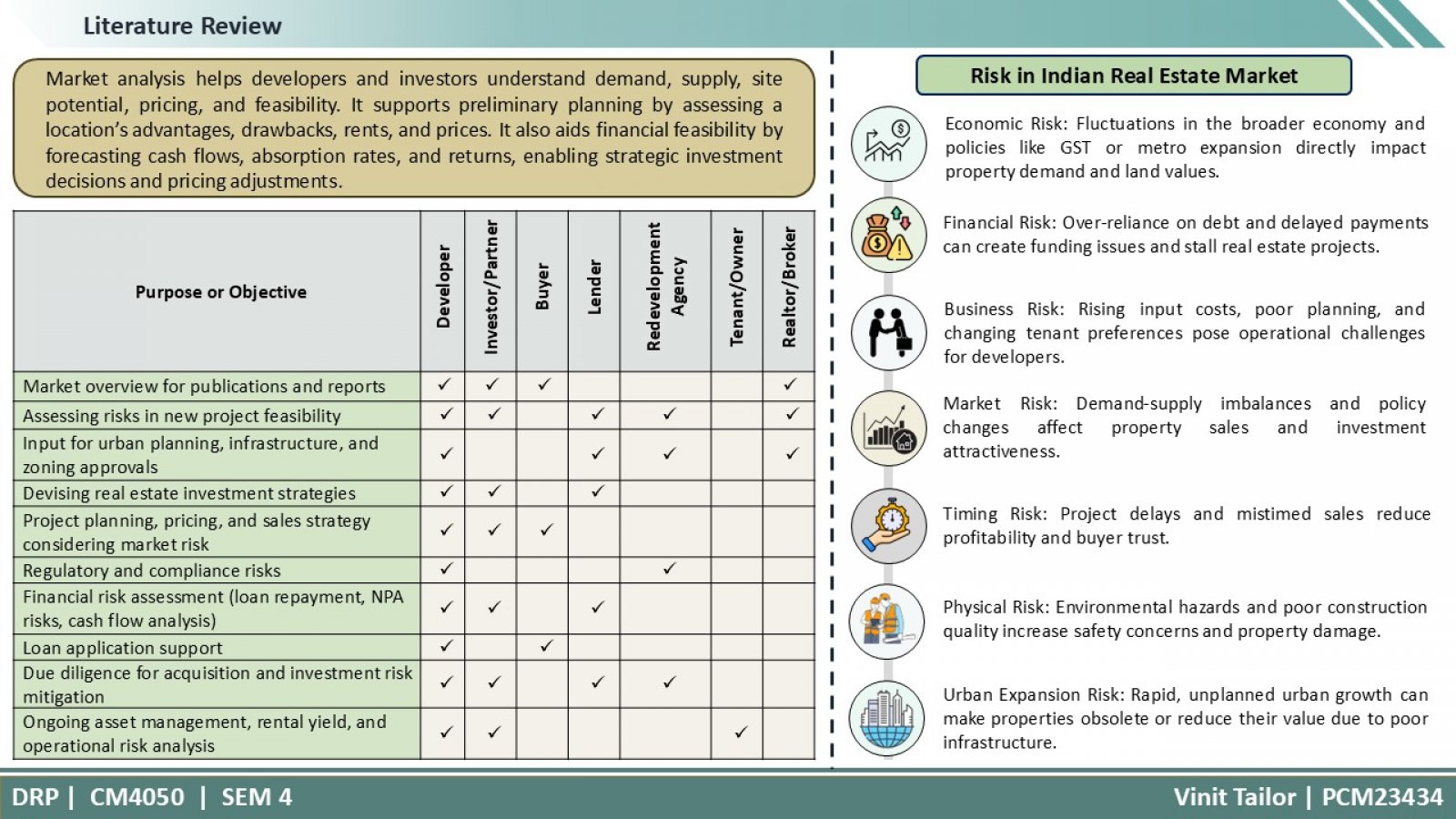

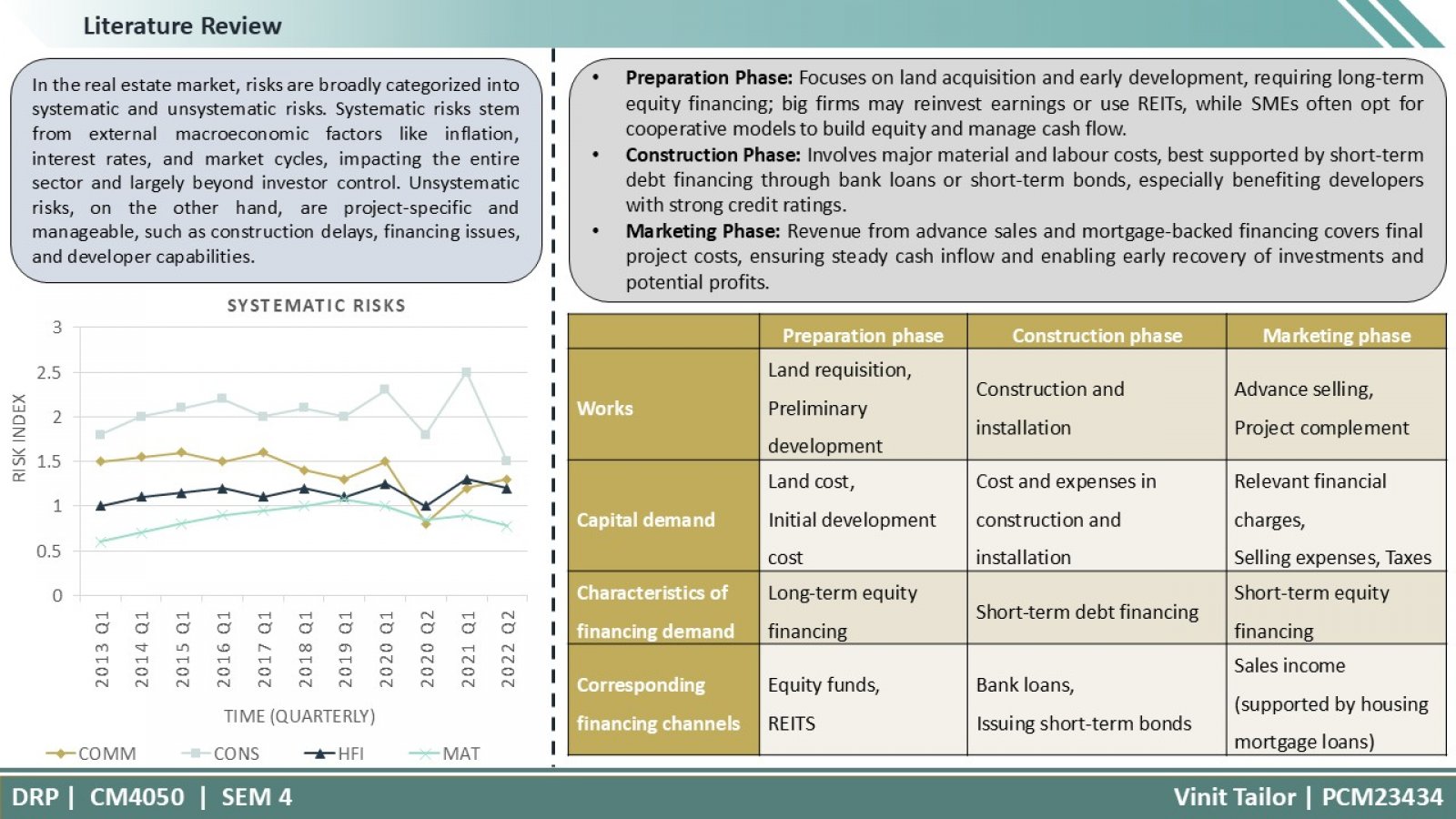

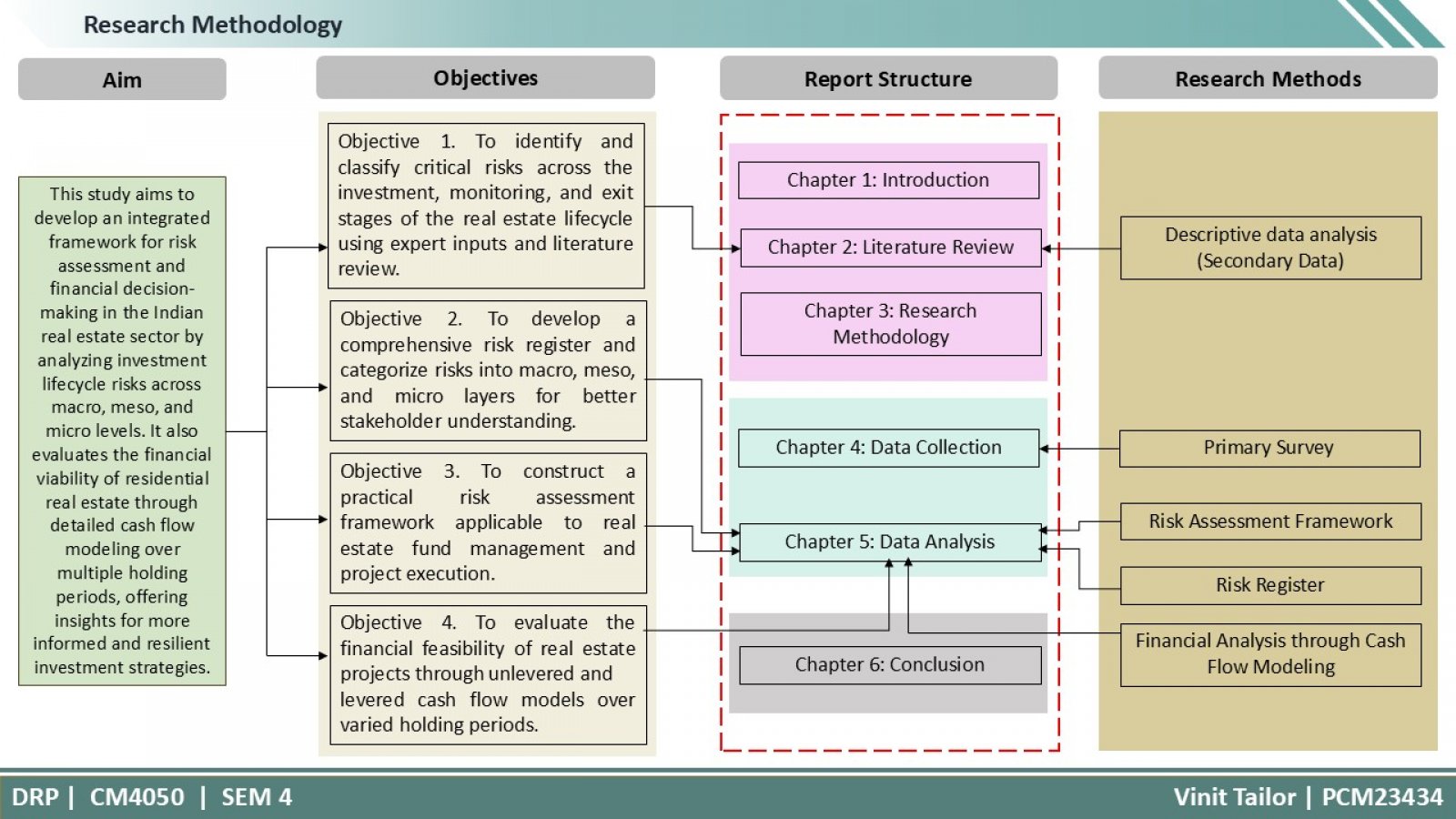

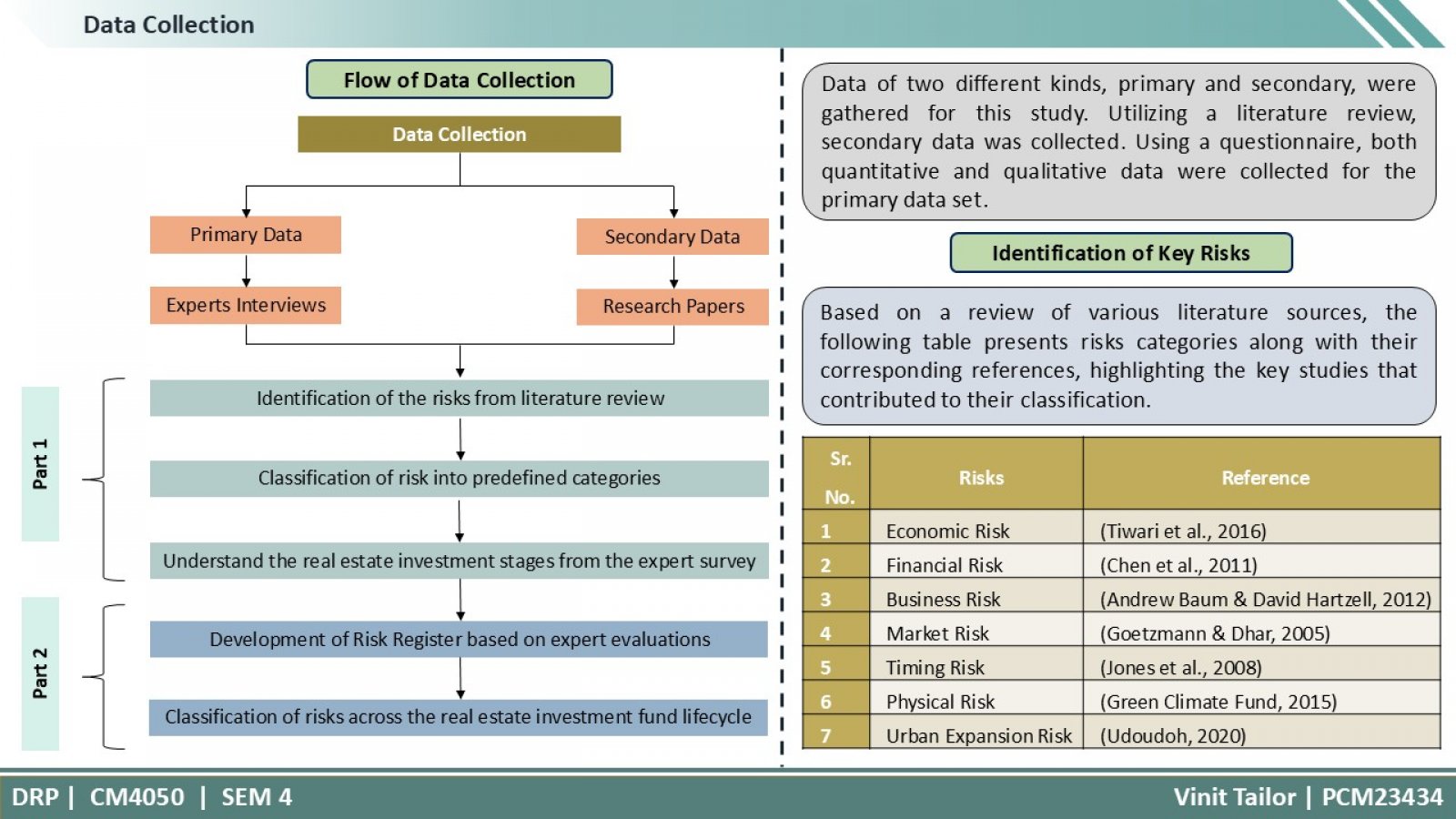

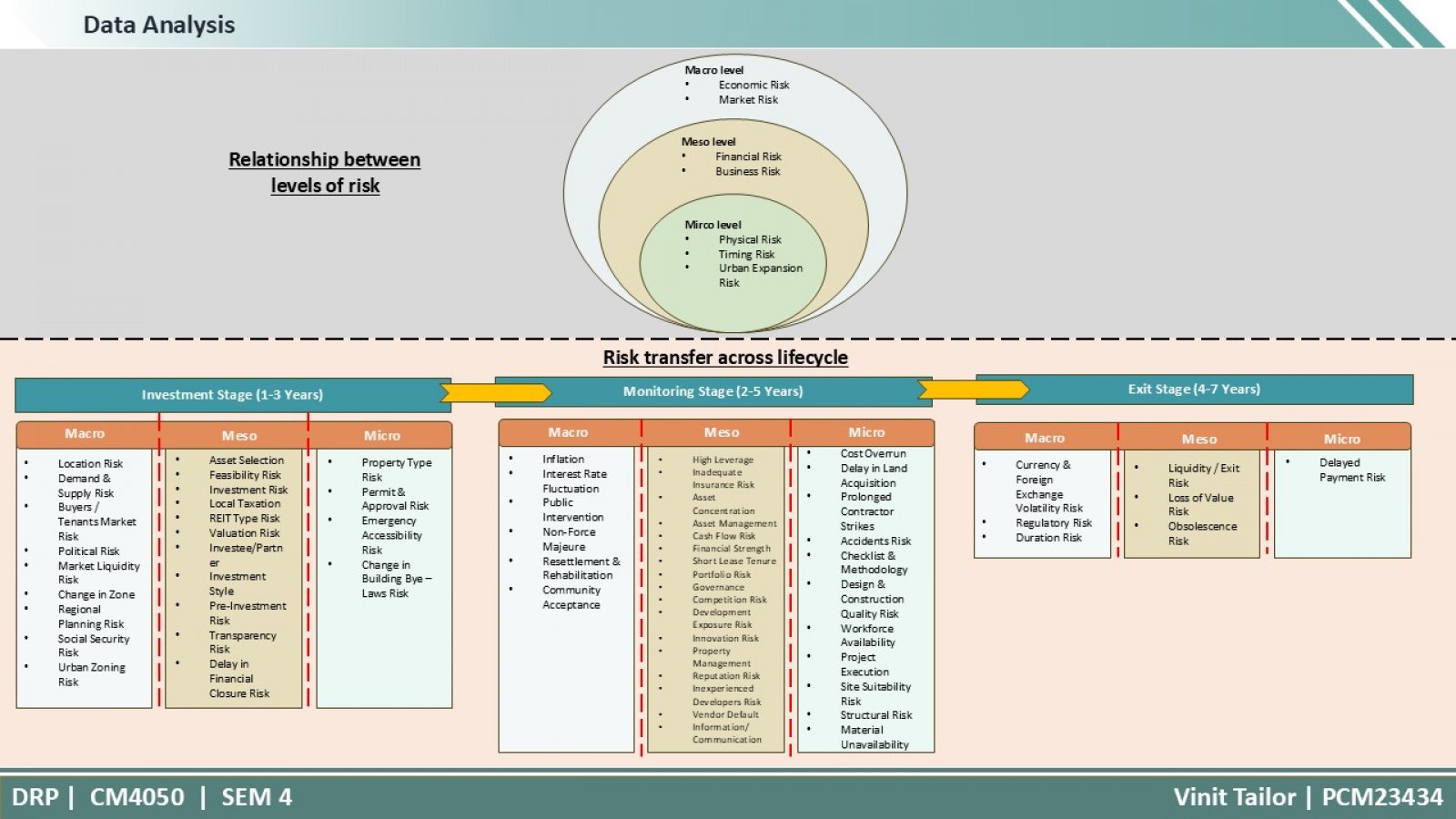

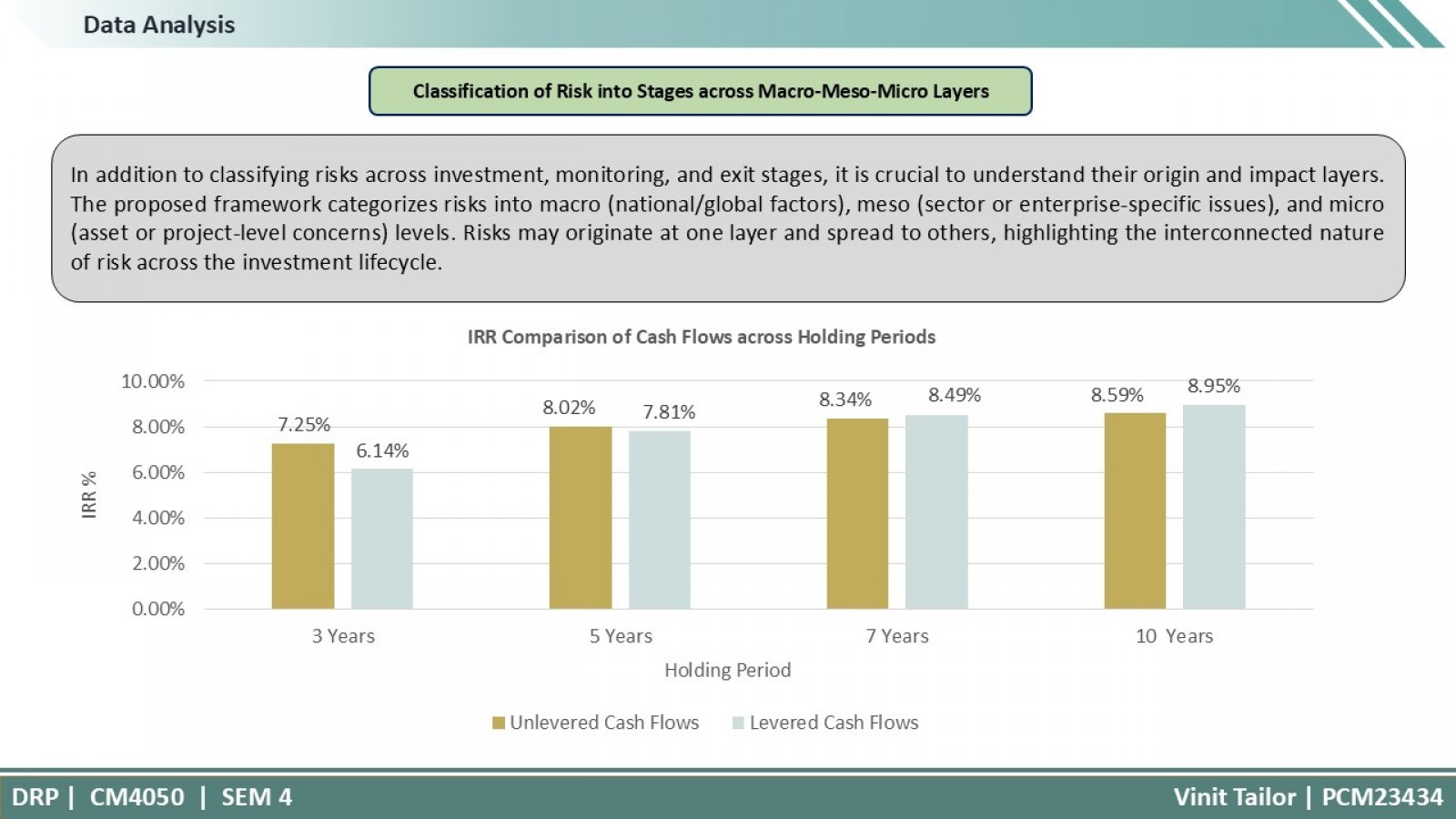

This research examines the connection between risks and financing decisions across different stages of real estate investment in India. Using a mixed-methods approach, it identifies 65 risks categorized into economic, financial, market, and other types, based on expert surveys. Risks were assessed on a five-point Likert scale to build a severity-weighted risk register and mitigation strategies. A macro, meso, and micro-level framework mapped risk impacts across investment, monitoring, and exit stages. Additionally, a financial model for a 2 BHK unit assessed unlevered and levered IRRs over 3, 5, 7, and 10 years, showing that longer holding periods improve returns. The integrated approach offers valuable insights for strategic investment planning in India's evolving real estate market.