Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

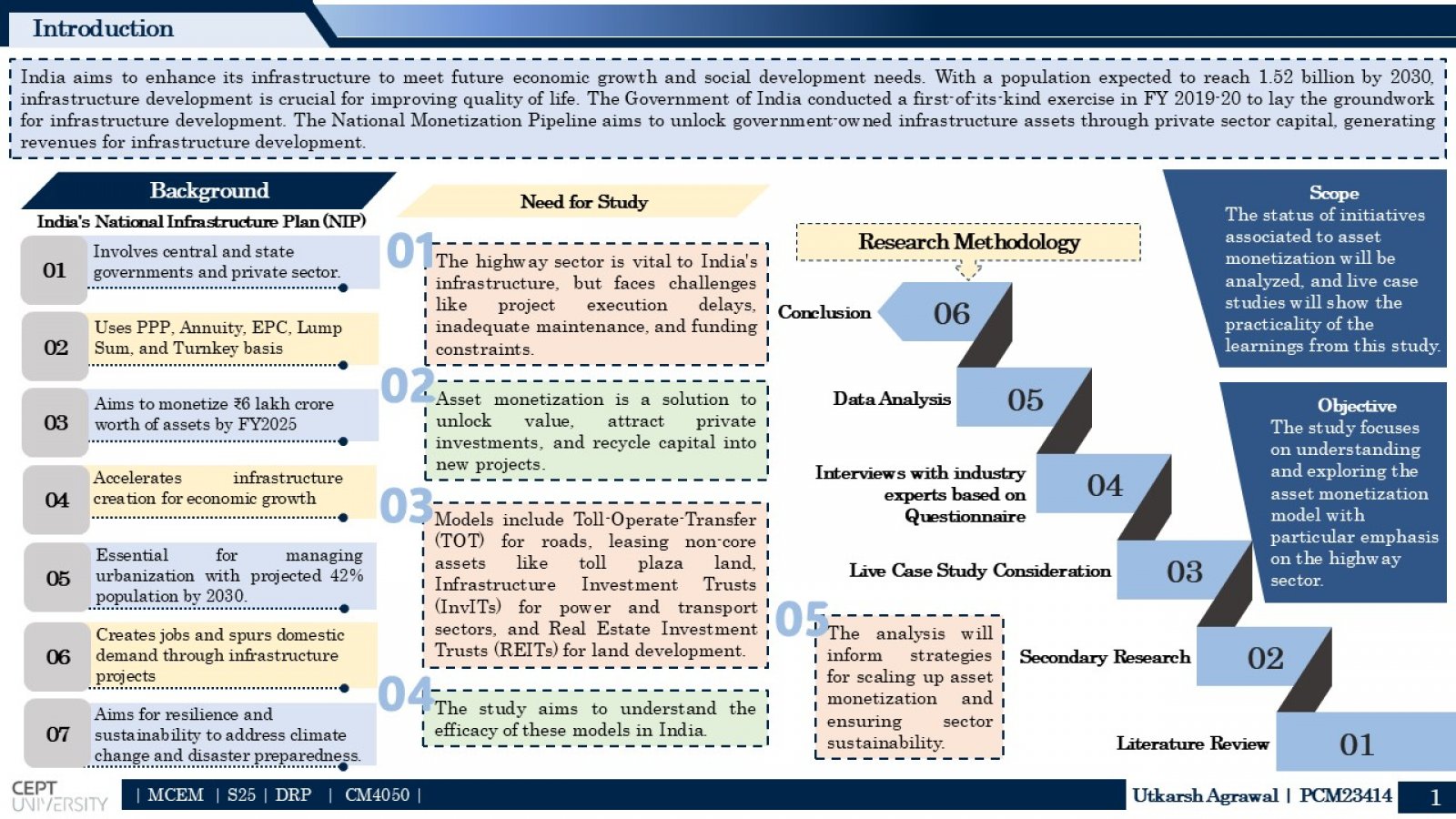

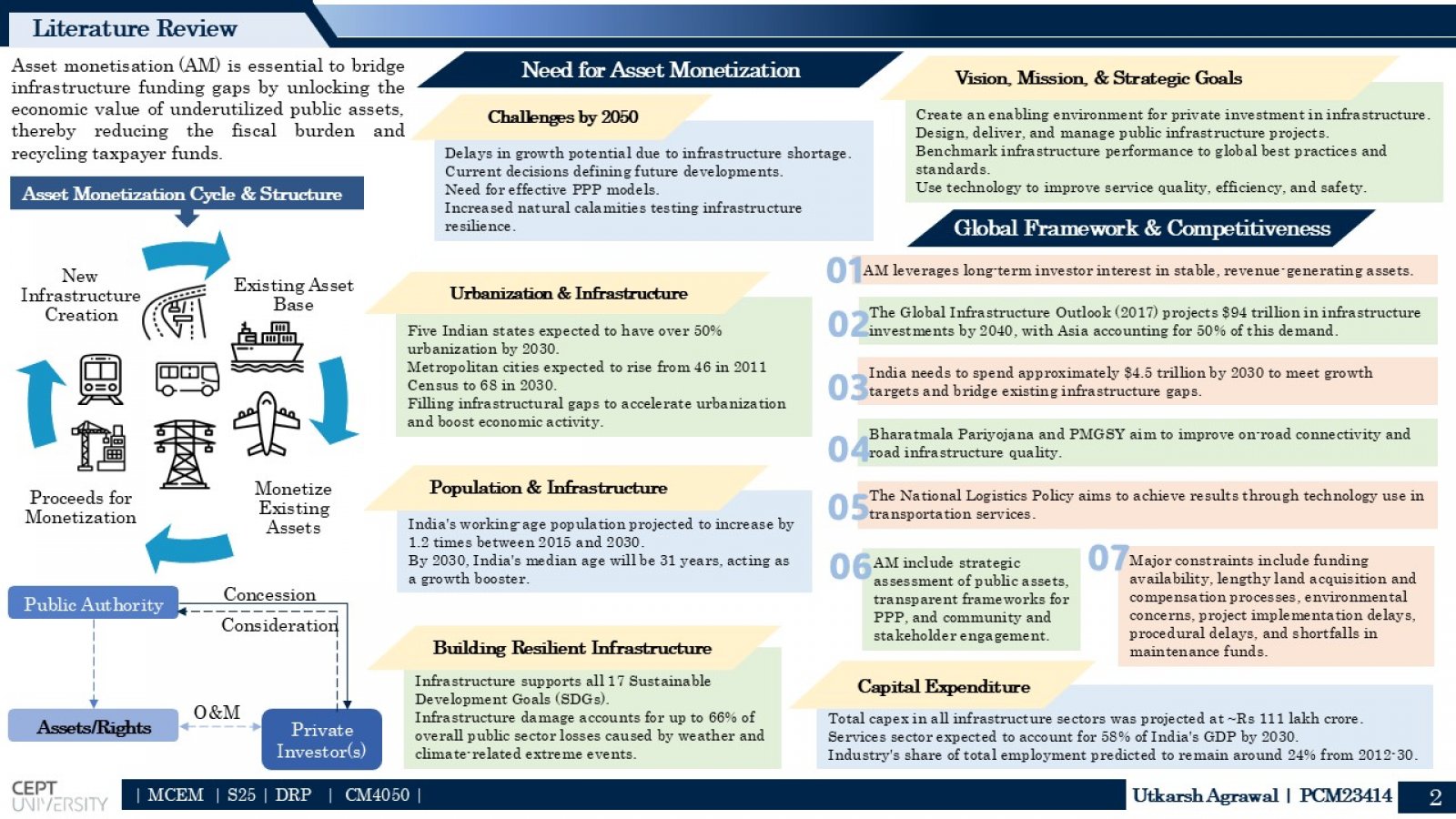

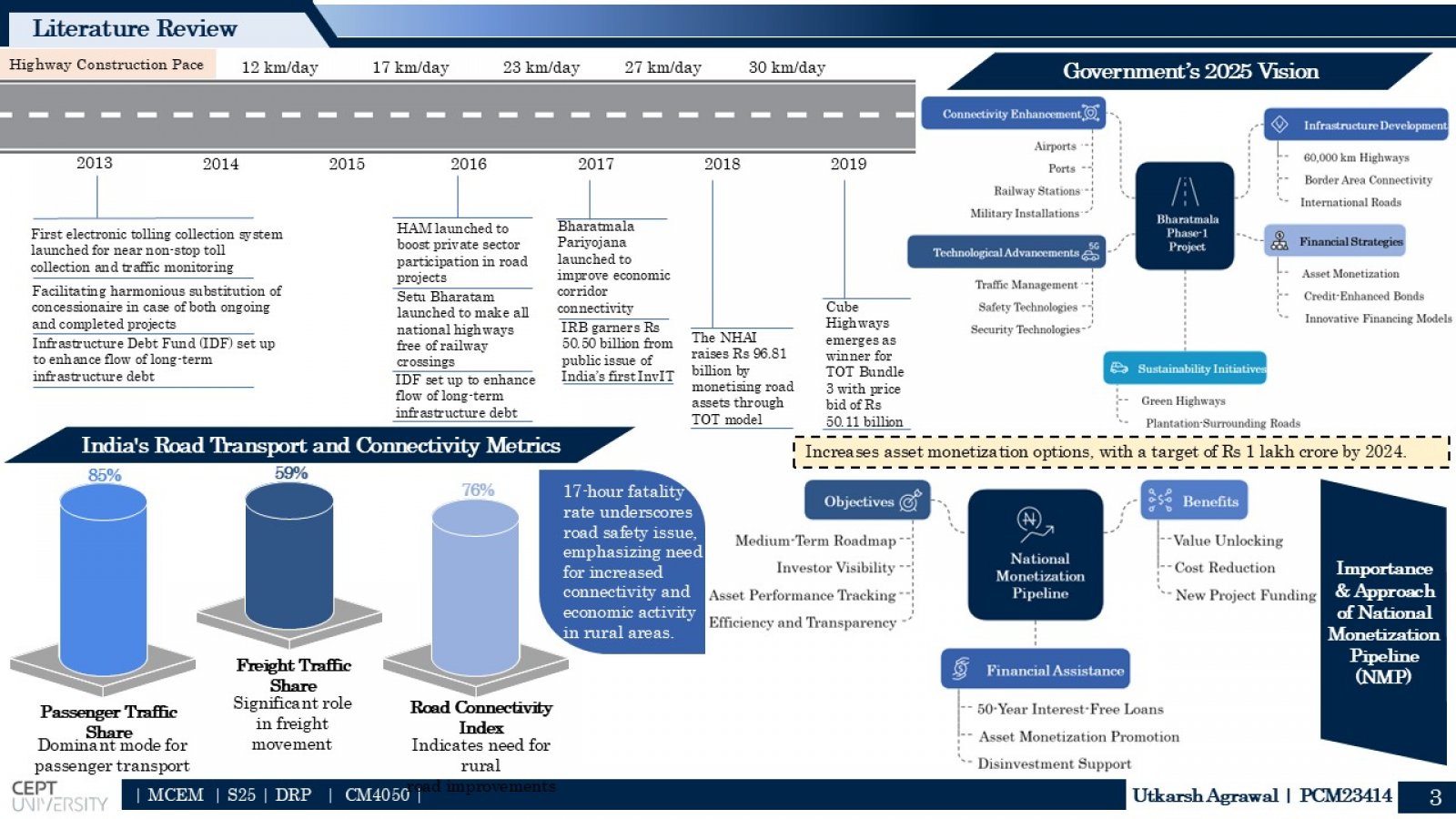

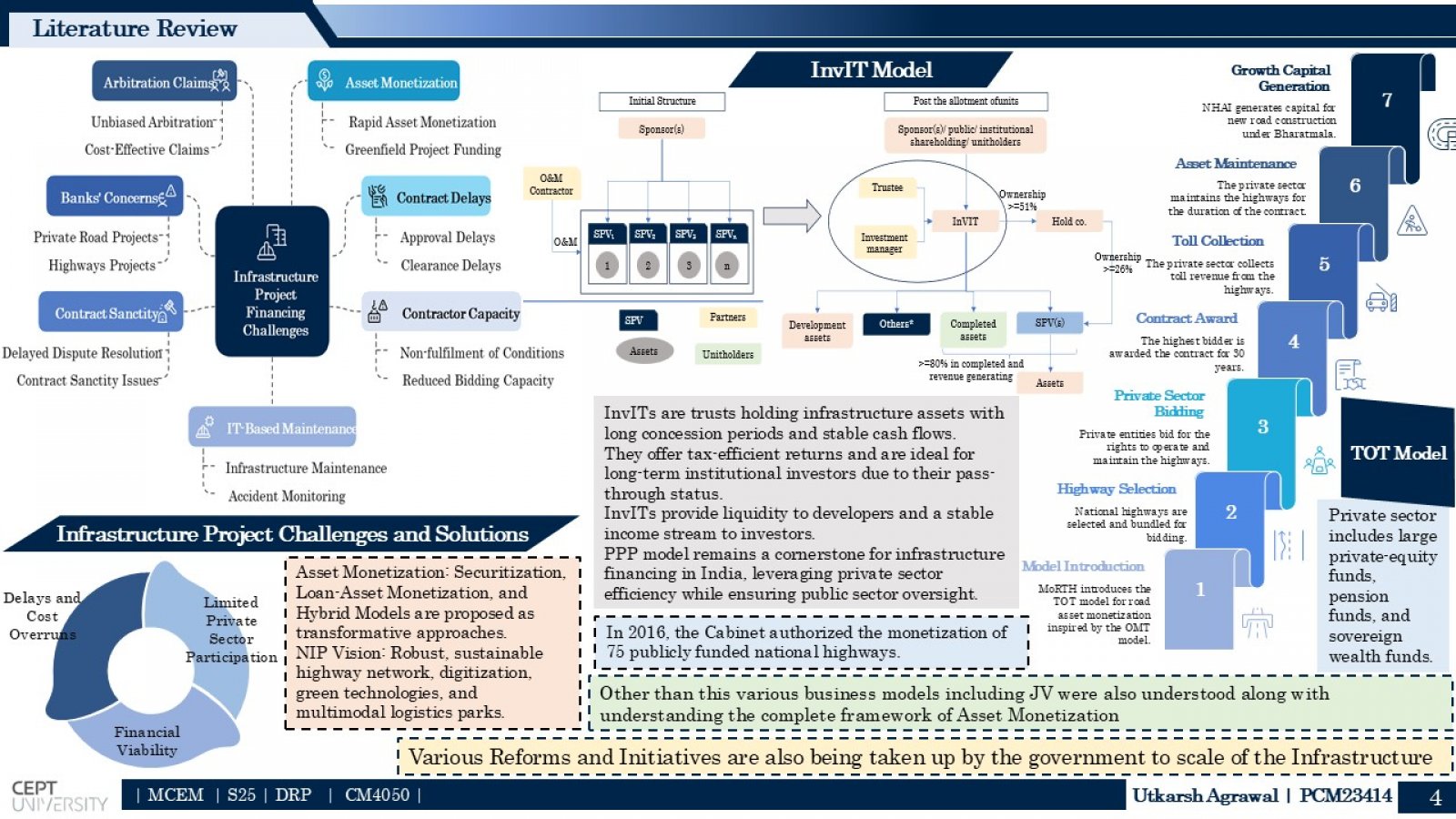

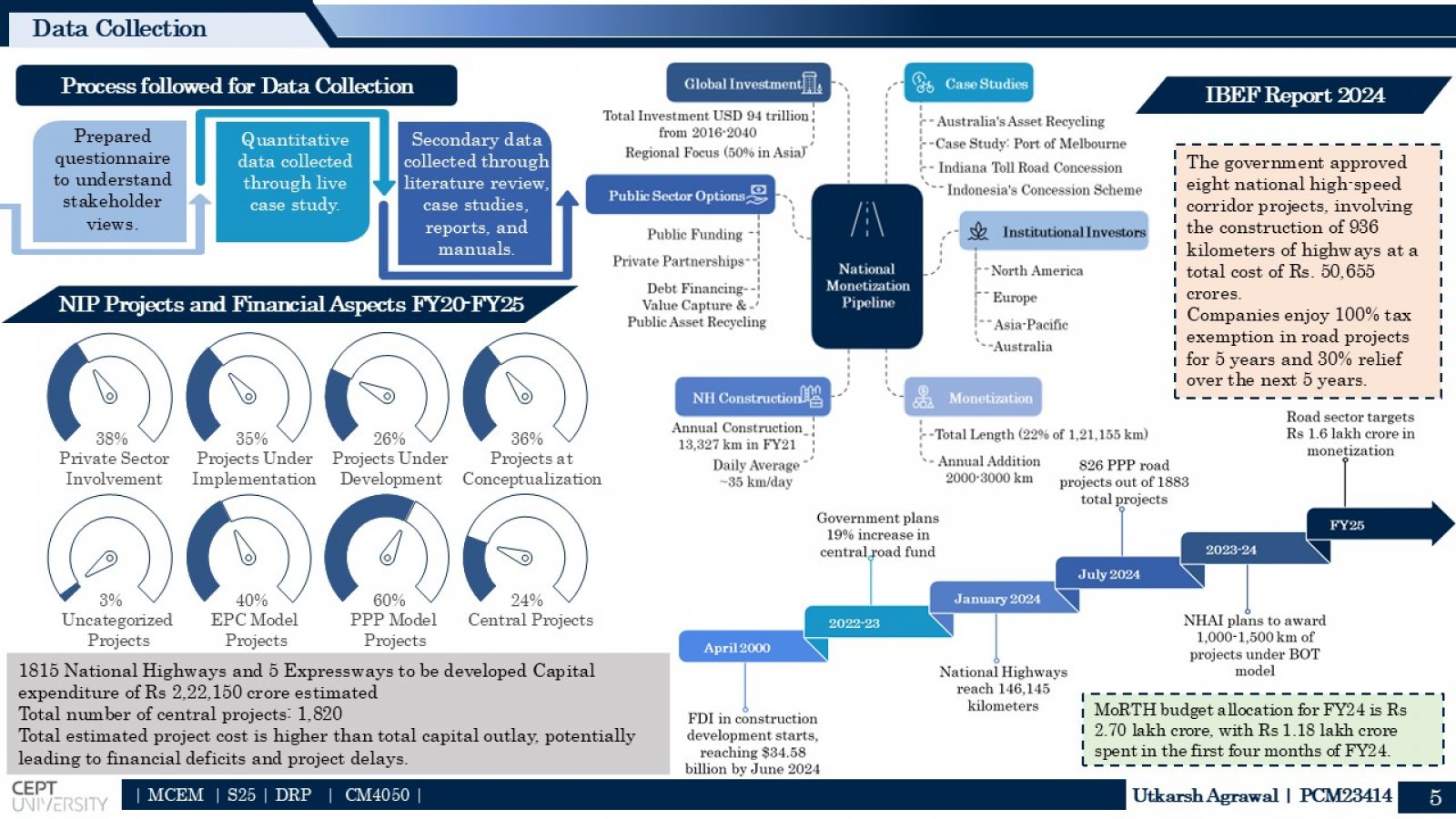

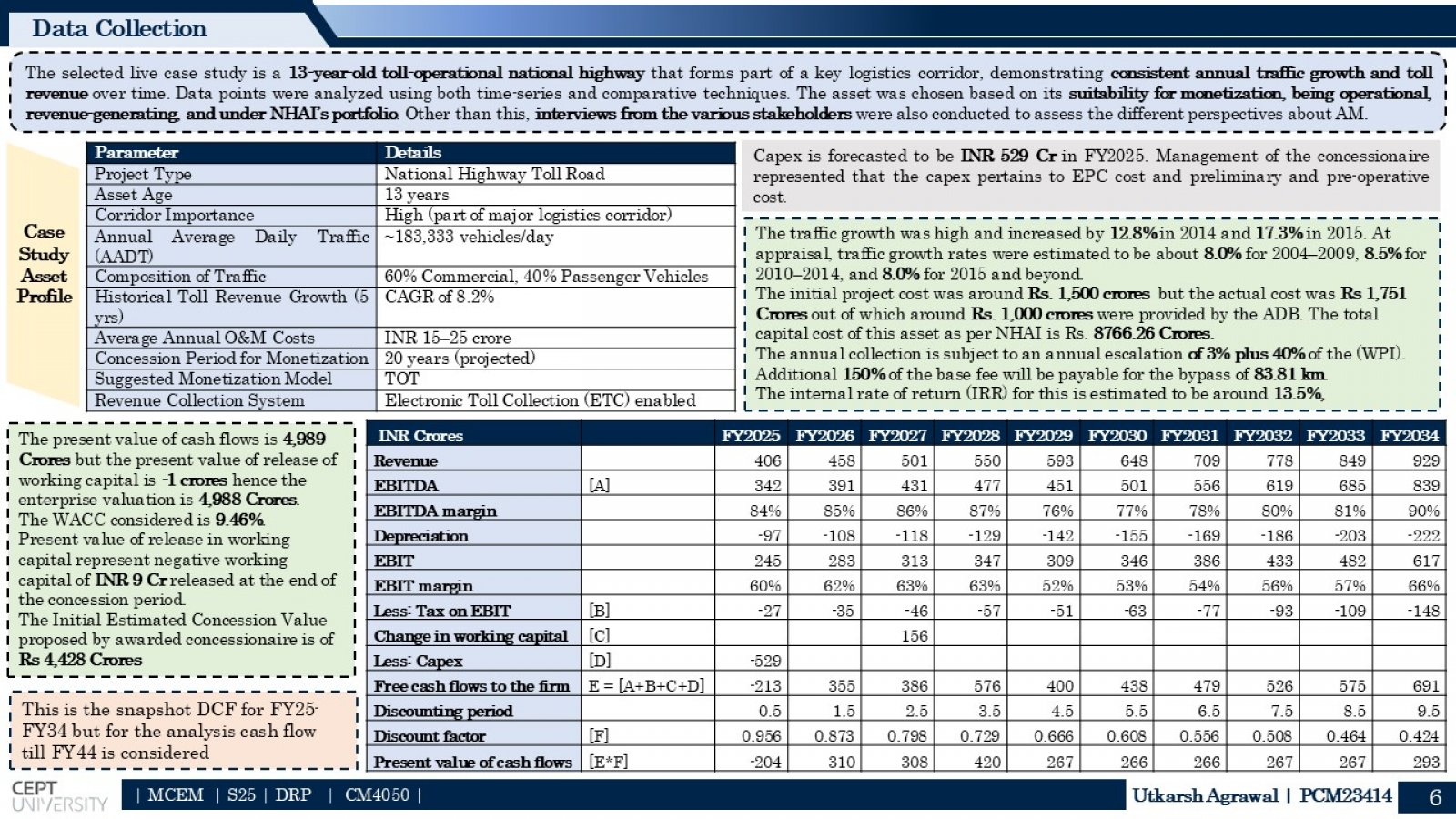

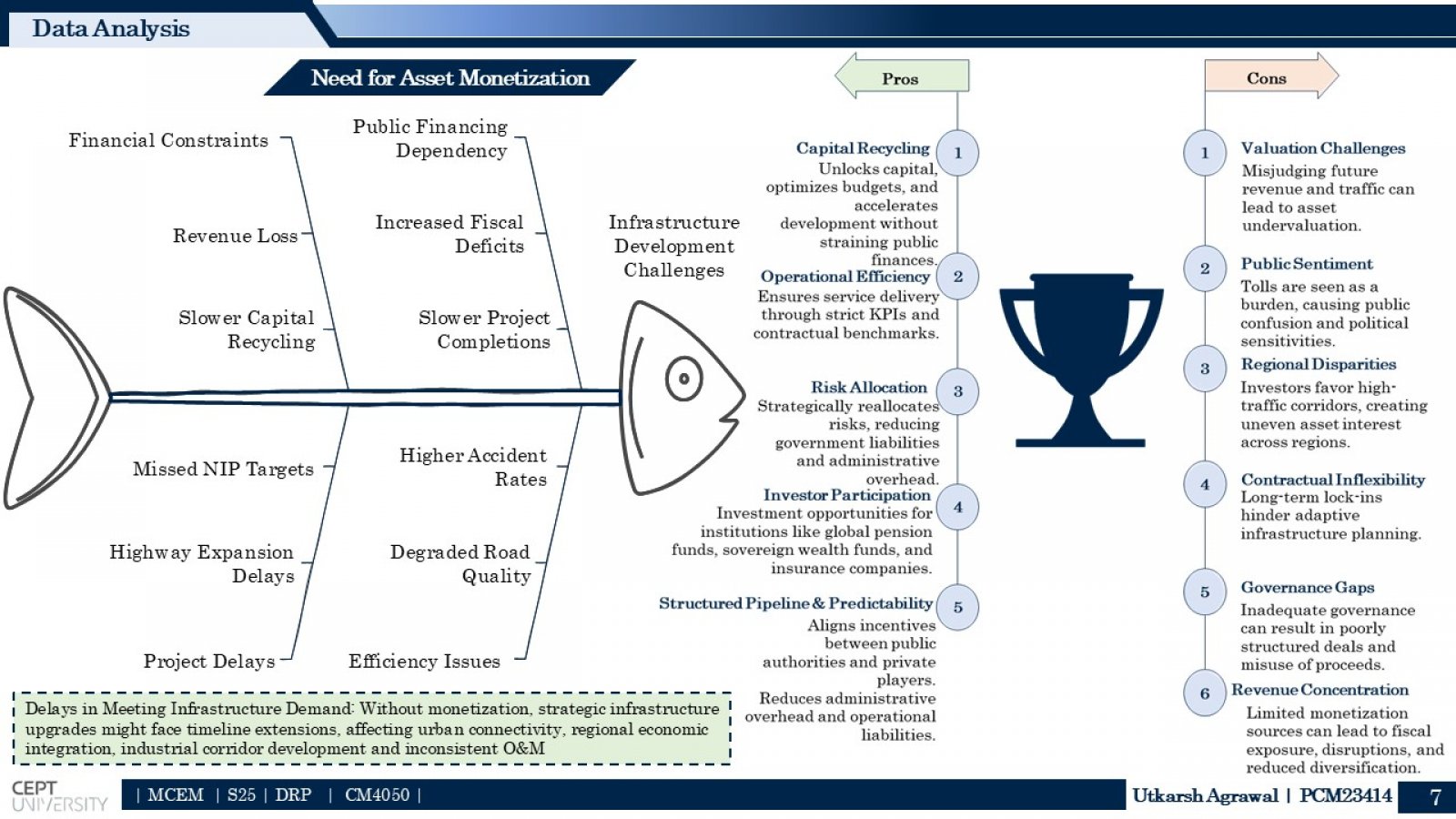

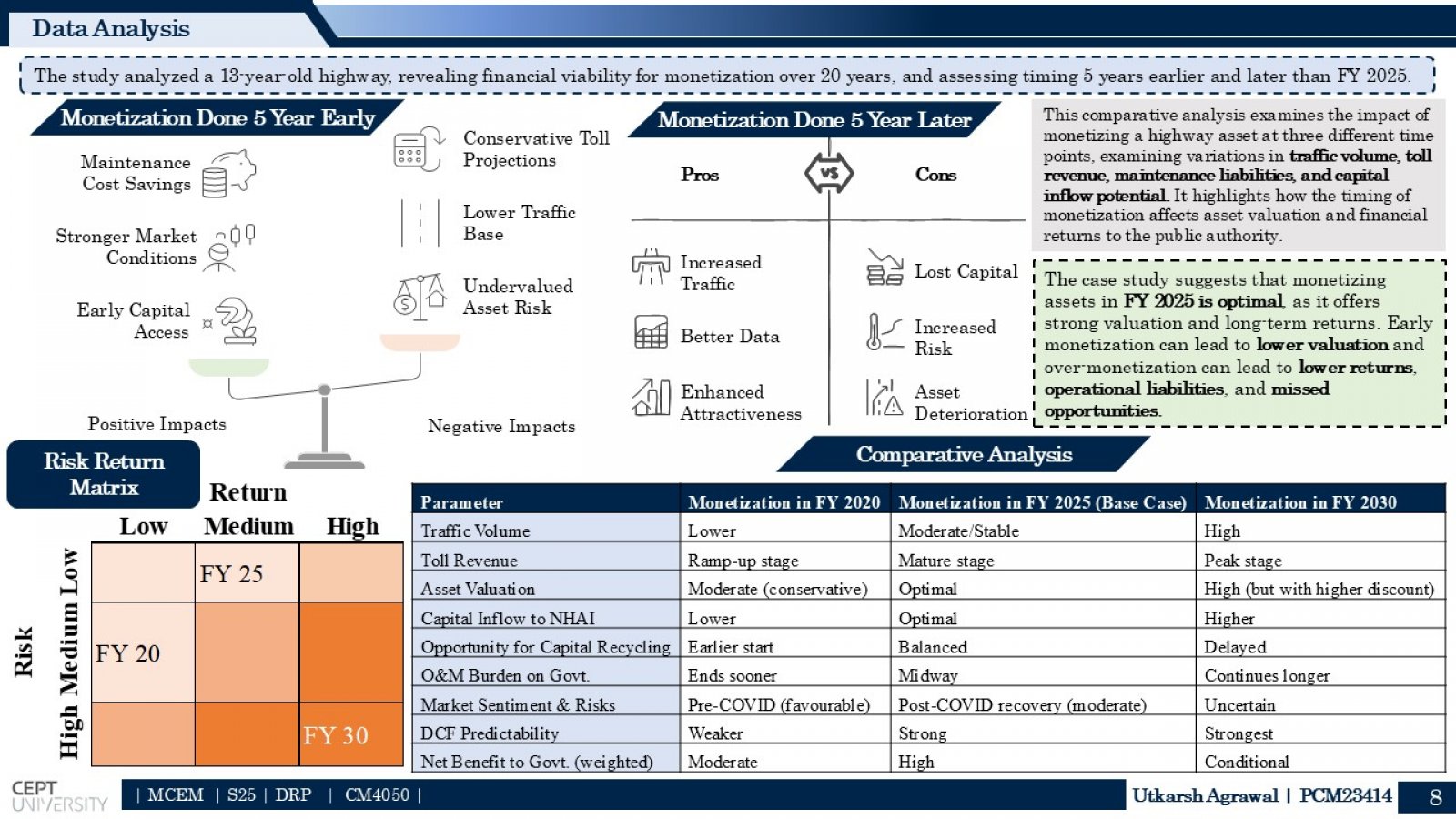

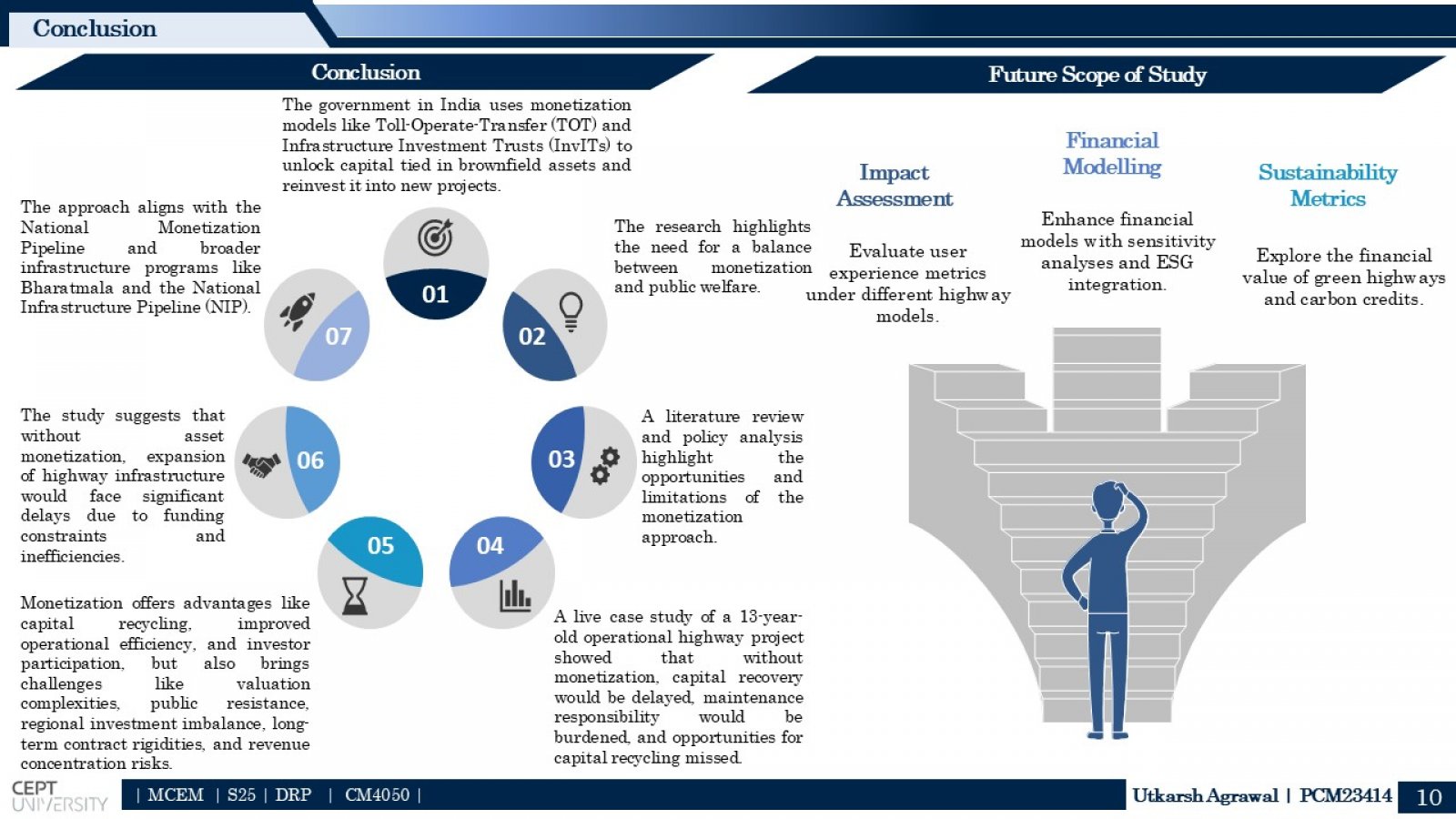

India’s rising infrastructure demands, especially in highways, require innovative financing beyond traditional public funding. This study explores asset monetization as a strategic model using Toll-Operate-Transfer (TOT) and Infrastructure Investment Trusts (InvITs). It reviews global and national frameworks, analyzes a live case study, and incorporates stakeholder insights. Findings highlight monetization’s benefits—capital recycling, risk transfer, and efficiency—alongside risks like valuation uncertainty and public resistance. The study also identifies supplementary revenue avenues such as land leasing and digital advertising. With strong institutional backing and clear policies, asset monetization emerges as a crucial tool for sustaining highway infrastructure development in India.