Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

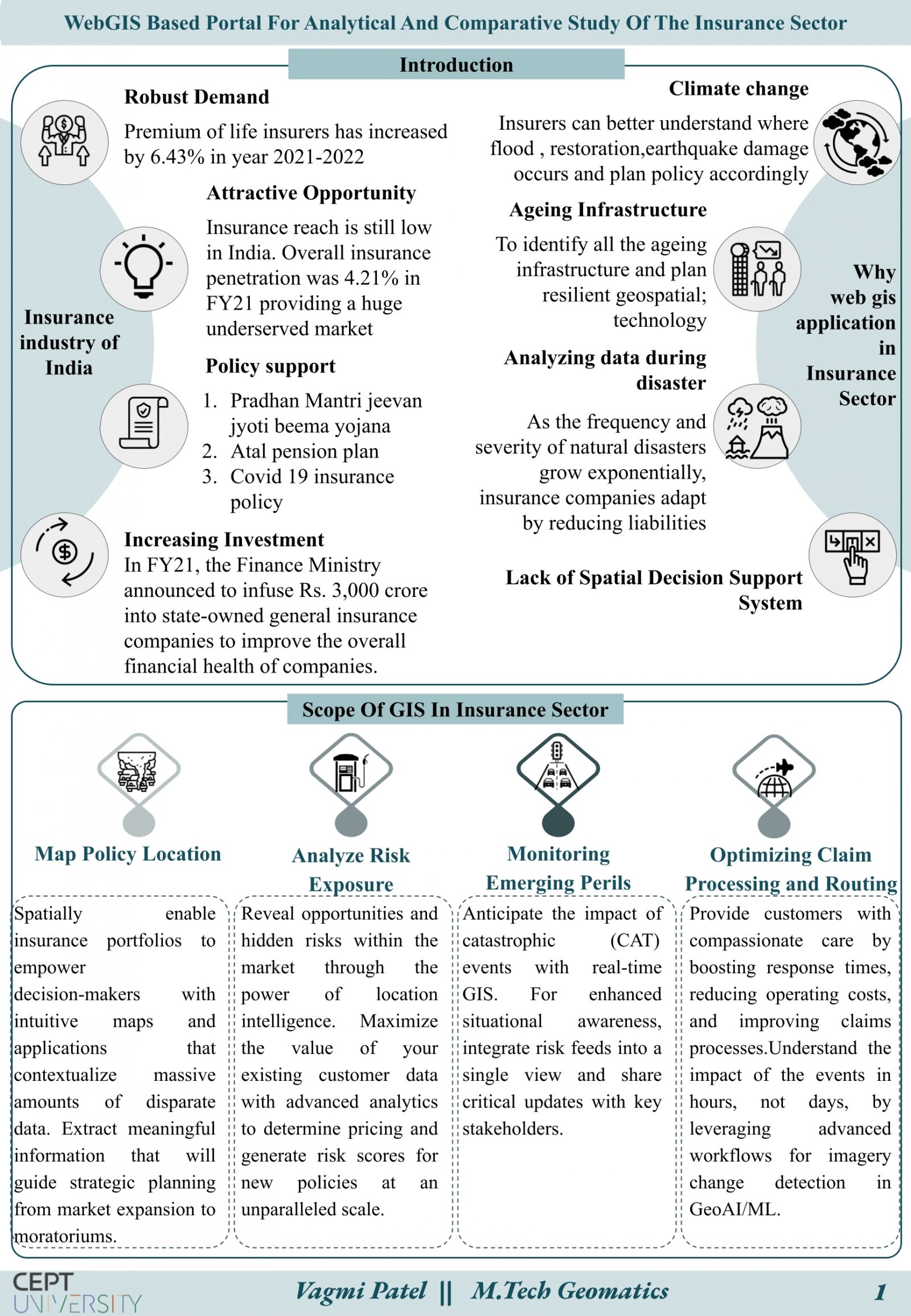

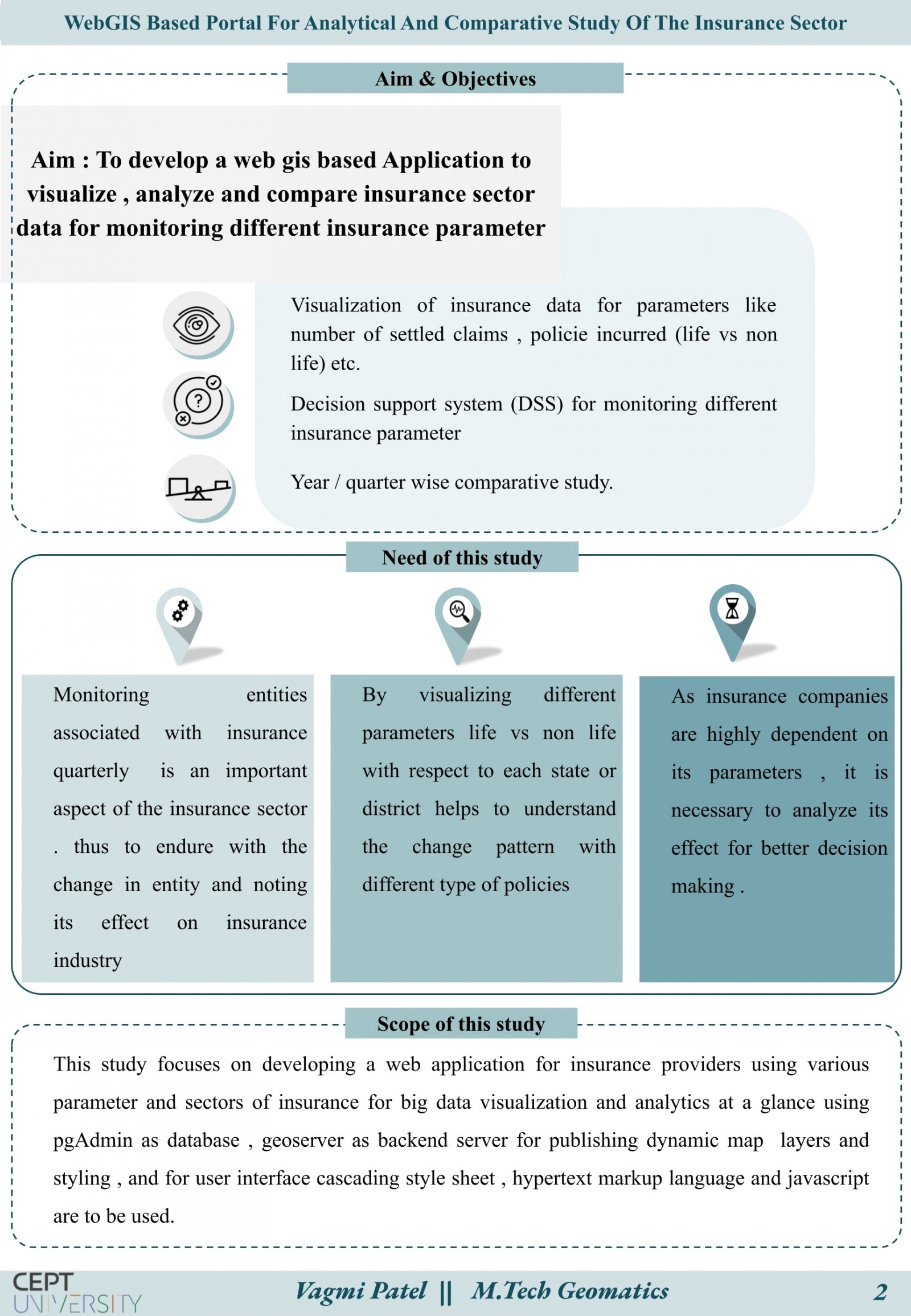

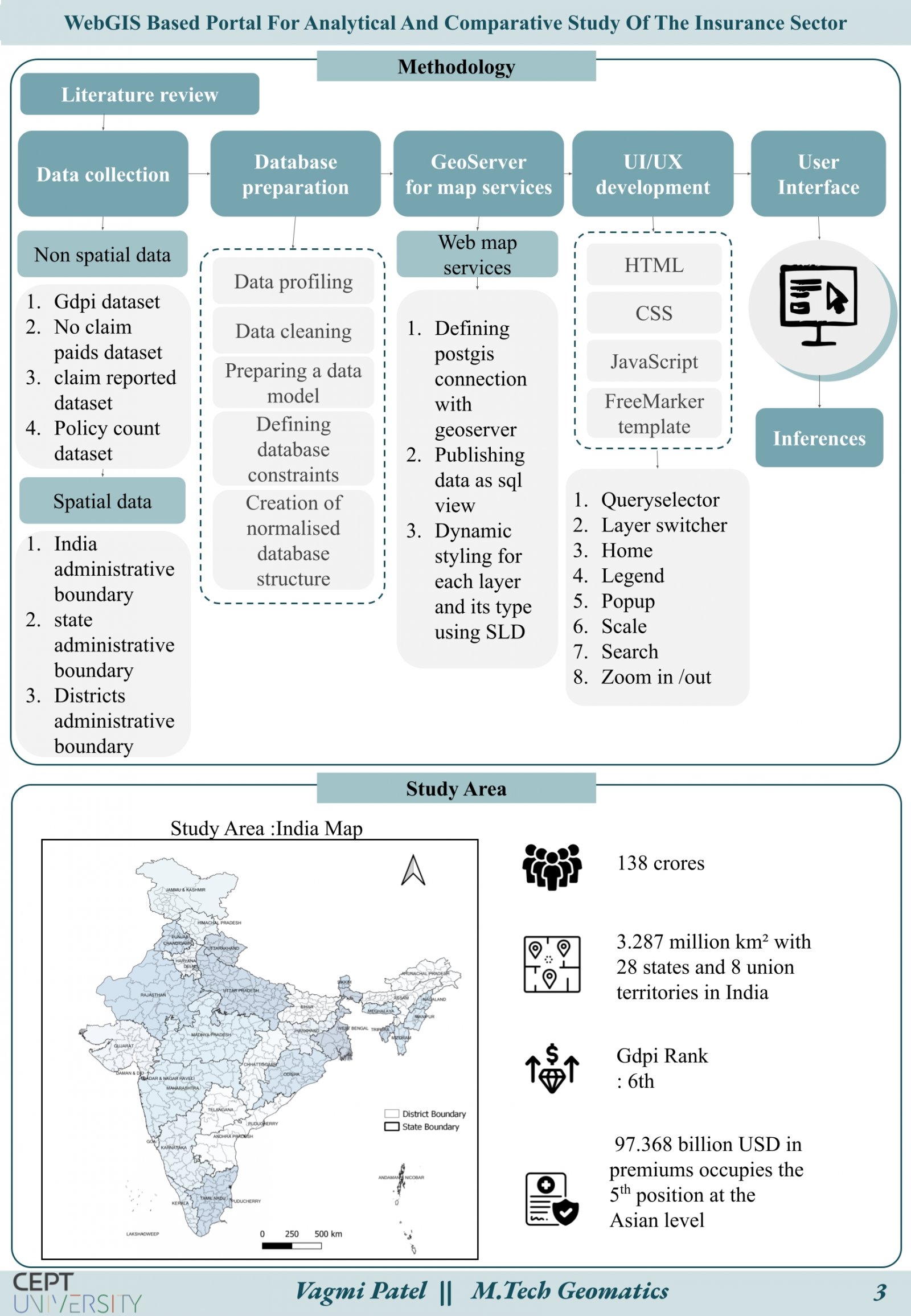

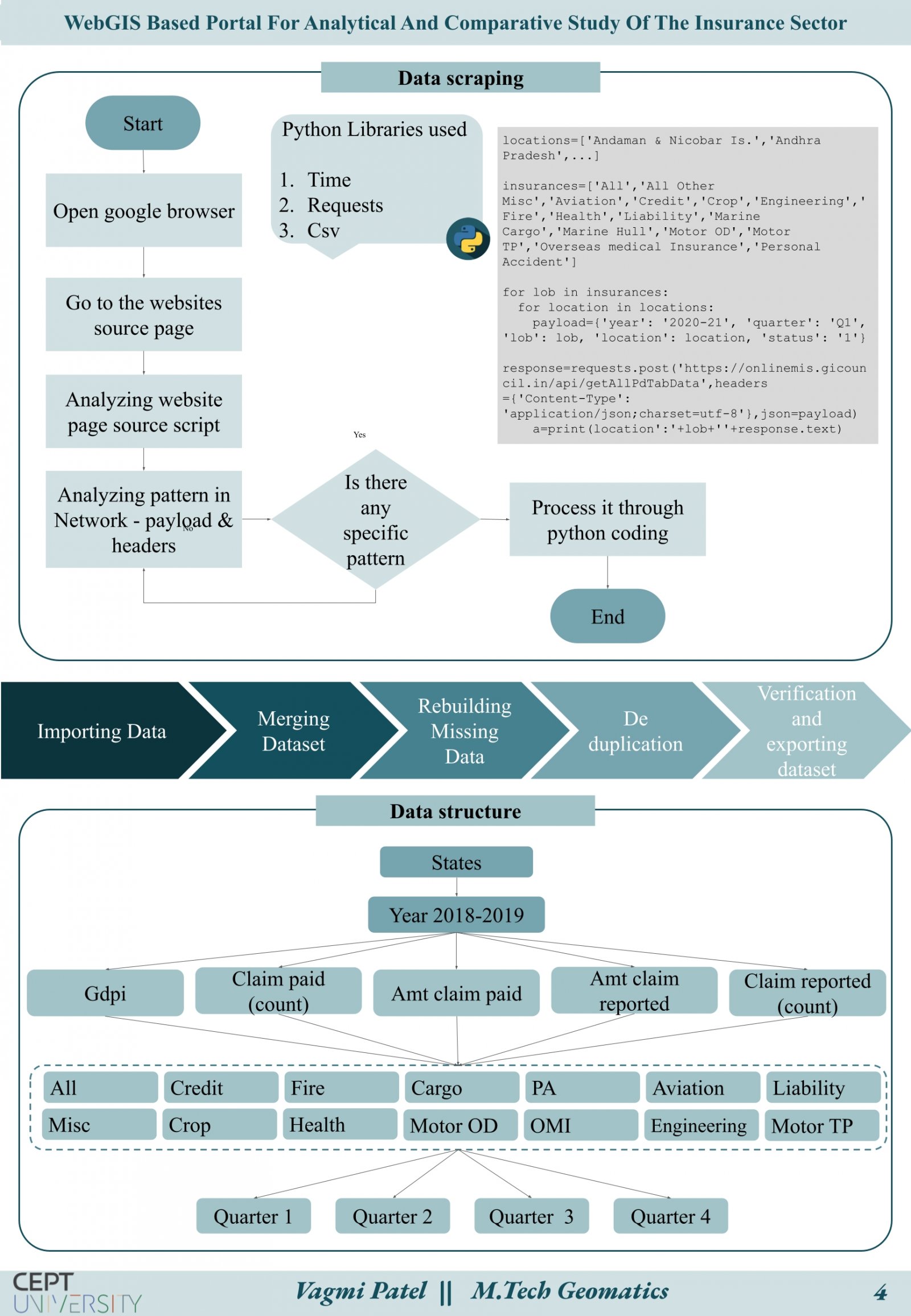

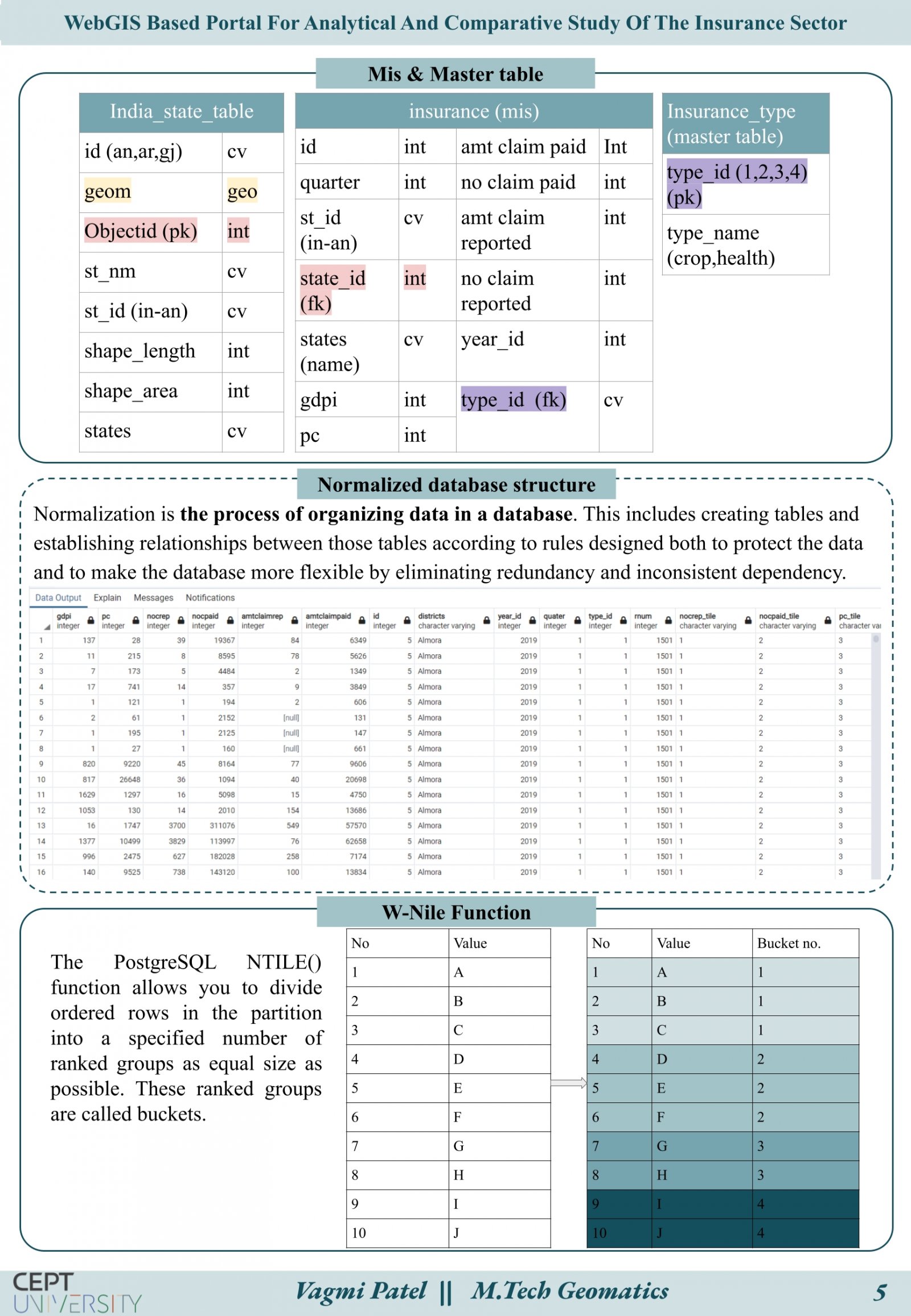

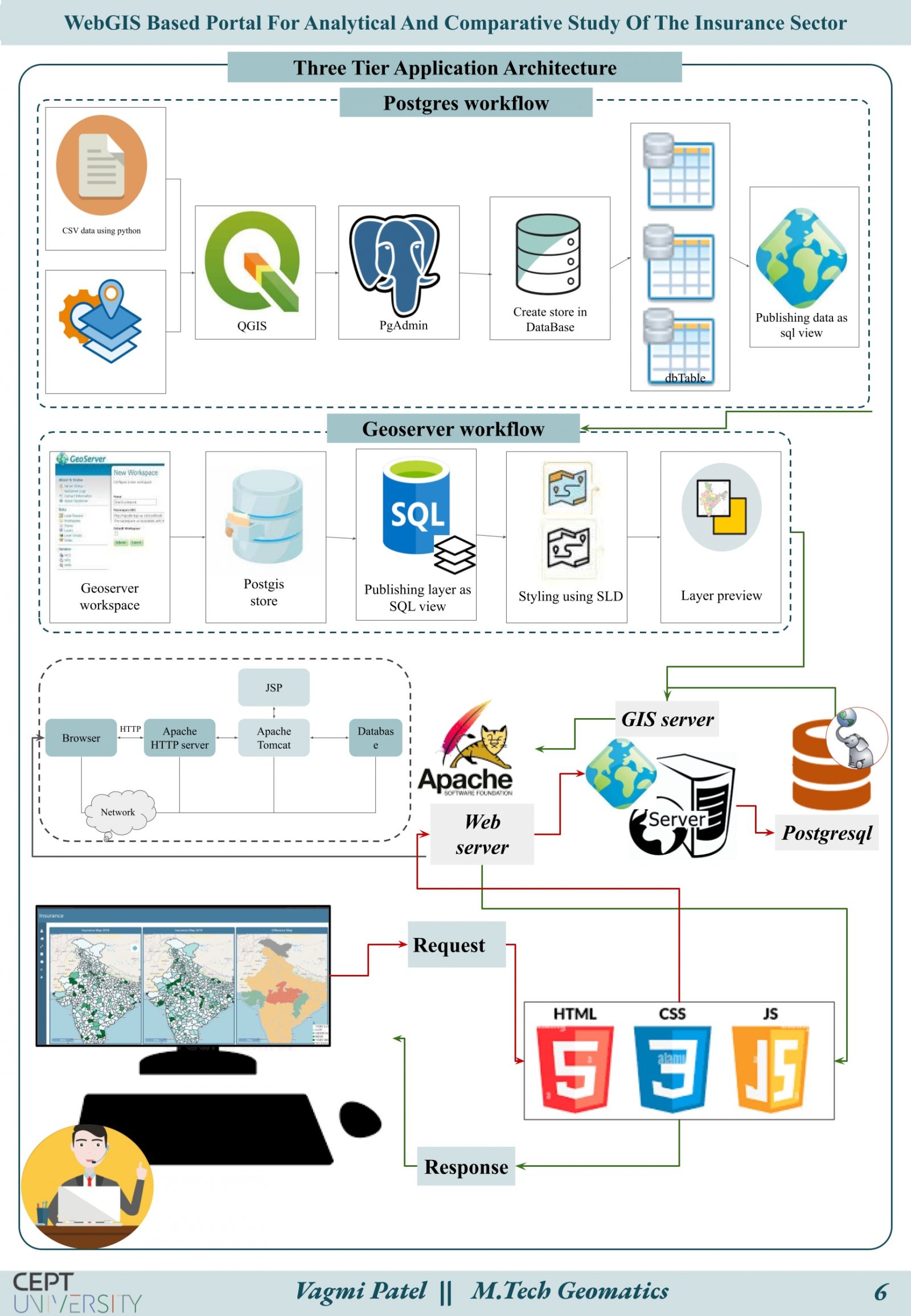

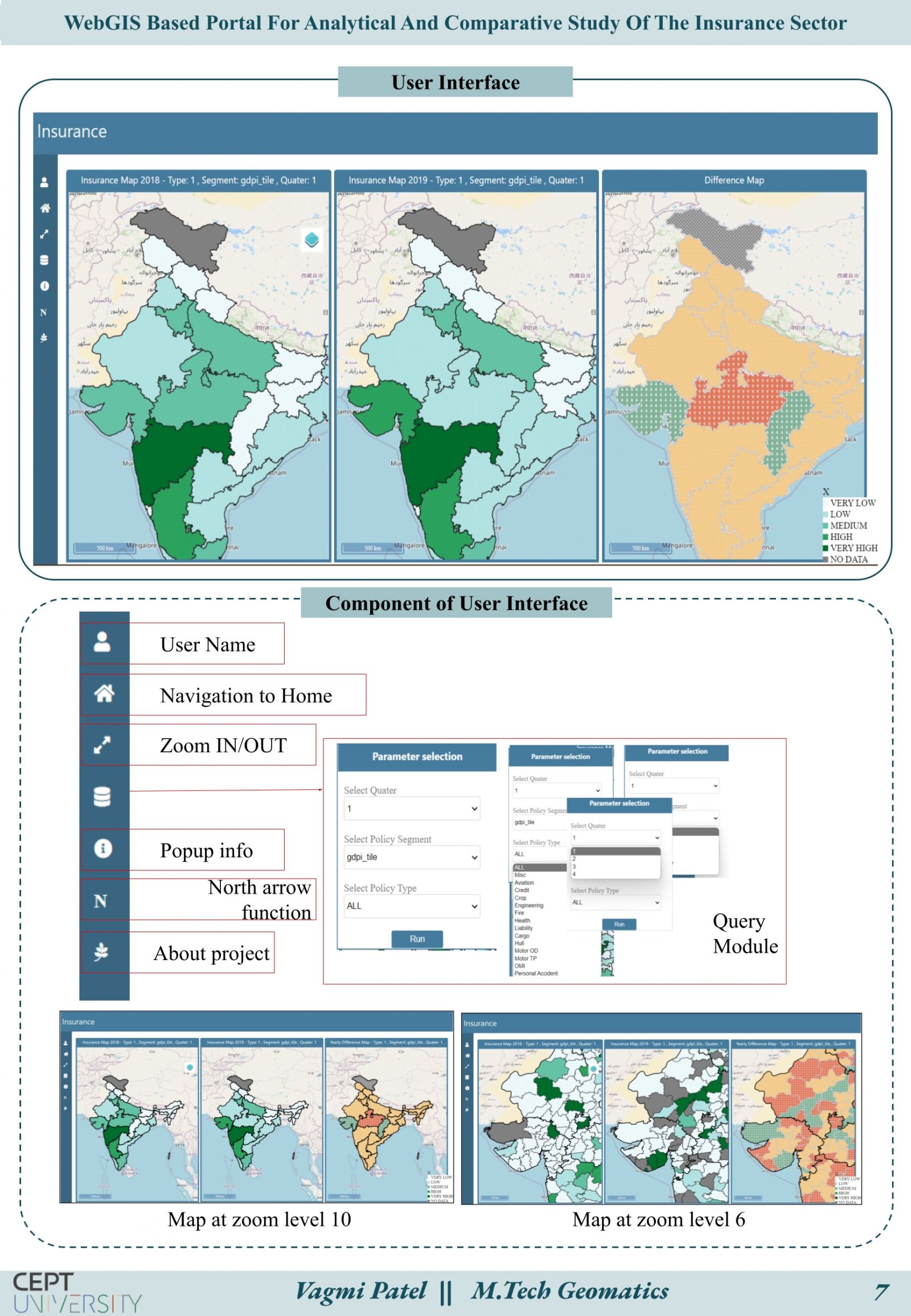

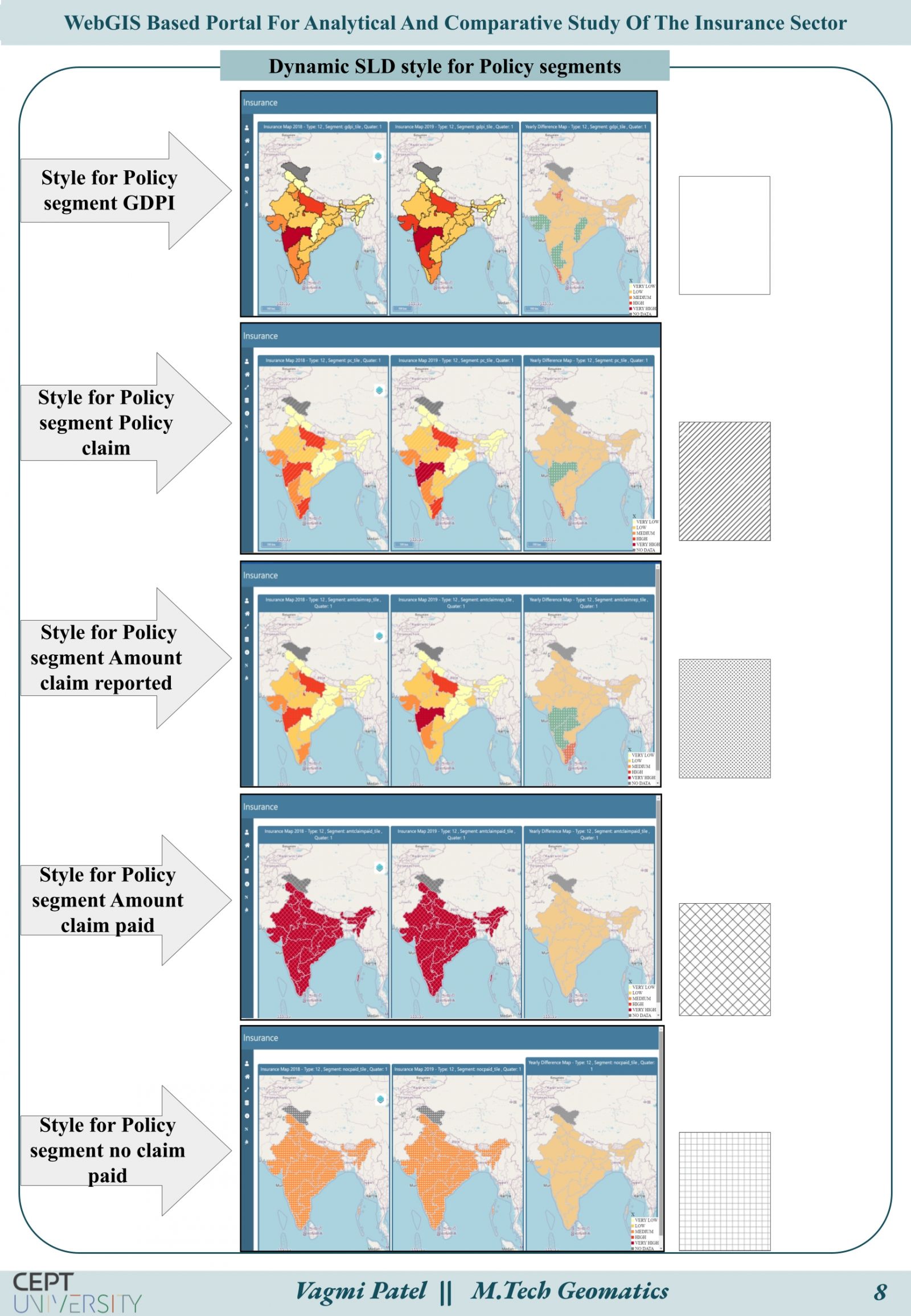

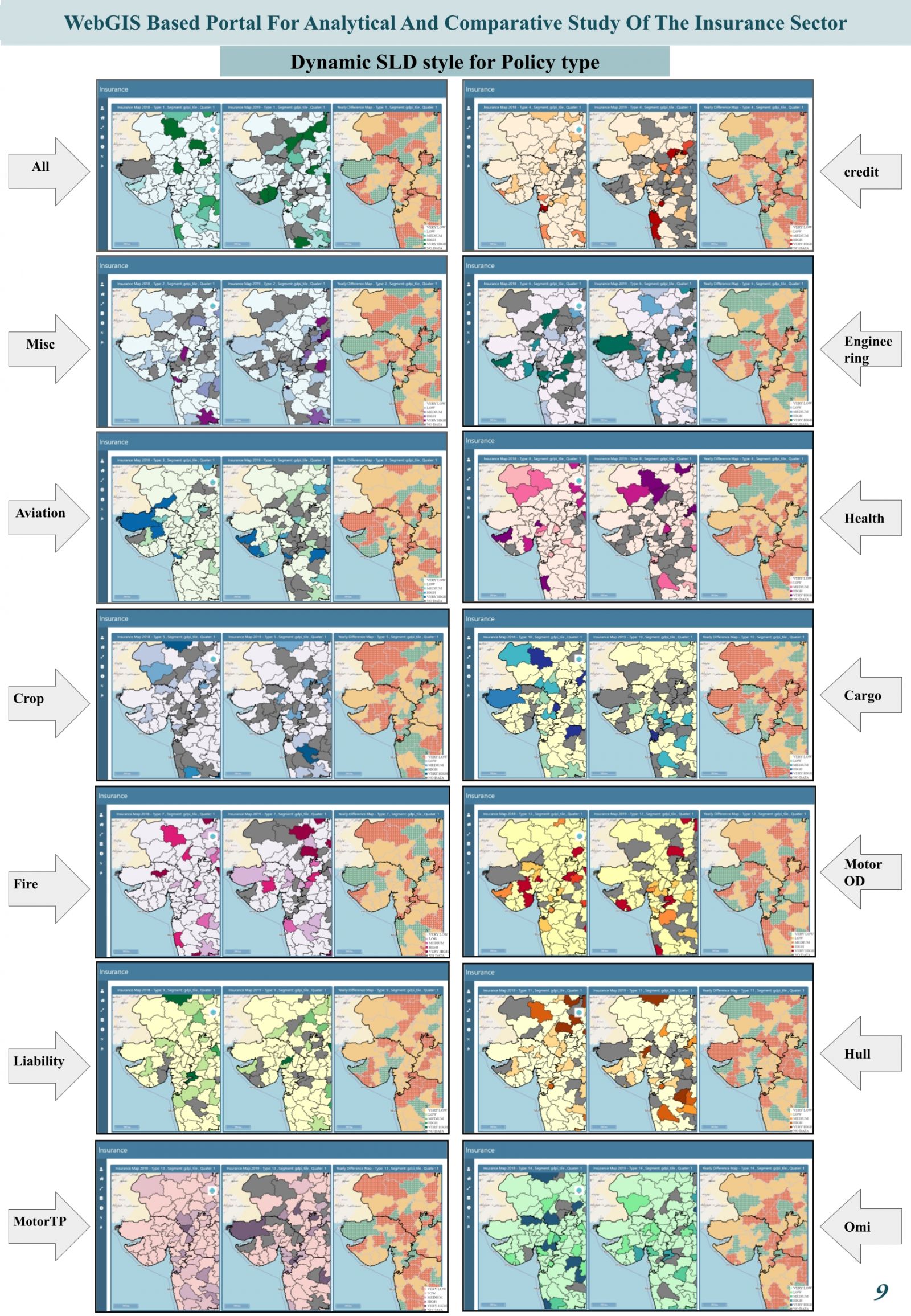

Technological innovations are the major driver of change in the Insurance sector, and these have led to unmeasurable efficiency gains, even though these changes initially are accompanied by uncertainty and doubts . From storing data to paper and now storing data in excel , the insurance sector is a big data industry , where there is ample amount of data available . With availability of data comes responsibility to handle the data , bring conclusions and analytics out of it, to know strength and weakness impacting the industry.As a sector, insurance is not immune to such changes , with possibilities of new methods of service provision and greater opportunities for data collection and fraud detection that can result in better risk identification and mitigation.For Insurance, understanding location is critical. It impacts risk assessment and pricing models and enables successful underwriting and claims processes. Insurance companies need to go beyond static figures and spreadsheets to get dynamic insight. Using open source mapping technology, spatial analytics and authoritative geo-data, Insurers can gather real world knowledge from their desktop, to help define risk scores, manage accumulation and calculate exposures in support of Underwriting and Claims processes.