Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

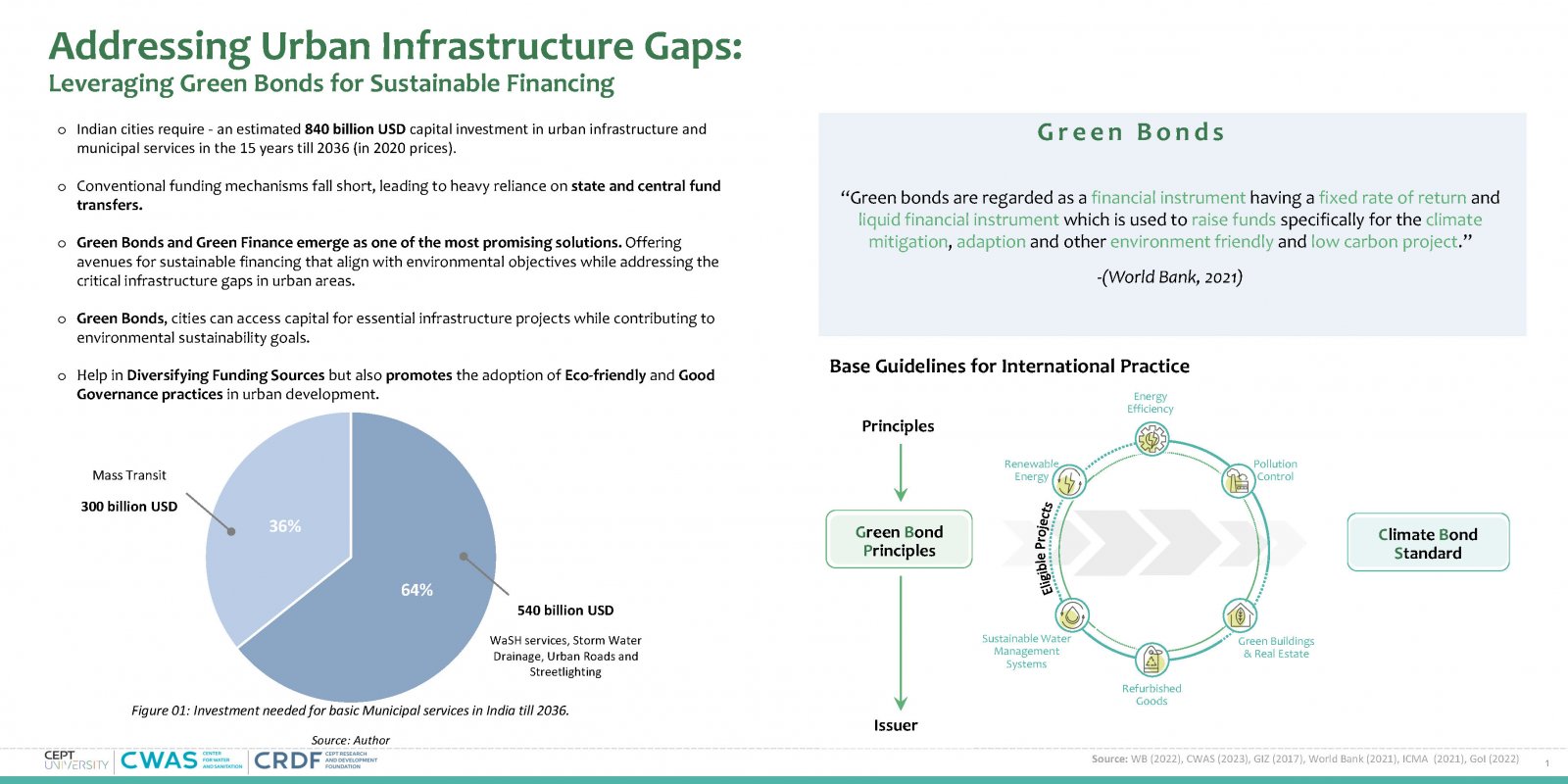

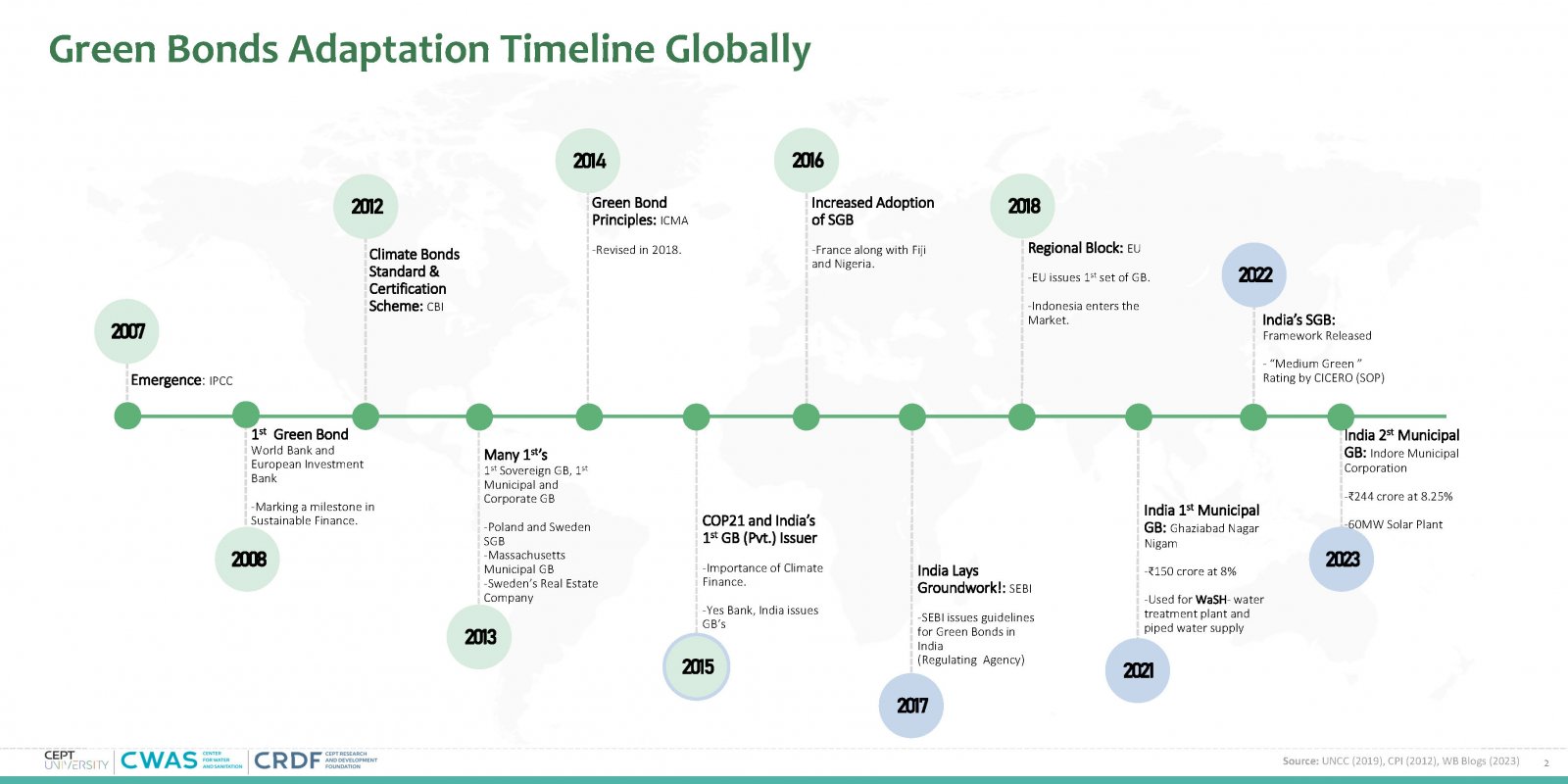

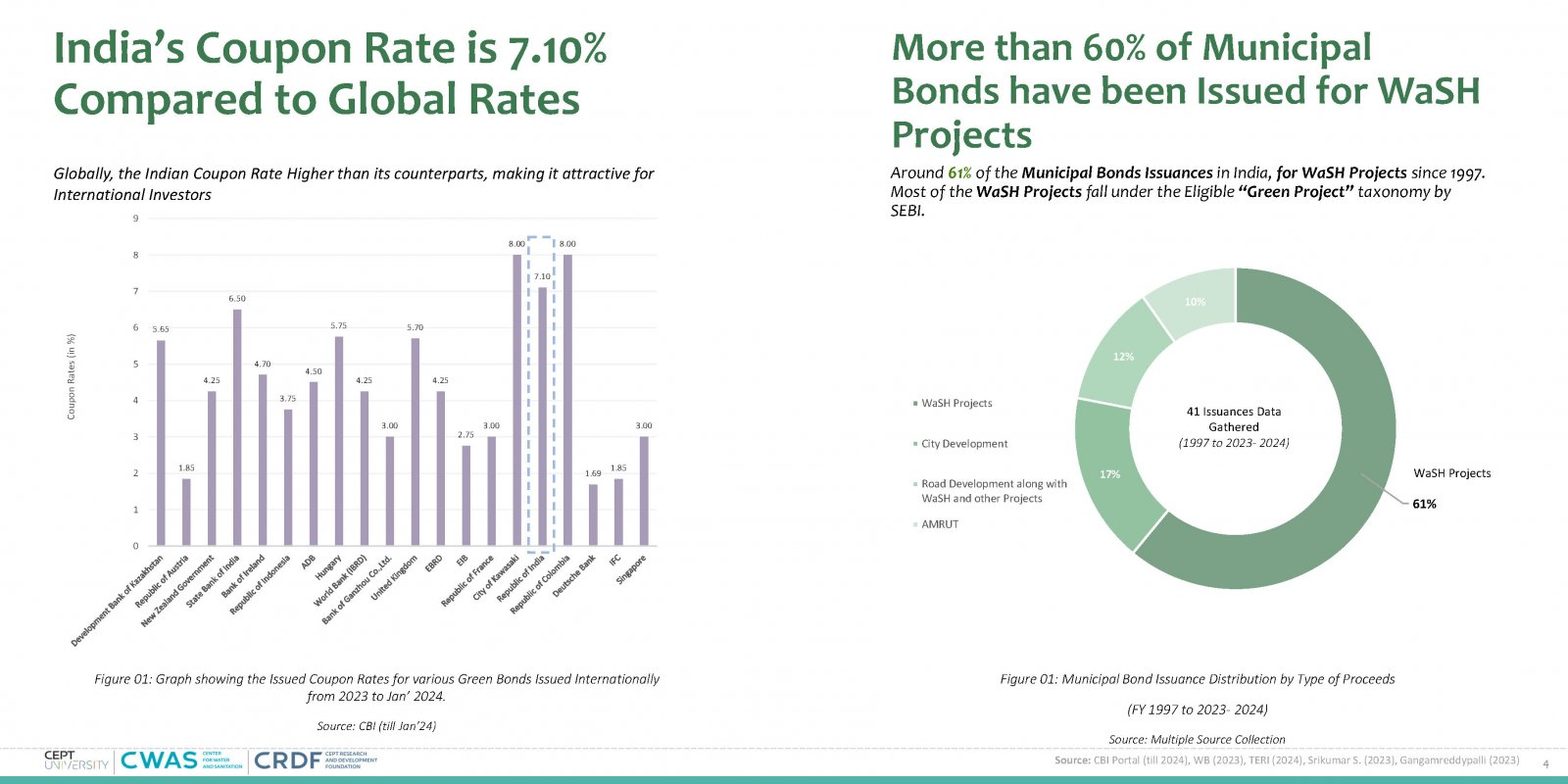

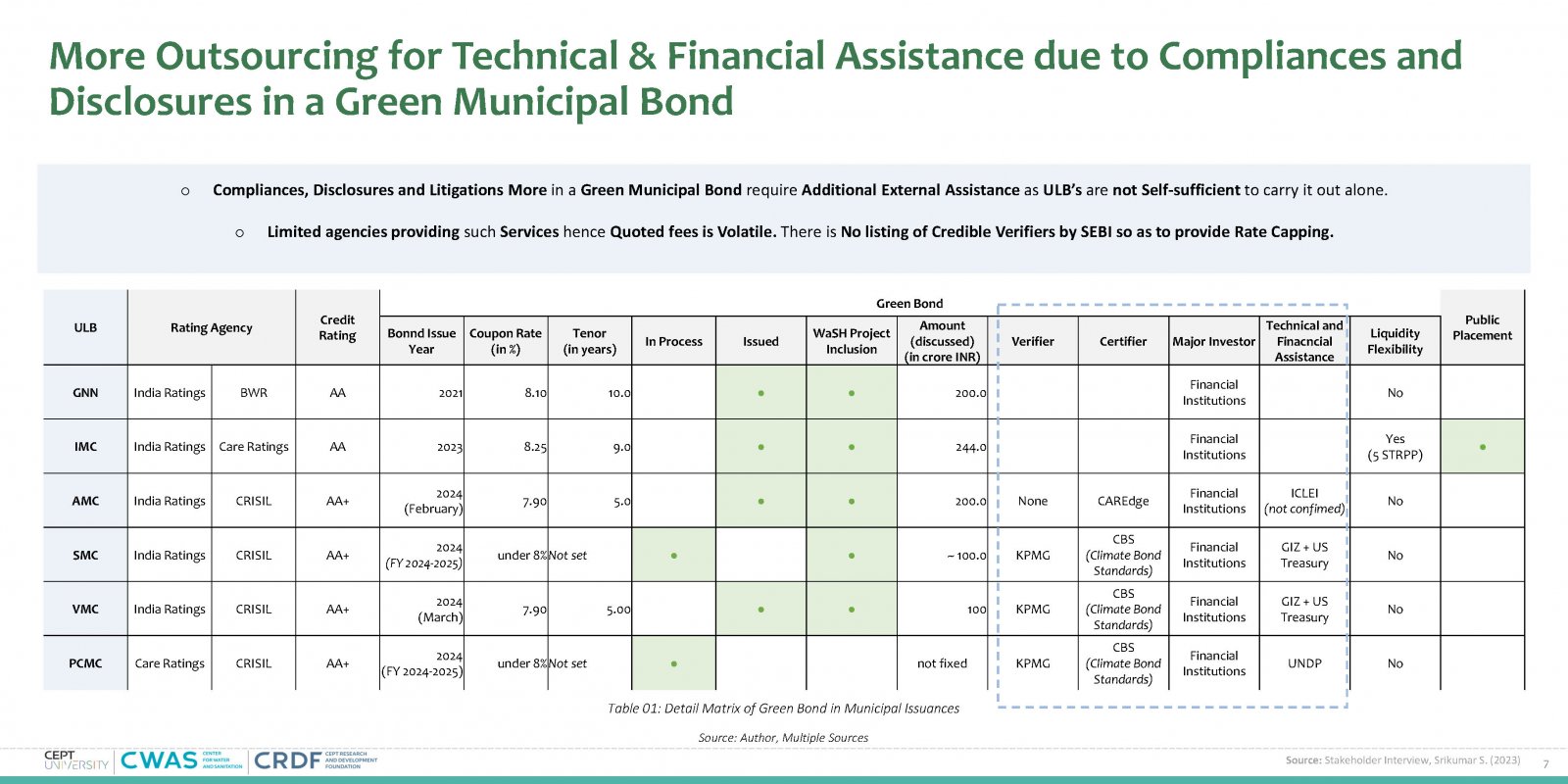

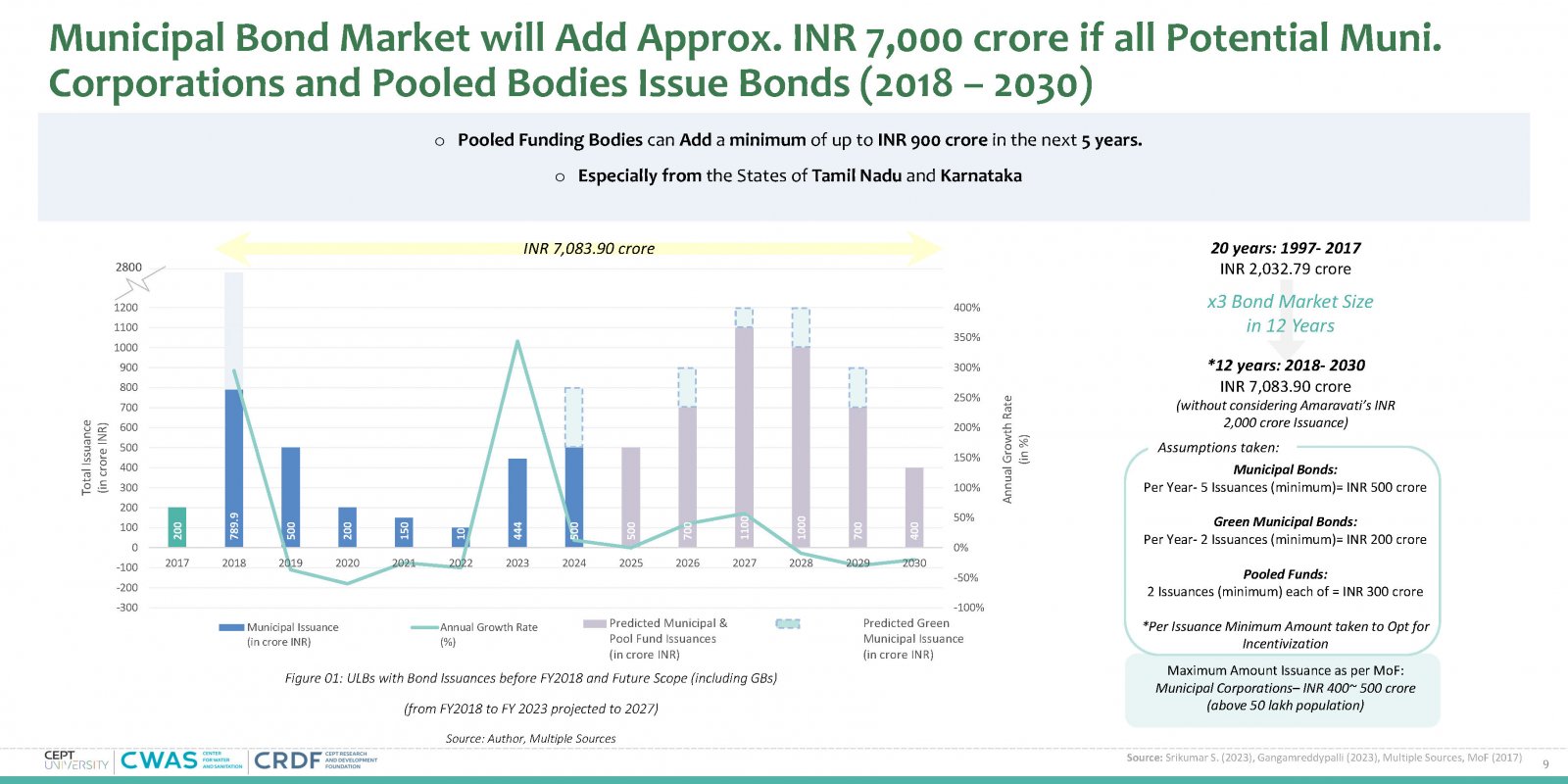

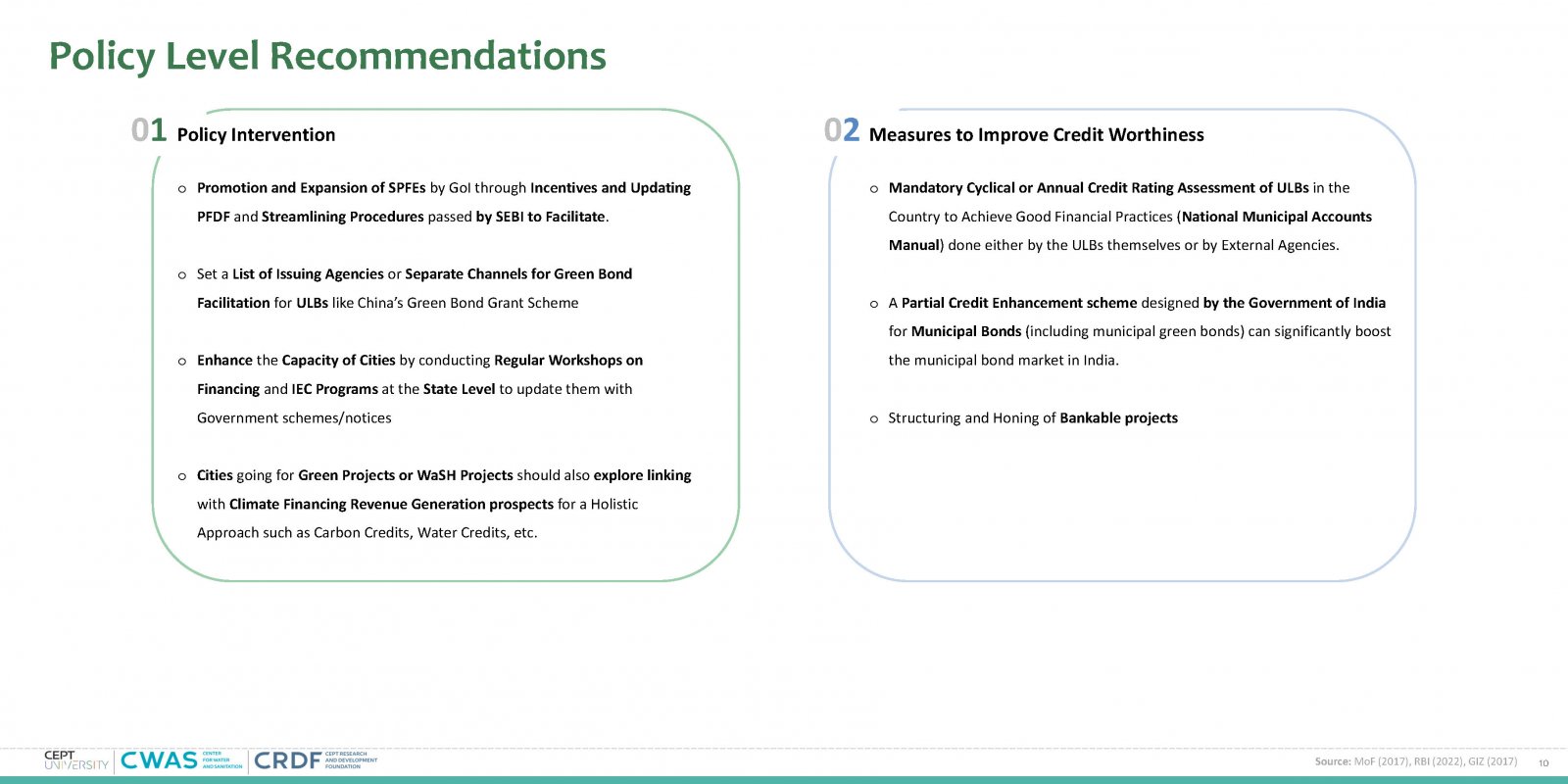

This study explores green bonds' role in funding urban WaSH infrastructure, aligning with global sustainability goals. In India, despite government incentives, municipal green bond issuances remain low, hindering climate-resilient infrastructure development. Challenges include high costs and SEBI compliance requirements. Recommendations aim to increase ULB green bond issuance, enhance market access, and facilitate sustainable urban development funding.