Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

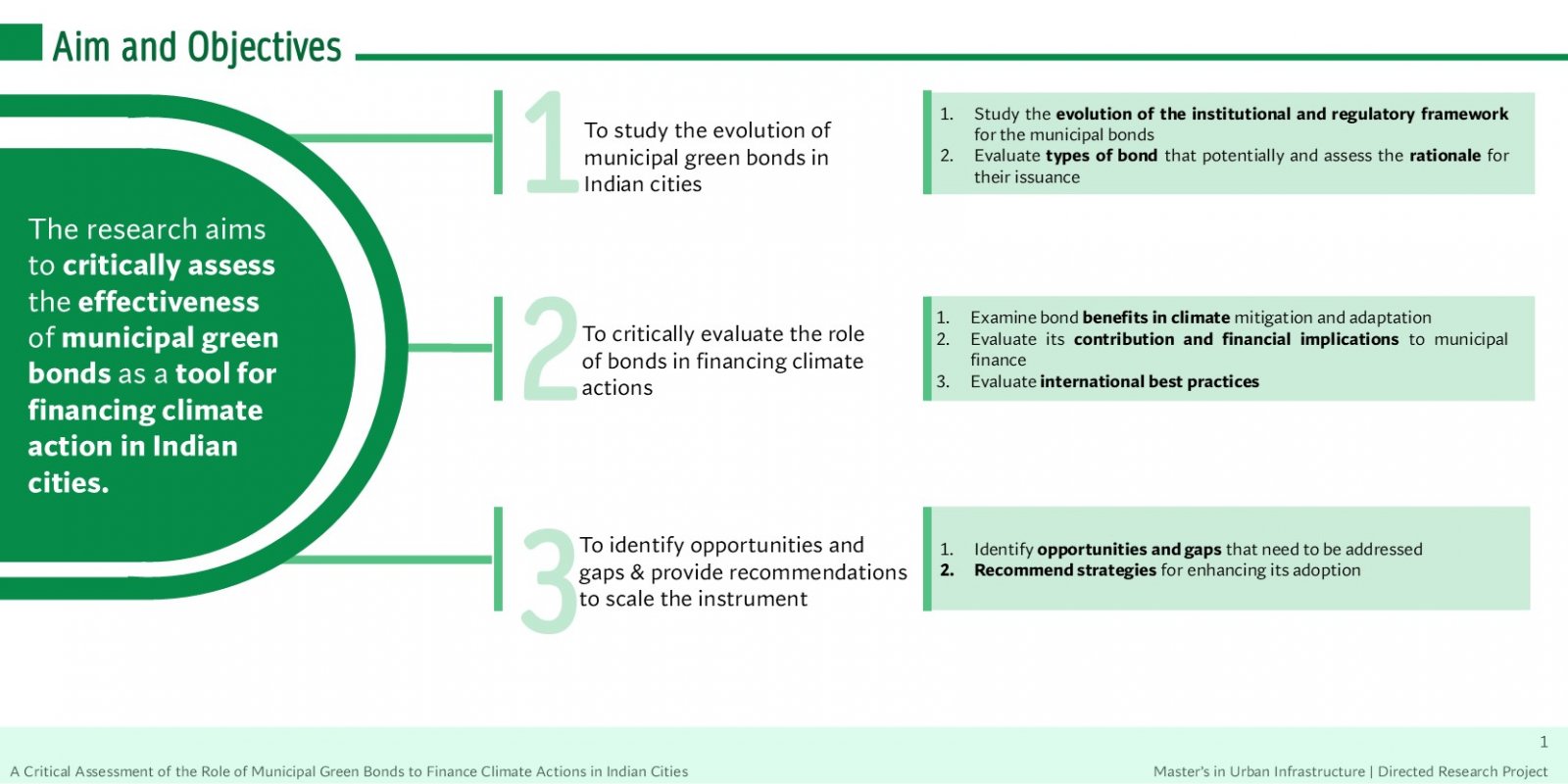

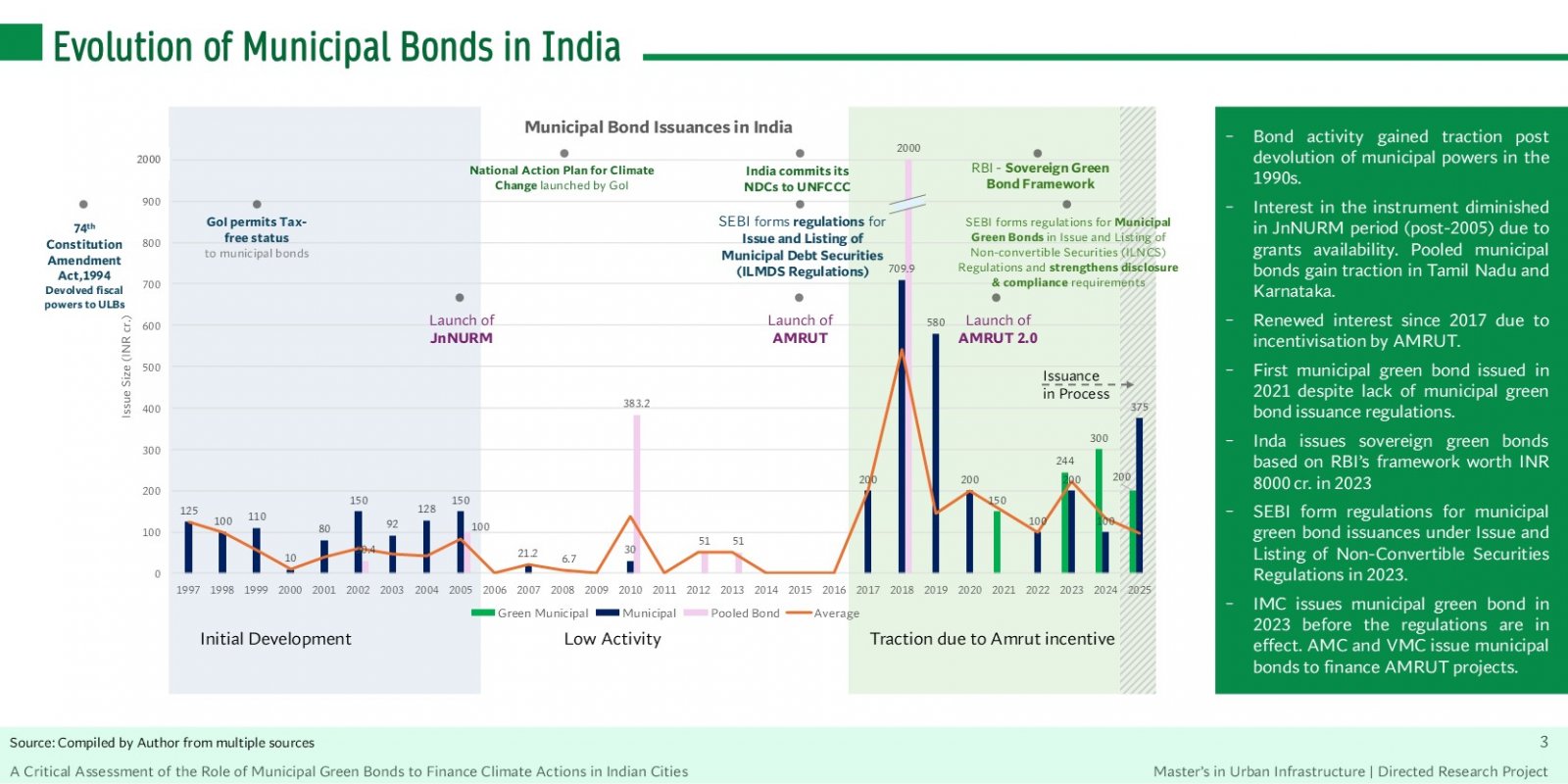

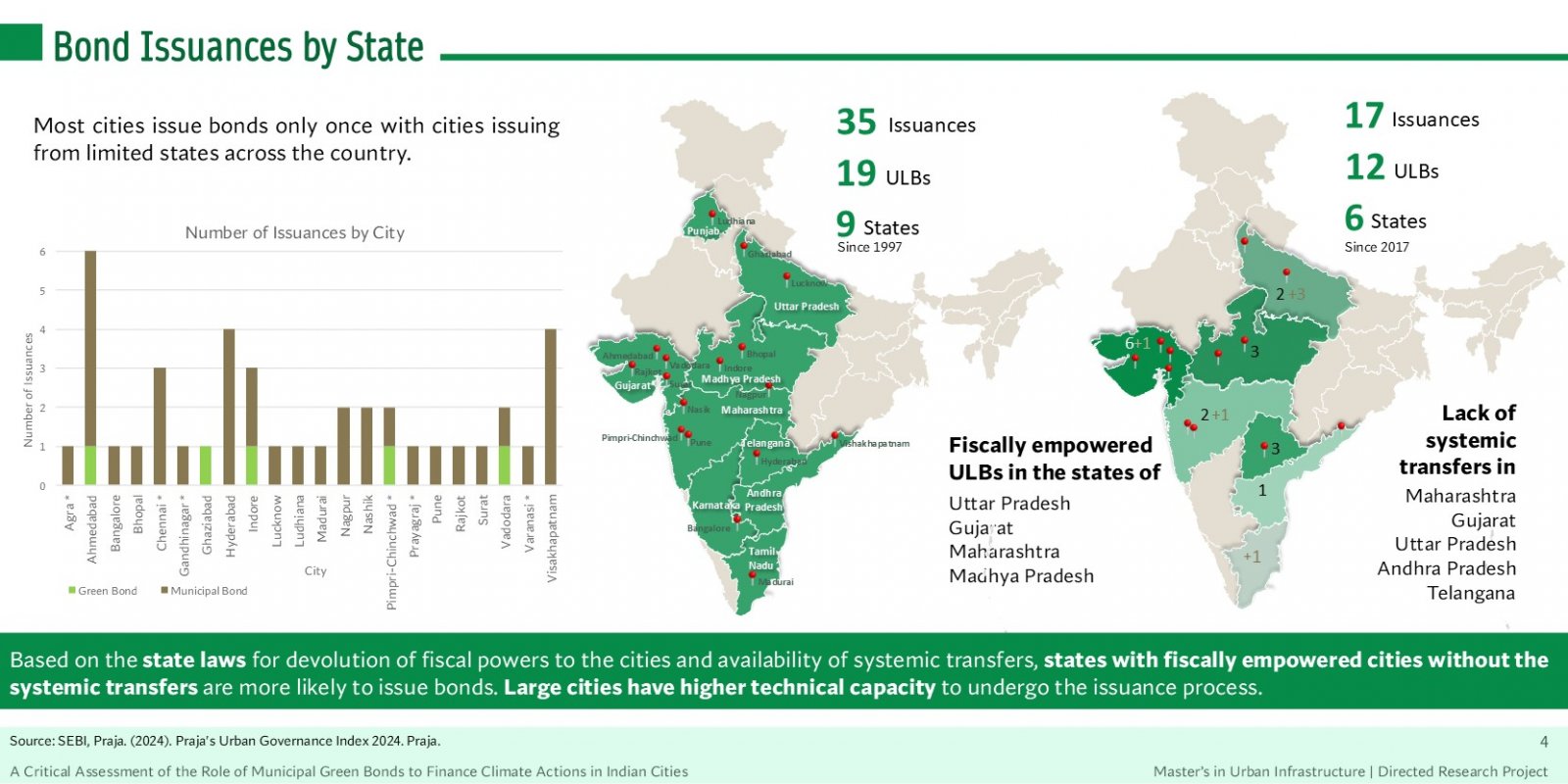

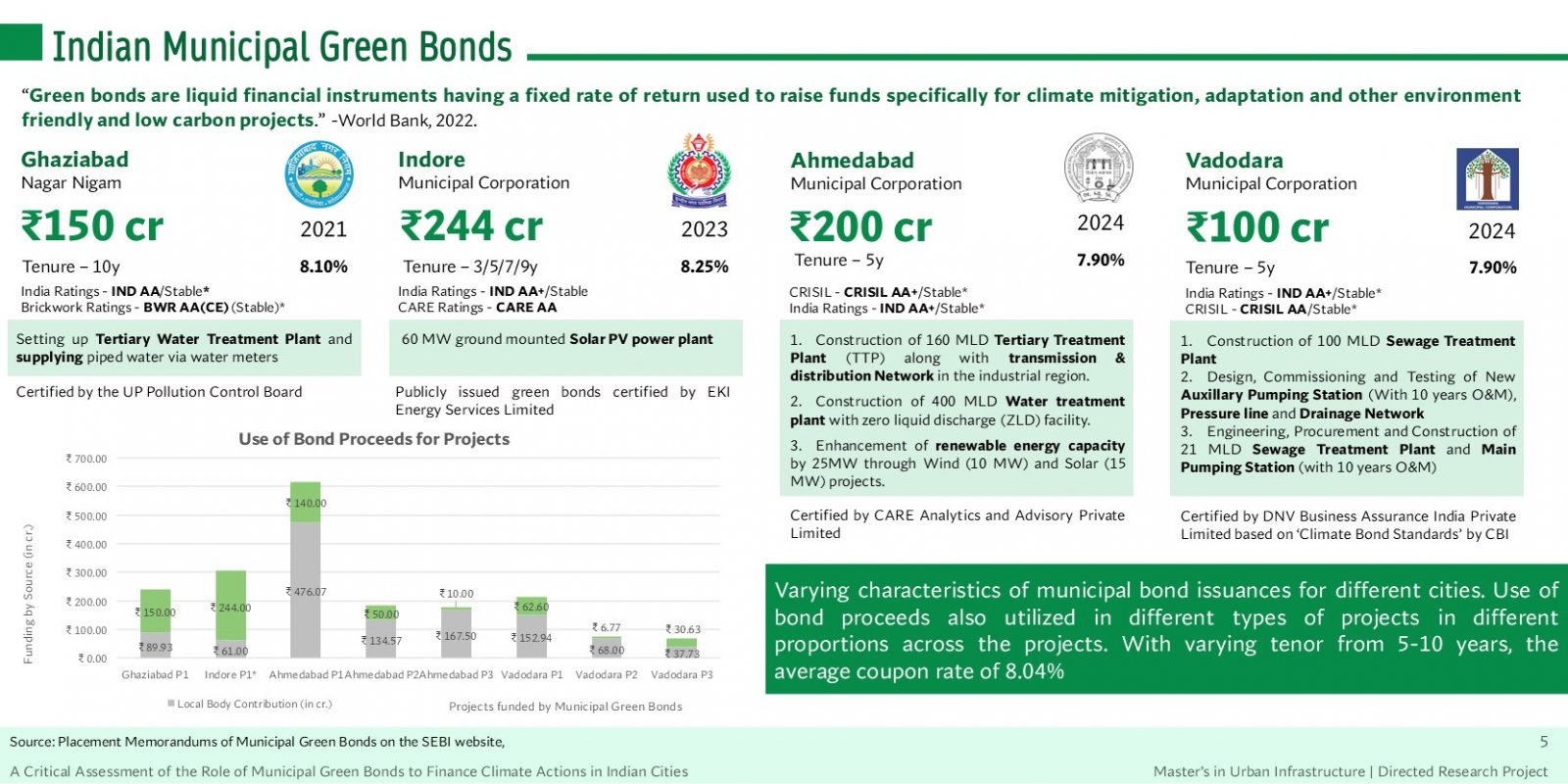

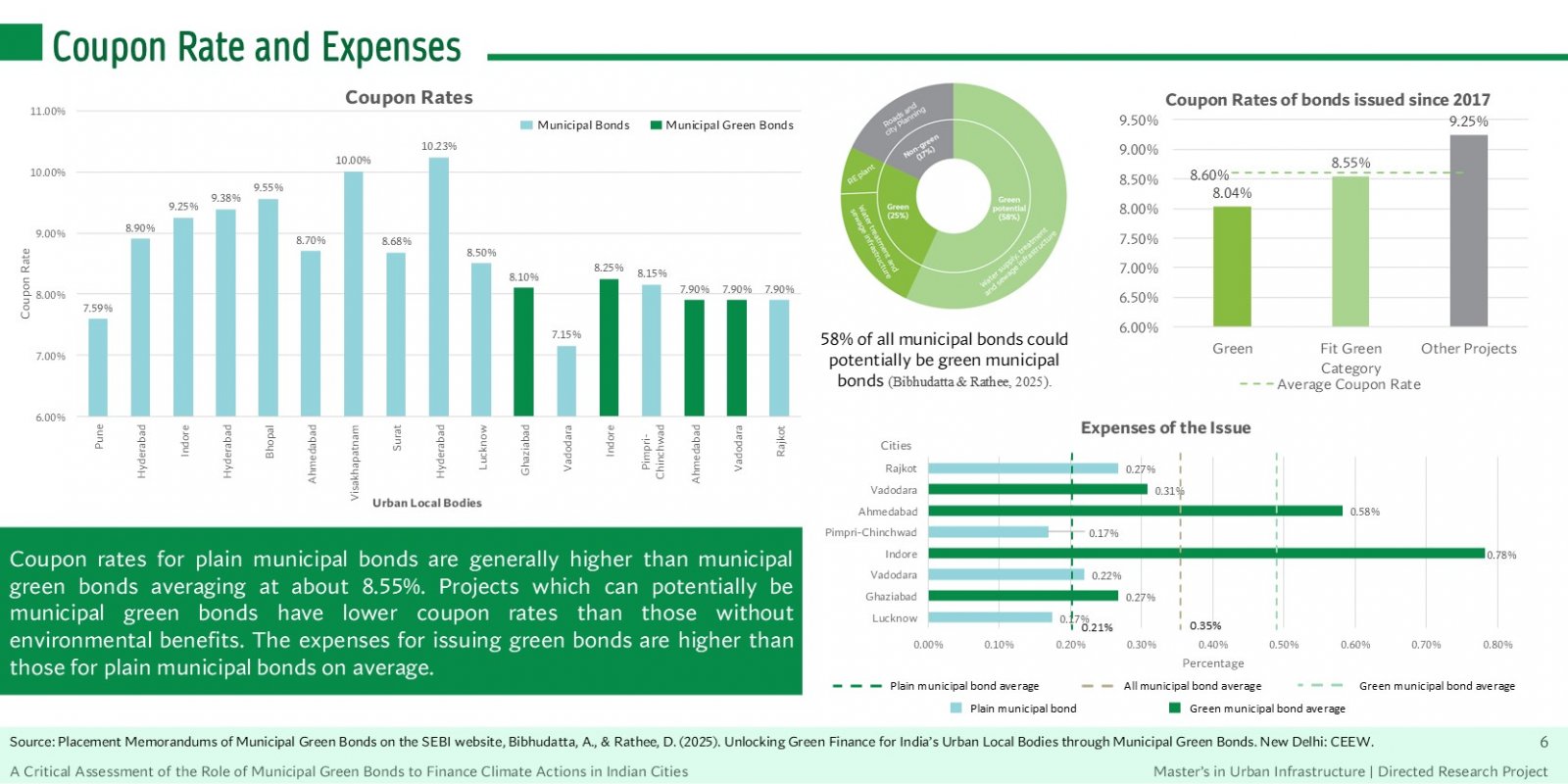

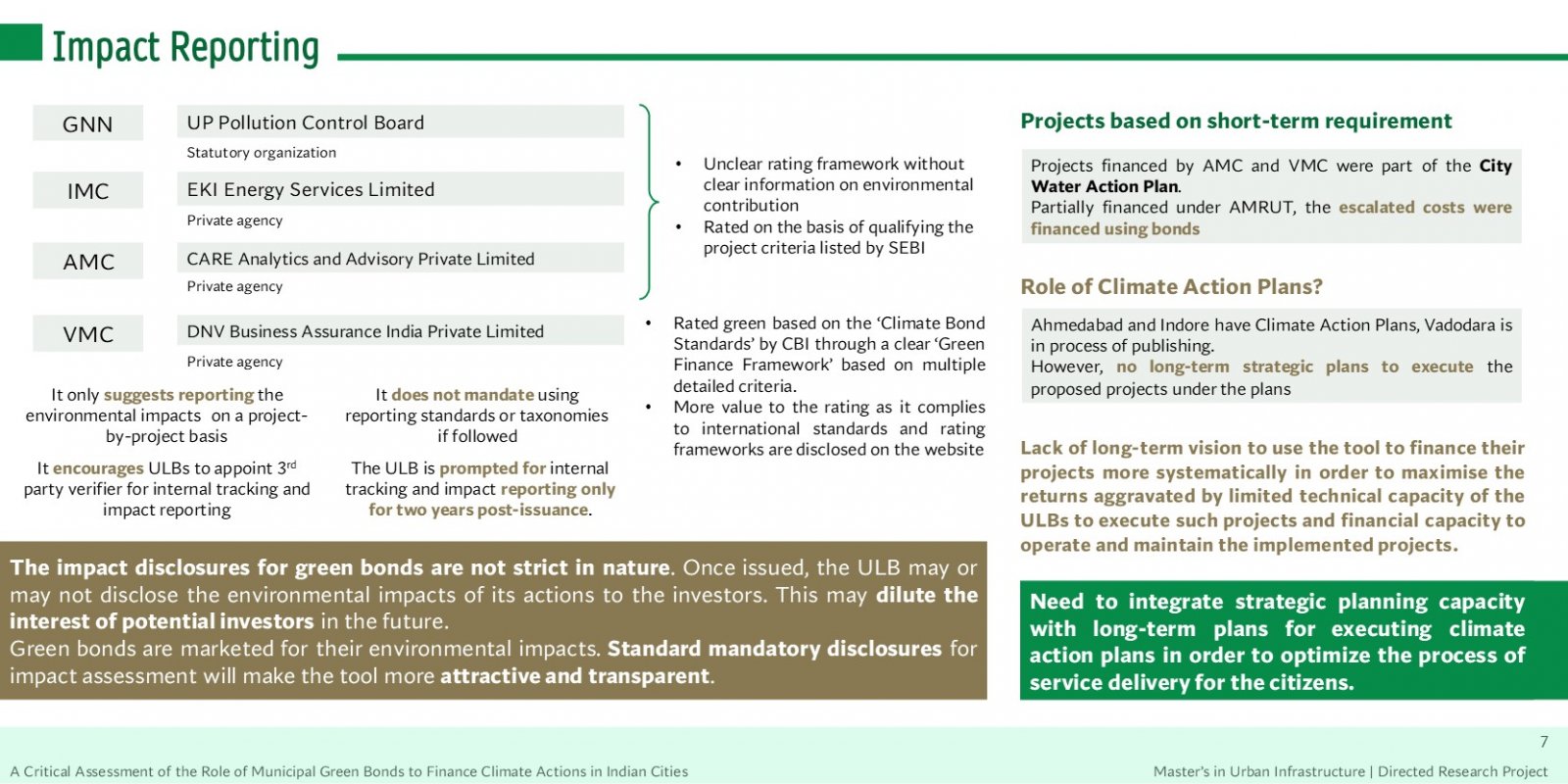

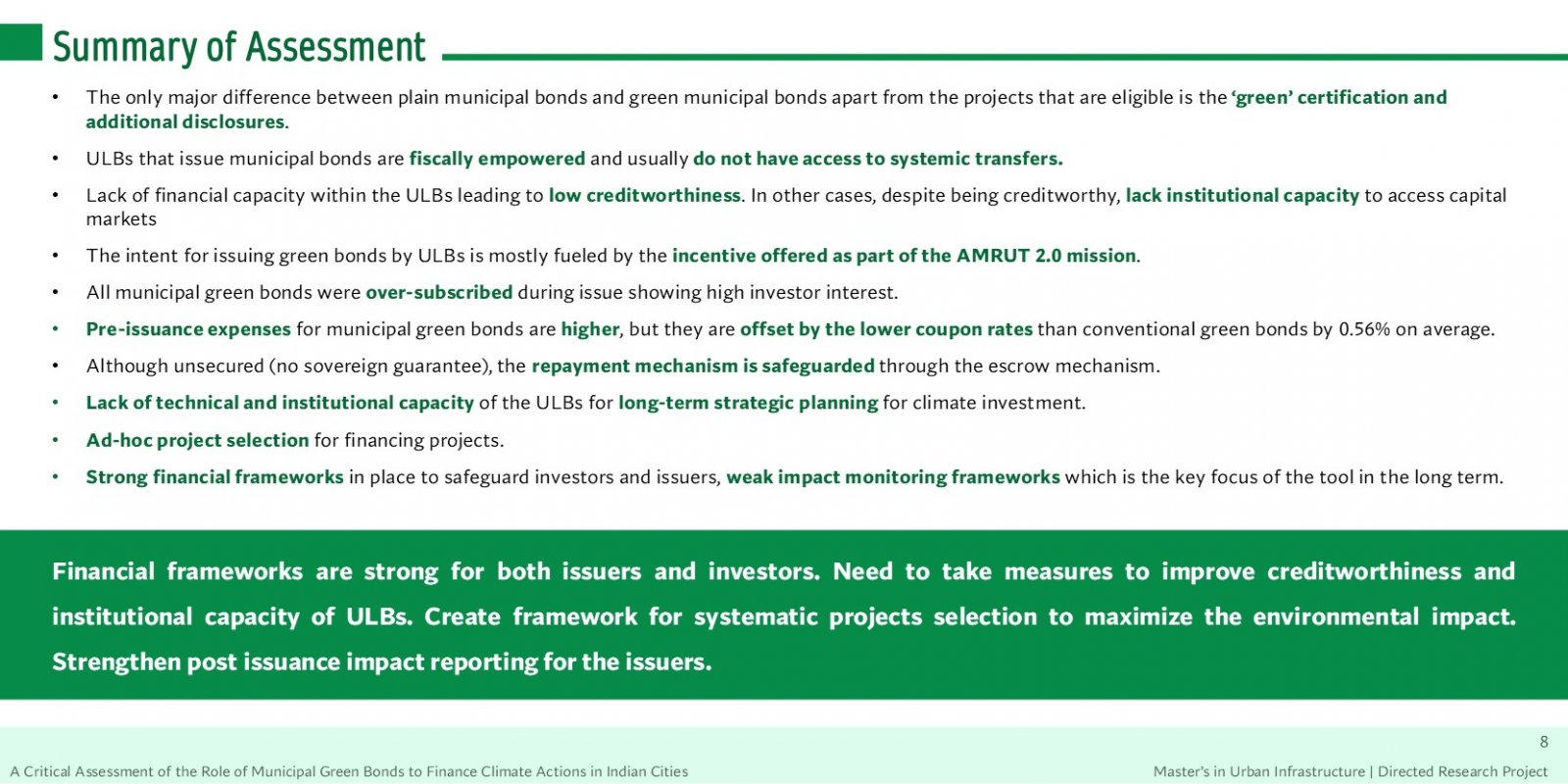

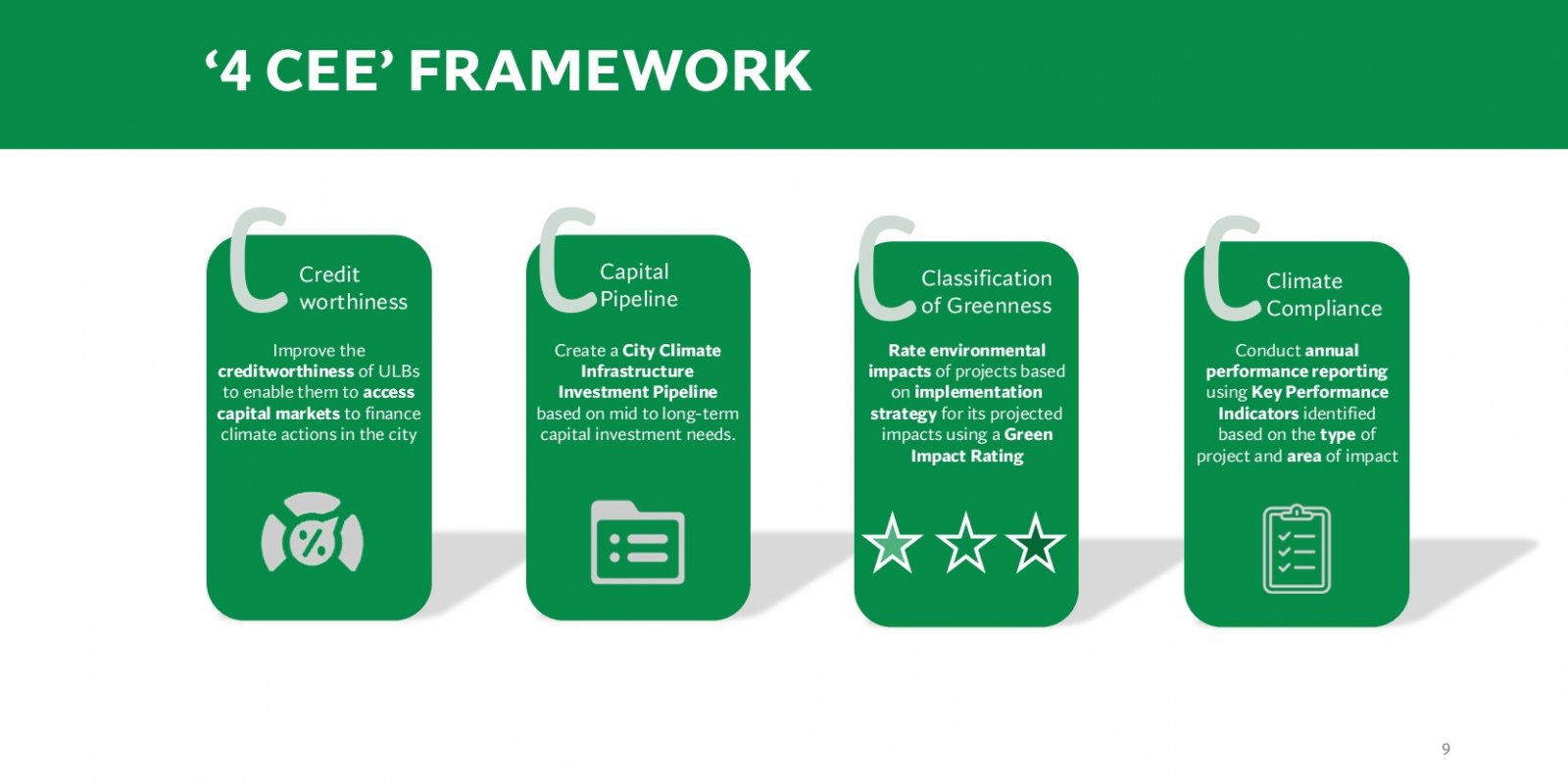

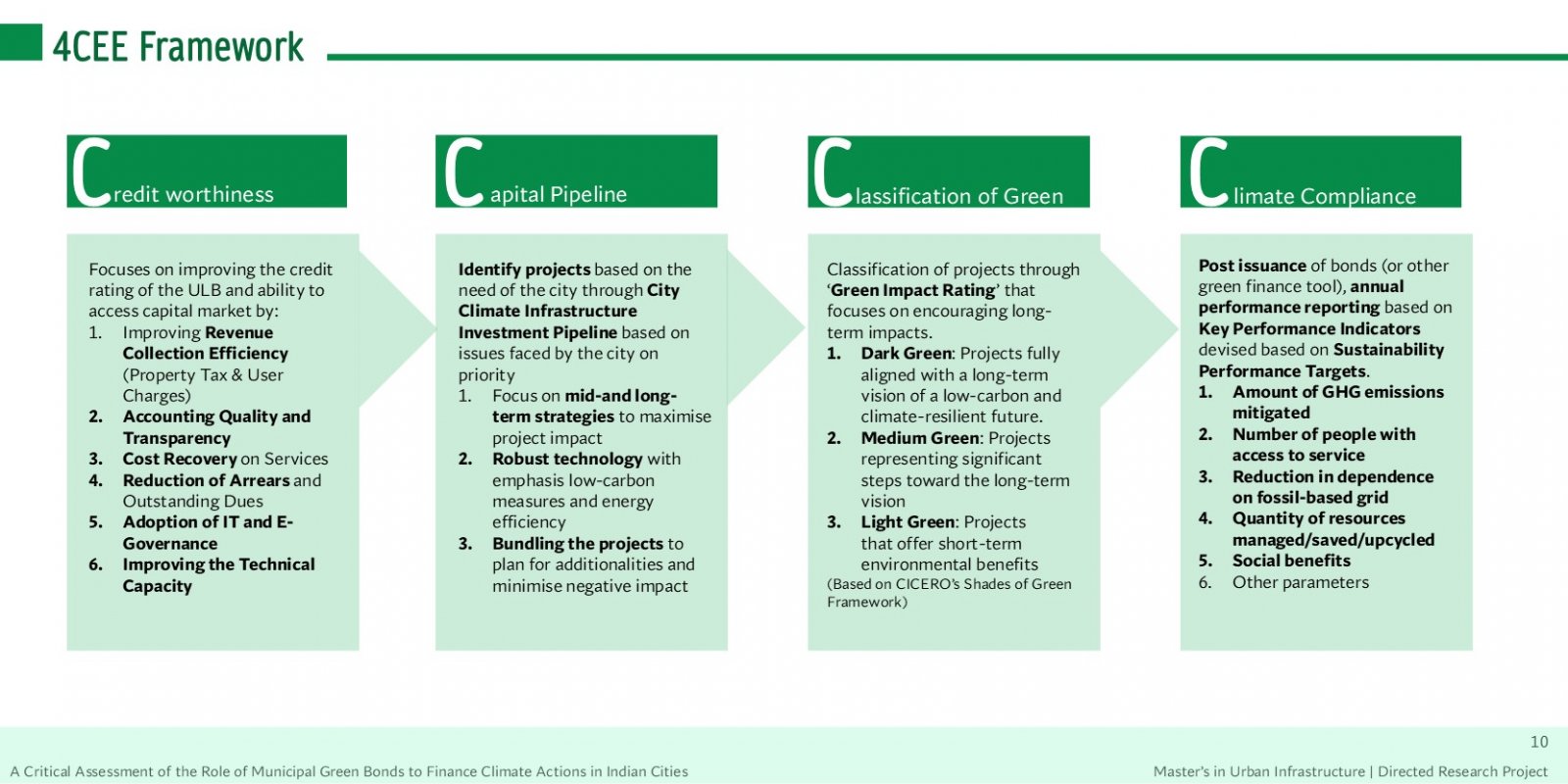

This research critically assesses the role of Municipal Green Bonds in financing climate actions in Indian cities. By examining case studies from Ghaziabad, Indore, Ahmedabad, and Vadodara, it evaluates the evolution, effectiveness, and scalability of green bonds in Indian cities. The study employs a mixed-methods approach involving regulation analysis, financial assessments, and expert interviews. It finds that while green bonds enhance transparency and investor confidence, adoption remains limited due to institutional and regulatory gaps. Recommendations include standardizing frameworks, enhancing ULB capacity, and implementing performance-linked measures to scale the instrument and support climate-focused urban infrastructure.