Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

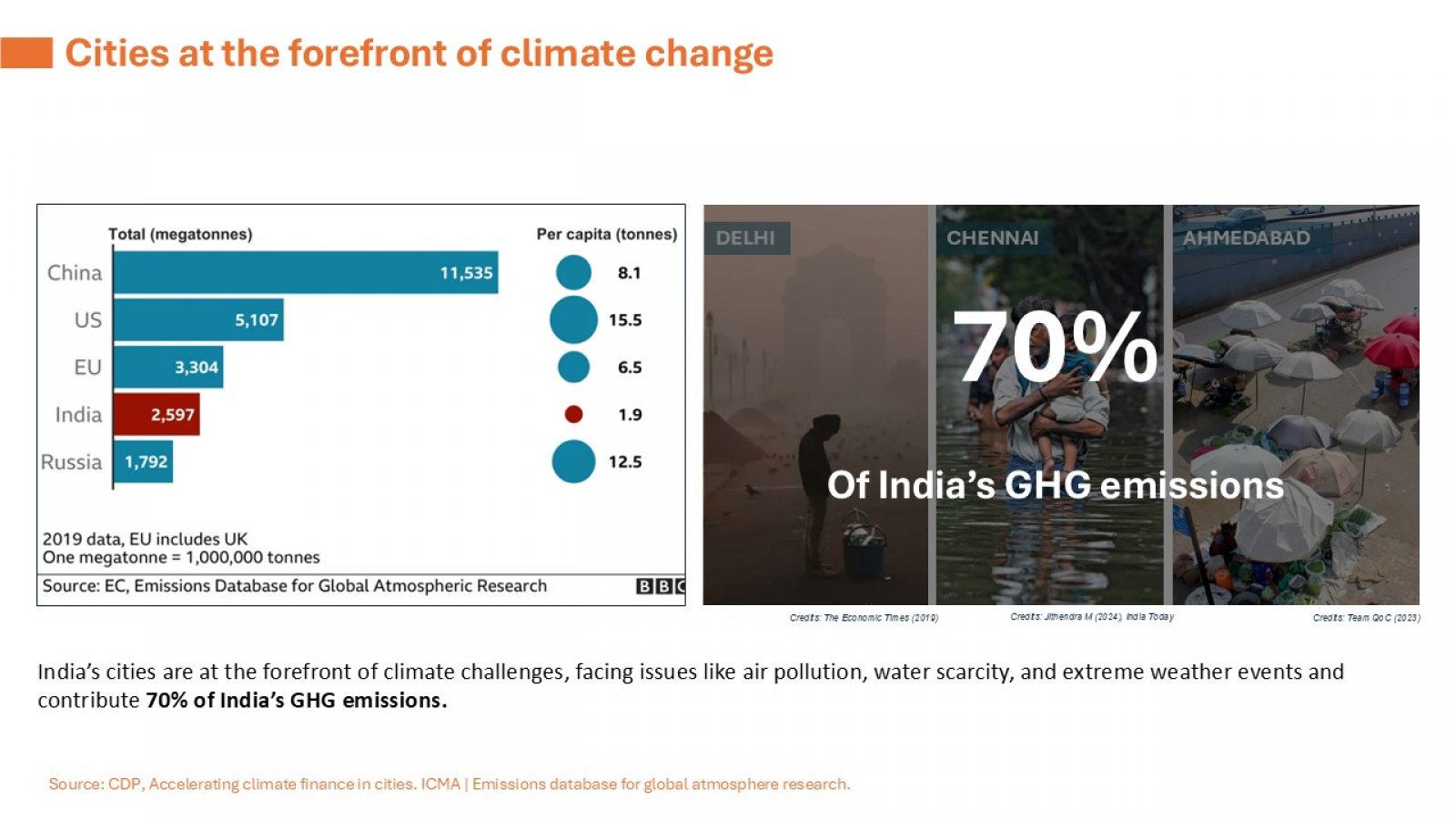

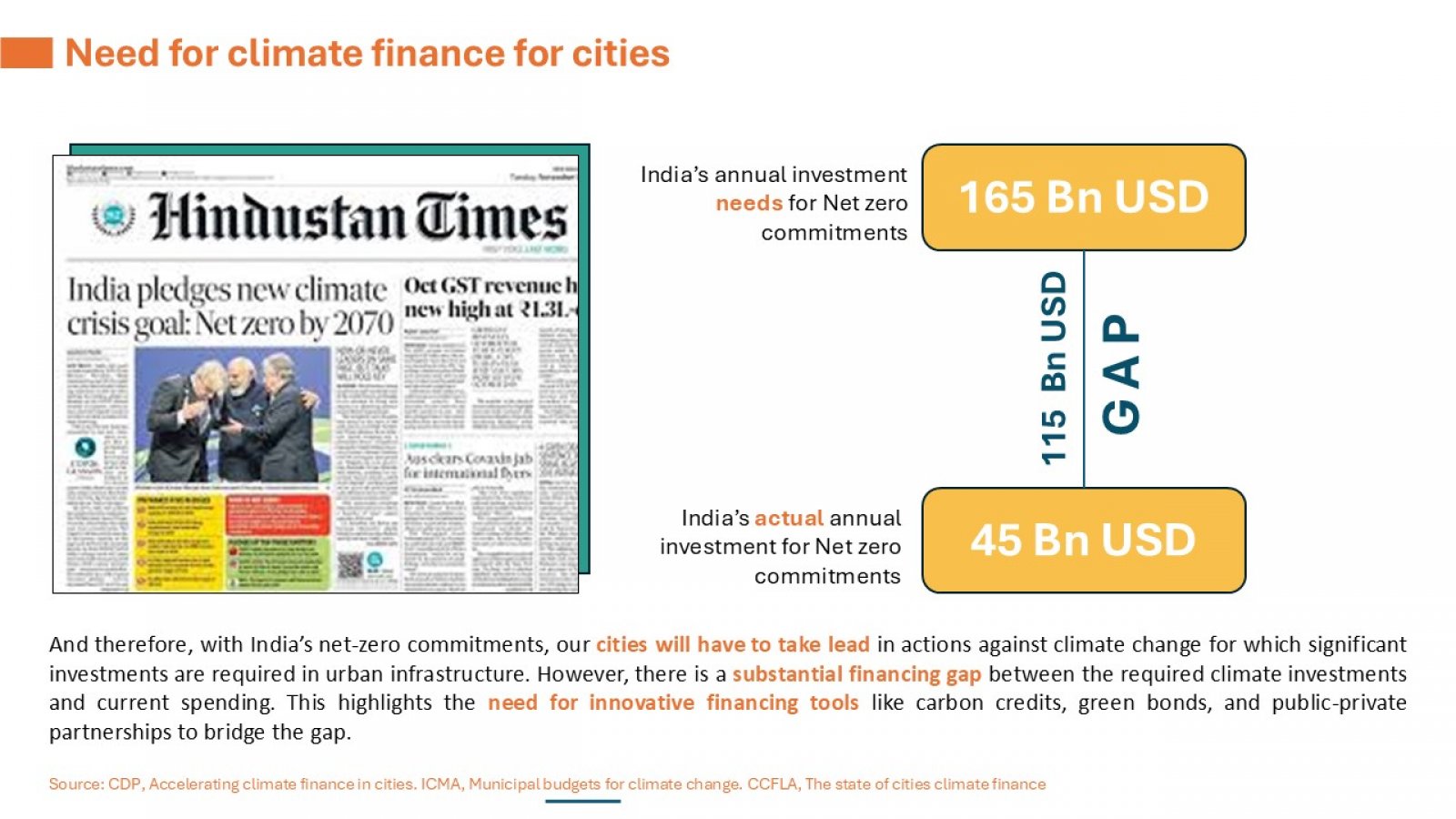

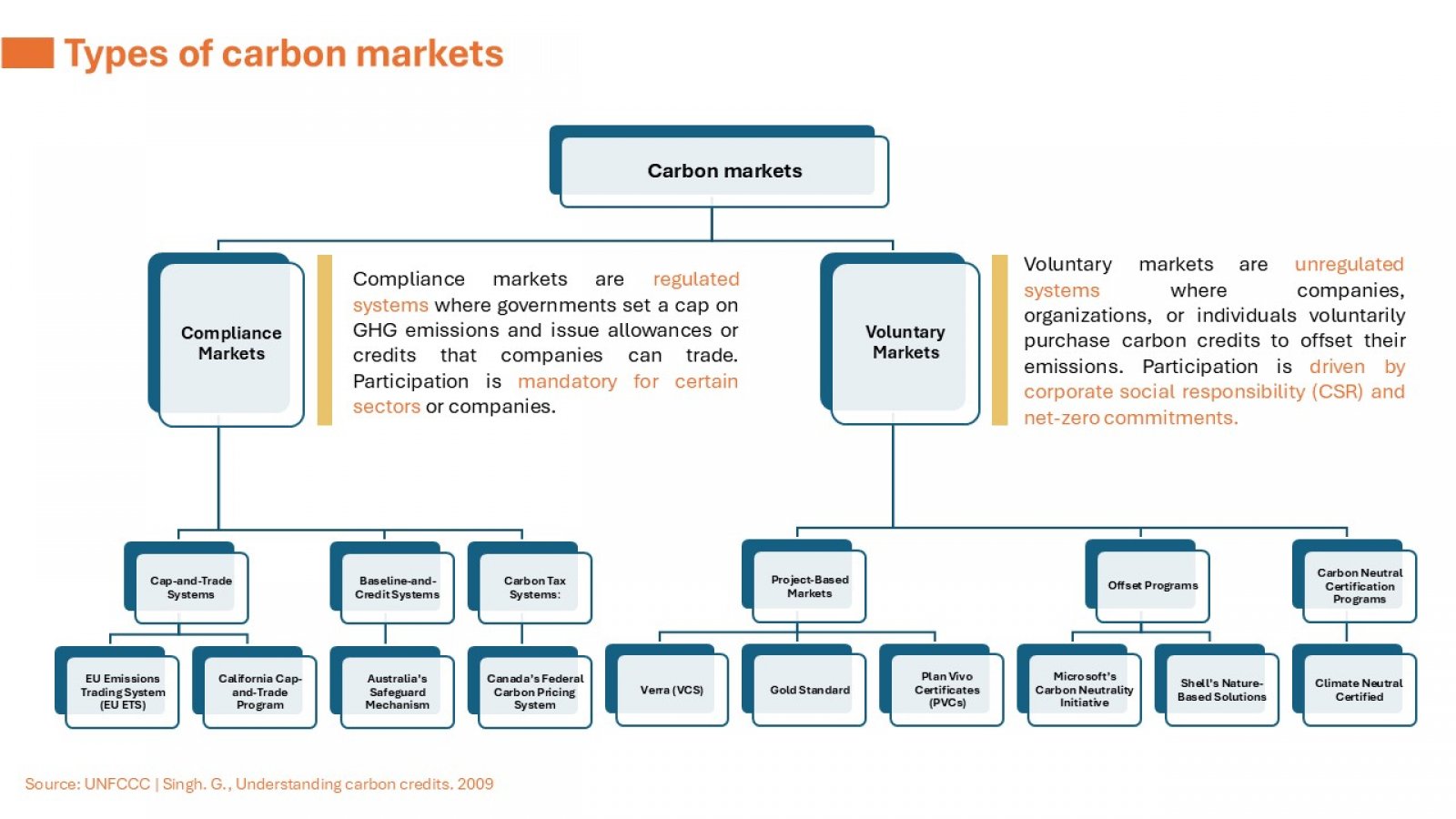

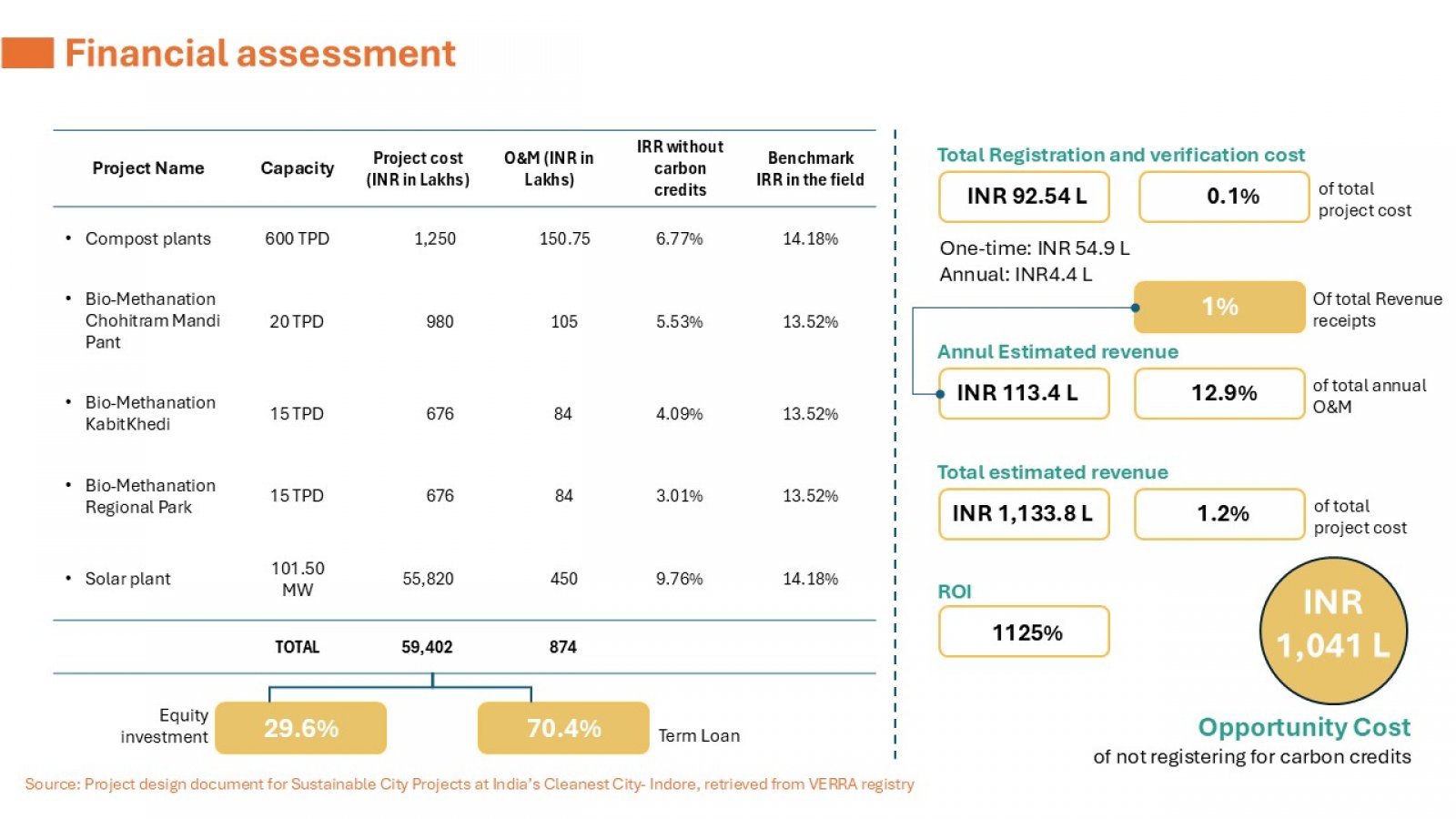

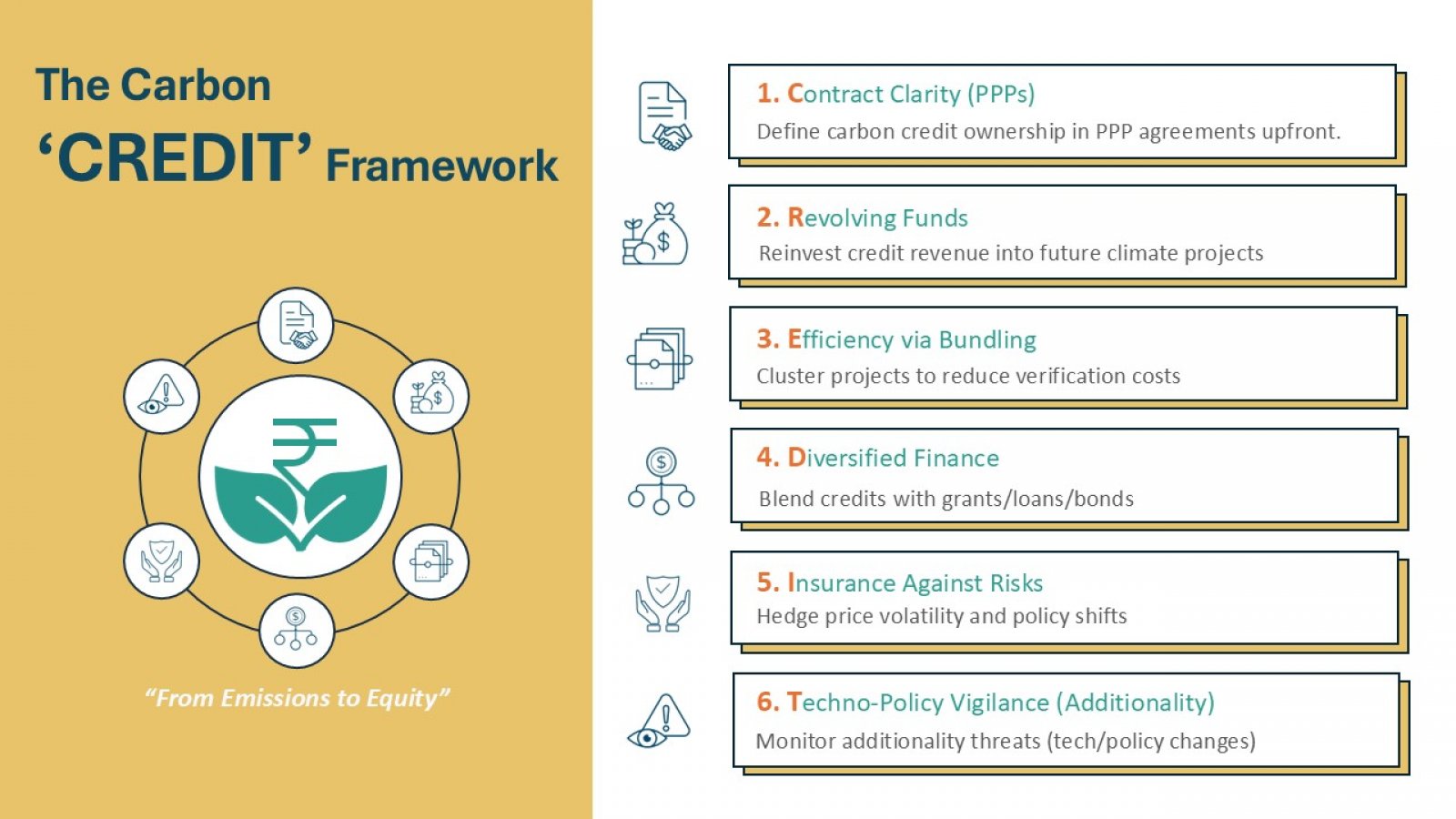

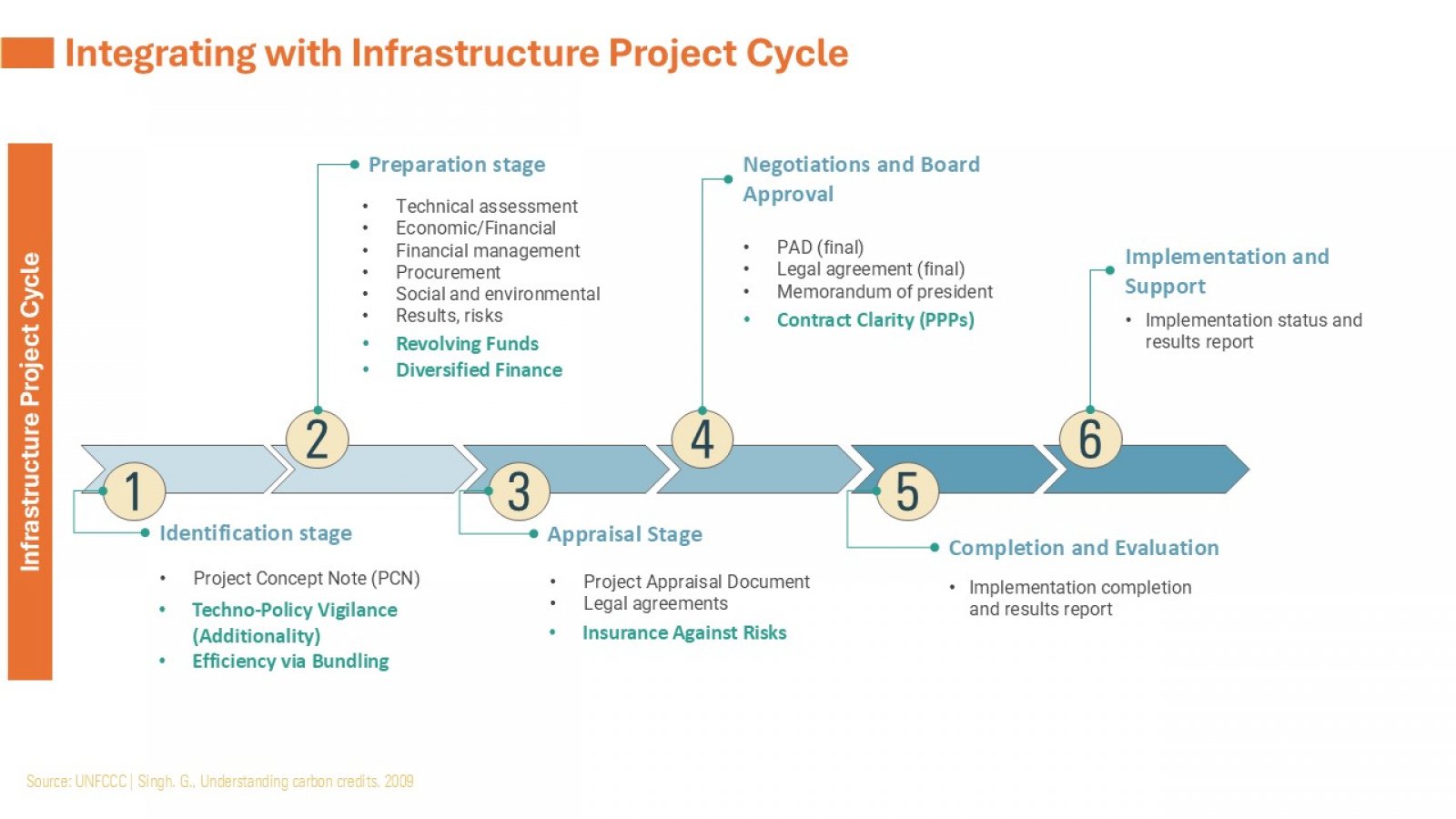

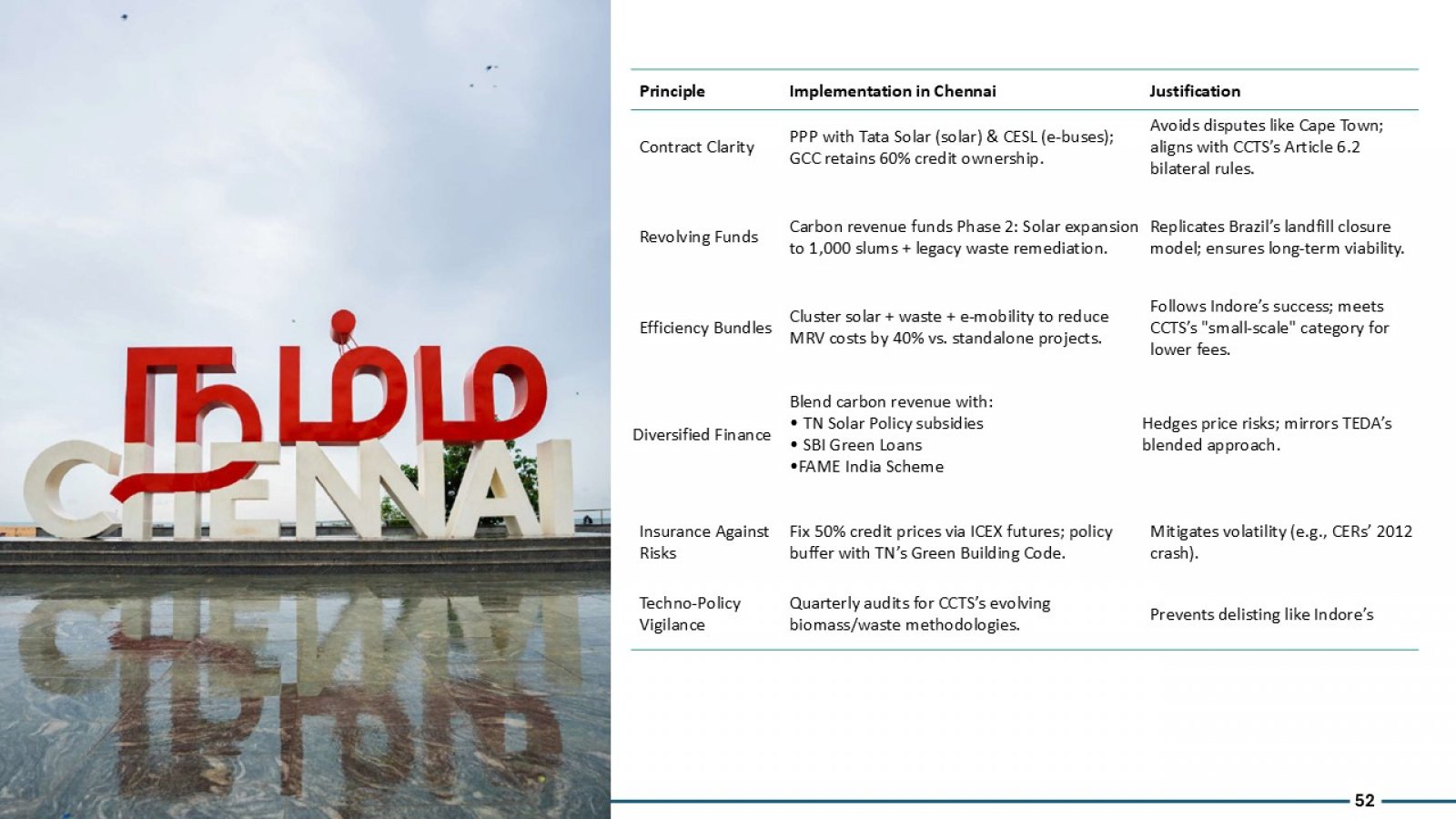

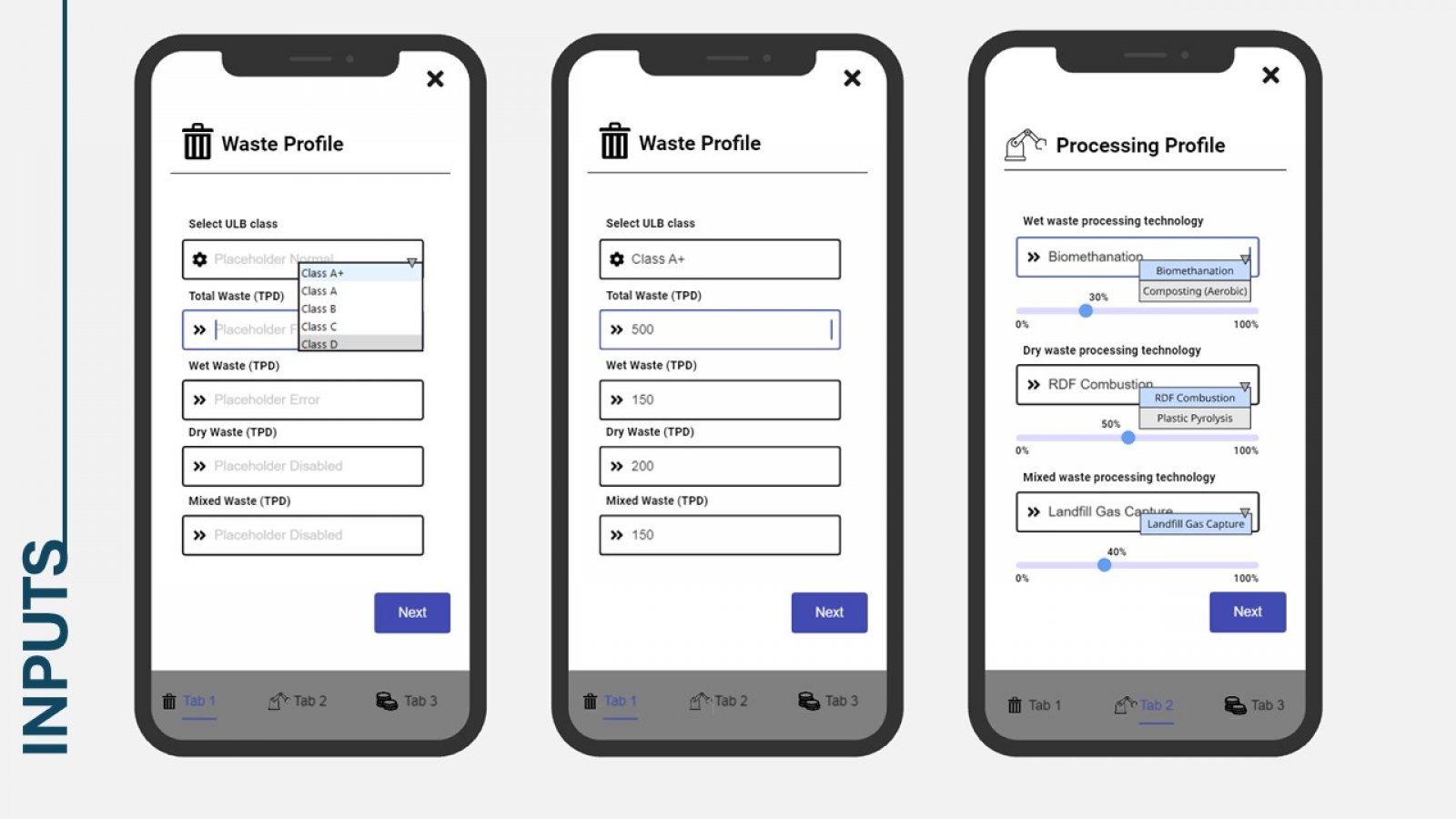

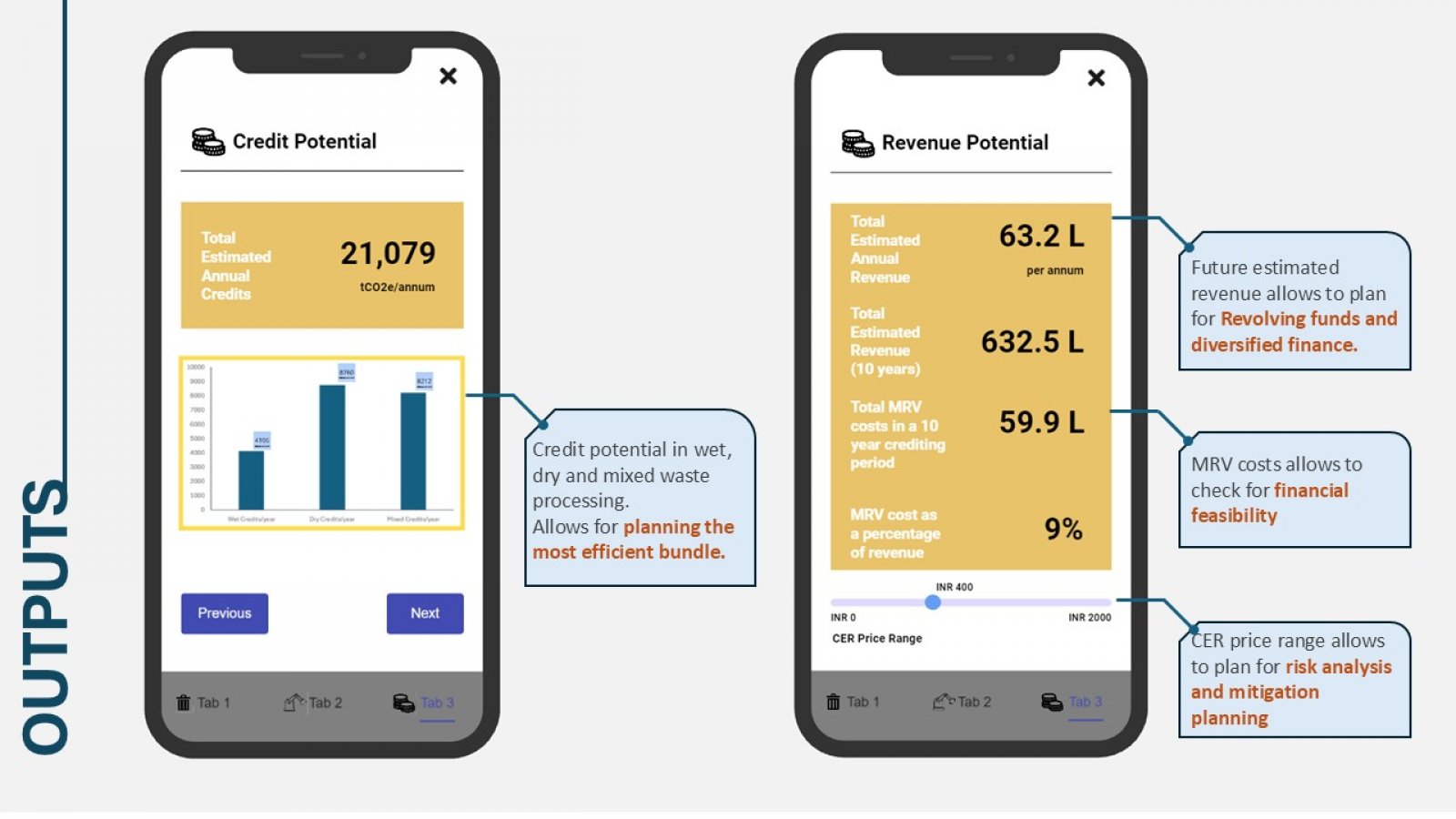

This study investigates the potential for Urban Local Bodies in India to leverage carbon credits as a financing mechanism for climate action, addressing the critical gap between municipal climate plans and implementation. It was found that ULBs face barriers include regulatory complexity, price volatility, and institutional gaps. To address these challenges, the report proposes the CREDIT framework, a six-principle approach for ULBs to increase preparedness to participate in carbon markets. The framework is complemented by the CarbonMitra Toolkit, a user-friendly calculator designed to help ULBs estimate credit potential, costs, and revenue for waste projects.