Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

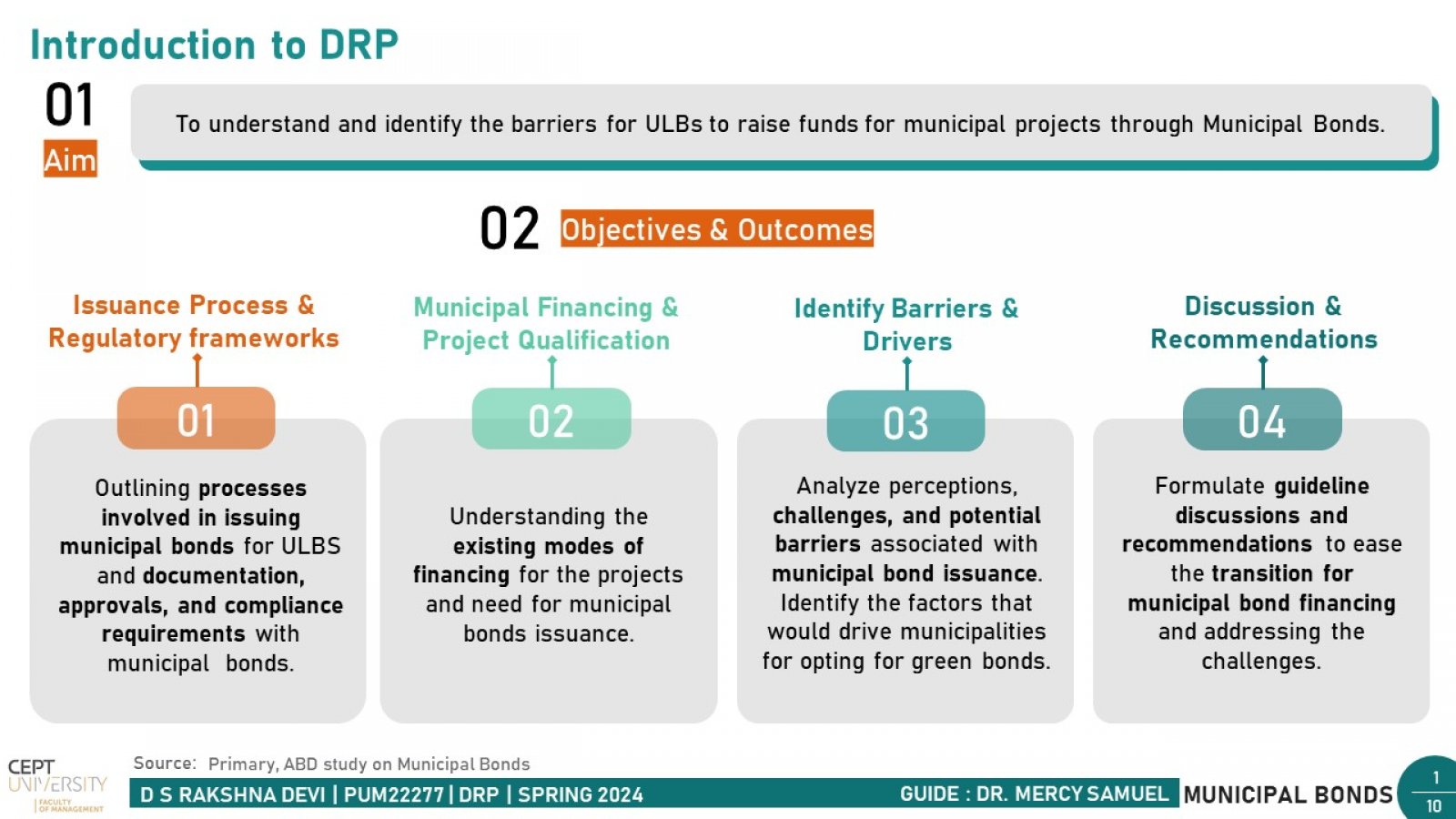

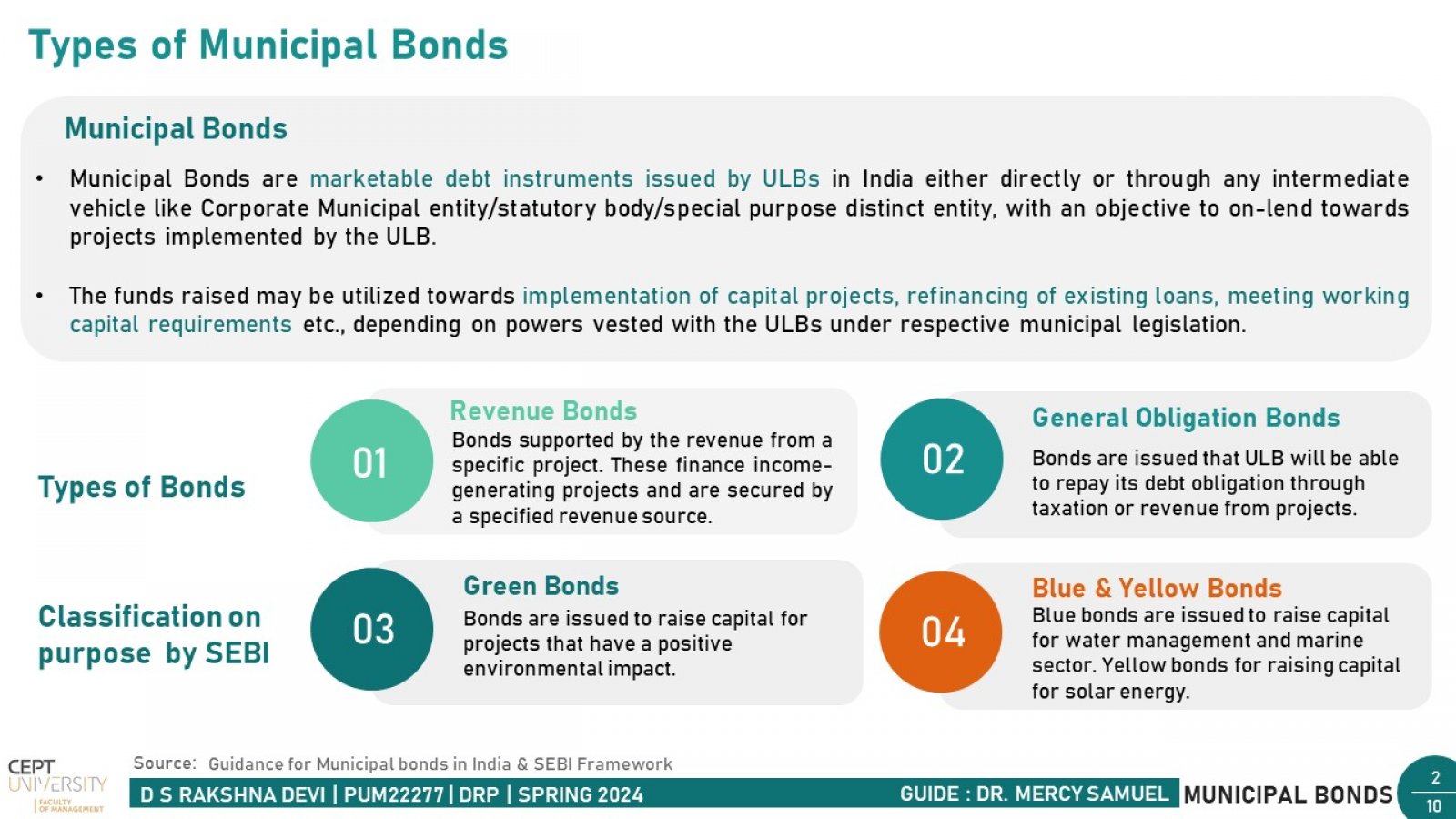

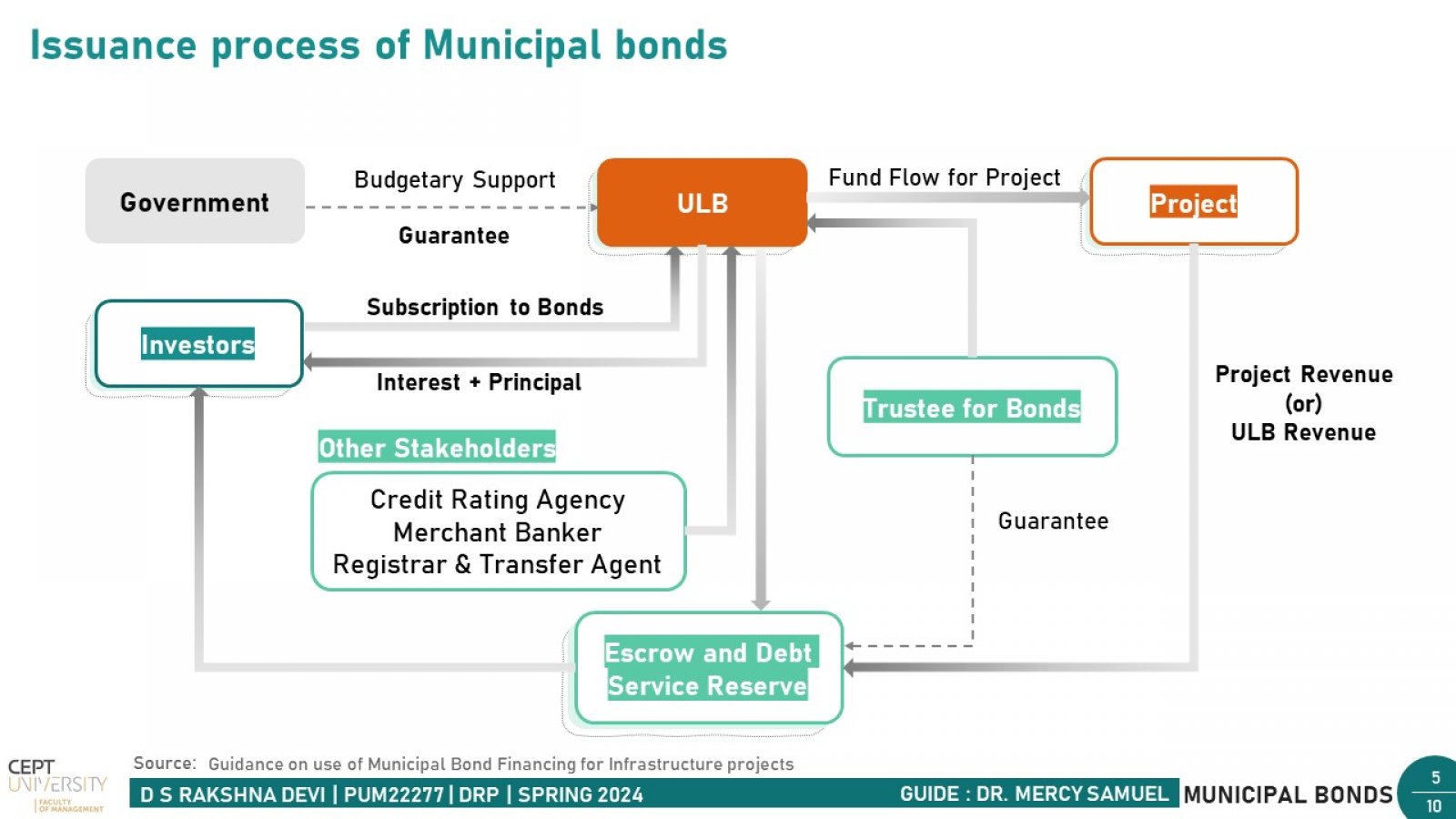

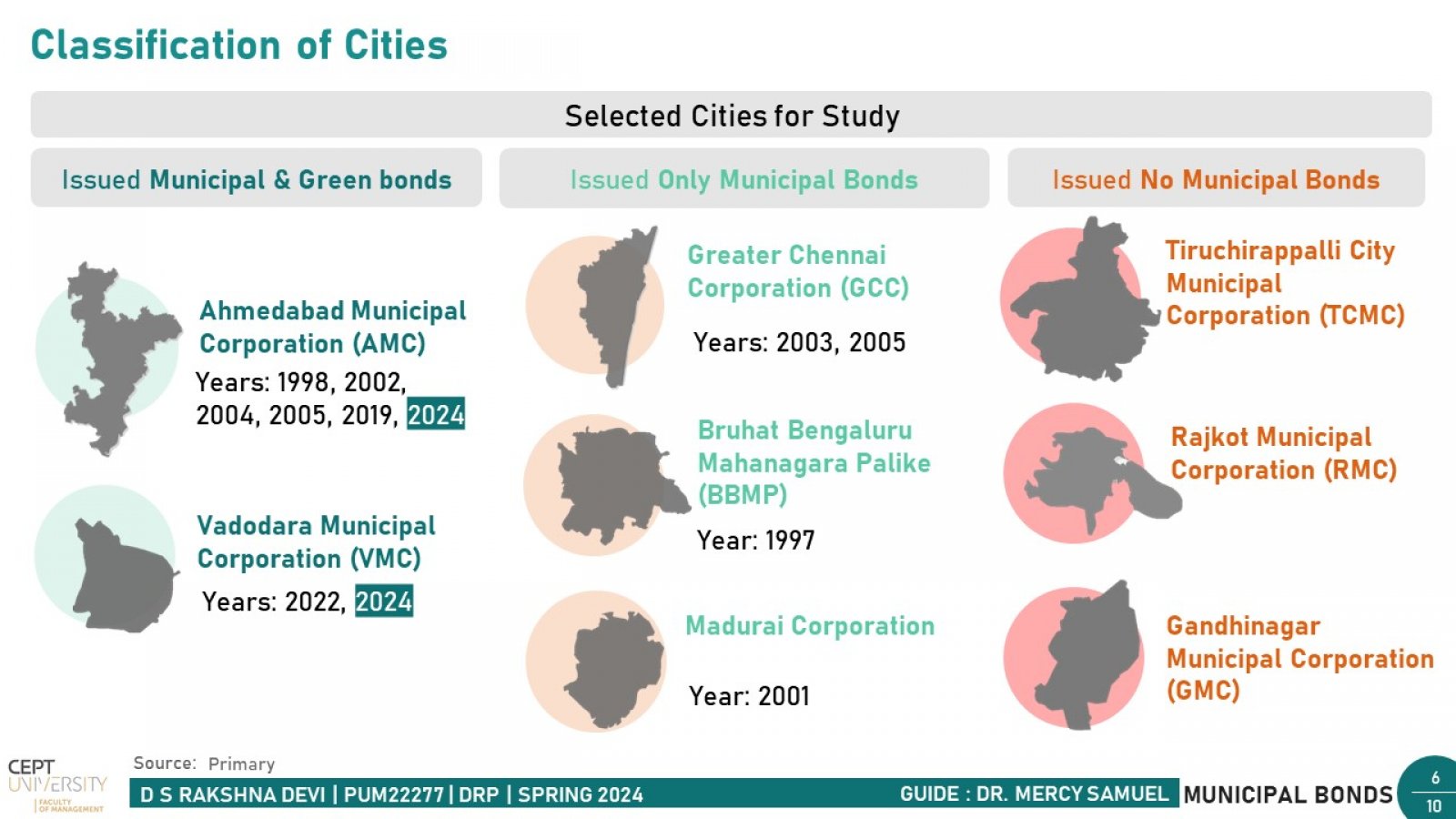

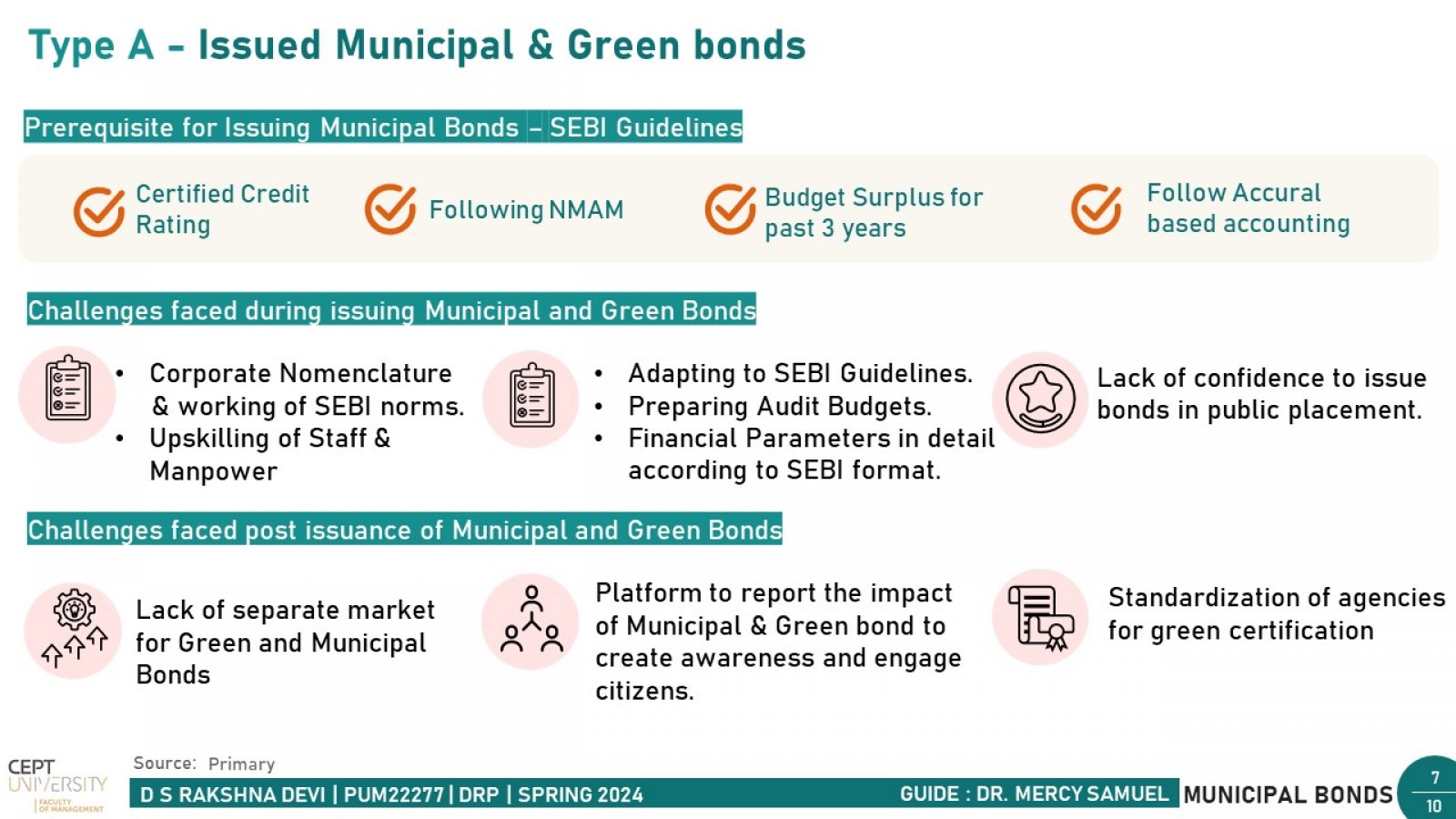

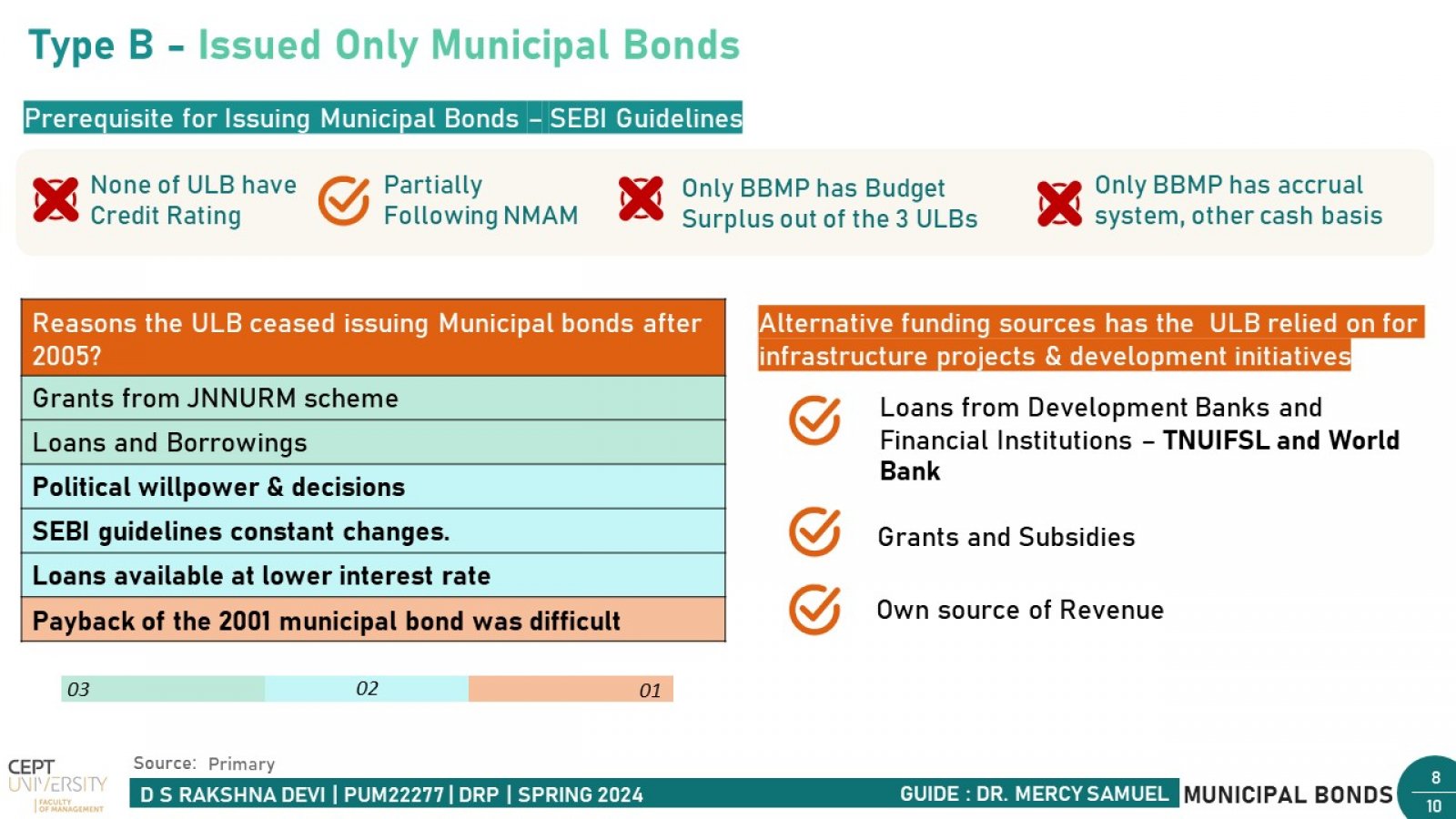

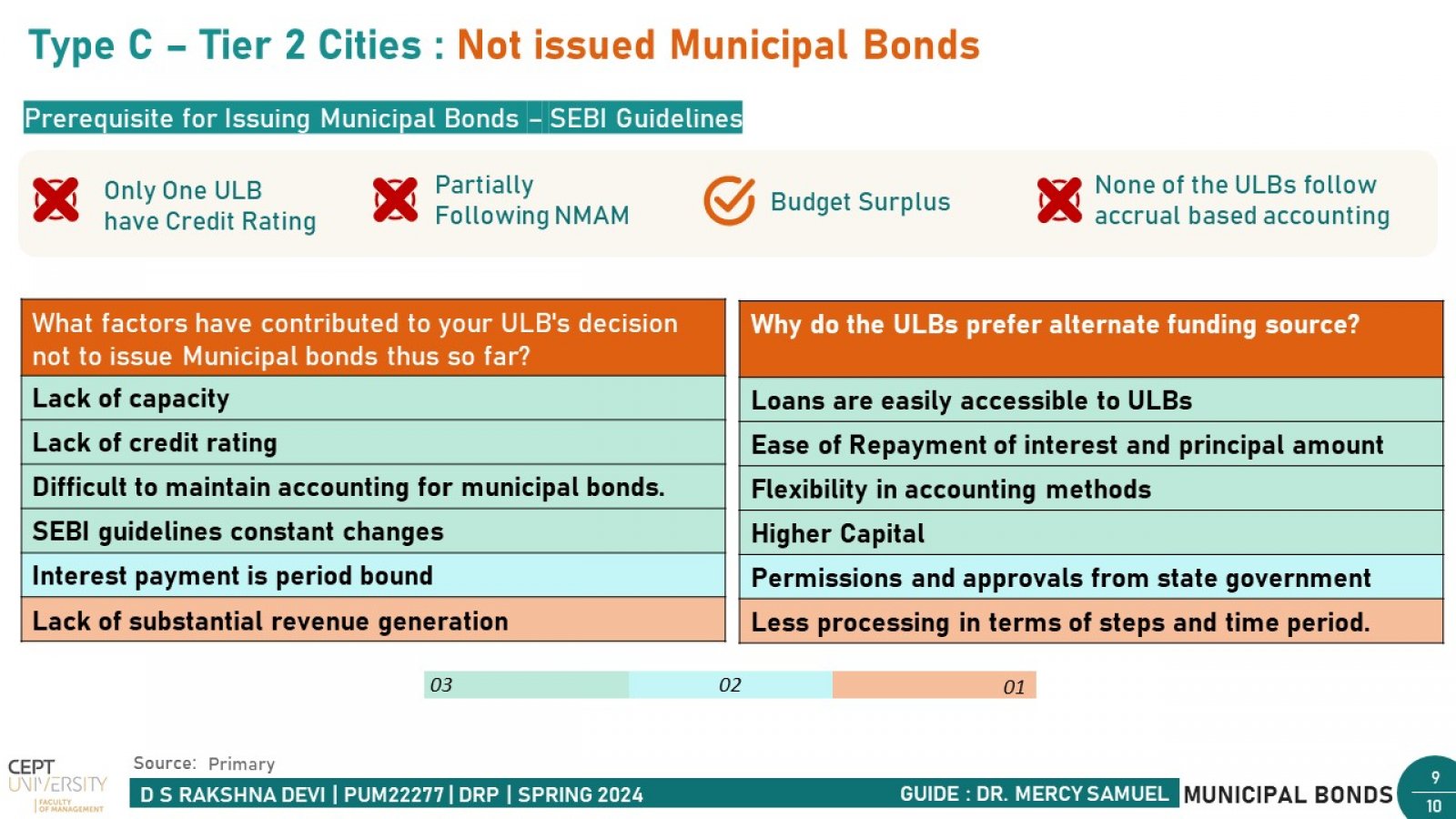

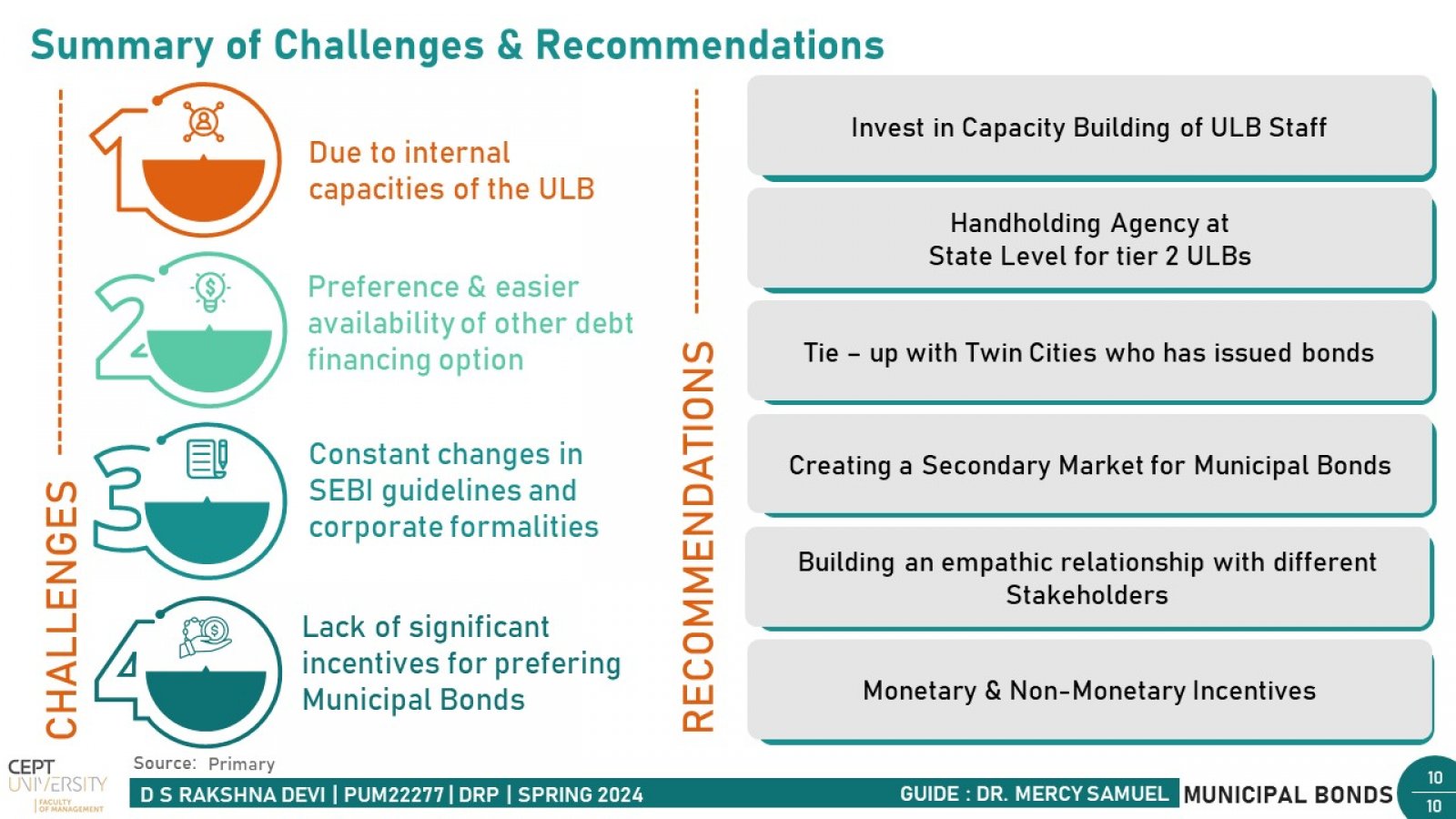

The municipal bond market in India has witnessed slow growth since its inception in 1997, with only 17 cities across 9 states issuing municipal bonds for infrastructure development until 2023. This slow pace is concerning given the pressing need for extensive infrastructure development and maintenance in the face of rapid urbanization. This study aims to explore the barriers and resistances that cities face in issuing municipal bonds in India and to understand how these challenges can be mitigated to encourage cities to utilize this financing route. A preliminary study suggests that only a few cities have repeatedly opted for the bond route, indicating resistance among cities to explore and utilize the bond market. The study seeks to identify the deterrents cities are experiencing in raising funds through the municipal bond market and propose strategies to address these challenges. By understanding the barriers and resistances faced by cities and identifying strategies to overcome them, this study aims to recommend measures to facilitate ULBs to adopt the municipal bond market route for funding urbanisation.