Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

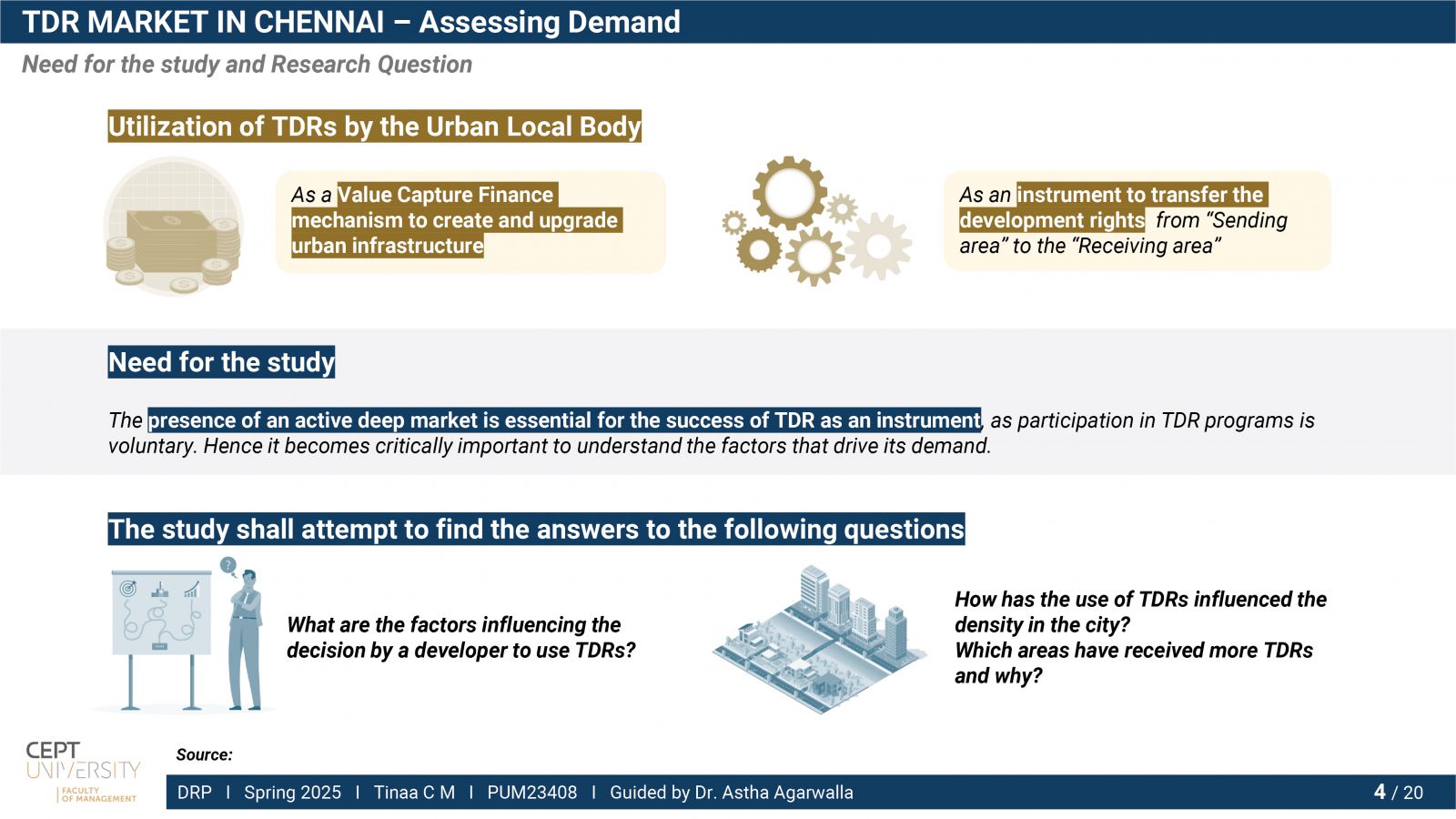

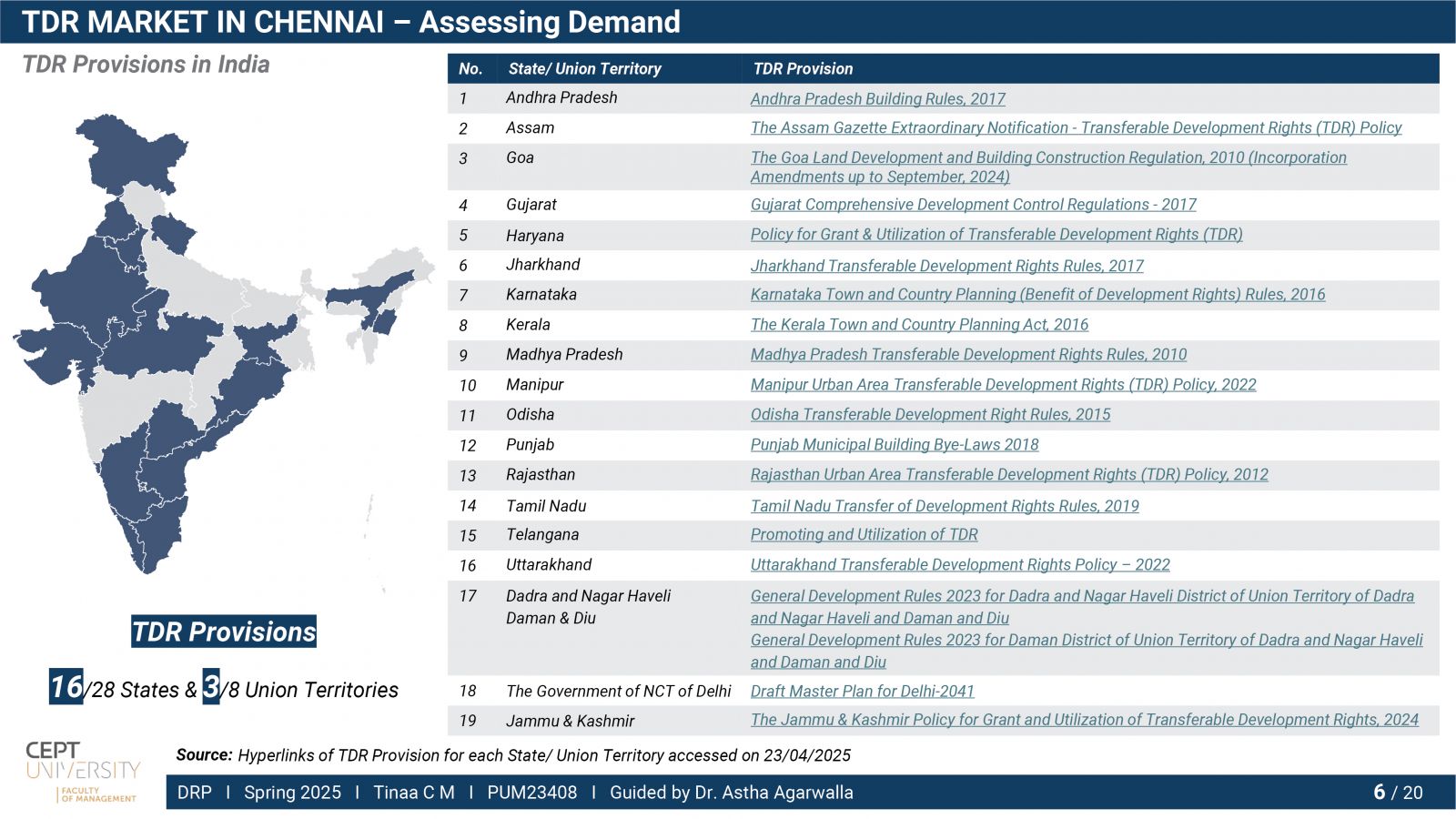

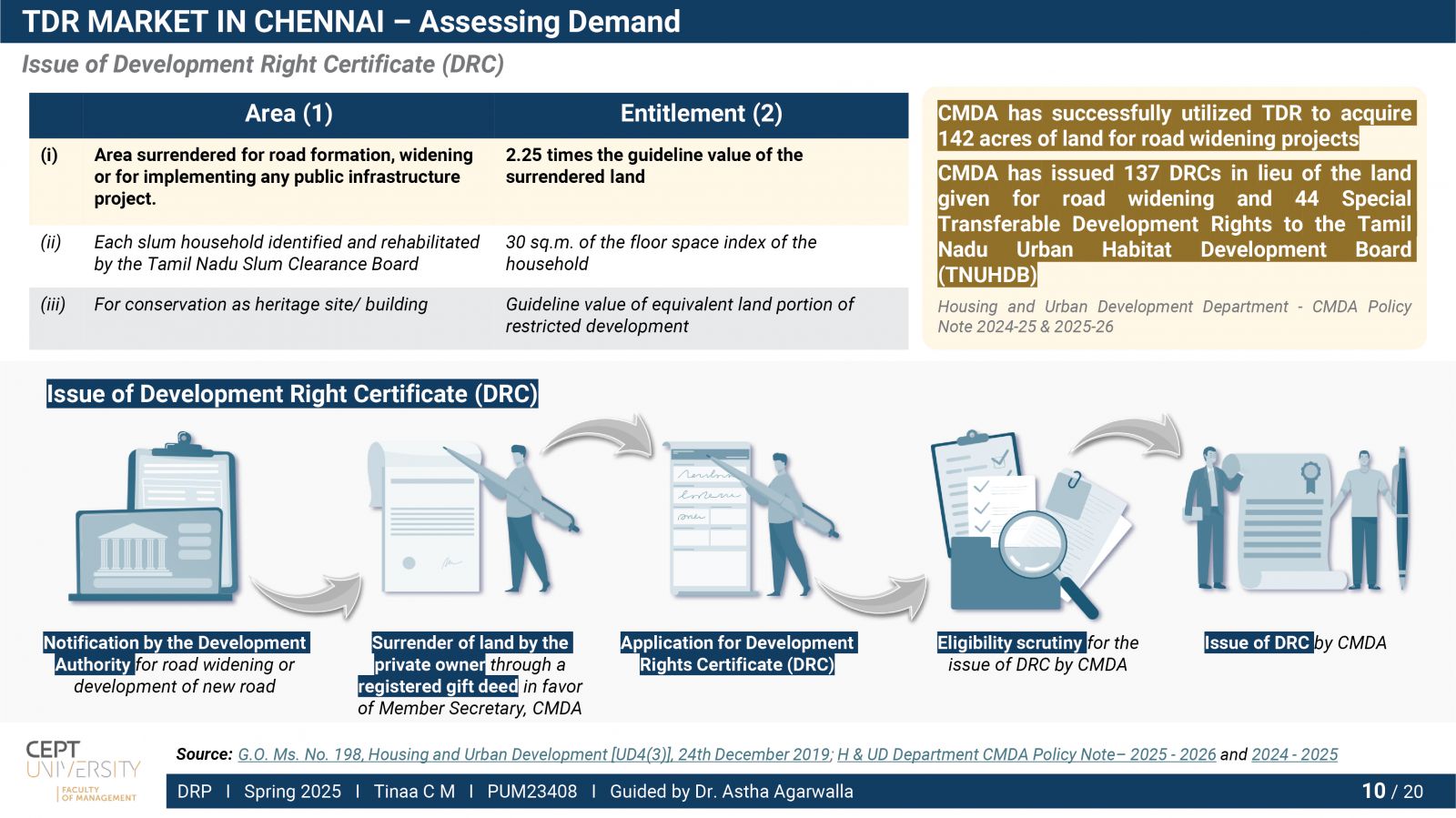

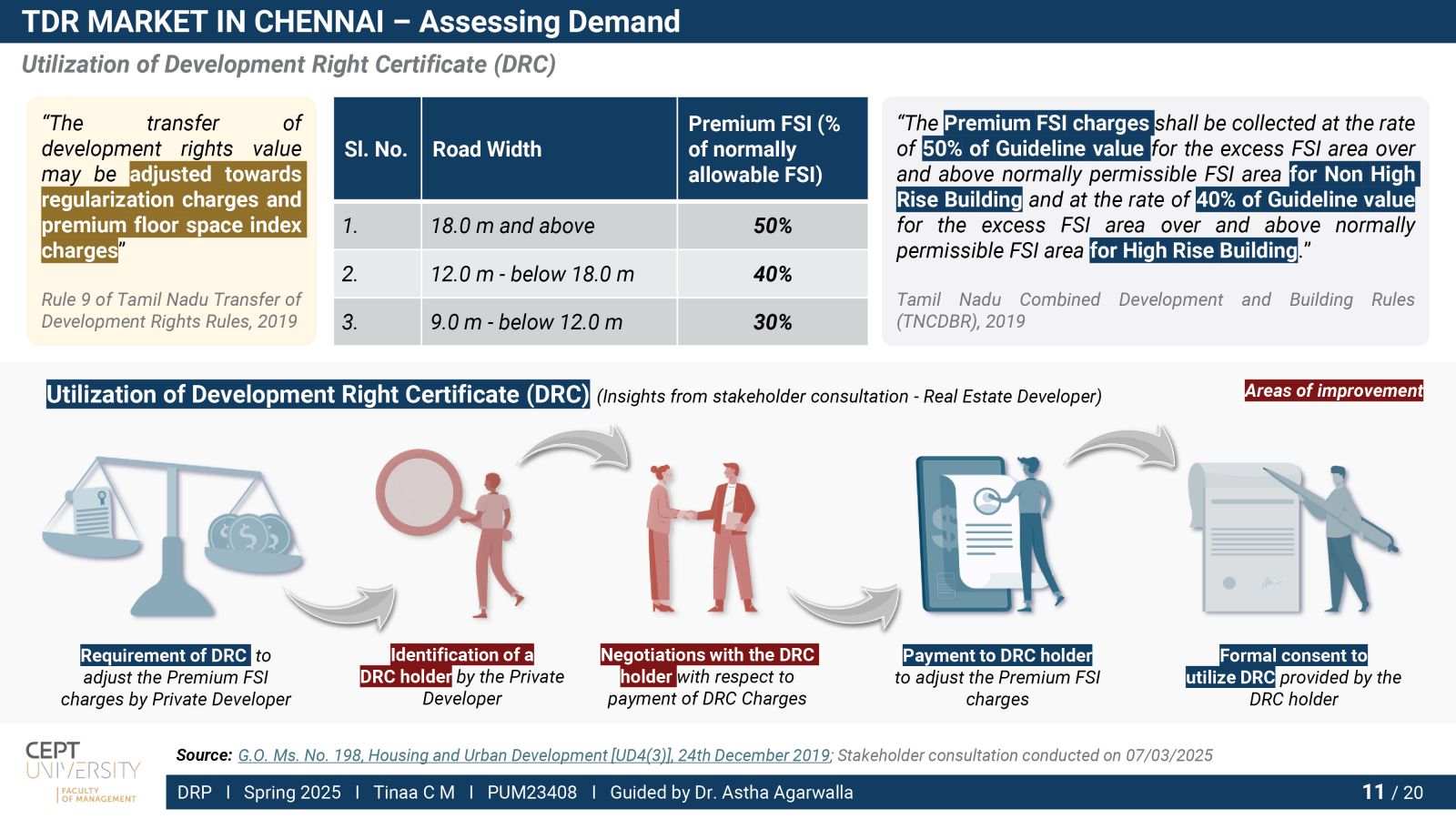

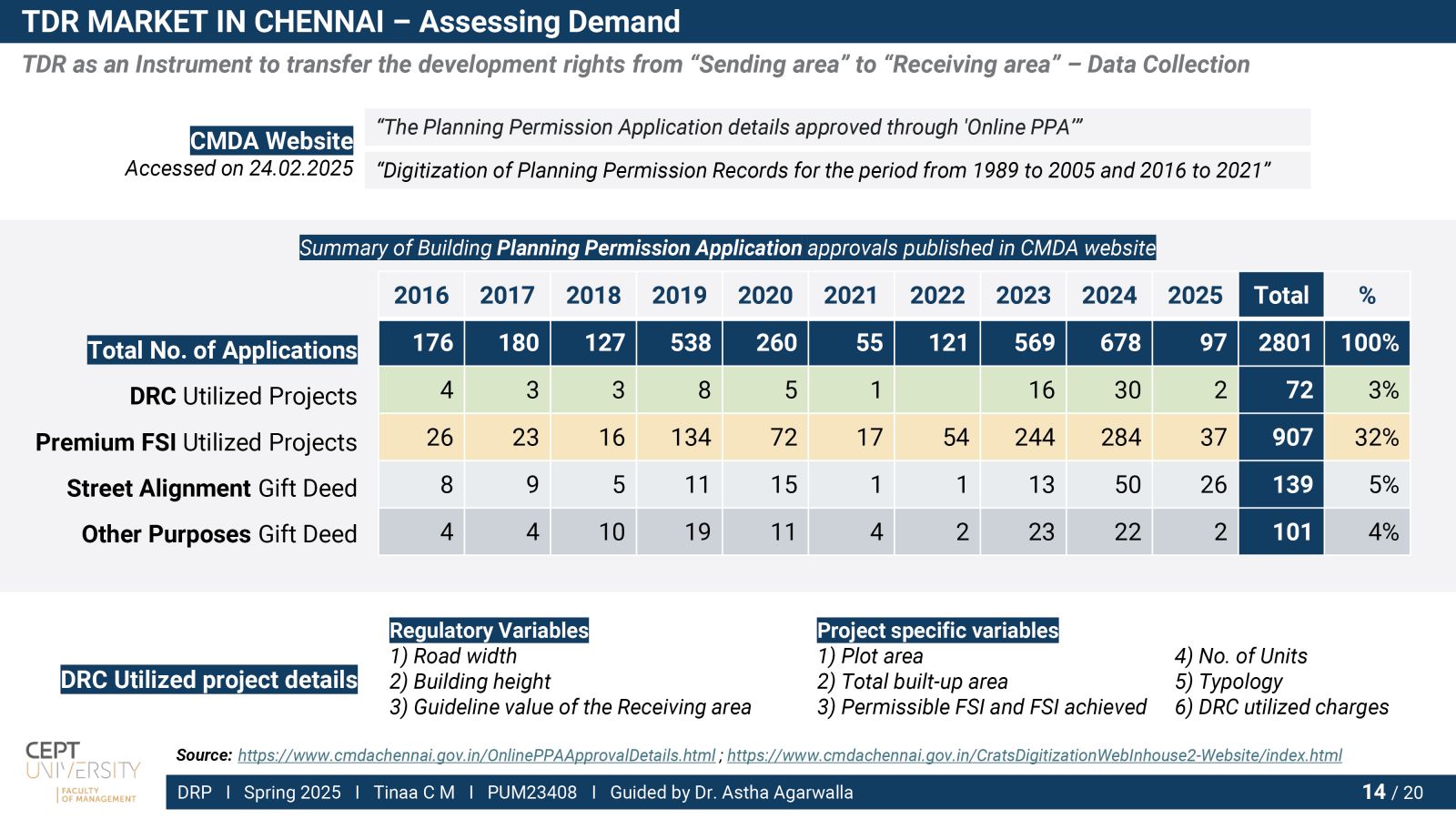

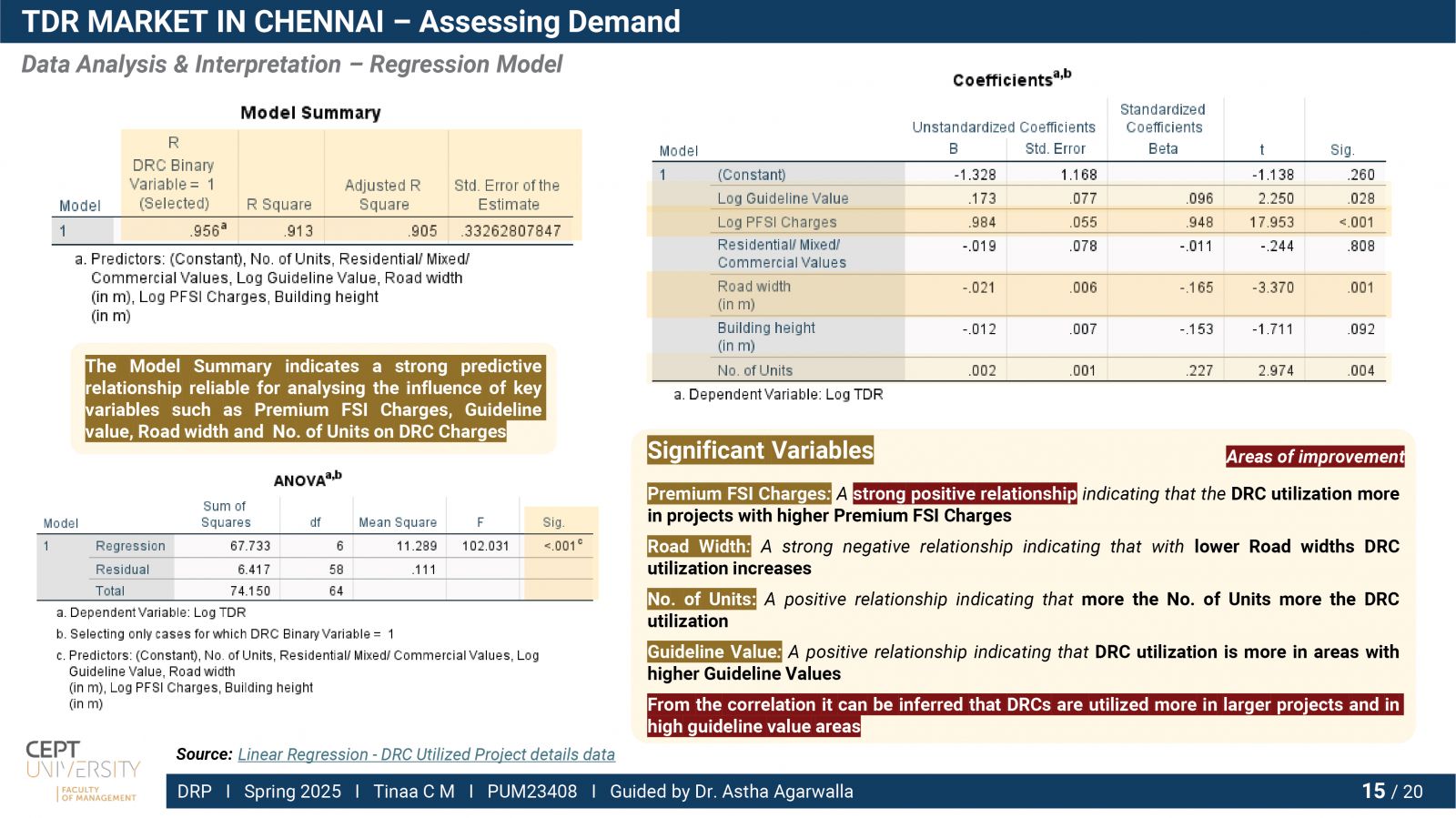

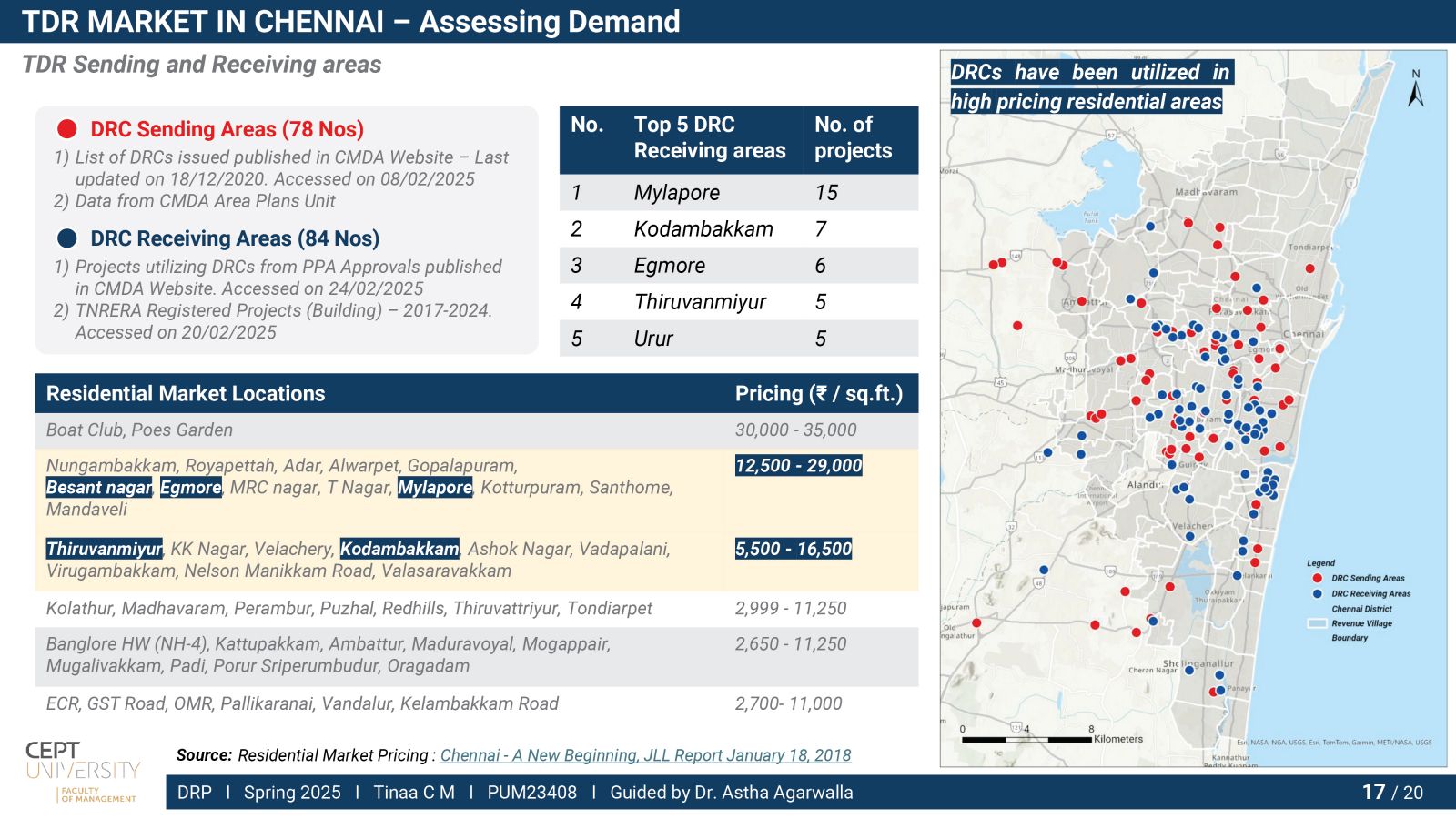

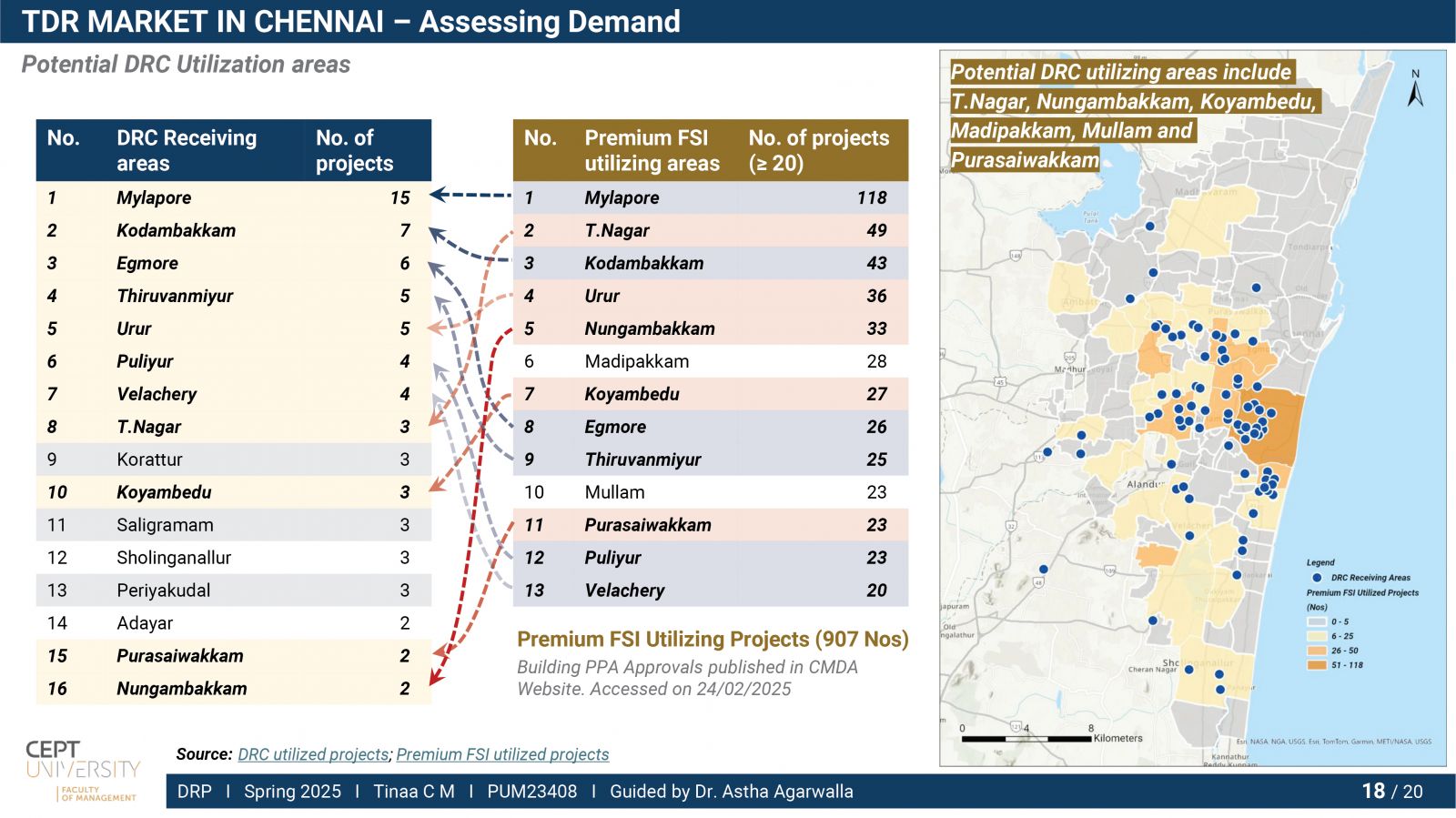

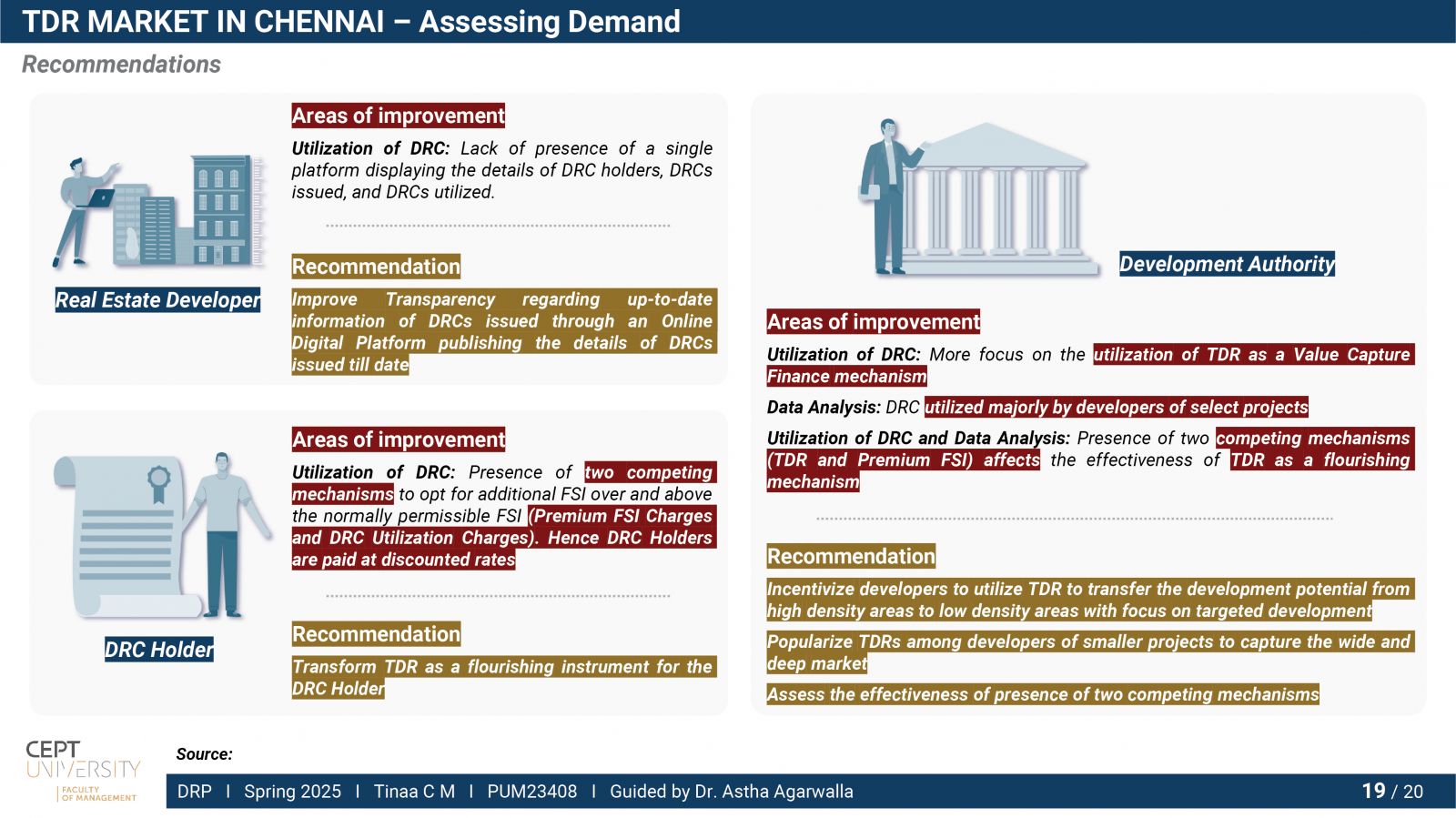

To meet the growing infrastructure requirements arising from rapid urbanization, Urban Local Bodies (ULBs) are continually exploring new sources of financing. ULBs have been using different Value Capture Finance methods to raise funds and “Transfer of Development Rights (TDR)” is one of the 10 such methods as per the MoUD’s “Value Capture Finance Policy Framework”. TDR essentially means an award (issued in the form of a TDR Certificate) specifying the Built-Up Area (BUA) an owner of a plot can either sell (to a third party or a real estate developer) or utilize in-situ or elsewhere, in lieu of the land surrendered free of cost to the ULB, set apart for public purpose as notified by the ULB’s Agencies for the purpose of road widening, slum redevelopment, heritage conservation, etc. Apart from utilizing TDRs as a Value Capture Finance method, it is also used as an instrument to transfer the development rights from growth restricted areas (Sending areas) to development potential areas (Receiving areas). The study shall capture the utilization of TDR in Chennai from both the perspectives. The presence of an active deep market is essential for the success of TDR as an instrument as participation in TDR programs is voluntary. Hence the study shall attempt to understand the factors that drive its demand in Chennai.