Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

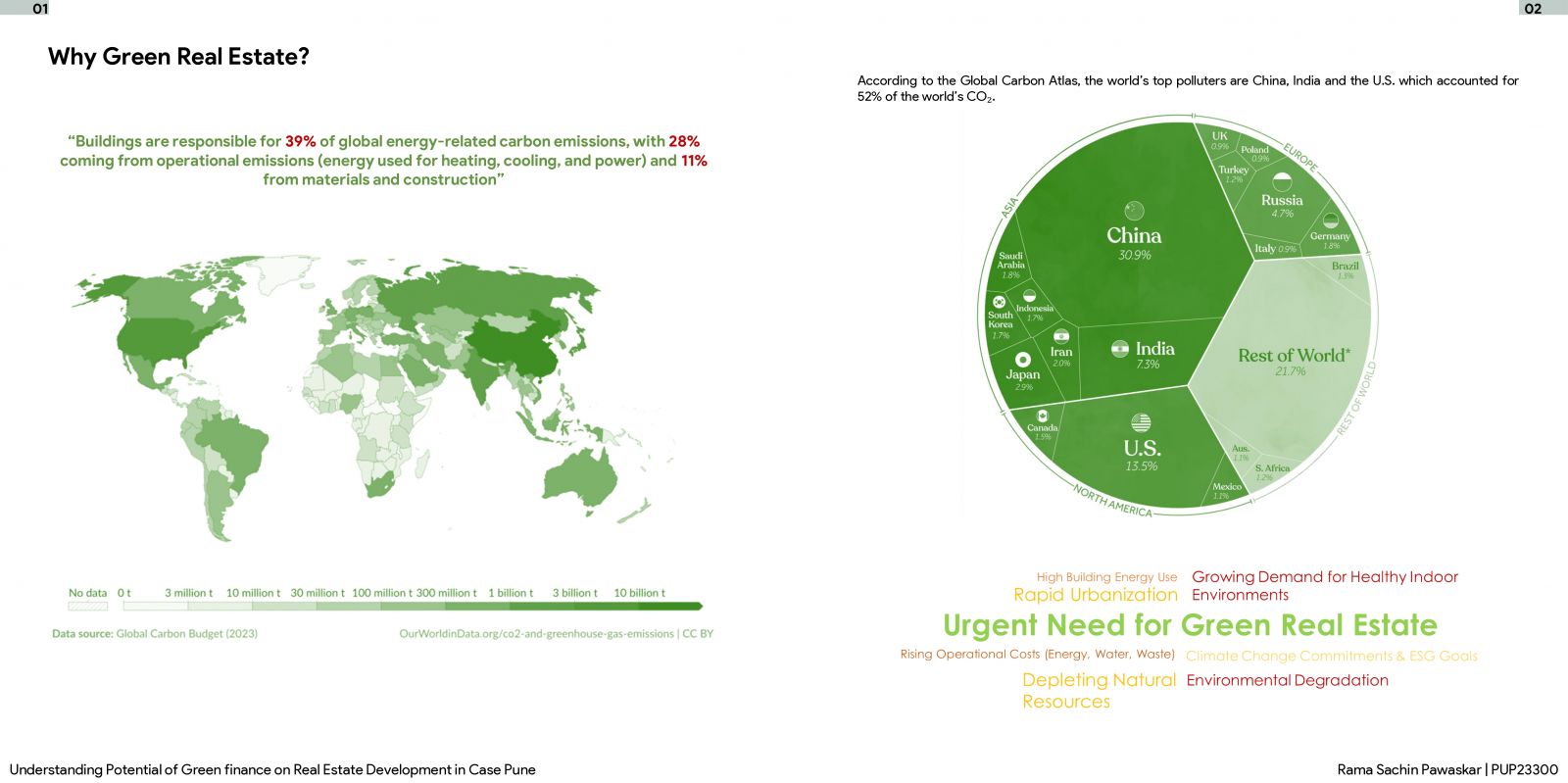

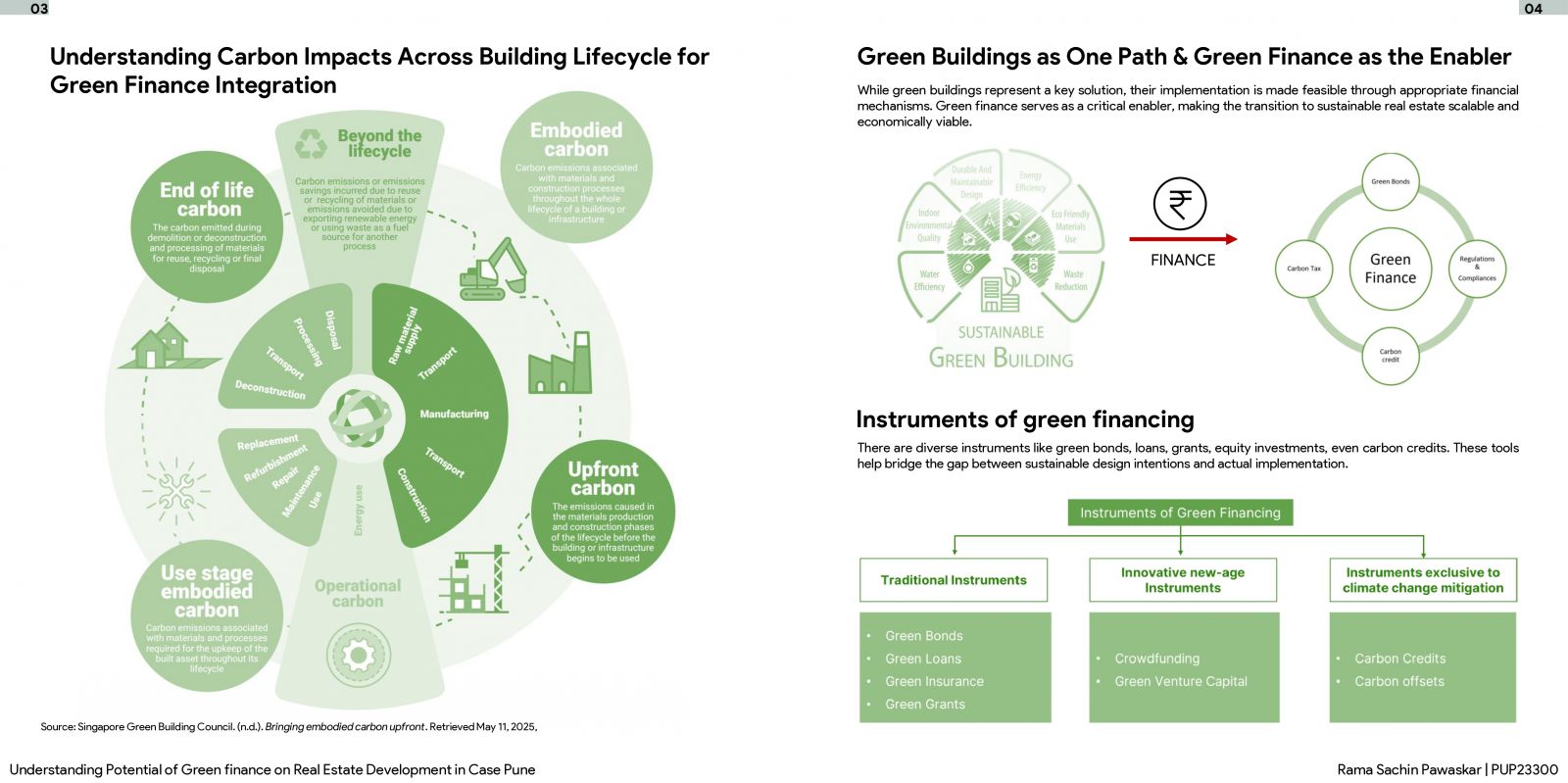

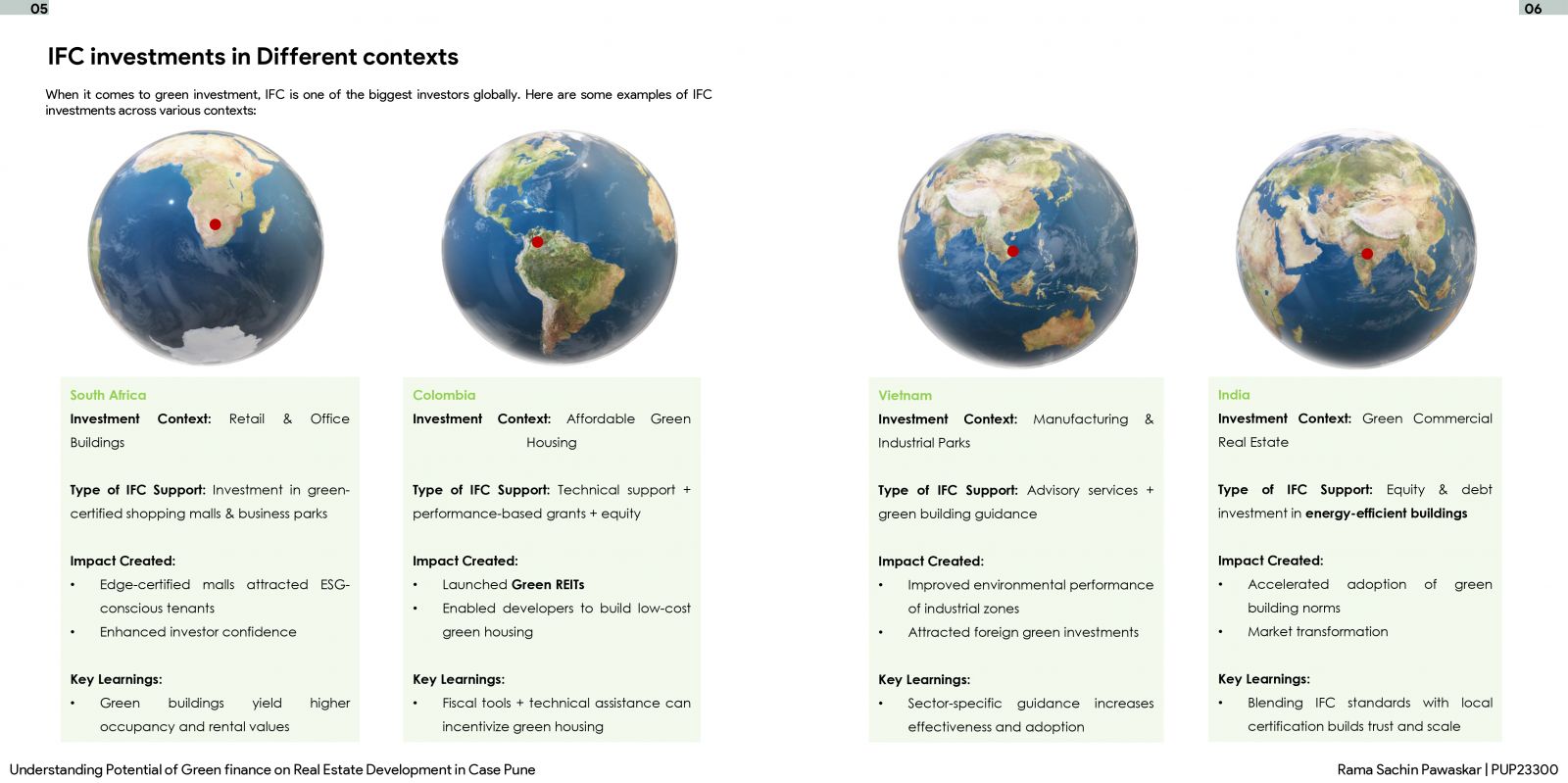

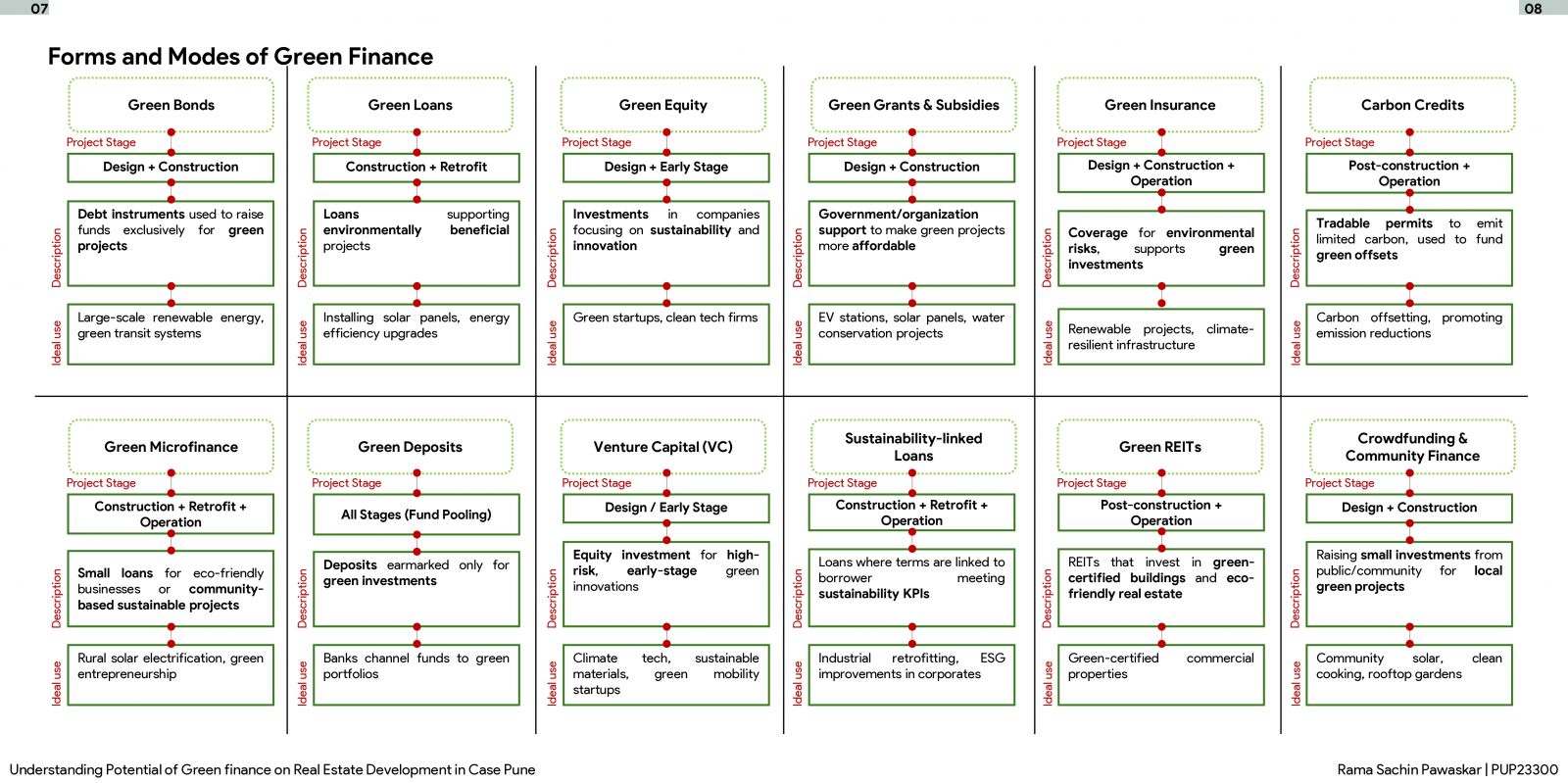

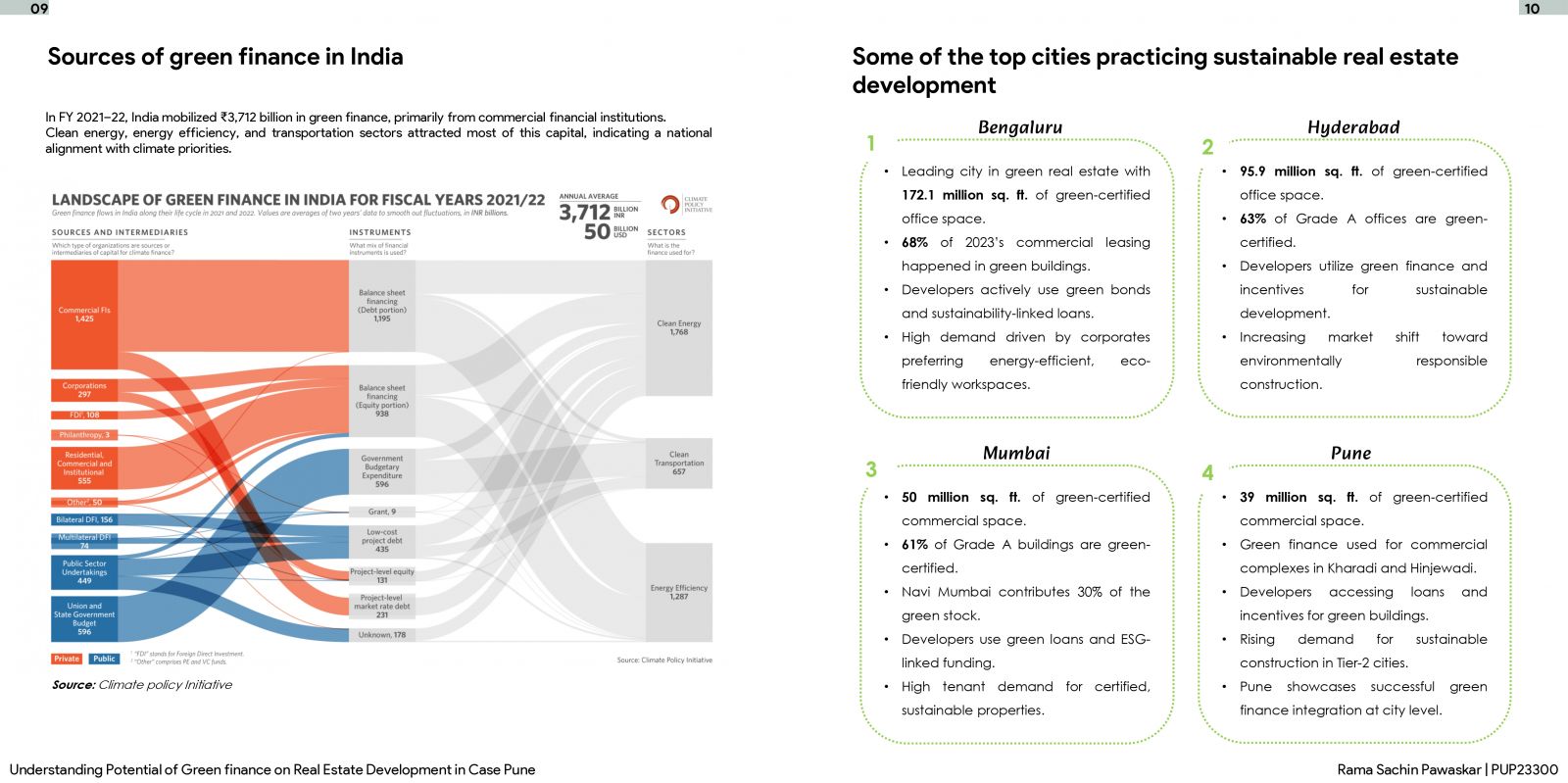

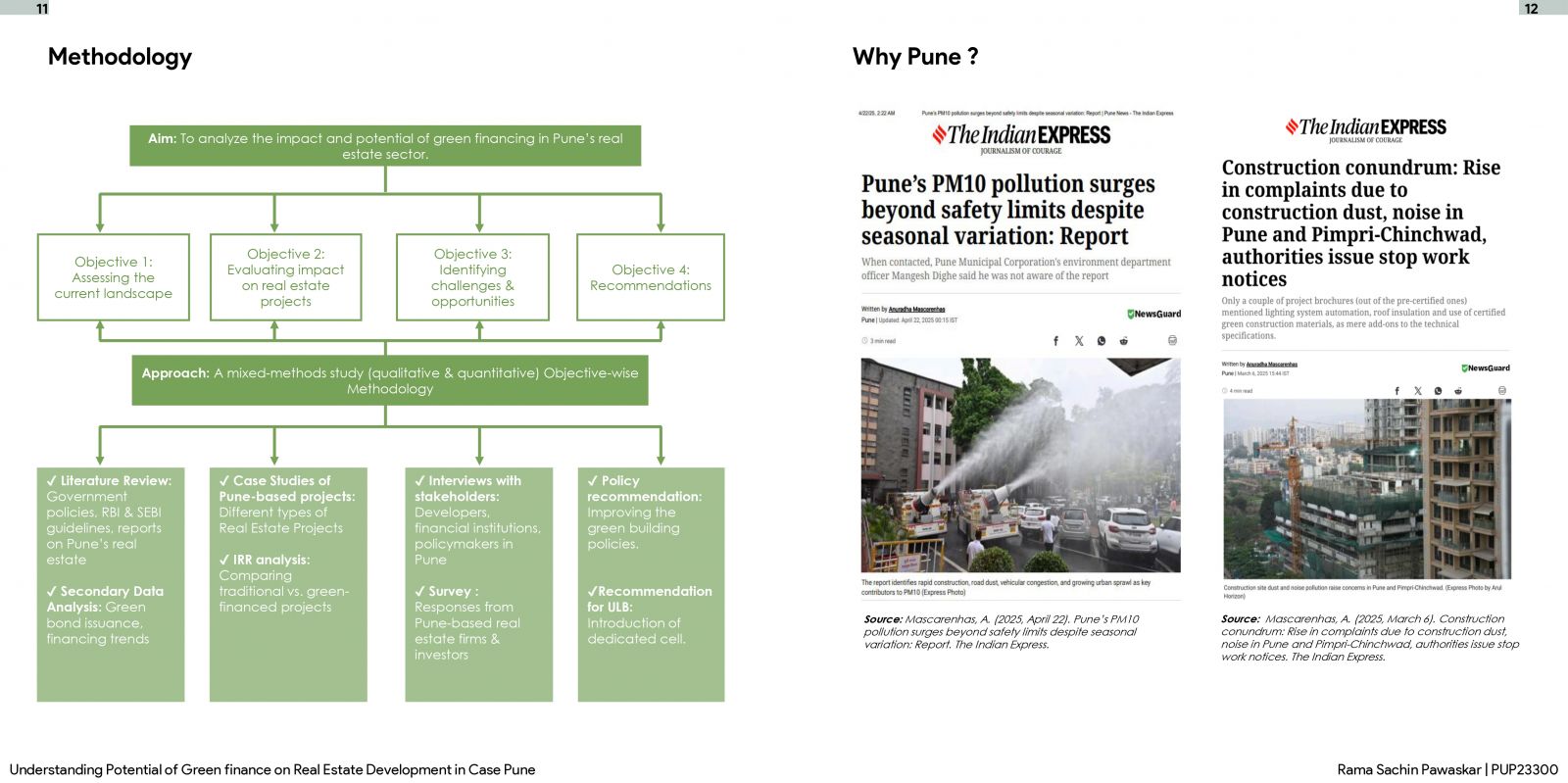

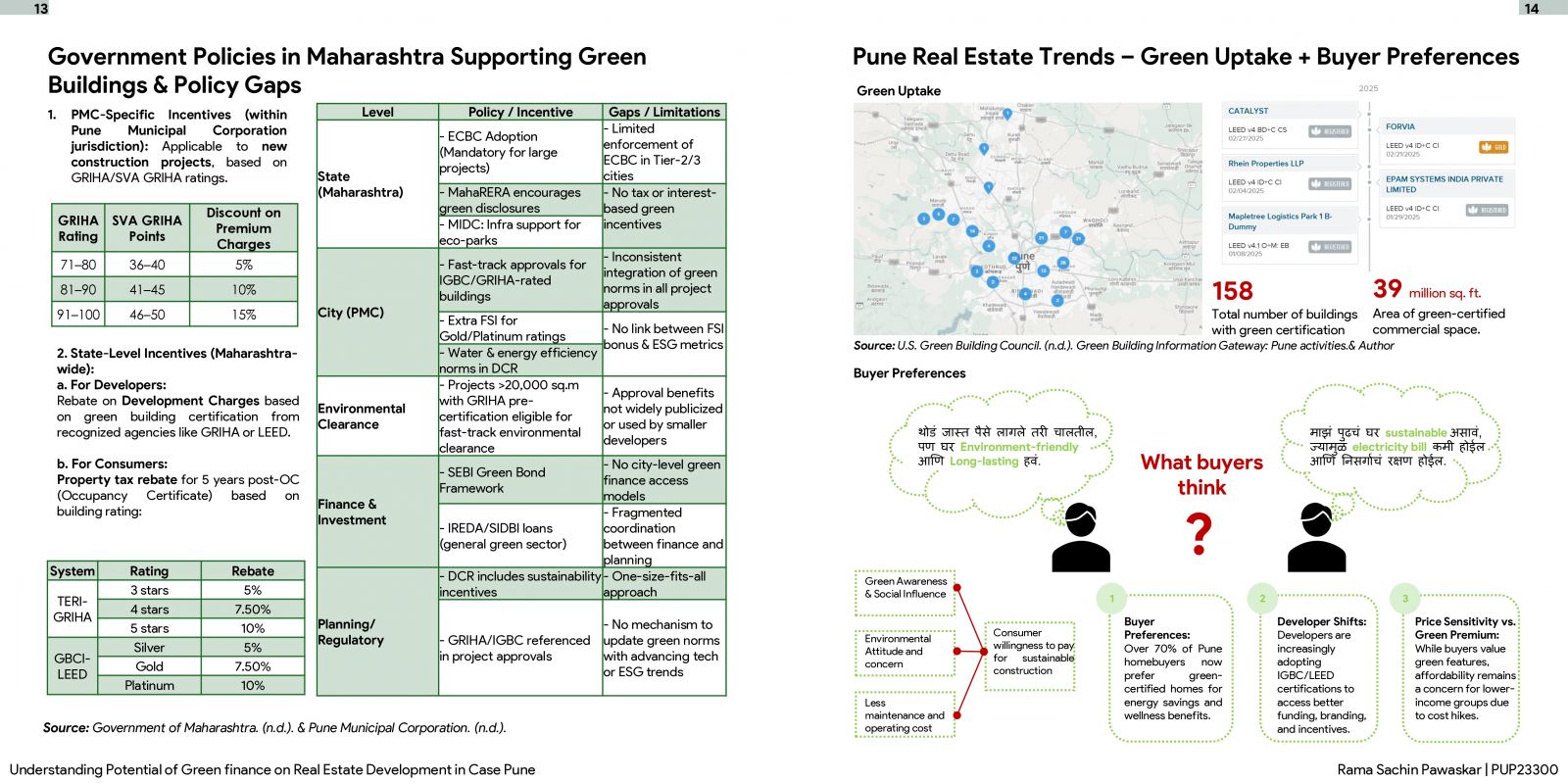

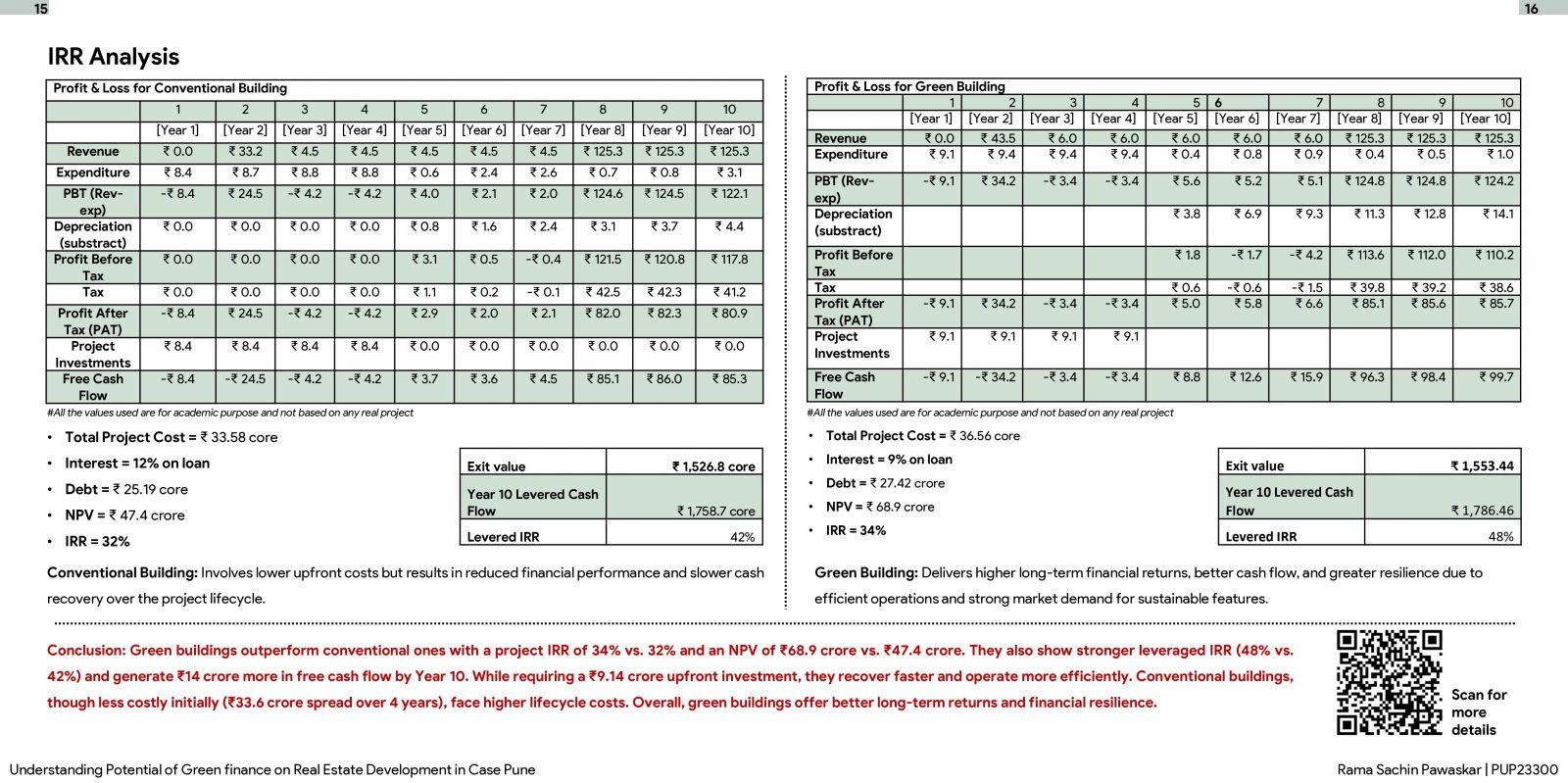

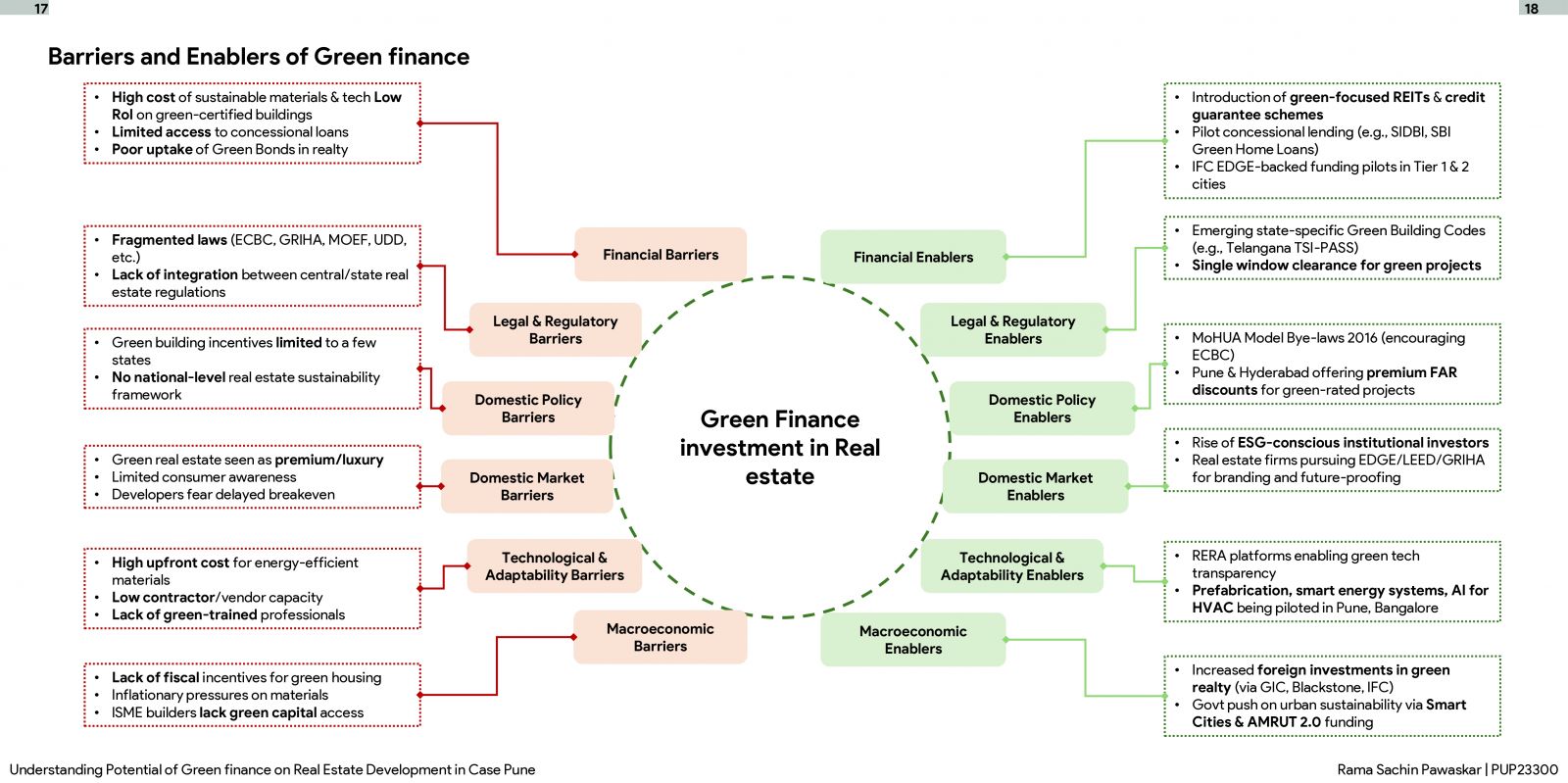

This study explores the role of green finance in transforming real estate development in Pune, focusing on tools like green bonds, ESG-linked loans, and sustainability-focused REITs. It includes a comparative analysis of green vs. conventional projects on cost, IRR and profitability, as well as stakeholder insights on financing hurdles and institutional readiness. The research also analyzes the policy gap, identifying inconsistencies and barriers that hinder the growth of green finance. Key recommendations include tax incentives, ESG disclosures, and establishing a Green Finance Facilitation Cell to bridge the policy gap, scale green finance and drive sustainable urban growth in Pune and beyond.

View Additional Work