Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

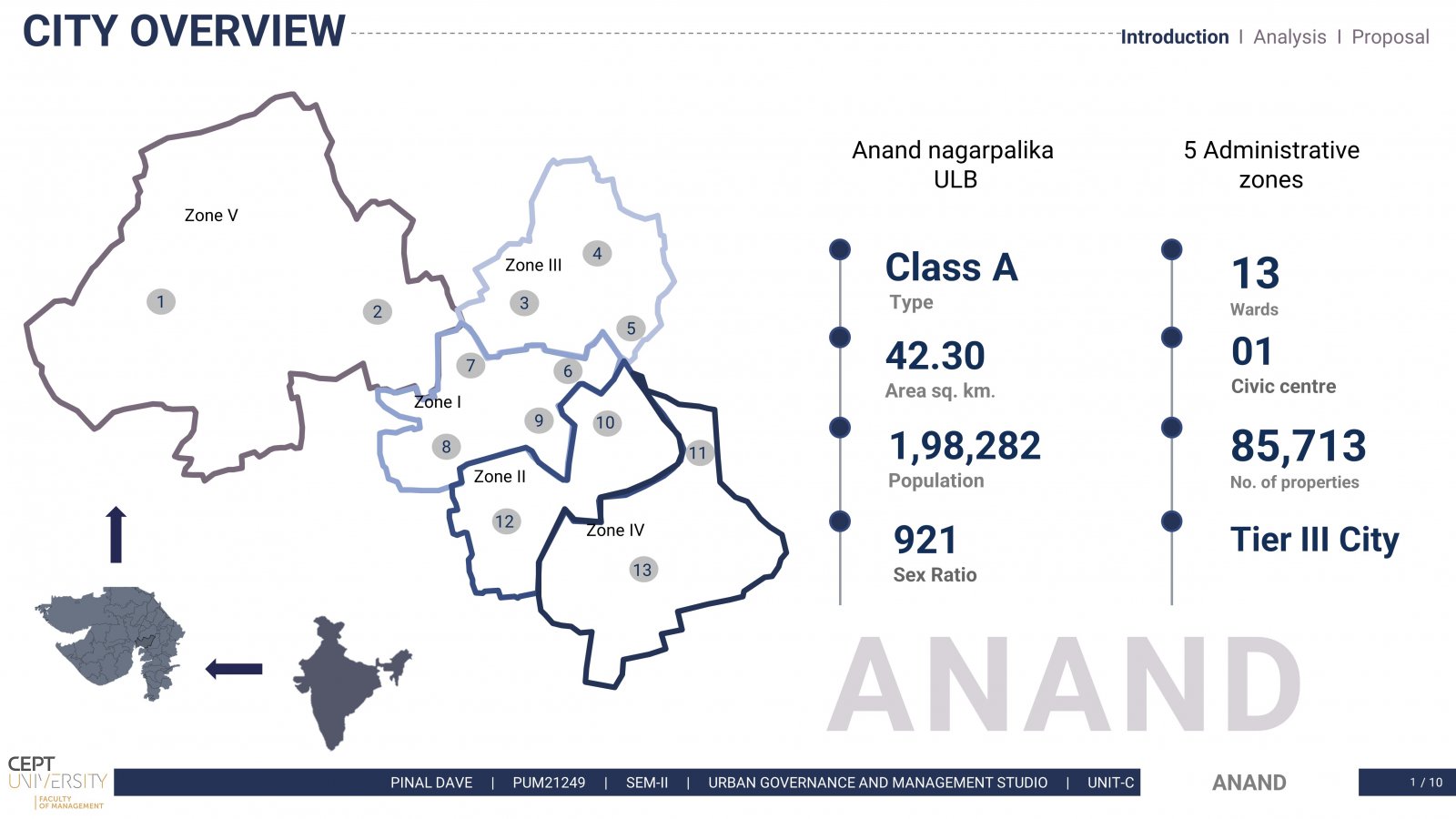

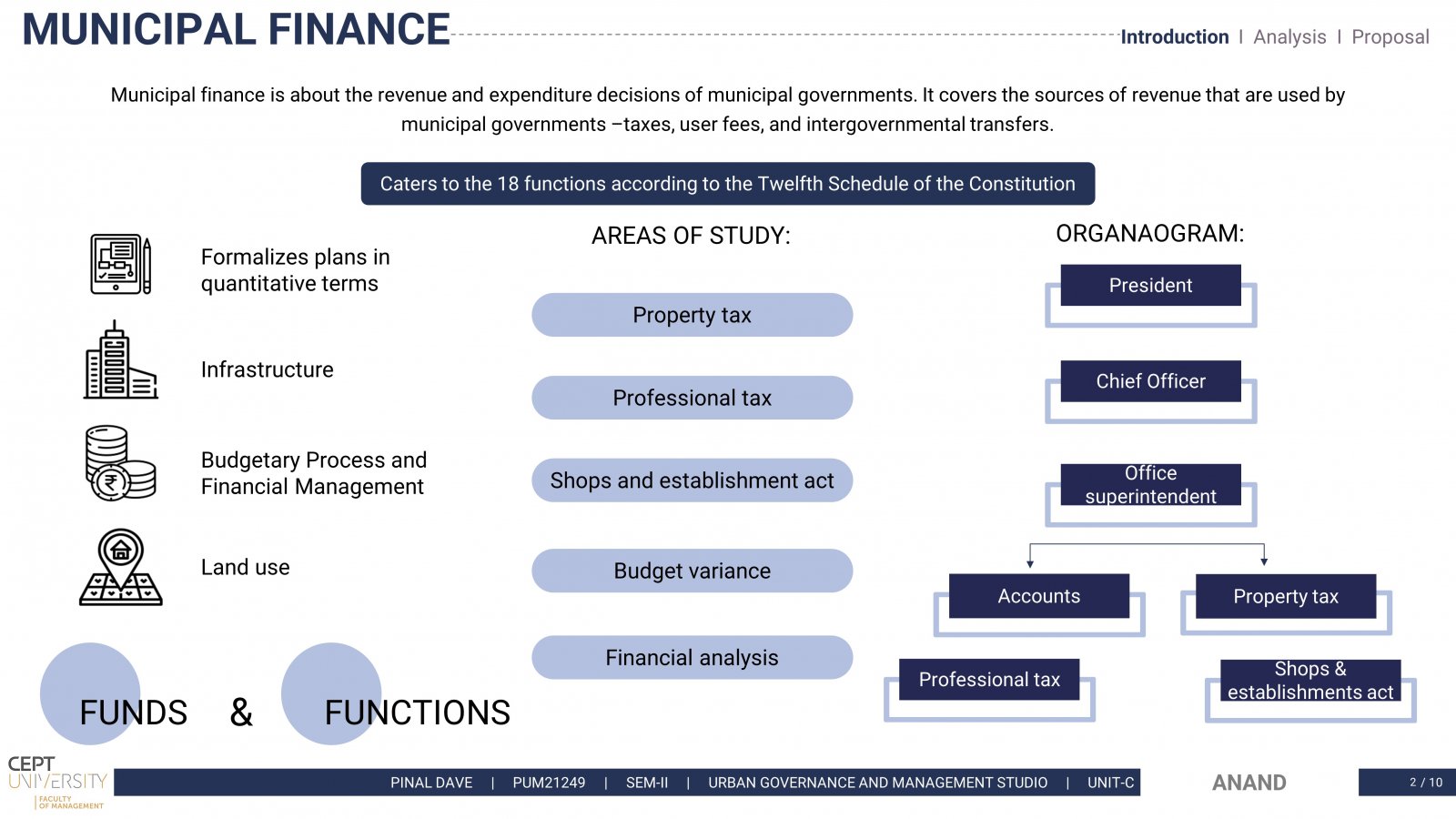

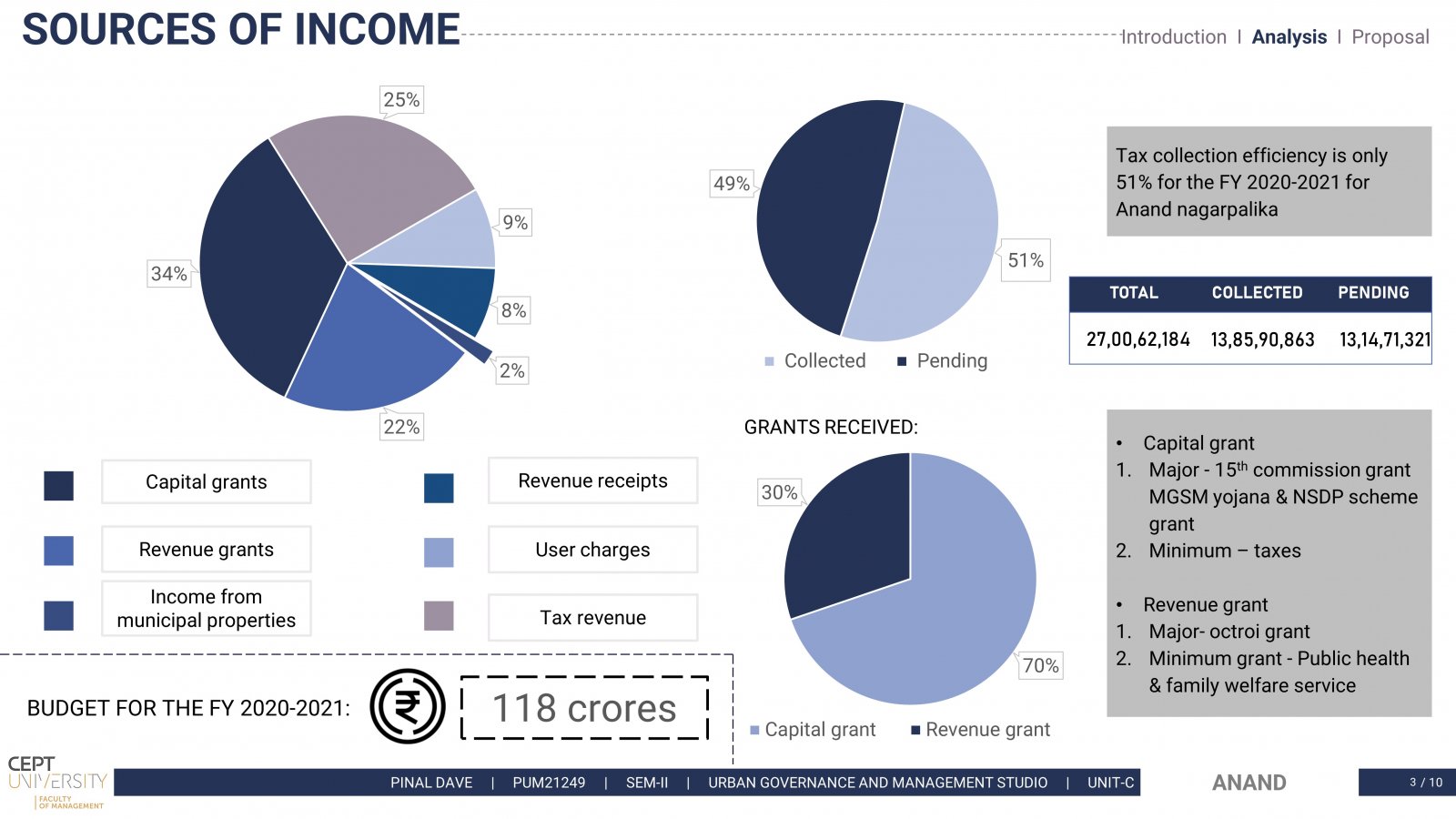

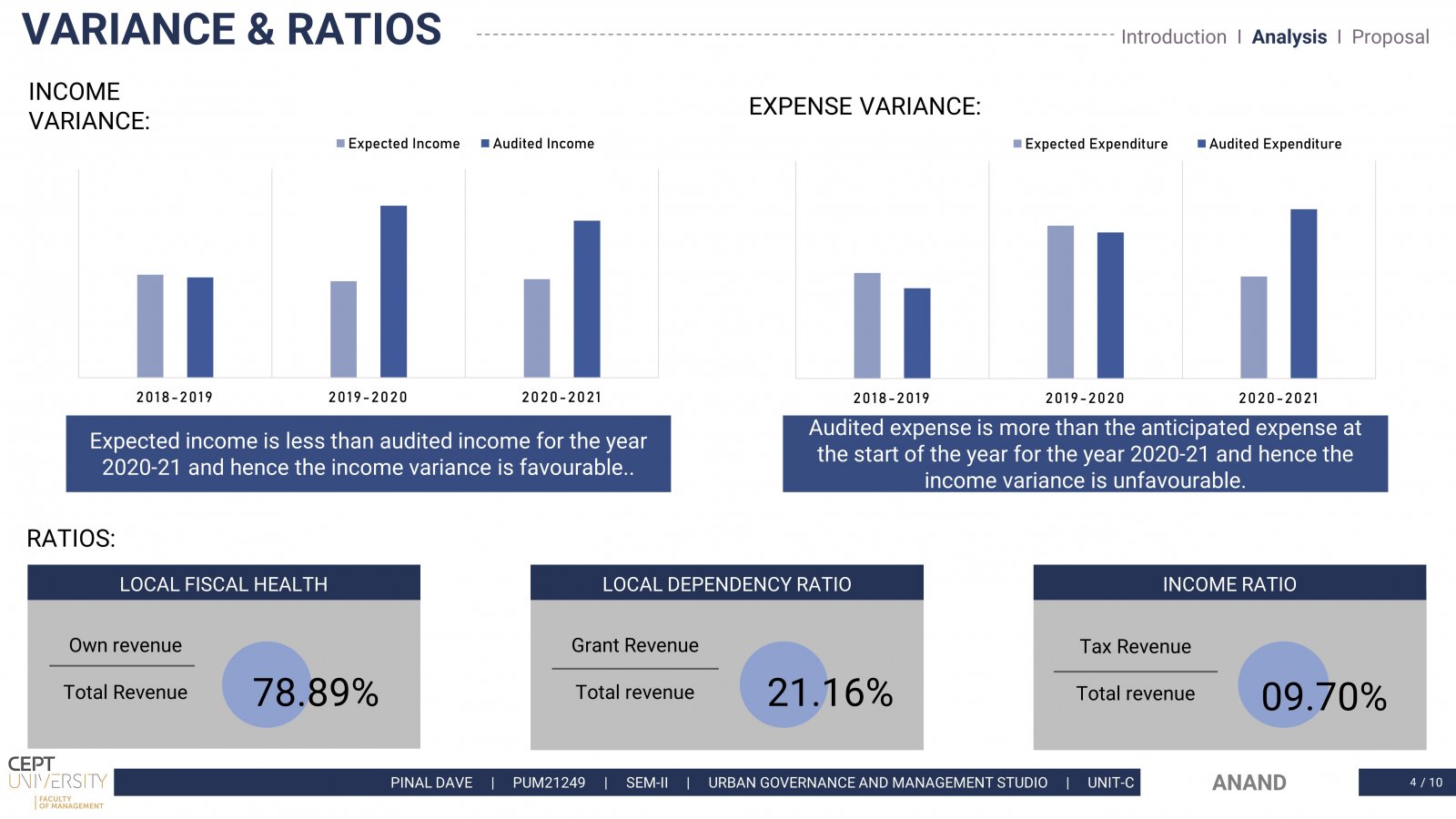

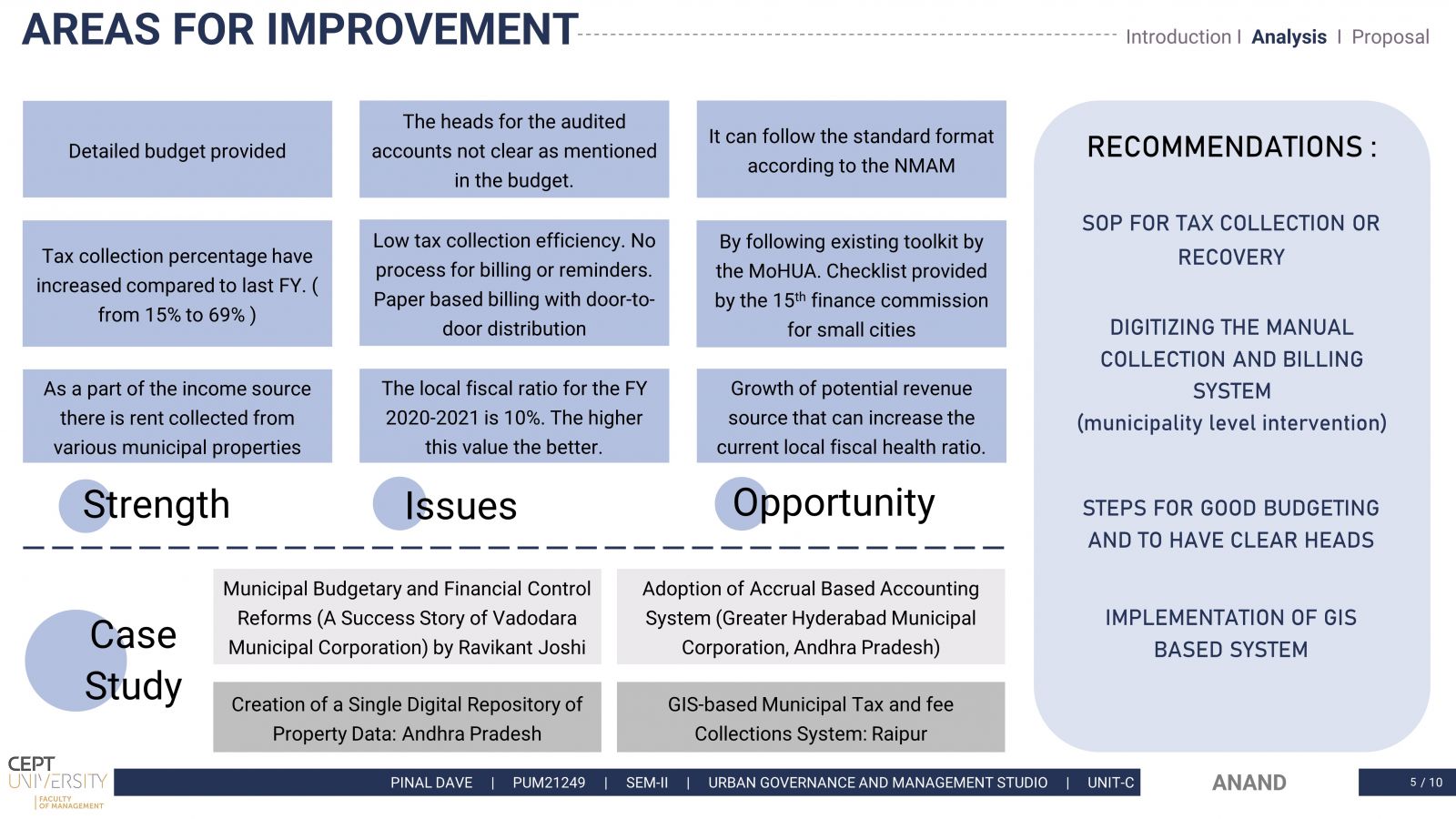

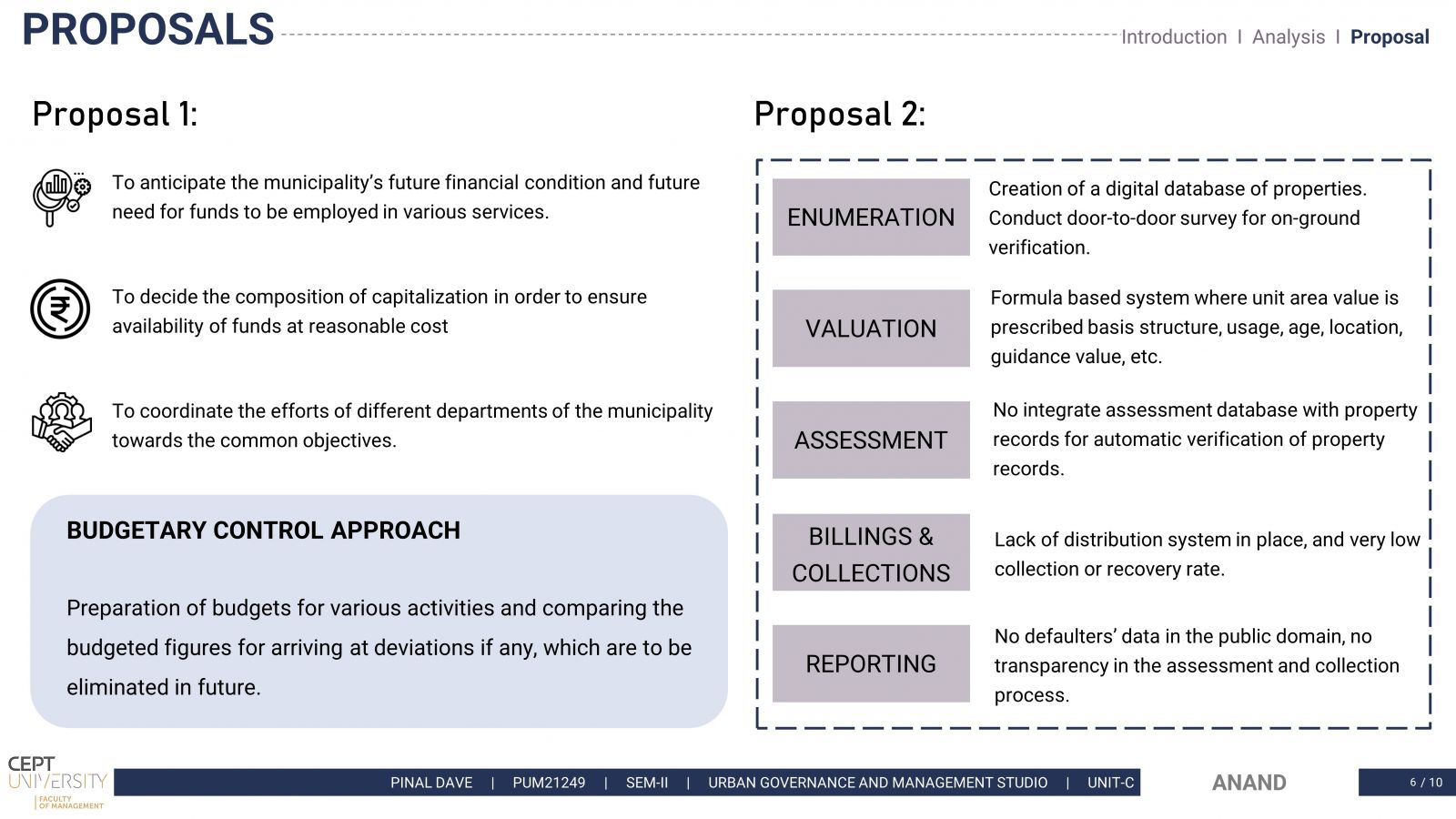

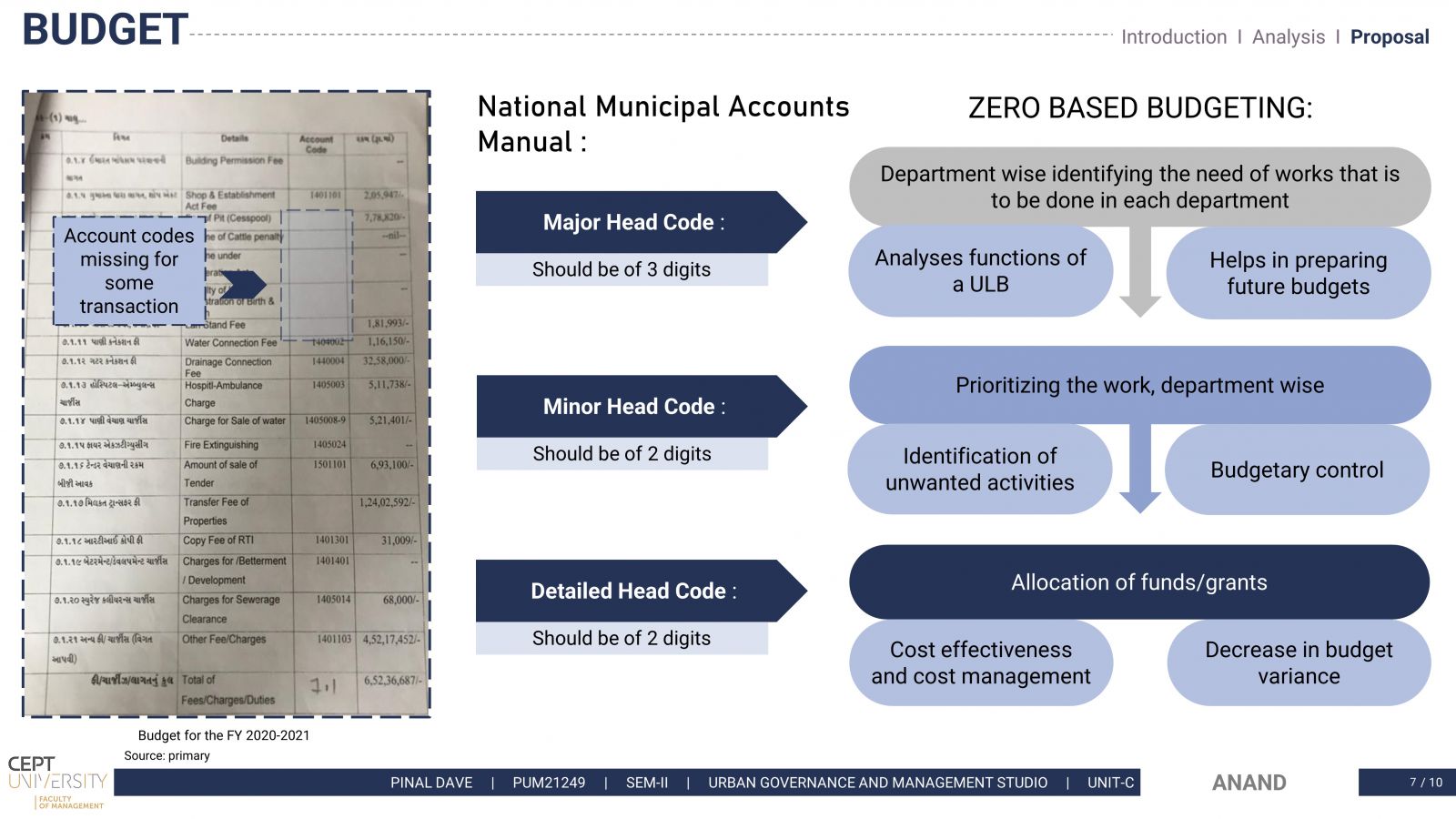

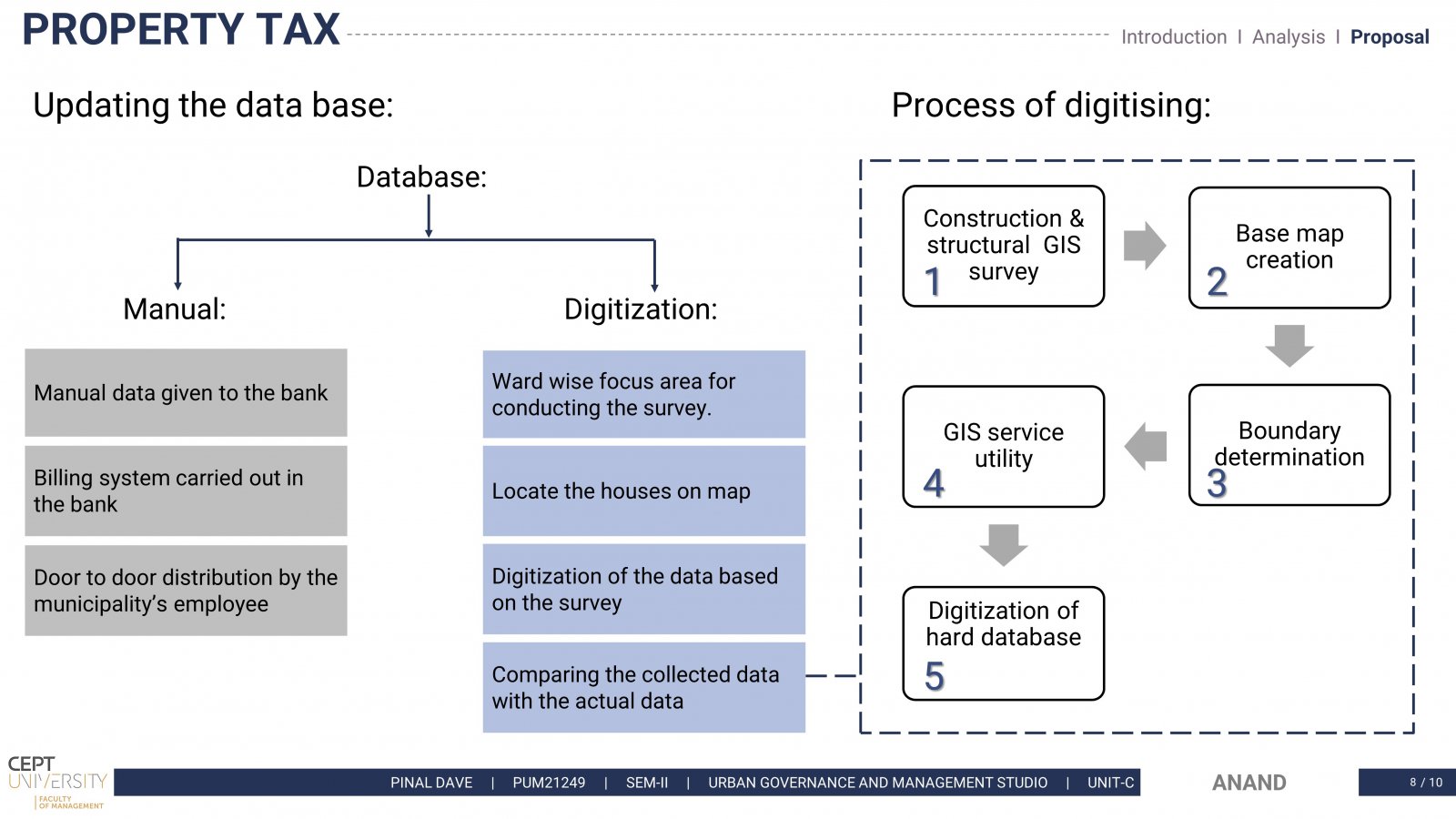

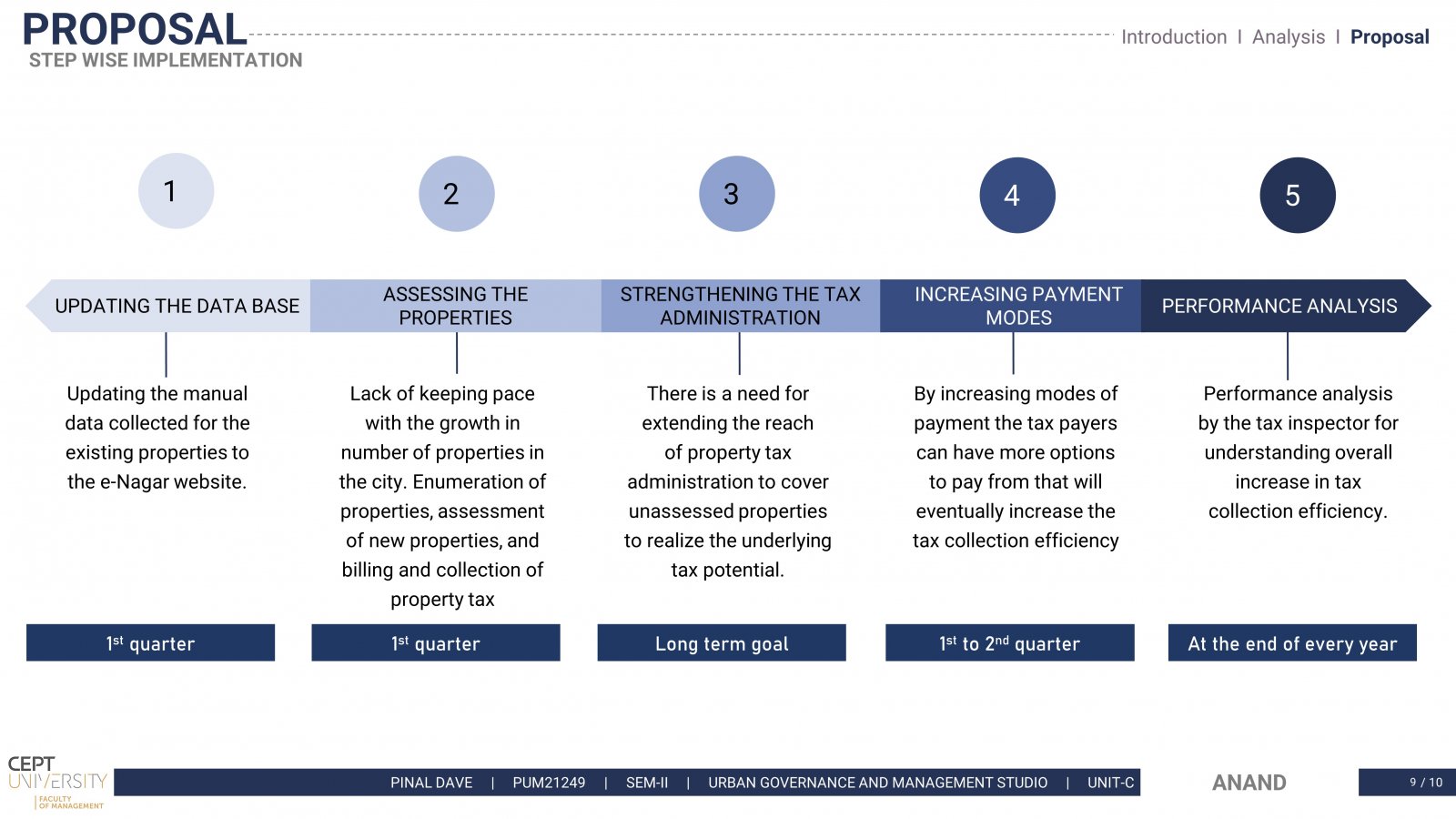

While the 74th Constitutional Amendment Act (CAA) gave local governments a lot of functional autonomy, it didn't give them much in the way of financial autonomy. Municipal fiscal health is one such component, as it helps the municipality to sustain itself. While there are many policies and standards for big cities, smaller cities are left behind in this regard. The property tax collection mechanism could be strengthened to enhance fiscal health. The aim should be to adequately utilize the tax and other revenues in an effective manner. The low level of revenue generation in small cities have, thus, precluded them from providing even the basic public services to their citizens. Here, we have tri

View Additional Work

.jpg)