Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

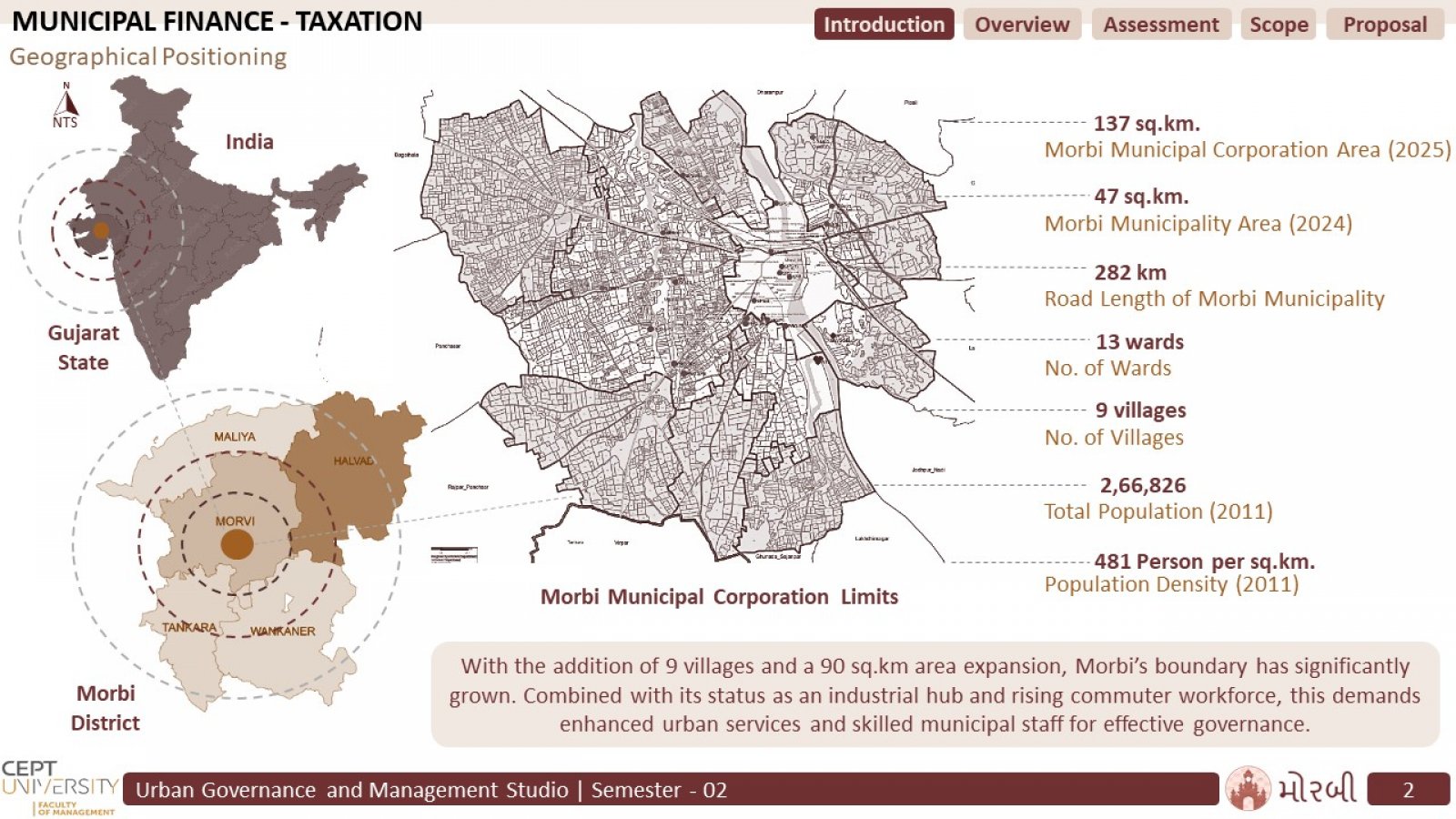

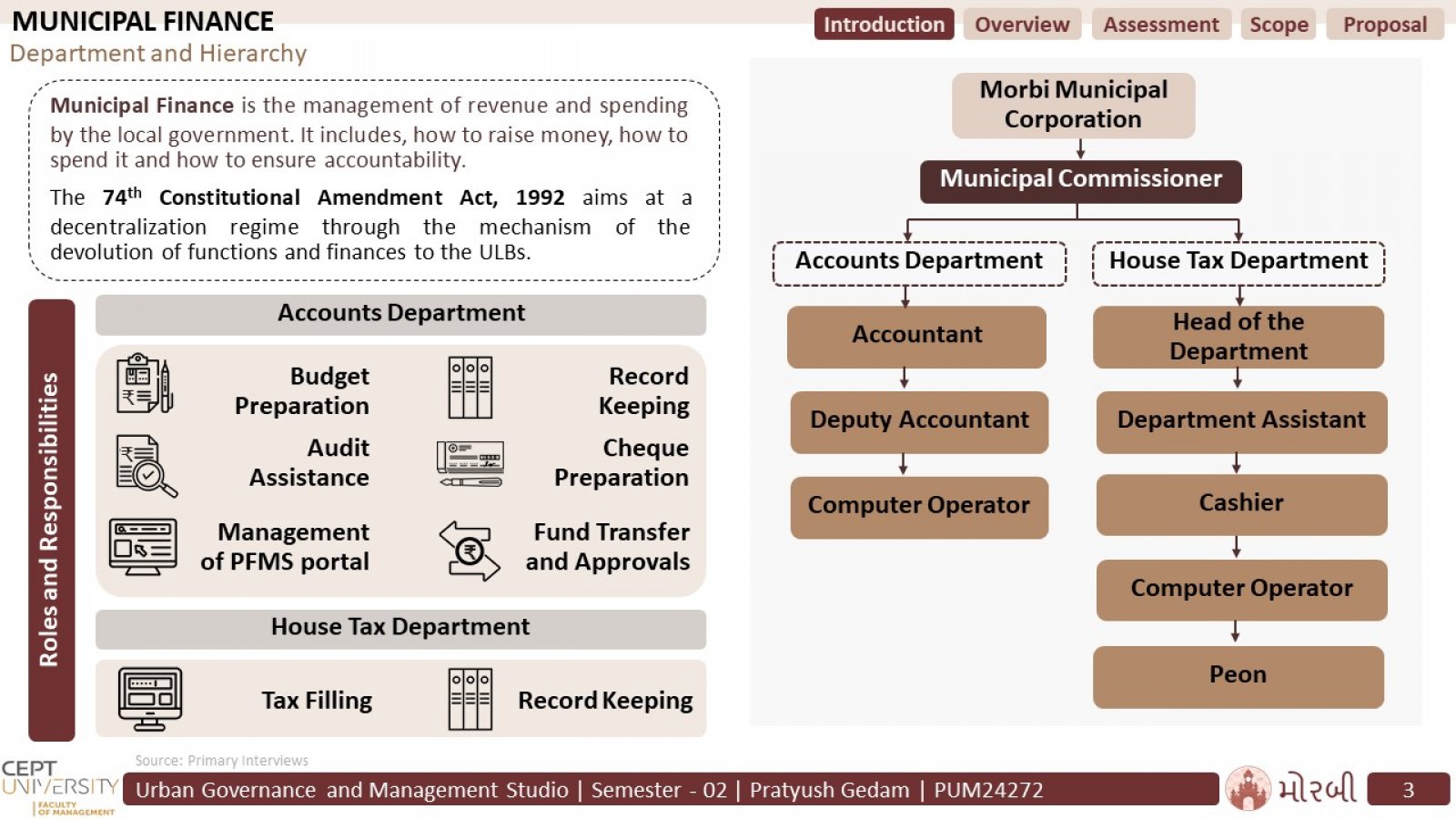

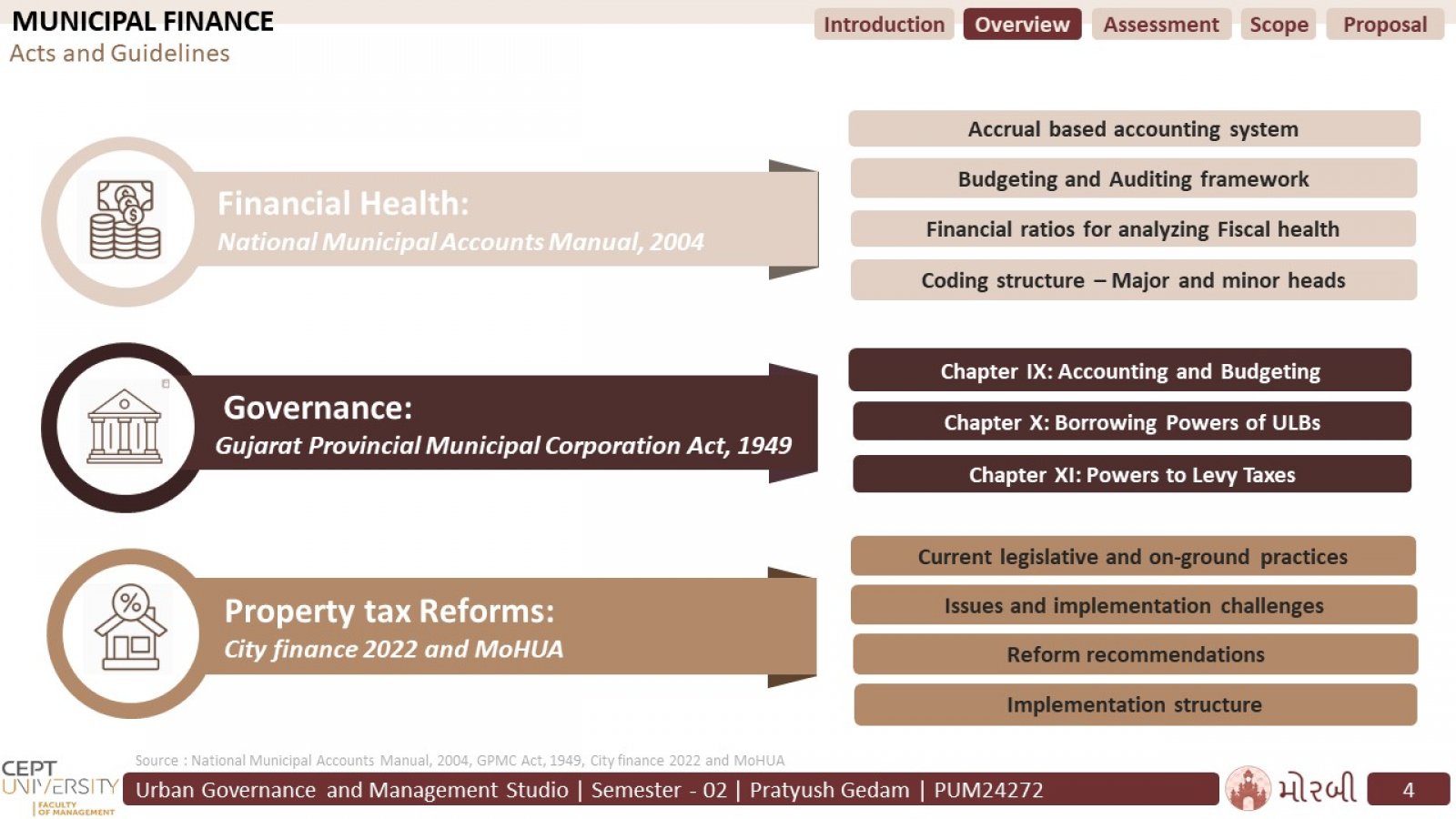

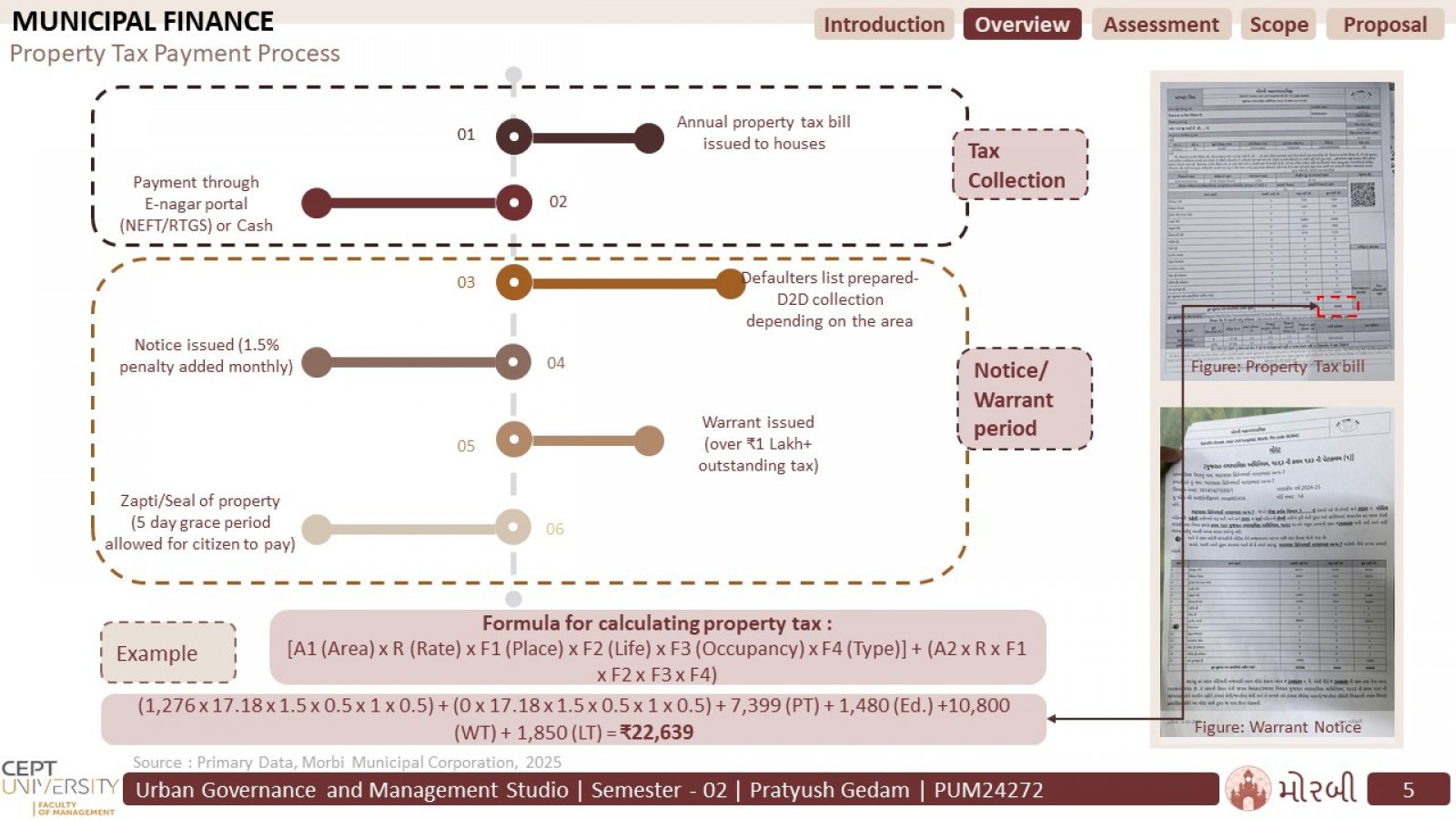

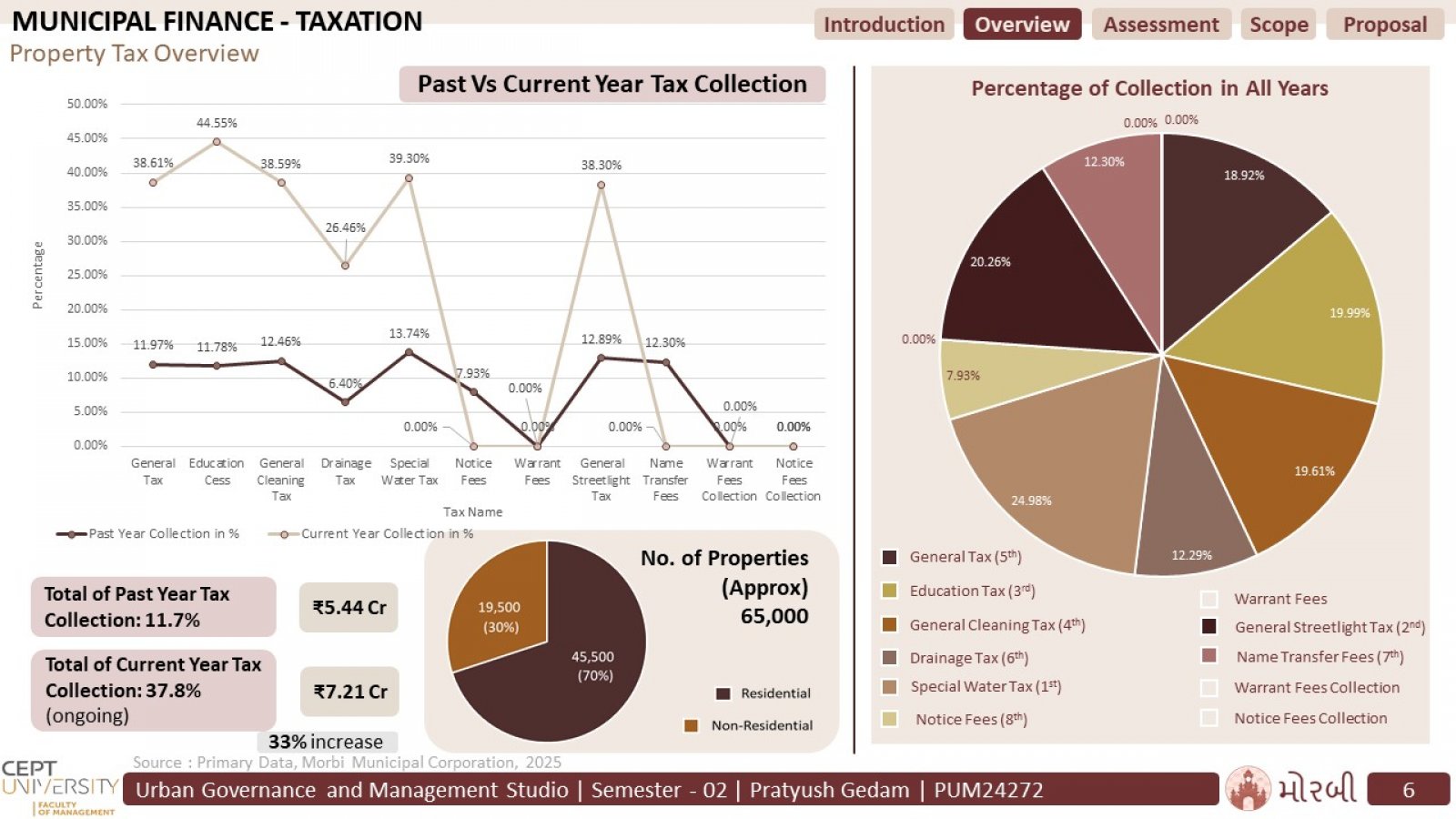

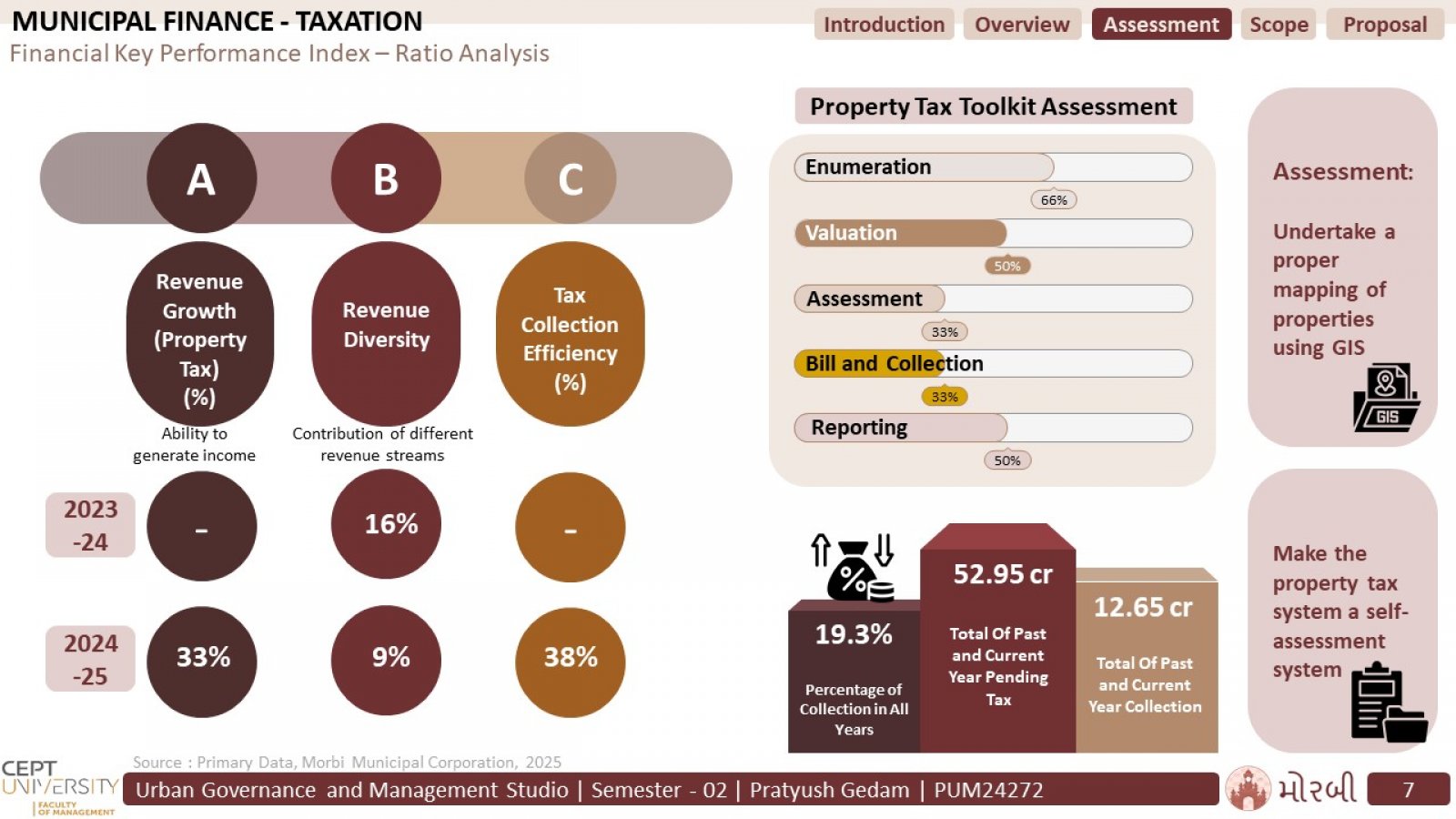

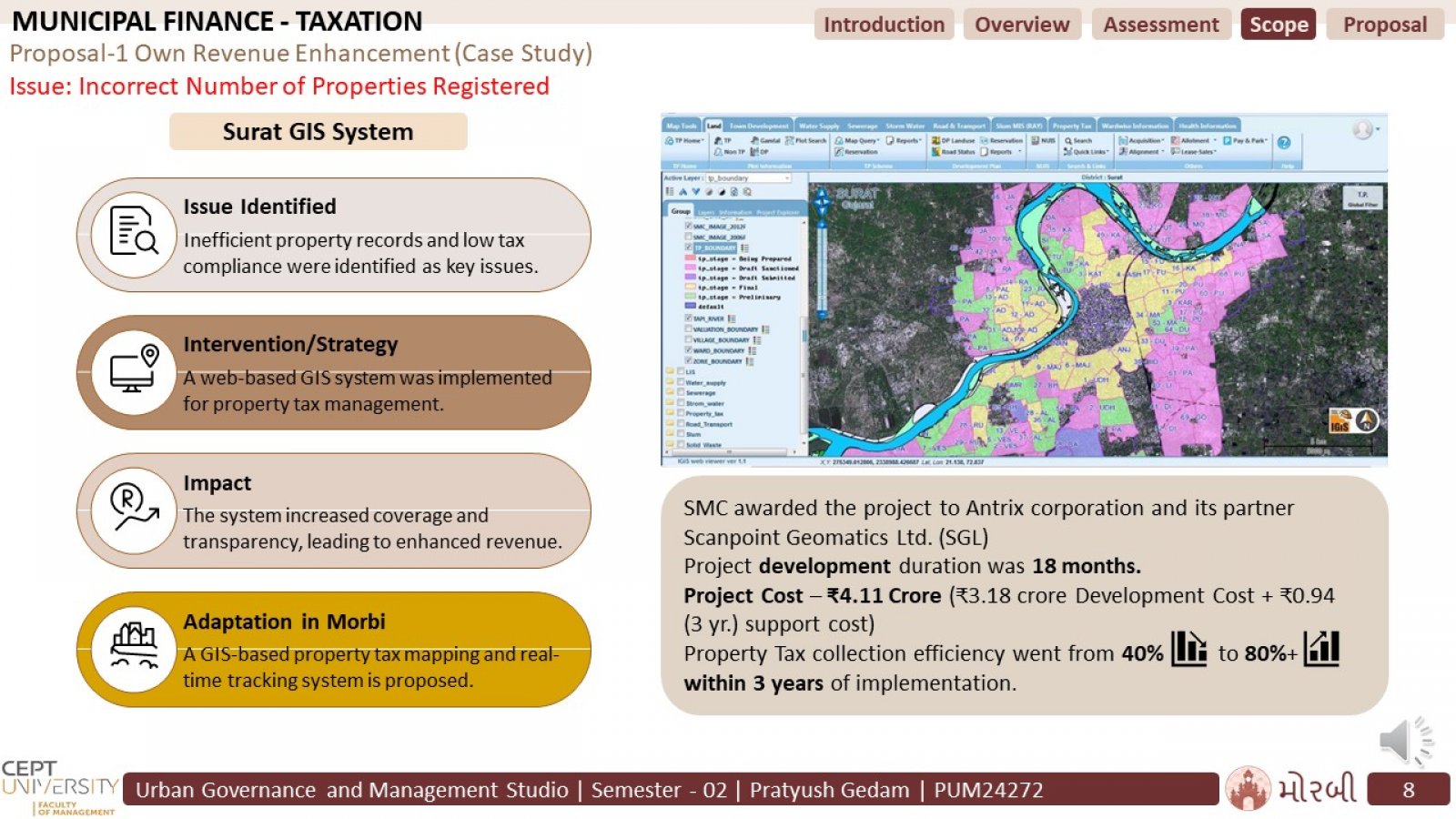

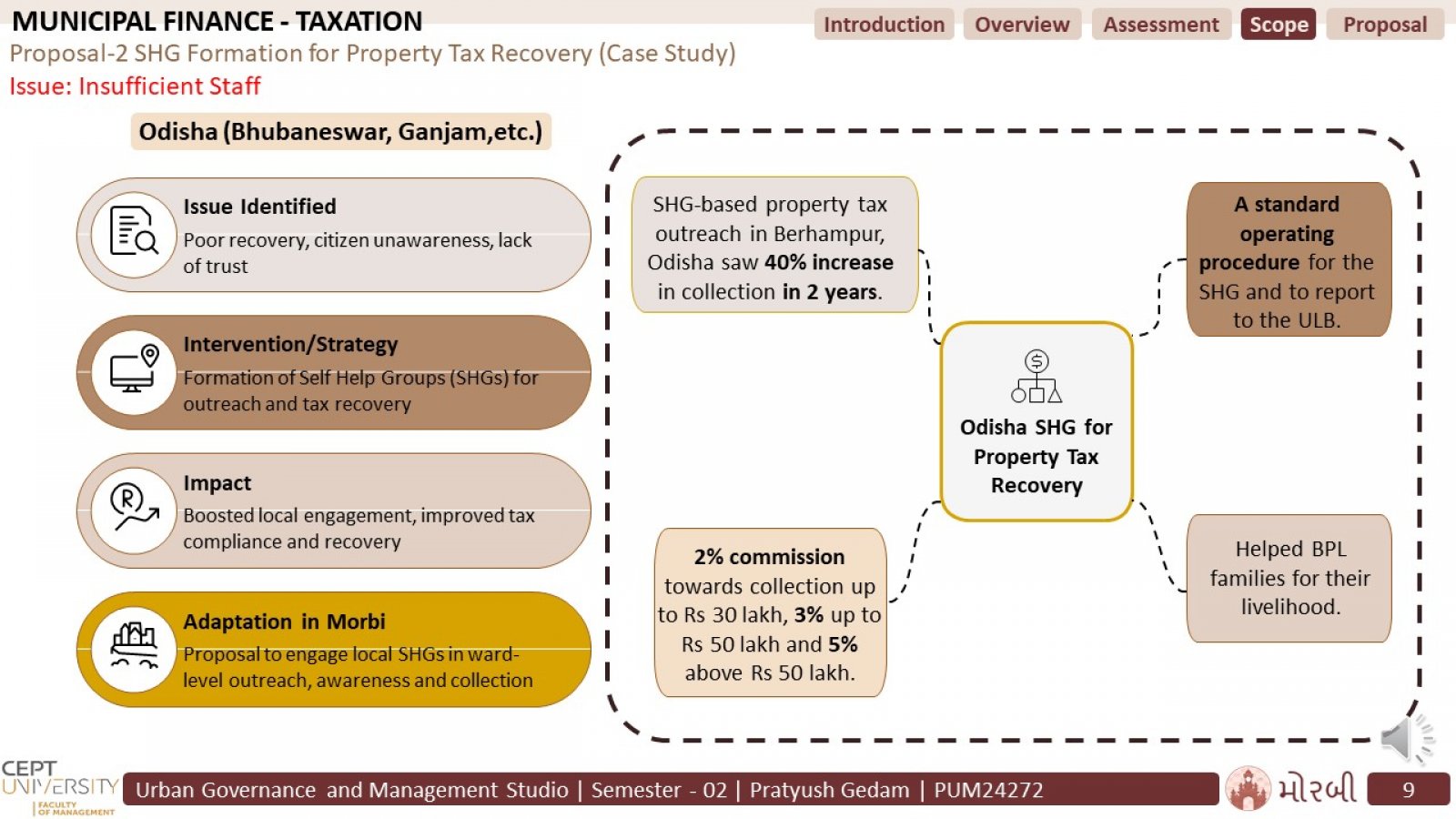

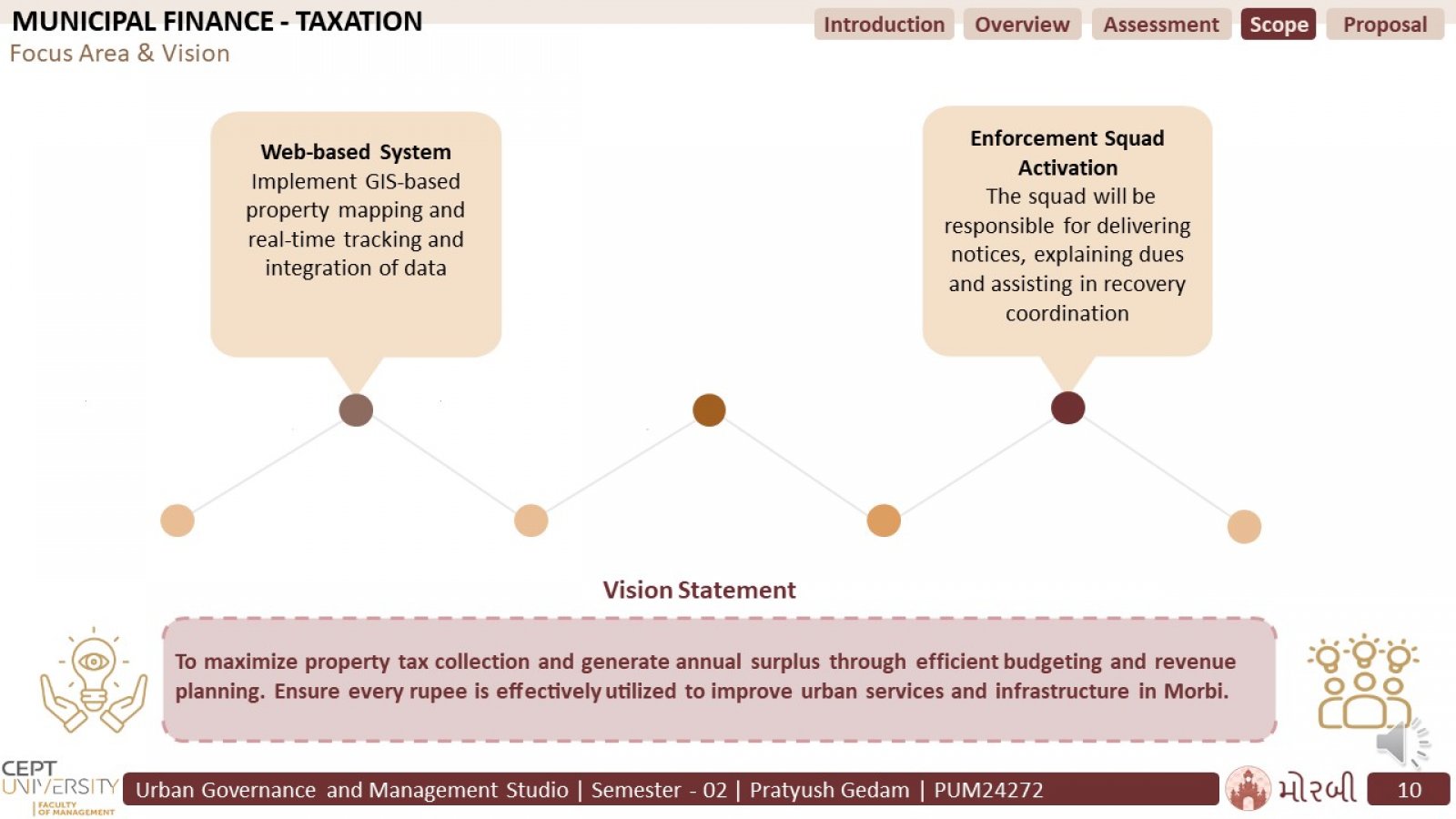

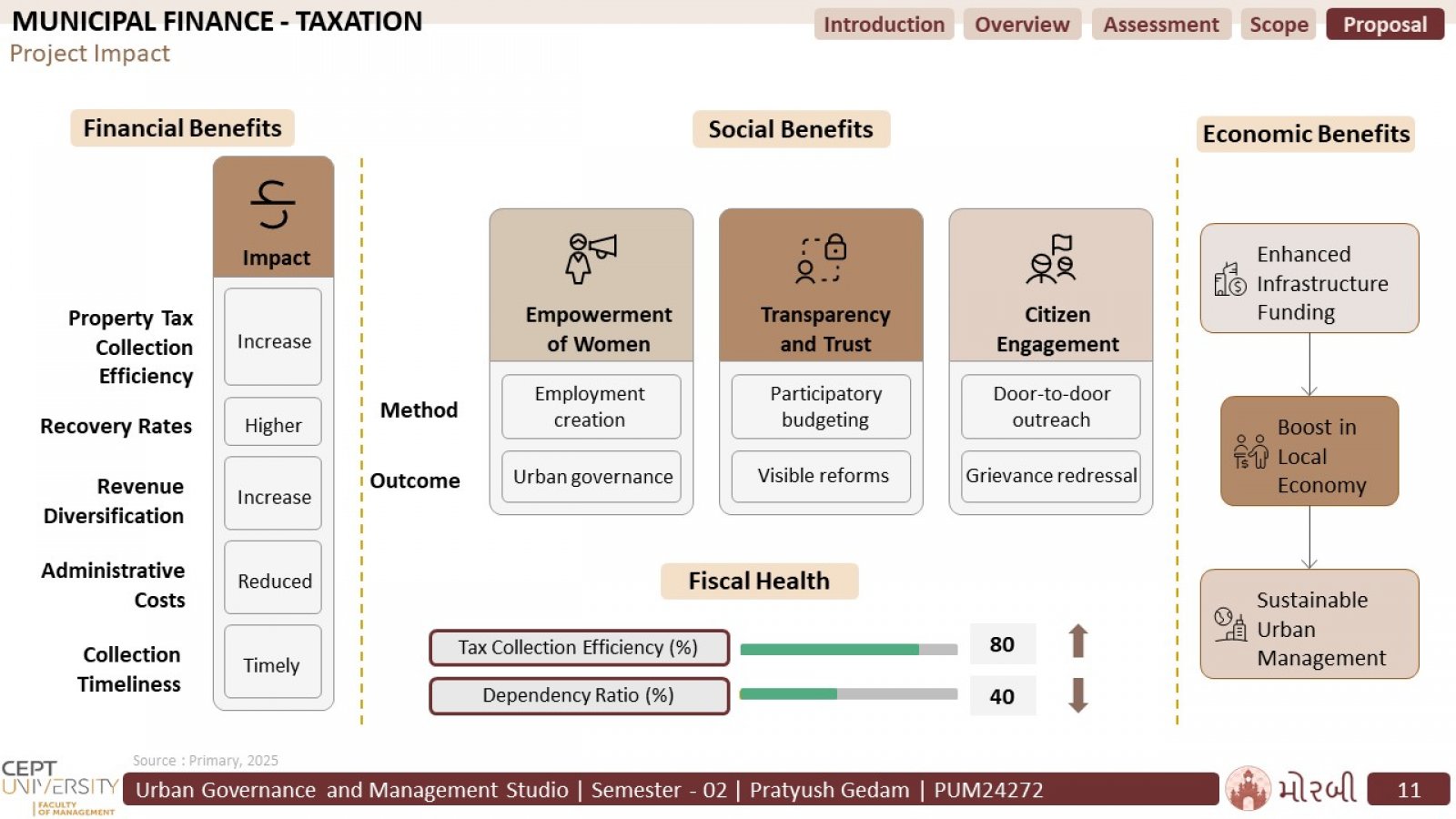

Morbi Municipal Corporation (MMC) faces critical challenges in its revenue generation capacity due to a limited property tax base, manual processes, and a growing burden of unauthorized developments. The existing system lacks spatial accuracy, real-time integration, and citizen transparency, resulting in inefficiencies and revenue leakage. This project aims to address these issues through a dual strategy: implementing a GIS-based web property tax system and introducing an Impact Fee mechanism. The GIS platform will enable spatial mapping of properties, accurate tax assessments, land use and ownership data integration, and public access for improved transparency. The Impact Fee, operationalized under the GRUDA Act 2023 and based on international best practices, will help MMC recover infrastructure costs from new and unauthorized developments. An integrated approach to enhance revenue generation, promote regularization, and build financial resilience for sustainable urban development.