Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

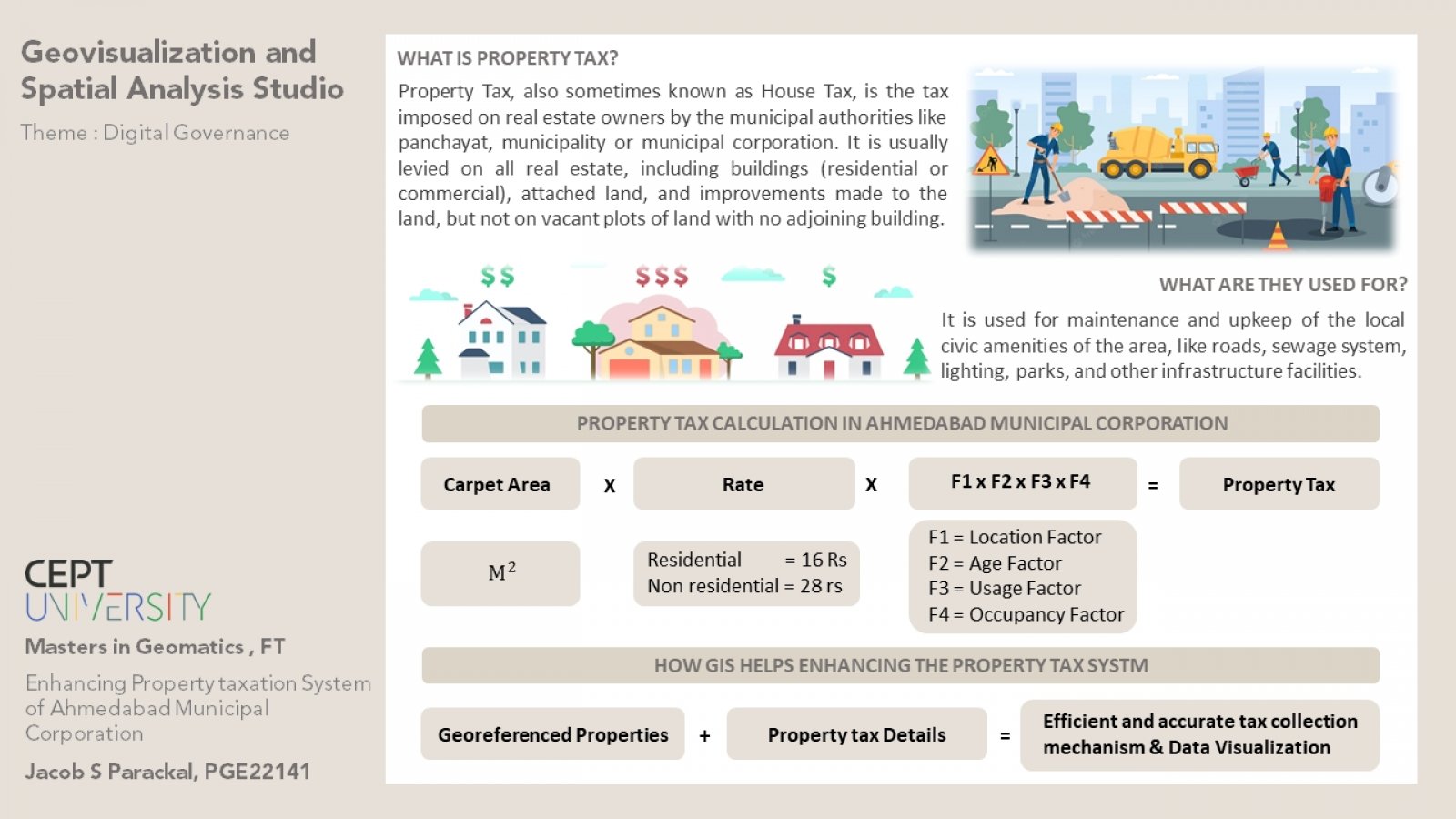

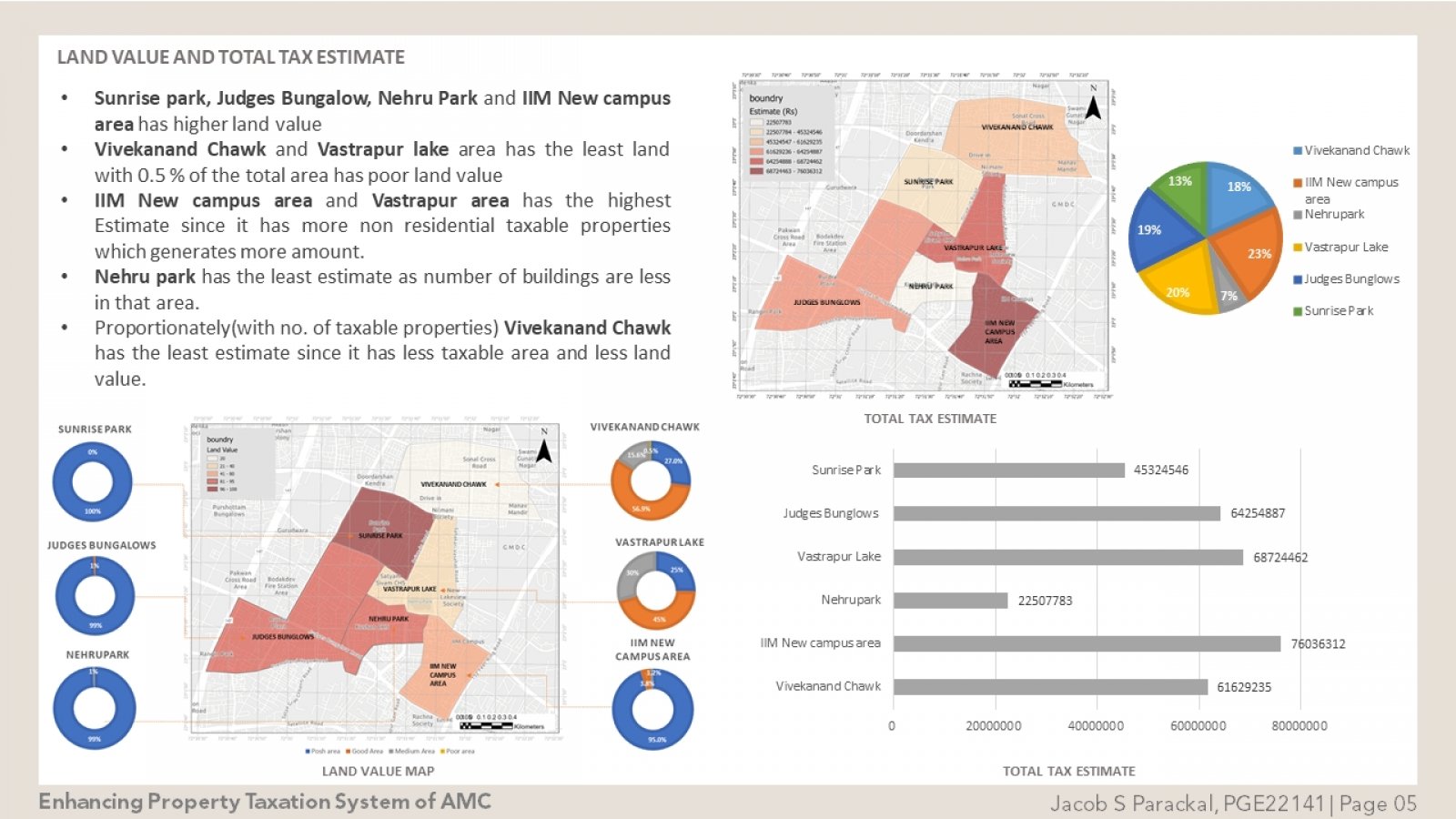

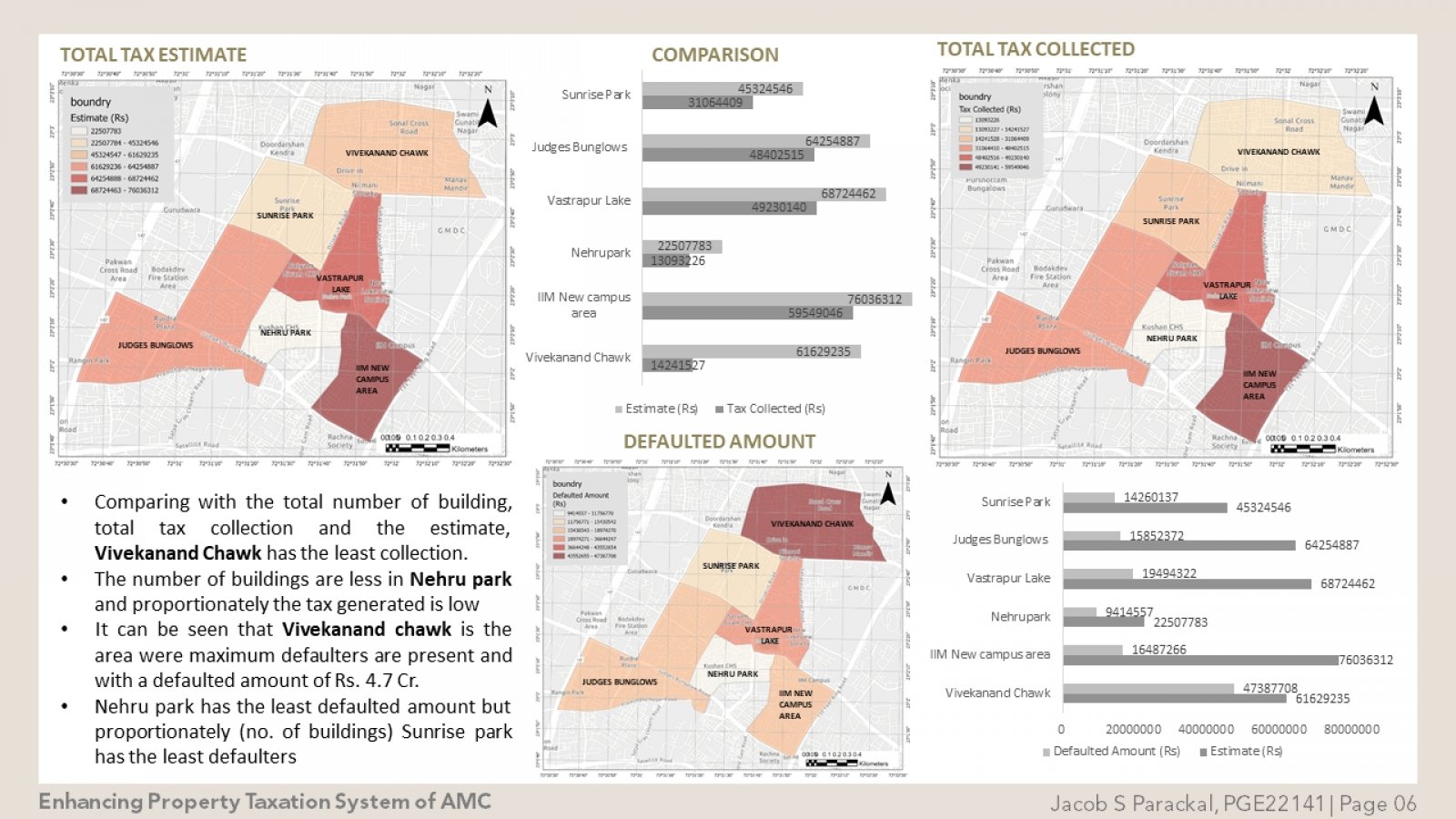

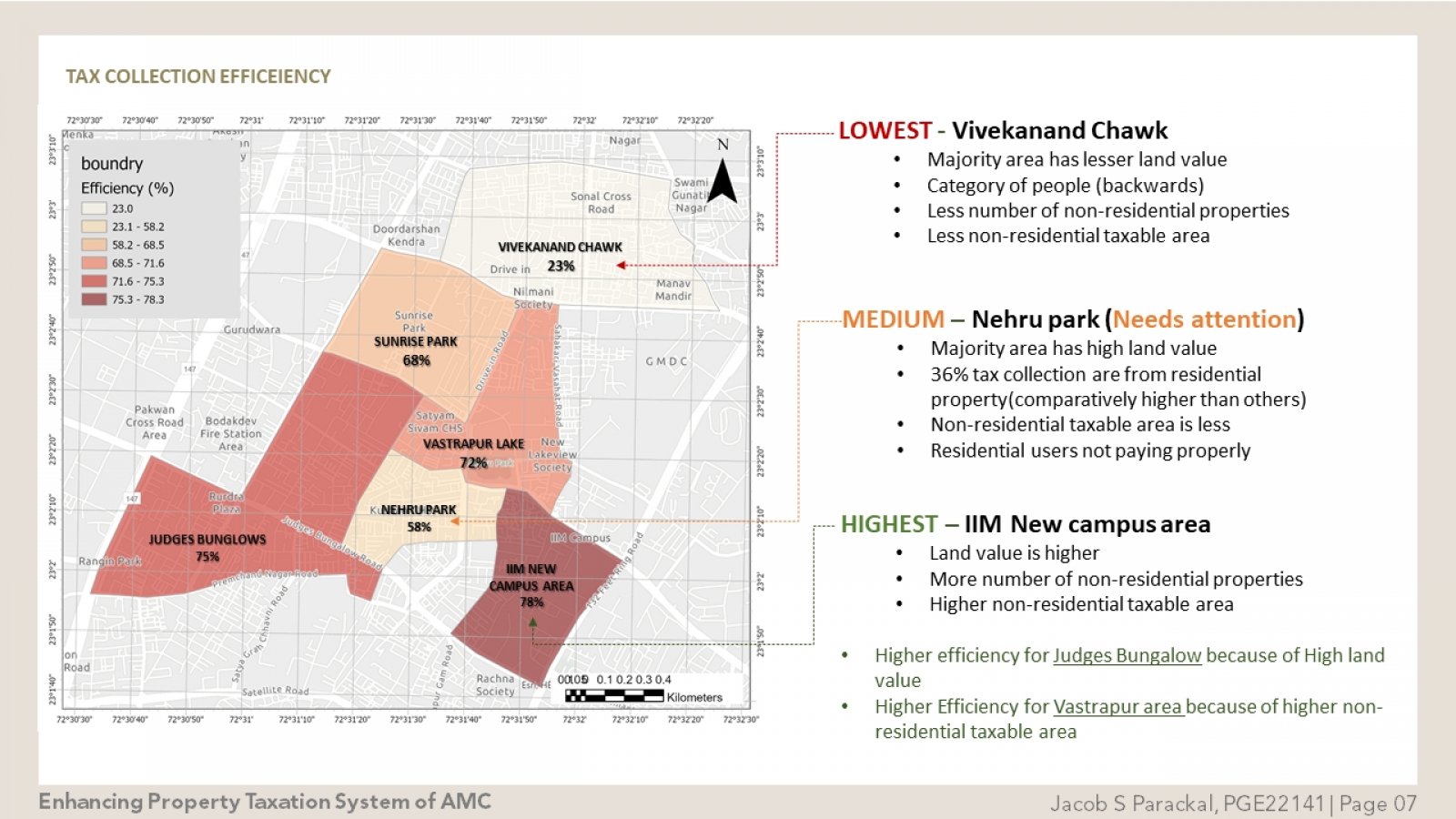

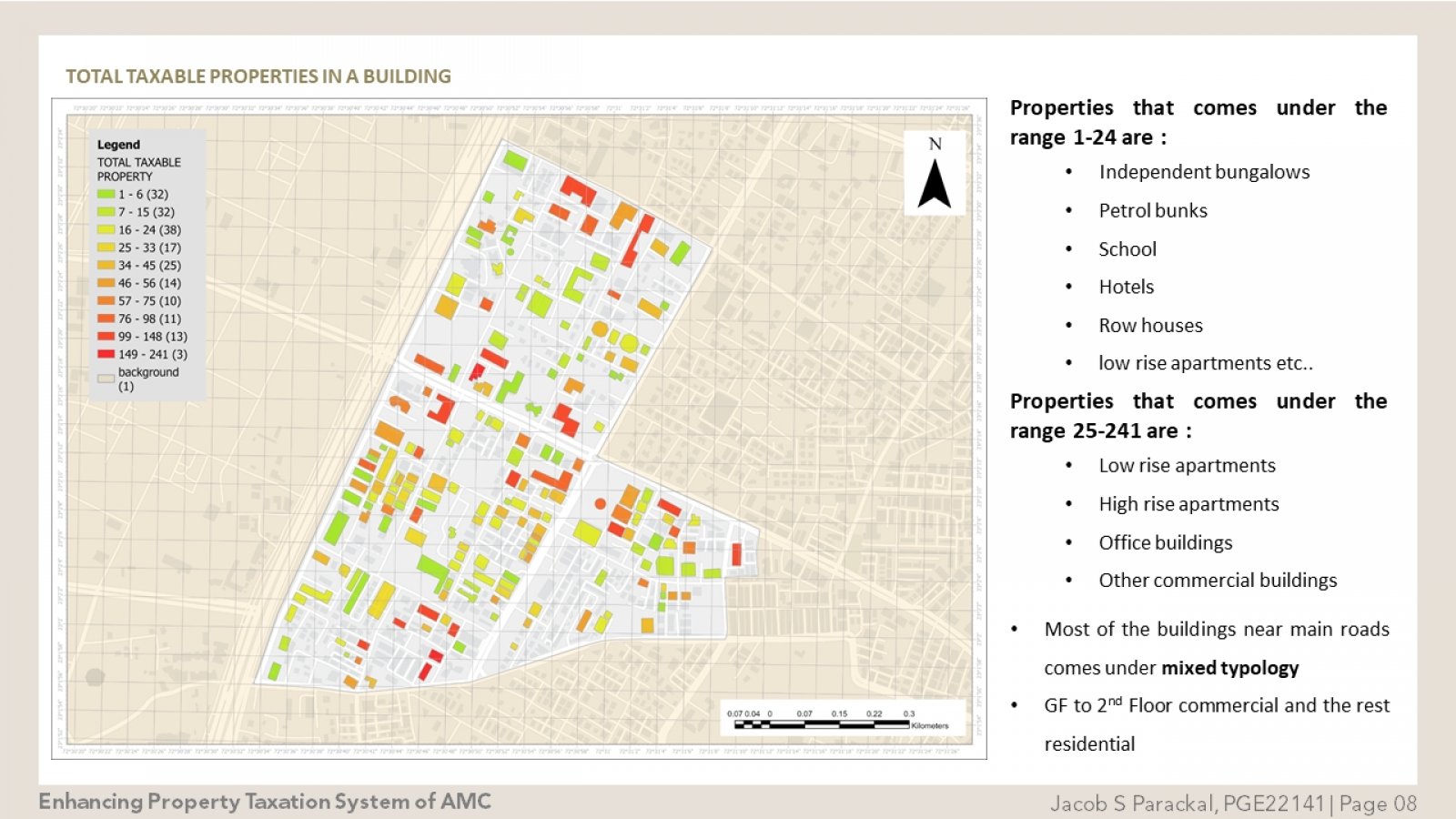

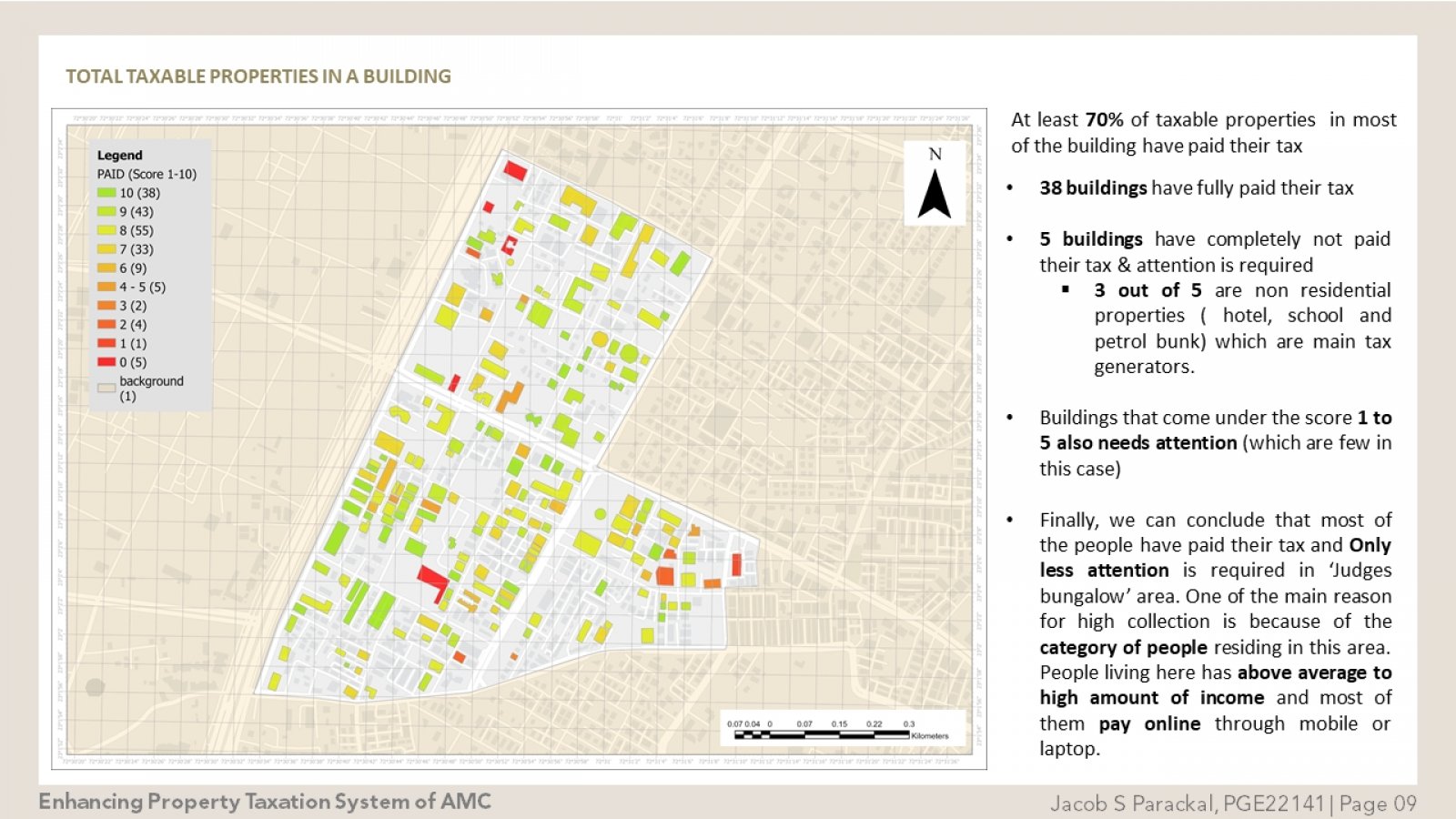

GIS could help monitor the property tax revenue by preparing a common platform that visually links all property related data such as the number of floors in each building, the total constructed area of each building individual plot areas details of locality road facing details with the applied tax calculation principles.Visual Representation of the whole property tax system helps in efficient and accurate tax collection mechanism reduces the frequency of field visits for complaint redress and other assessment purpose.More than 70% of tax can be increased from the existing value if GIS based applications are used.