Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

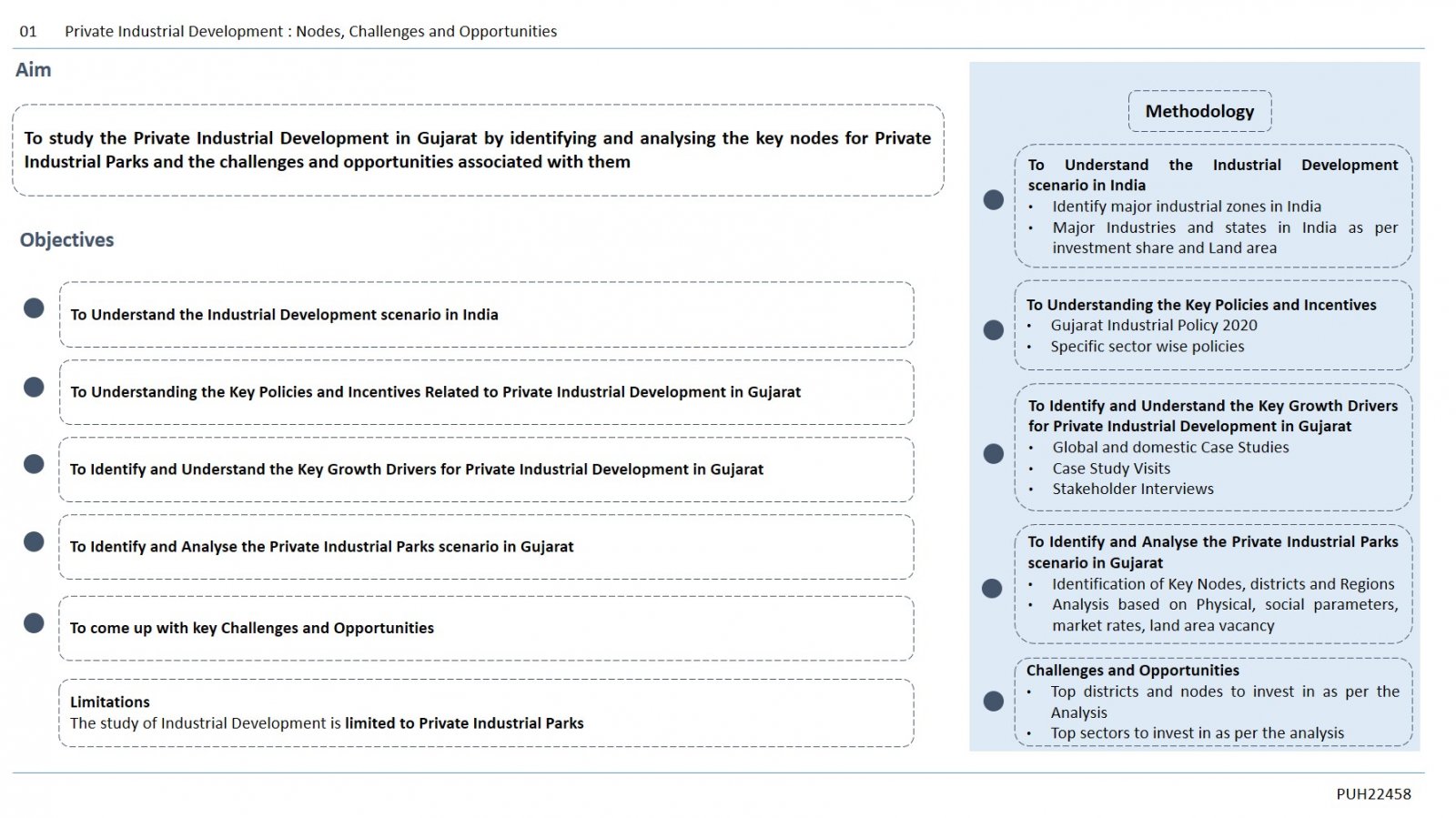

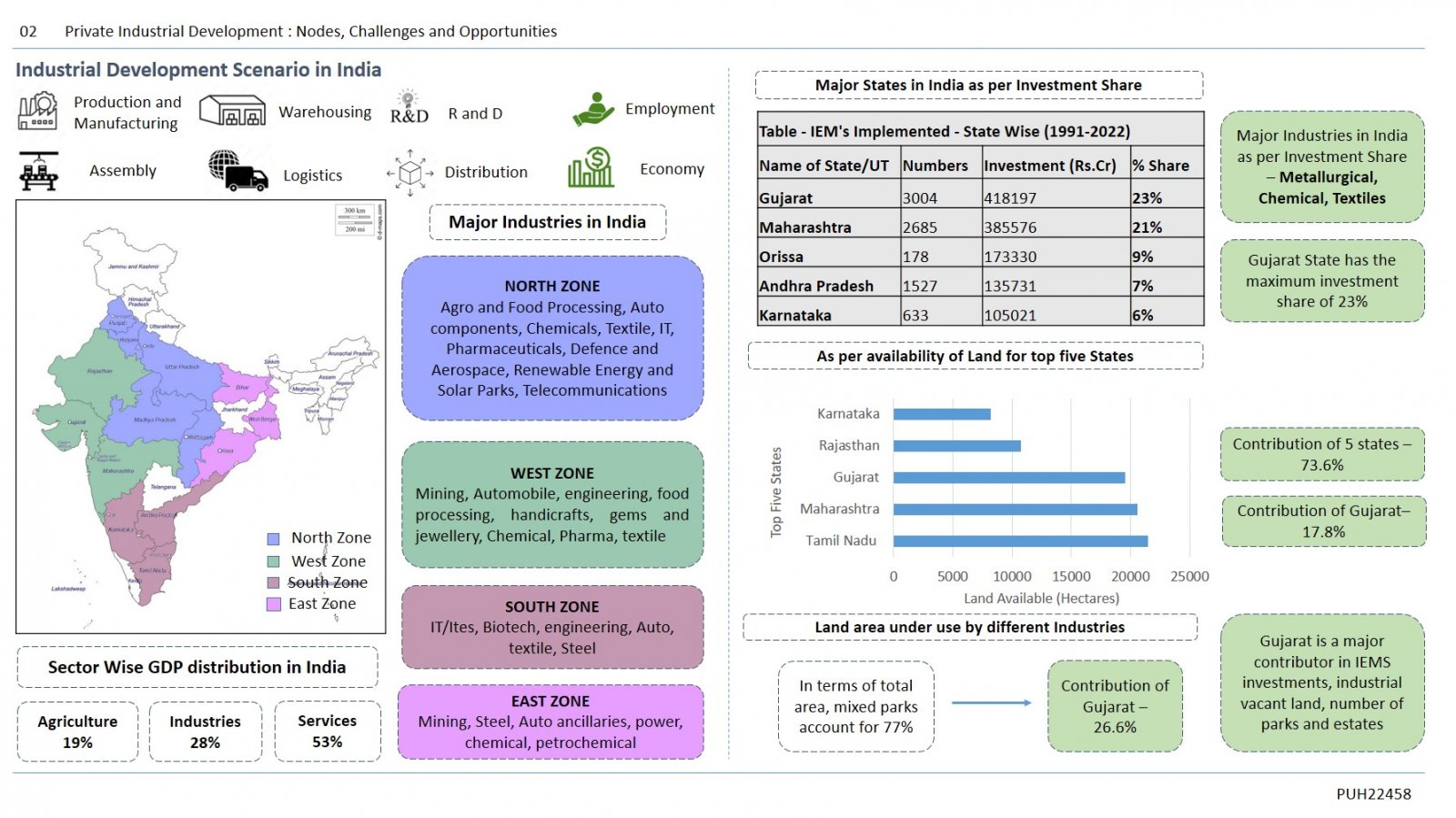

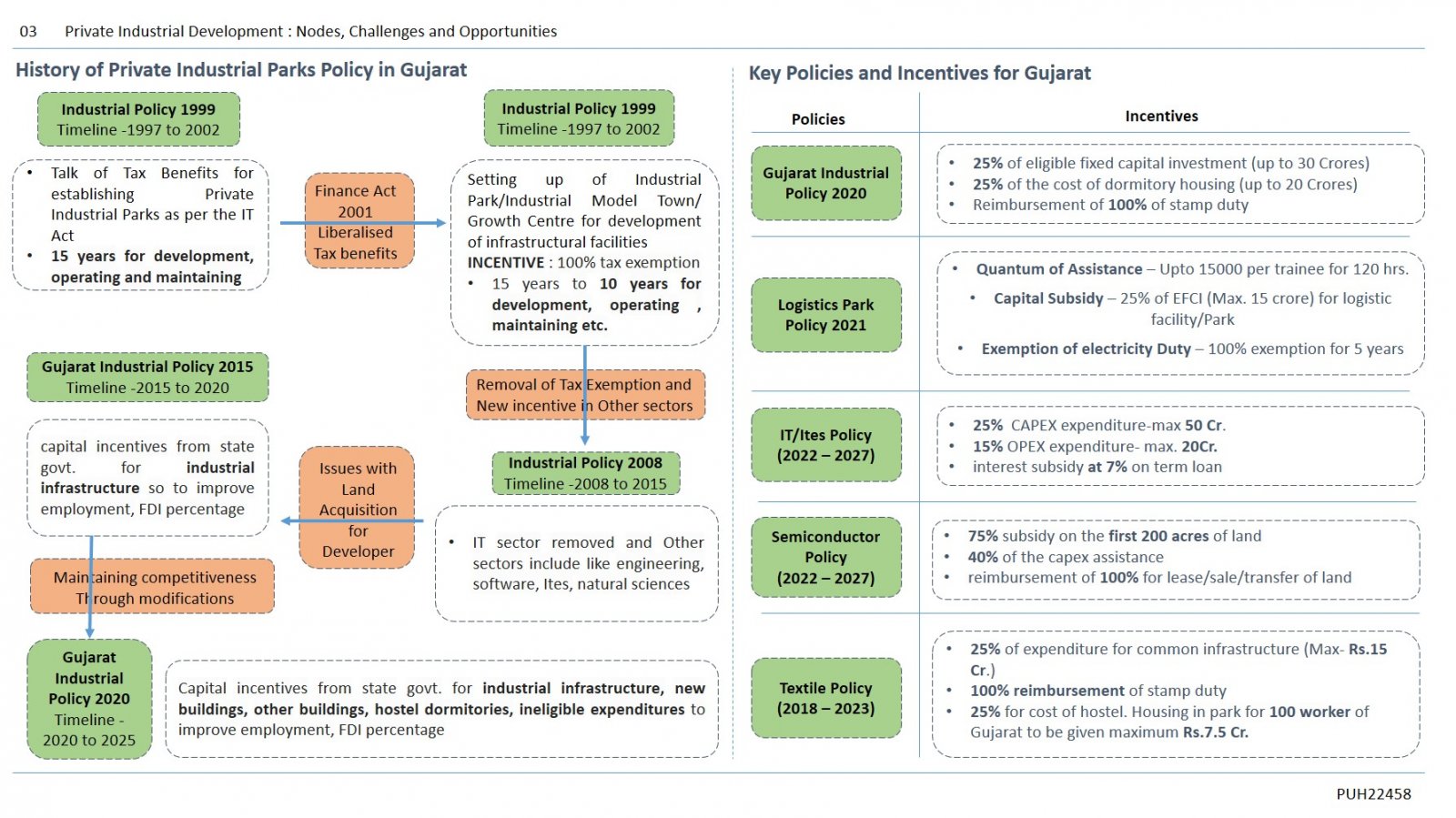

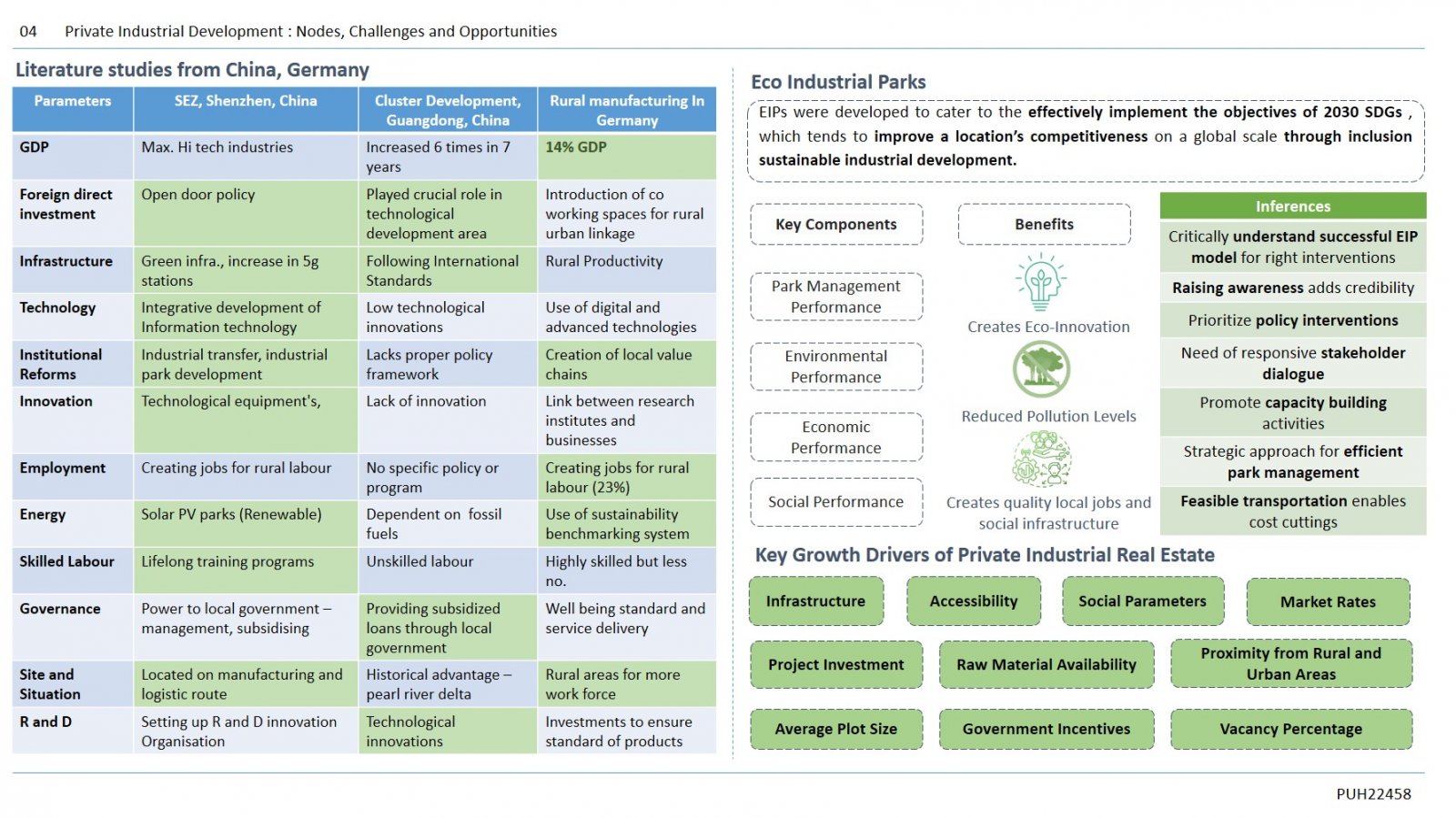

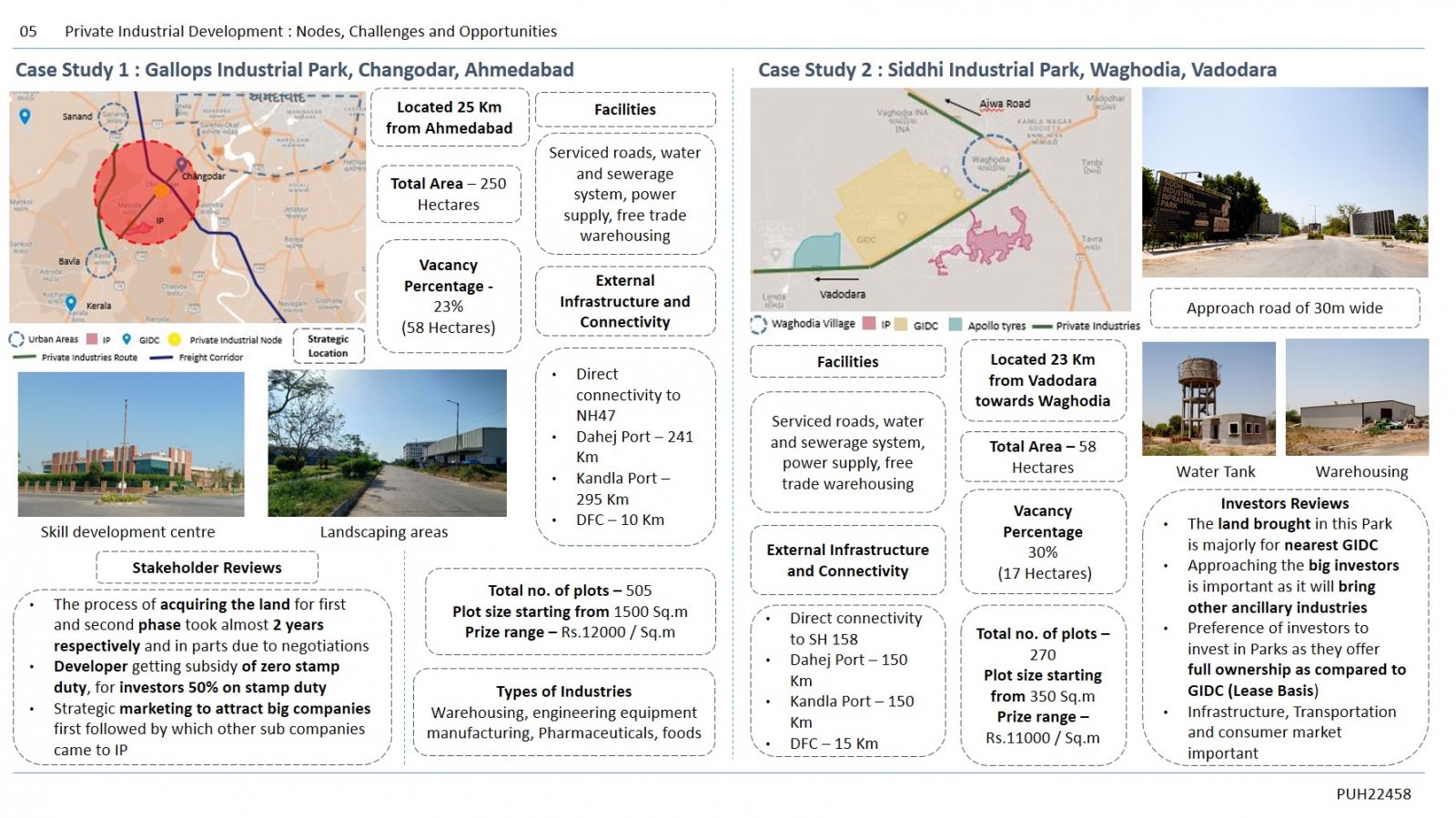

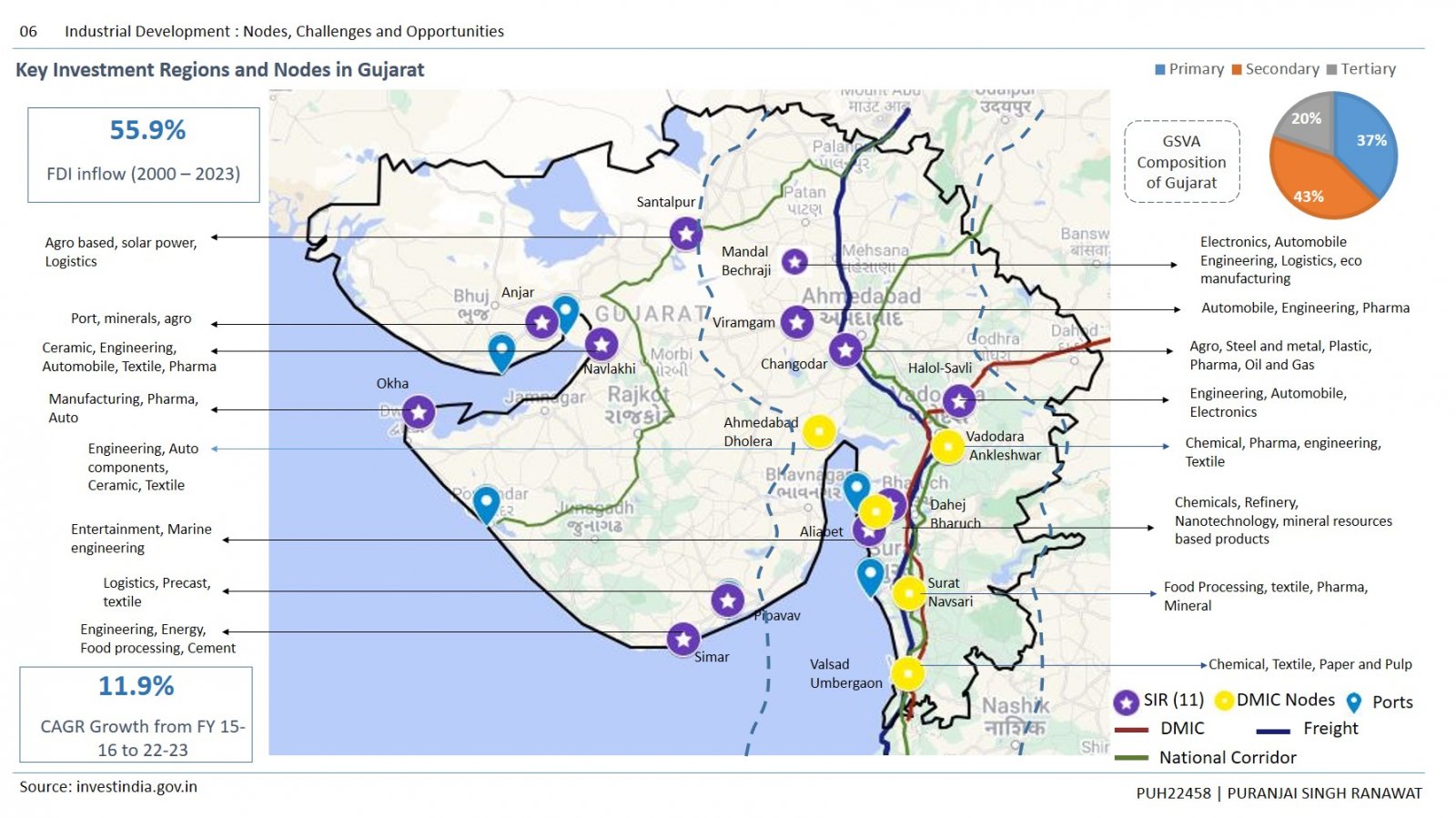

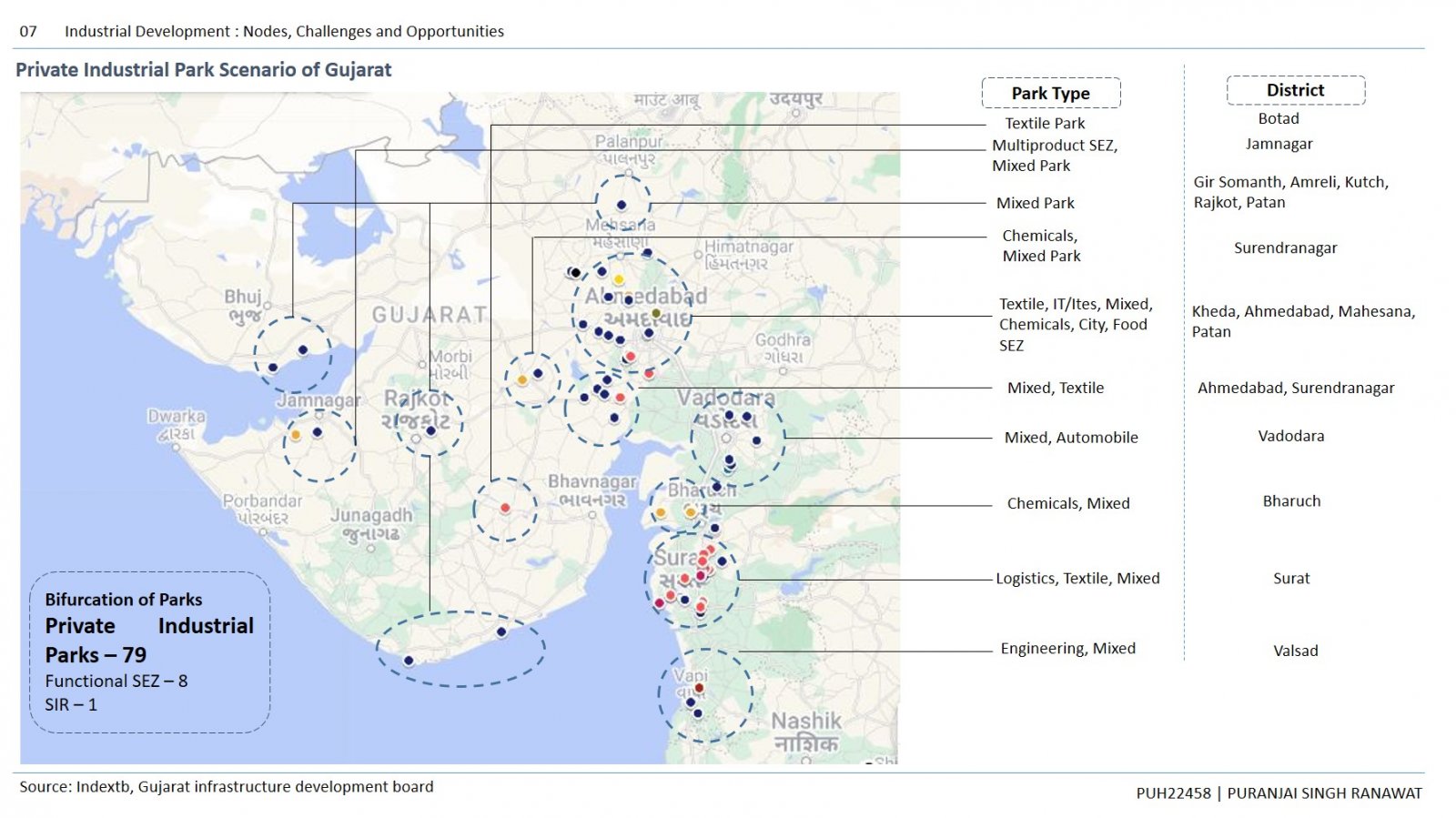

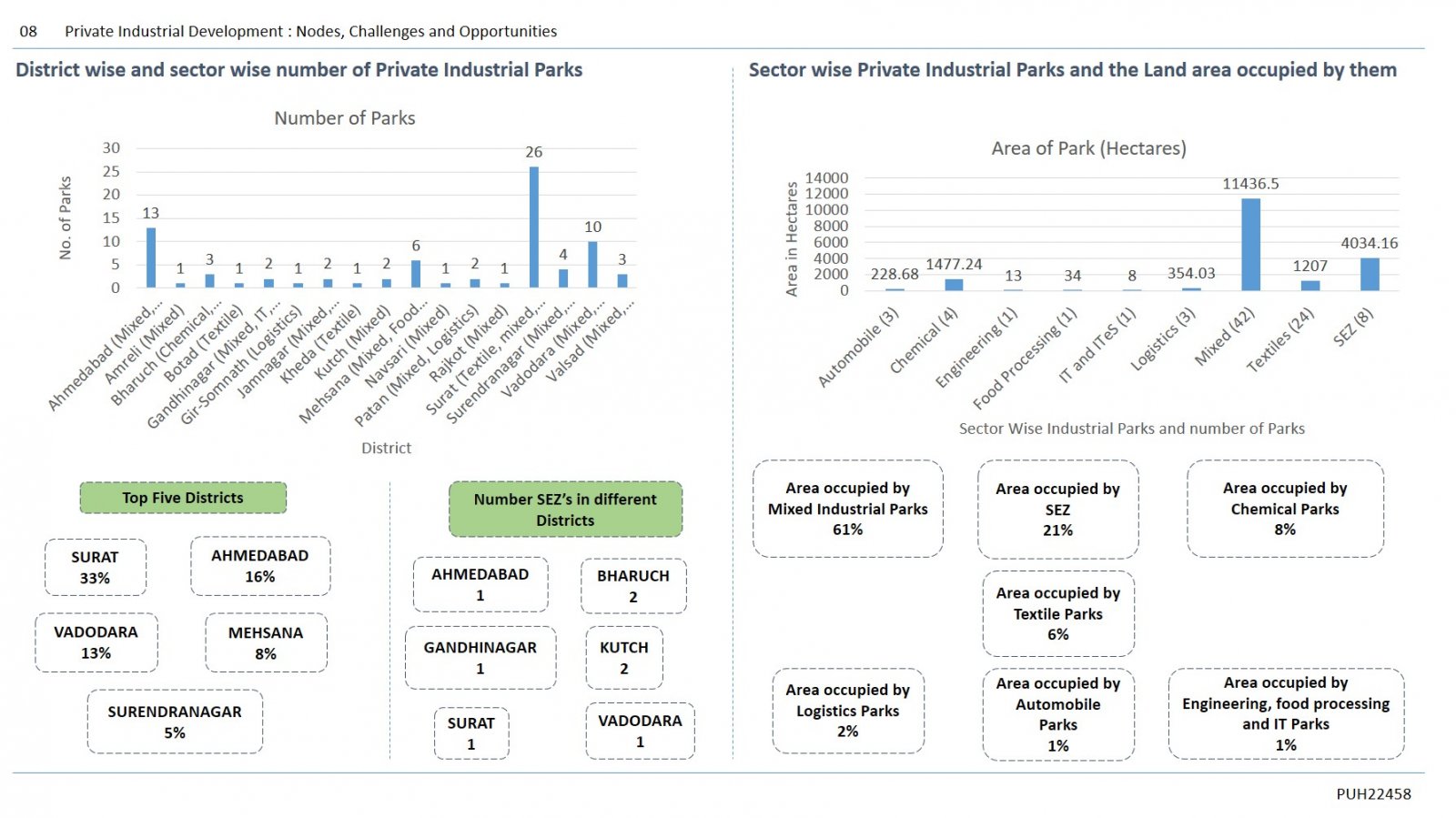

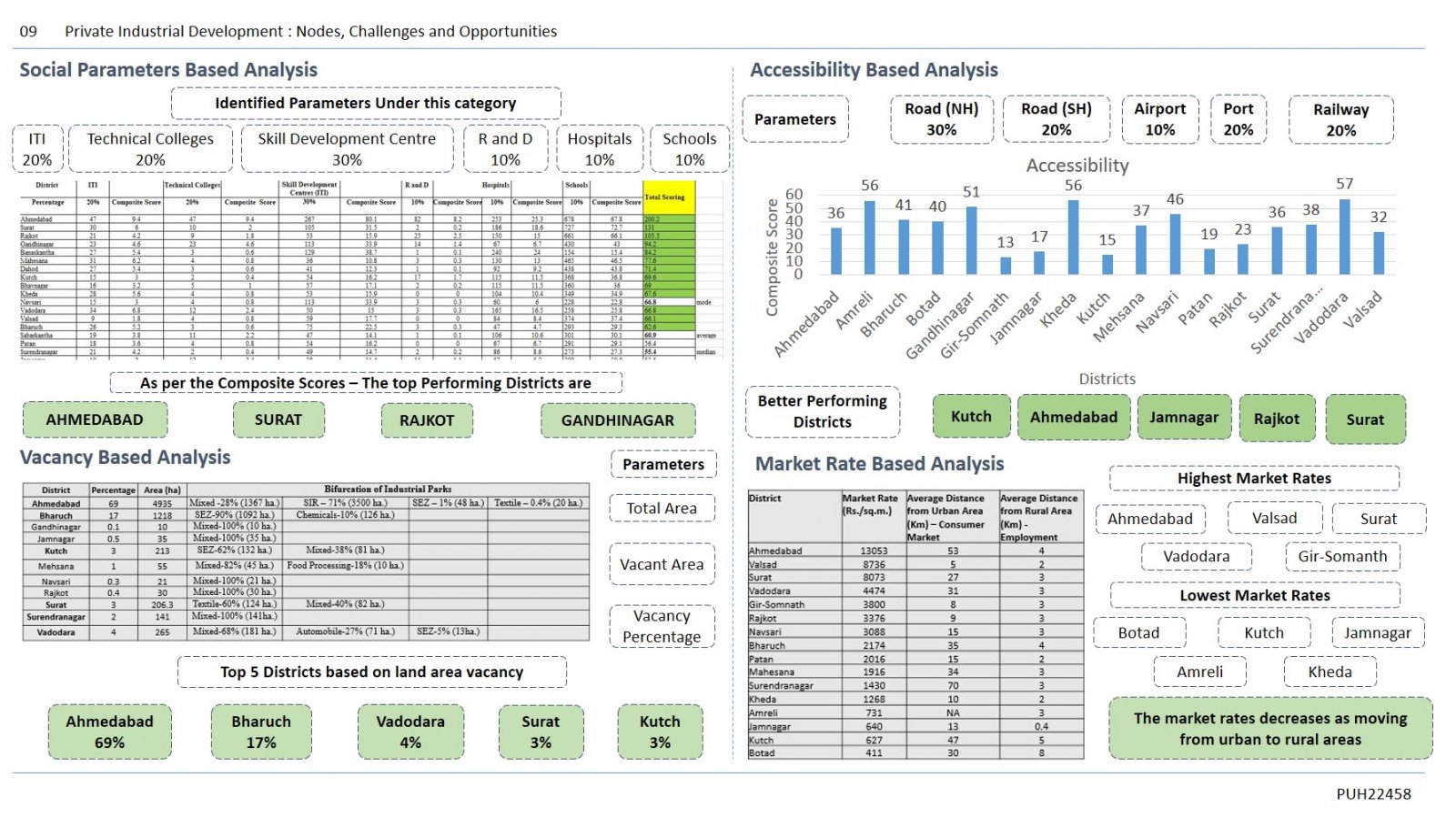

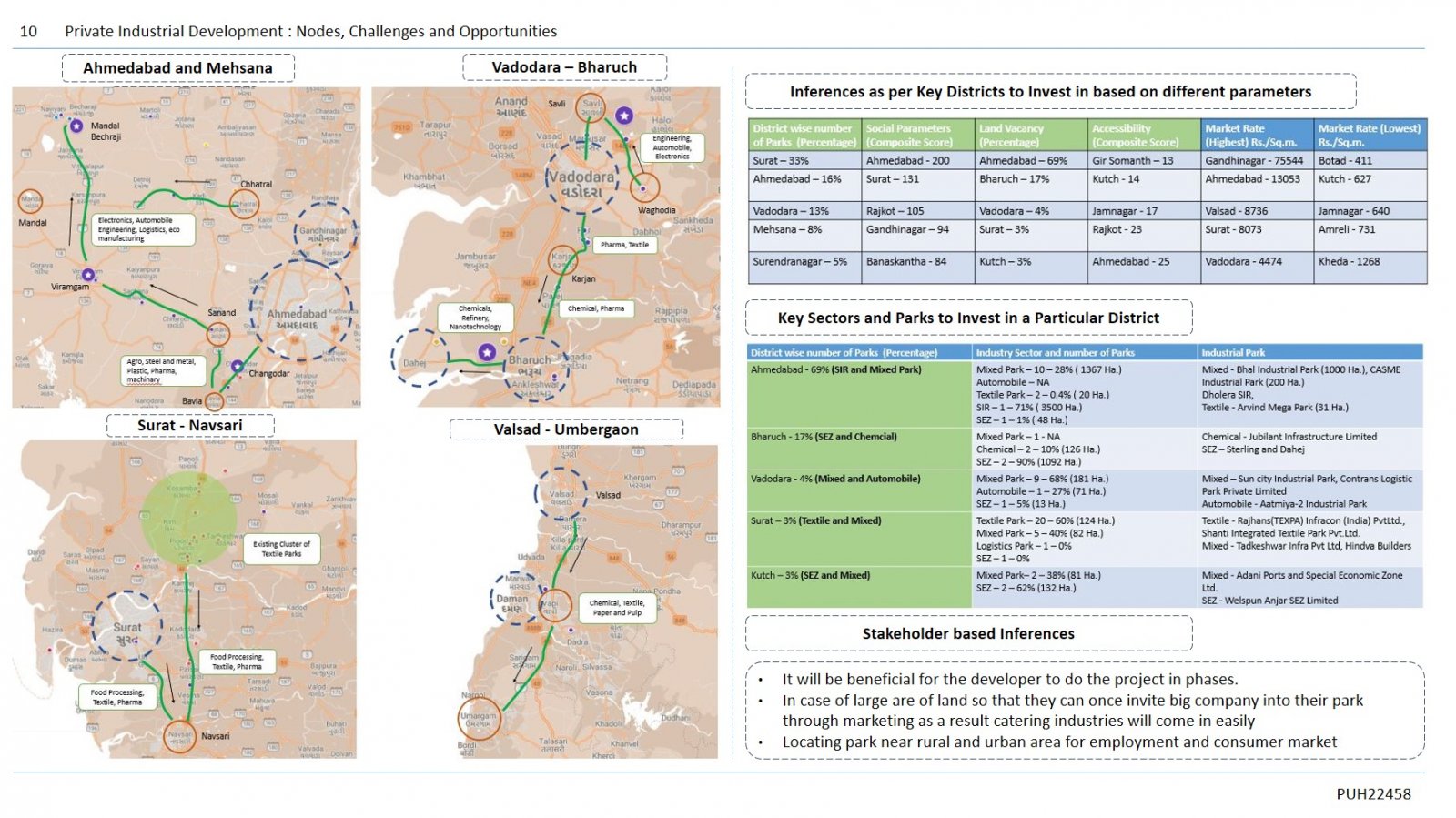

India is currently the fifth largest economy as per the International Monetary Fund with an average GDP growth rate of 5.6% from the year 2011-2022. In the industrial sector, the average manufacturing output contributes 14.8% to the GDP in the year 2022-2023. To increase the investment and employment generation in the industrial sectors, the Government of India came up with various initiatives like SEZ (Special Economic Zones), SIR (Special Investment Regions), Industrial corridors, and Private Industrial Parks. The large incentivized Private Industrial Parks boost the economy of the region they are situated in. They further lead to the development of various clusters of supporting industries. Therefore, it is important to identify Private Industrial Parks and the nodes to further analyze them and understand the demand for these parks along with the challenges and opportunities associated with them which will give the investors various options in terms of districts, sectors to invest in the Gujarat state for Private Industrial Parks. The methodology for this research starts with the understanding of the Industrial Development scenario in India through the identification of major Industrial Zones in India and Major Industries and States in India as per investment share and Land area. Understanding key policies and incentives related to the Private Industrial Parks in Gujarat through the Gujarat Industrial Policy of 2020 and sector-specific Industrial policies. Identifying and understanding the key growth drivers for Private Industrial Development in Gujarat through a literature review of global, and domestic case studies and stakeholder interviews. Identifying and analyzing the Private Industrial Parks scenario of Gujarat through mapping of key nodes, districts, and regions, followed by analysis based on Physical, and social parameters, market rates, land area vacancy, etc. Finally come up with key challenges and opportunities in terms of top-ranking districts, nodes, and sectors of industries to invest in. Gujarat is at the forefront of state-wise investment share, land area under use by various sectors of industries, mixed parks has maximum percentage of 62%, in this Gujarat states contribution is 26%. Gujarat’s contribution to vacant land area amongst the top five states is 17%. Therefore, Gujarat is a prime state to invest in terms of Industrial Real estate. The investment opportunities for investors from both domestic and FDI for setting up Private Industrial Real Estate in Gujarat have been a major focus of the Govt. of Gujarat to accelerate its economy. The Key Gujarat Government’s policies and incentives related to the Private Industrial Parks come from the “Gujarat Industrial Policy of 2020” whose aim is to incentivize the cost of building, infrastructure, and other facilities for the development of parks. The other policies allied to various sectors are the Gujarat Integrated Logistics Park Policy of 2021 for infrastructure facilities and other services related to logistics, IT/ITes policy for IT infrastructure, Textile Policy for weaving, knitting, Dying, technical textile, all other textiles related value chains, Semi-conductor Policy for setting up of Semiconductor Fabs, display Fabs, Compound Semiconductors / Silicon Photonics / Sensors Fab and Semiconductor Assembly, Testing, Marking and Packaging and Electronic Policy for building robust electronic manufacturing ecosystem. The majority of incentives from these policies are directed towards the physical and social infrastructure along with 100% exemptions in stamp duty and registration fees at the initial proposal of Private Industries/Industrial Parks. The identified Key growth drivers are Infrastructure, Accessibility, Social Parameters, Land rates, Project Investment, Raw material availability, Proximity to Rural and Urban areas, Average Plot size, Government Incentives, and Vacancy percentage. These “Key Growth Drivers” are derived from the secondary study of literature case studies of China, Germany, and India, Eco-Industrial Parks, and primary studies of Gallops Industrial Park near Ahmedabad and Siddhi Industrial Park near Vadodara along with stakeholder interviews from investors, developers, government officials, etc. Further to map and analyze the Private Industrial Parks, it is important to understand the overview of Gujarat state. The GSVA composition in the state is 43% of the secondary sector, 37% of the primary sector, and 20% of the tertiary sector. The primary advantages of investment in Gujarat include factors like high economic growth and industrial development, adequate power generation capacity, a rich labor pool, facilitating infrastructure, etc. The research further analyses Private Industrial Parks in Gujarat, industrial corridors, SIR (Special Investment Region) SEZ (Special Economic Zones), etc. It will help to understand the impact of other types of industrial developments in the state on these Private Parks. The other industrial development proposals include 11 SIR (Santalpur, Mandal-Bechraji, Viramgam, Changodar, Halol-Savli, Dahej-Bharuch, Aliabet, Simar, Pipavav, Okha, Navlakhi and Anjar), DMIC nodes (Ahmedabad-Dholera, Vadodara-Ankleshwar, Surat-Navsari, Valsad-Umbergaon), DMIC corridor (Delhi-Mumbai Industrial Corridor), Dedicated Freight Corridor etc. The major finding that could be drawn from the analysis is, Private Industrial Parks vary in number and sector type from district to district. There are a total identified 79 Private Industrial Parks in Gujarat. As per the number of Parks, the top five districts are Surat has a maximum number of industrial parks constituting 33% followed by Ahmedabad-16 %, Vadodara-13%, Mehsana-8%, and Surendranagar-5%. The top industries as per the number of parks are Mixed-42, Textile-24, Chemical-4, Automobile-3, etc. As per the area occupied by the parks, the maximum area is occupied by mixed-use parks constituting 61% followed by Chemical and Textile Park. Social Parameter-based analysis includes parameters like ITI, Technical colleges, skill development centers, R and D, schools, and hospitals. Analyzing these through a composite scoring method gives the top five states to invest in Ahmedabad, Surat, Rajkot, Gandhinagar, Mahesana, etc. As per vacancy-based analysis, the top five districts to invest in are Ahmedabad, Bharuch, Vadodara, Surat, and Kutch. The top sectors to invest in are Mixed, Chemical, Textile, and Automobile. Per the accessibility-based analysis, which includes parameters like the distance of the park from the National highway, state highway, port, airport, railway station, etc. The top five districts are Rajkot, Ahmedabad, Surat, Mahesana, Surendranagar, etc. As per the market rate-based analysis, the highest market rates are seen in districts of Ahmedabad, Surat, Vadodara, and Gir-Somnath. The lower market rates are in Botad, Kutch, Jamnagar, Amreli, and Kheda. As per the Primary and Secondary sources and stakeholder interviews the findings include, For the investor to invest in any industrial park the key factors to look at are Infrastructure, Accessibility, social parameters, market rates, project investment, raw material availability, proximity from rural and urban areas, average plot size, government incentives, vacancy percentage. The acquiring of land and NA conversion might take time due to negotiations from the original land owners and this may hamper the project cycle.