Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

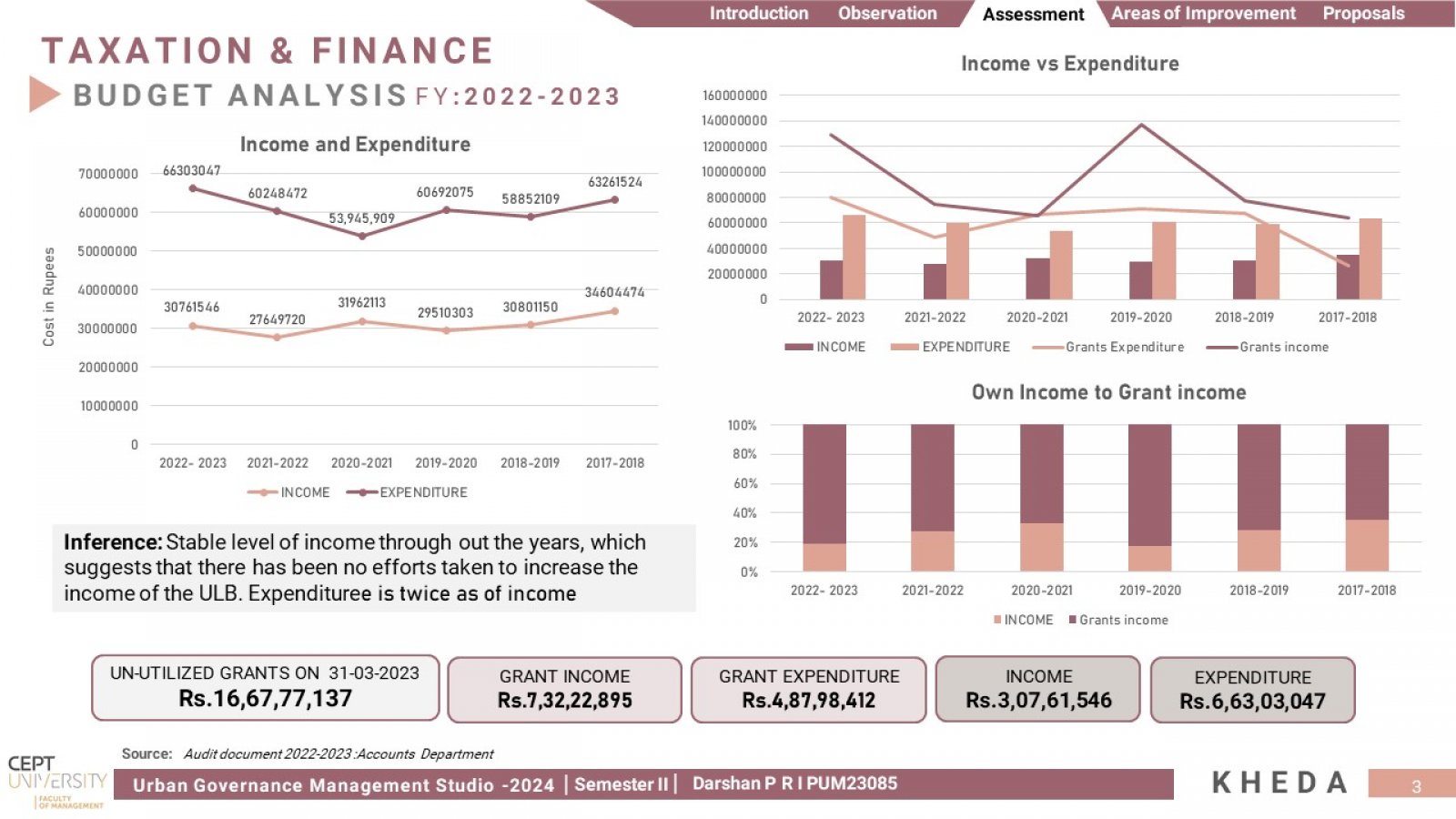

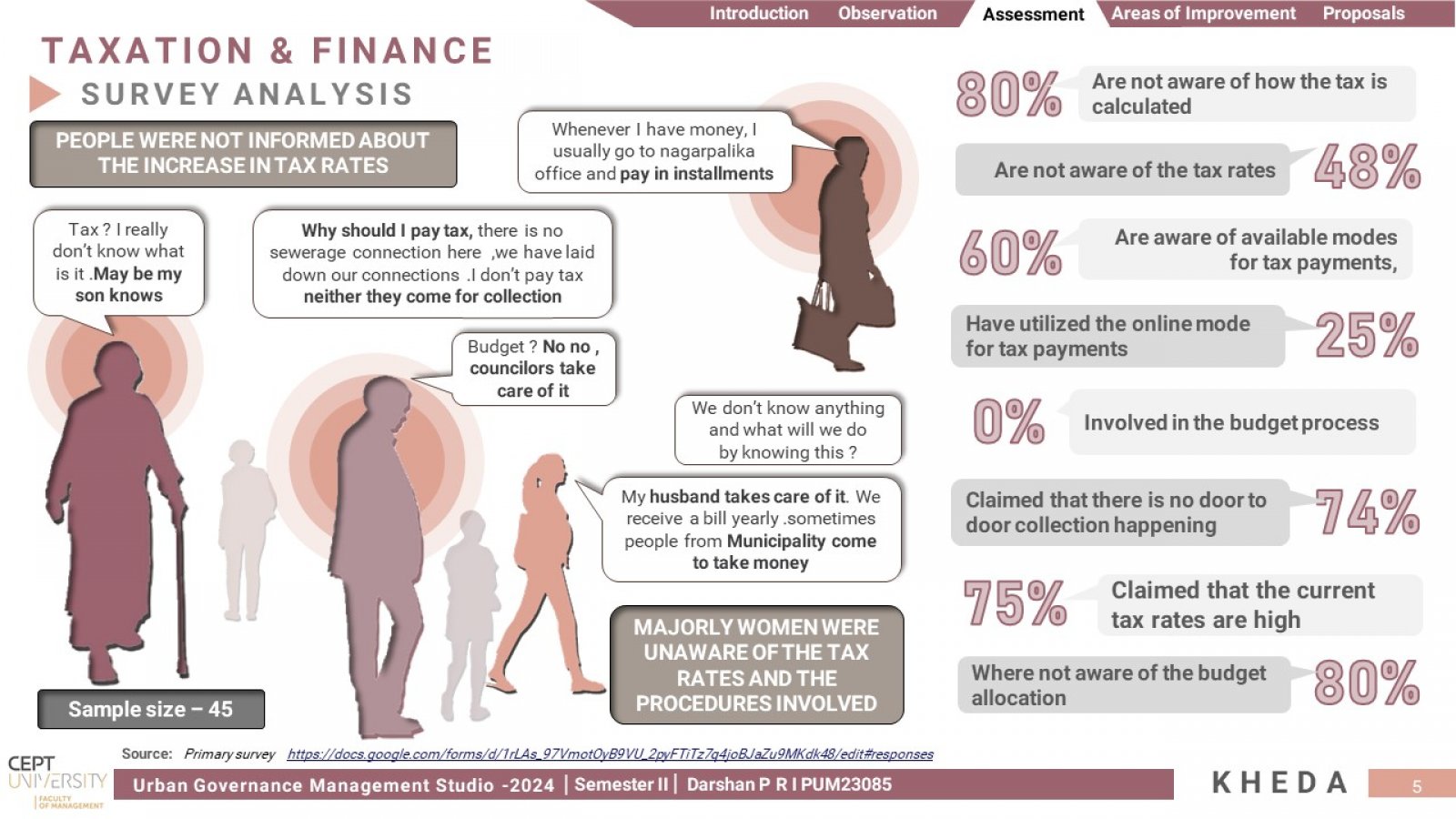

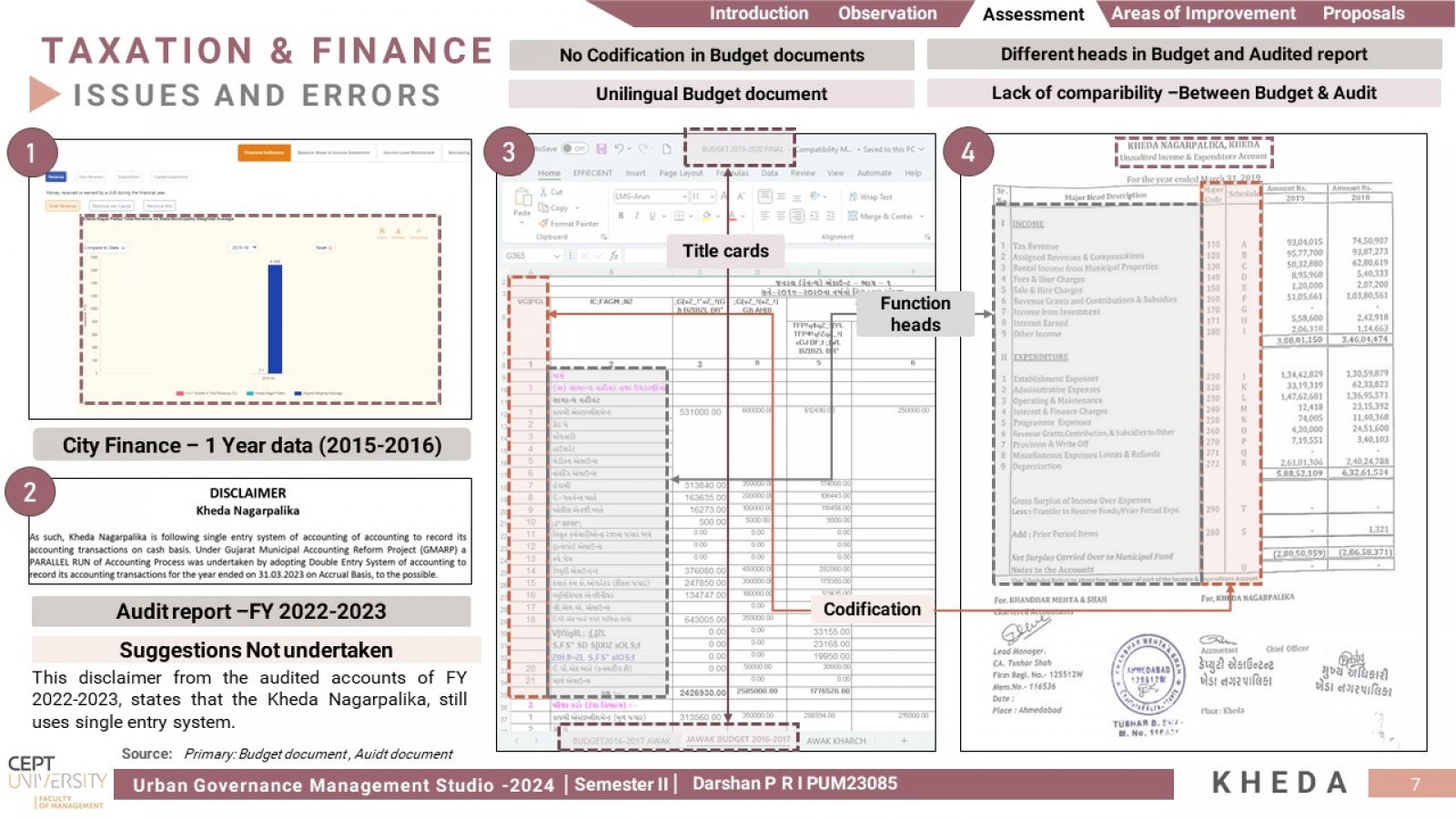

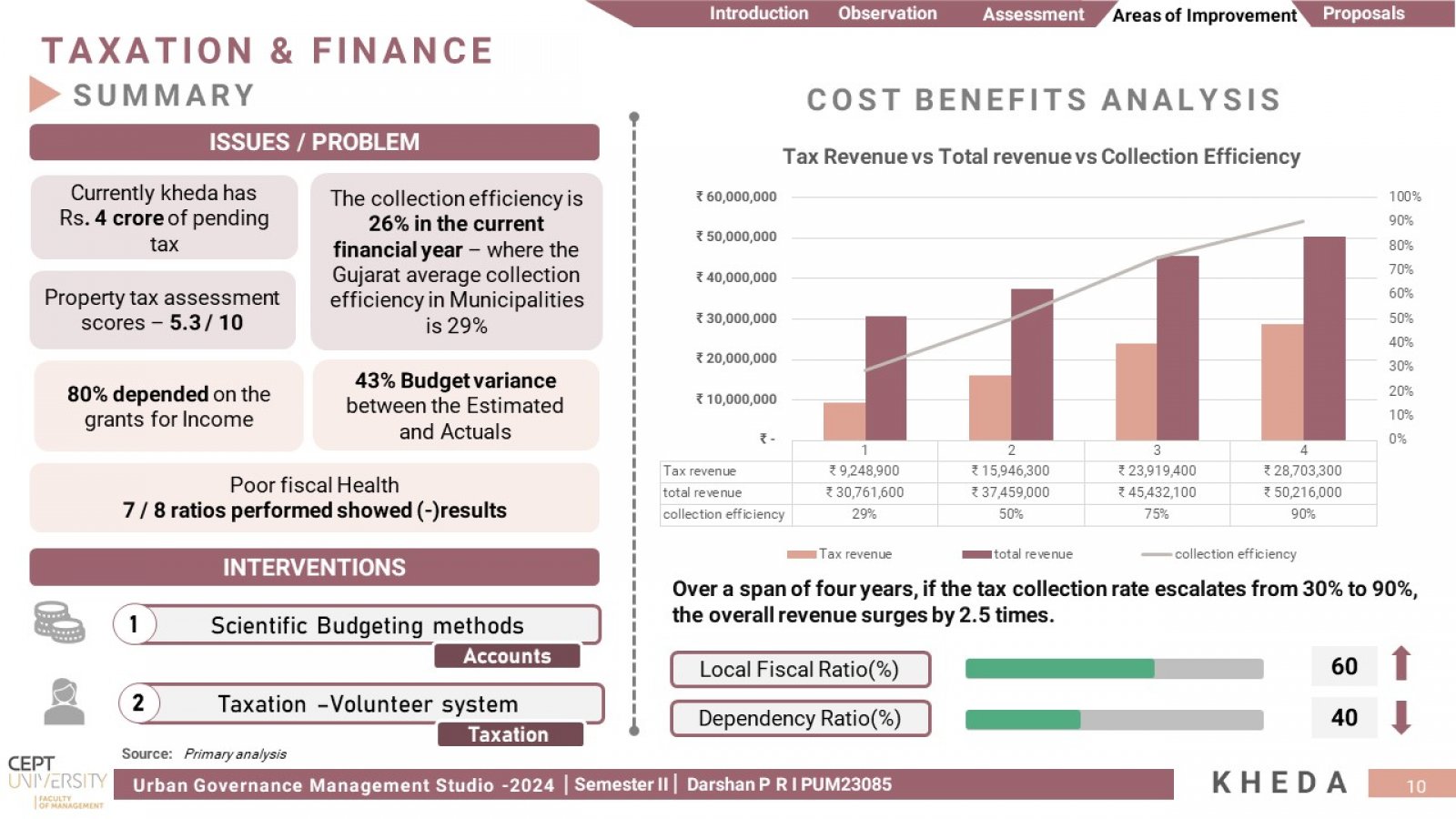

Finance stands as a pivotal pillar in the execution of any project within an Urban Local Body (ULB). My journey commenced with a thorough analysis of the current landscape, delving into the financial intricacies of a ULB. Three key documents, namely Budget documents, audited reports, and property tax records, served as my compass, revealing insightful revelations. To improve Kheda's financial health, we need a systematic overhaul in budgeting methods, ensuring optimal resource allocation and expenditure management. Additionally, mobilizing community volunteers can enhance tax collection efficiency, fostering citizen engagement and boosting revenue, while instilling a sense of civic responsibility.