Your browser is out-of-date!

For a richer surfing experience on our website, please update your browser. Update my browser now!

For a richer surfing experience on our website, please update your browser. Update my browser now!

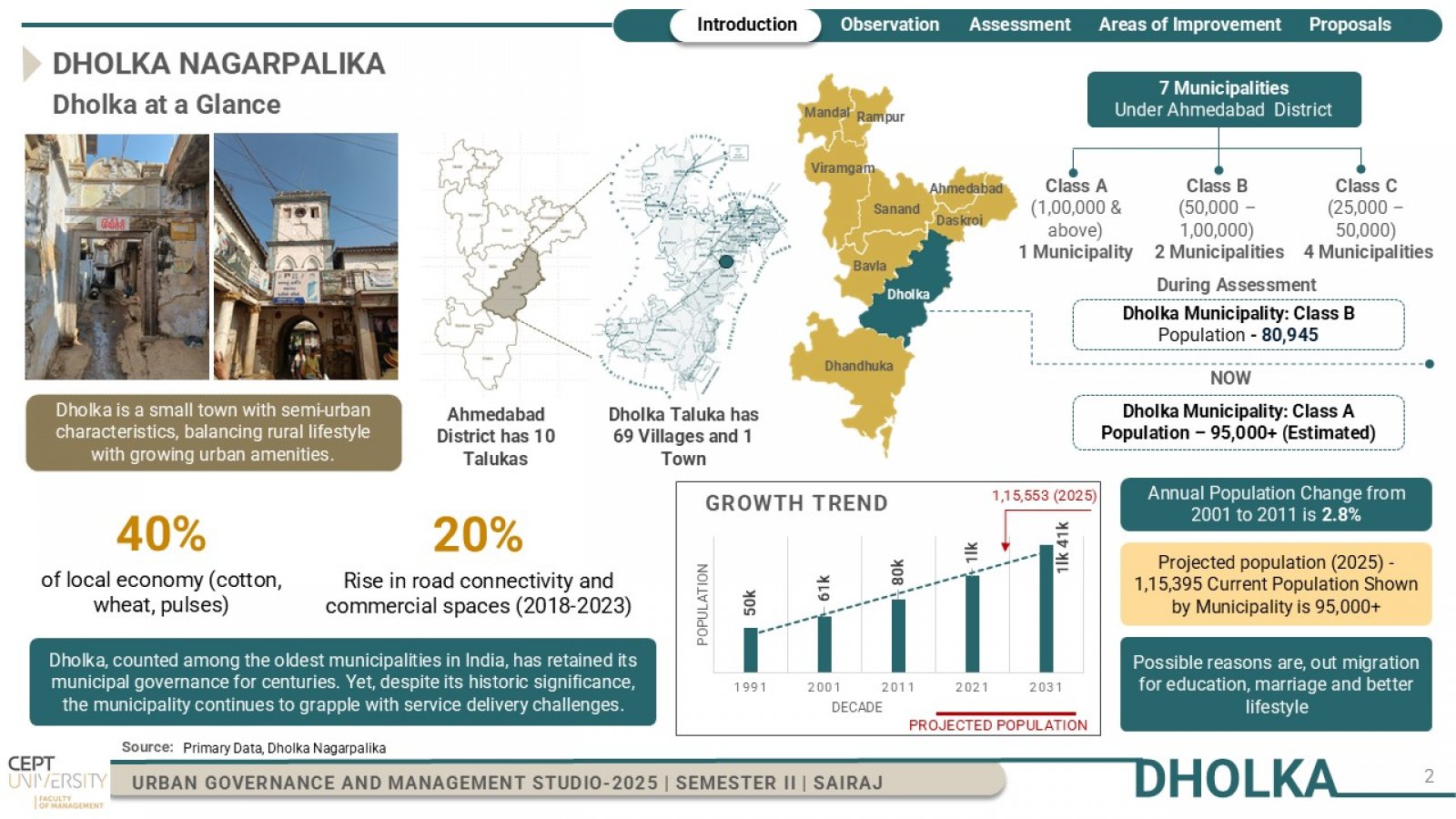

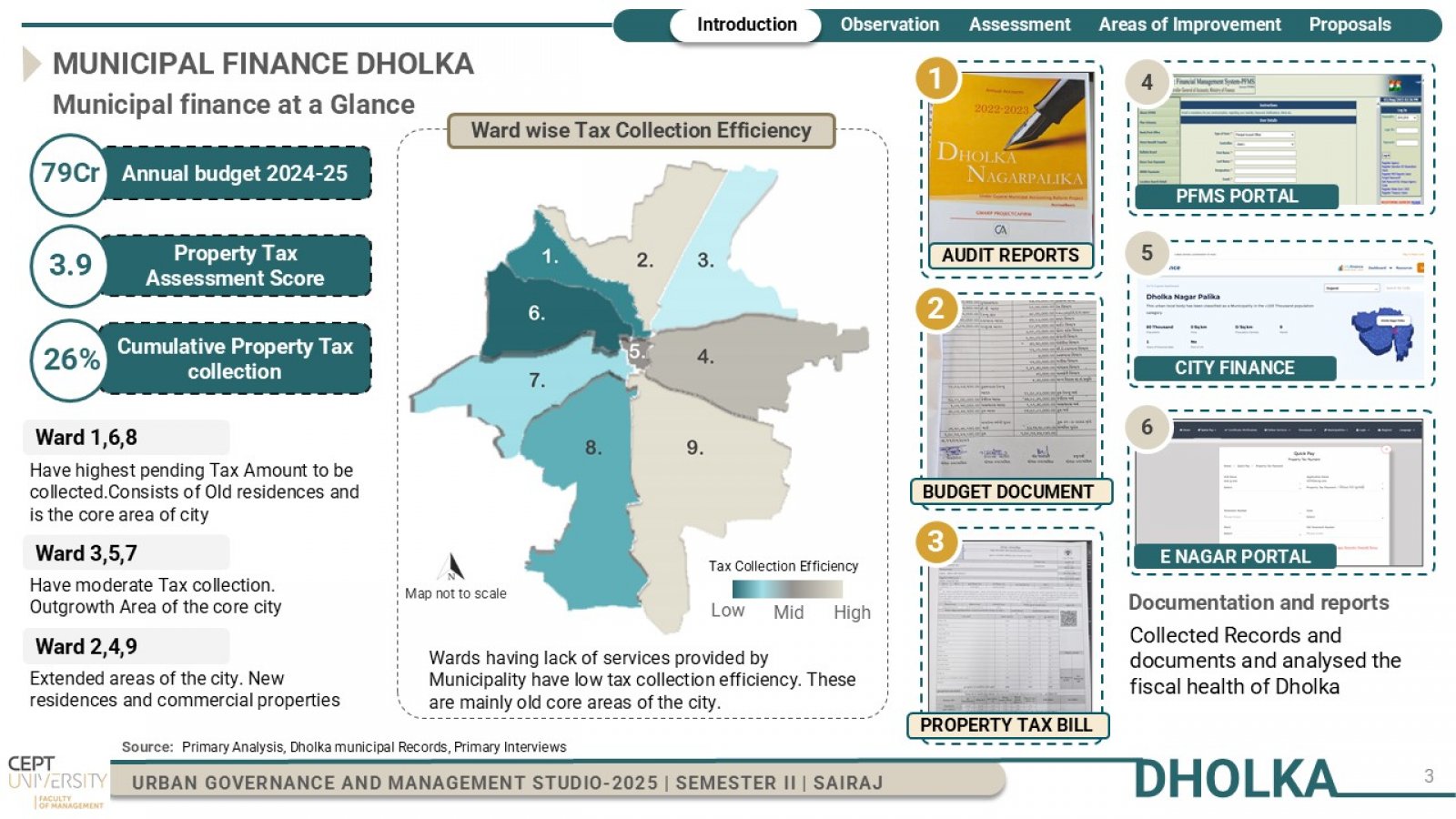

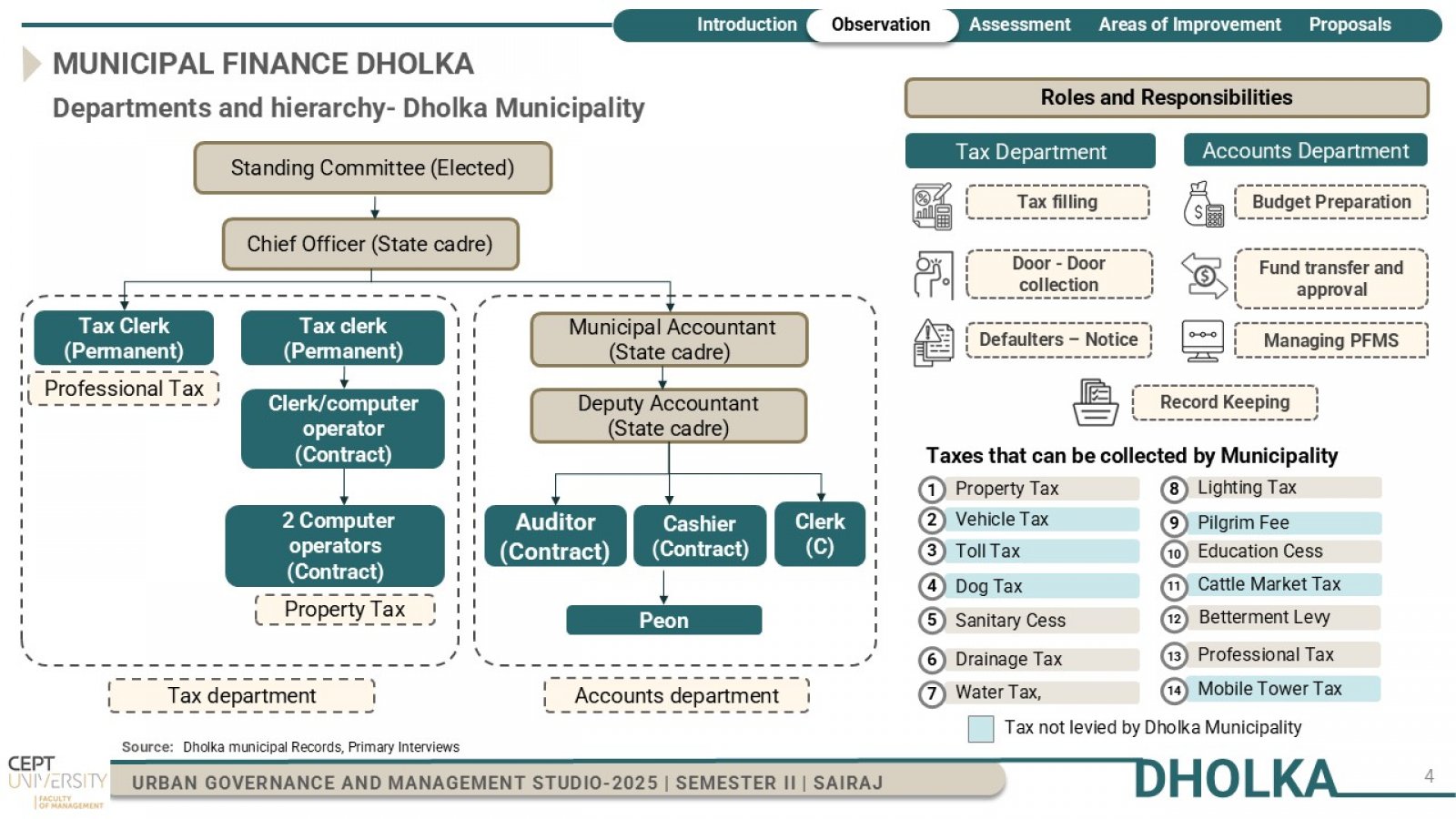

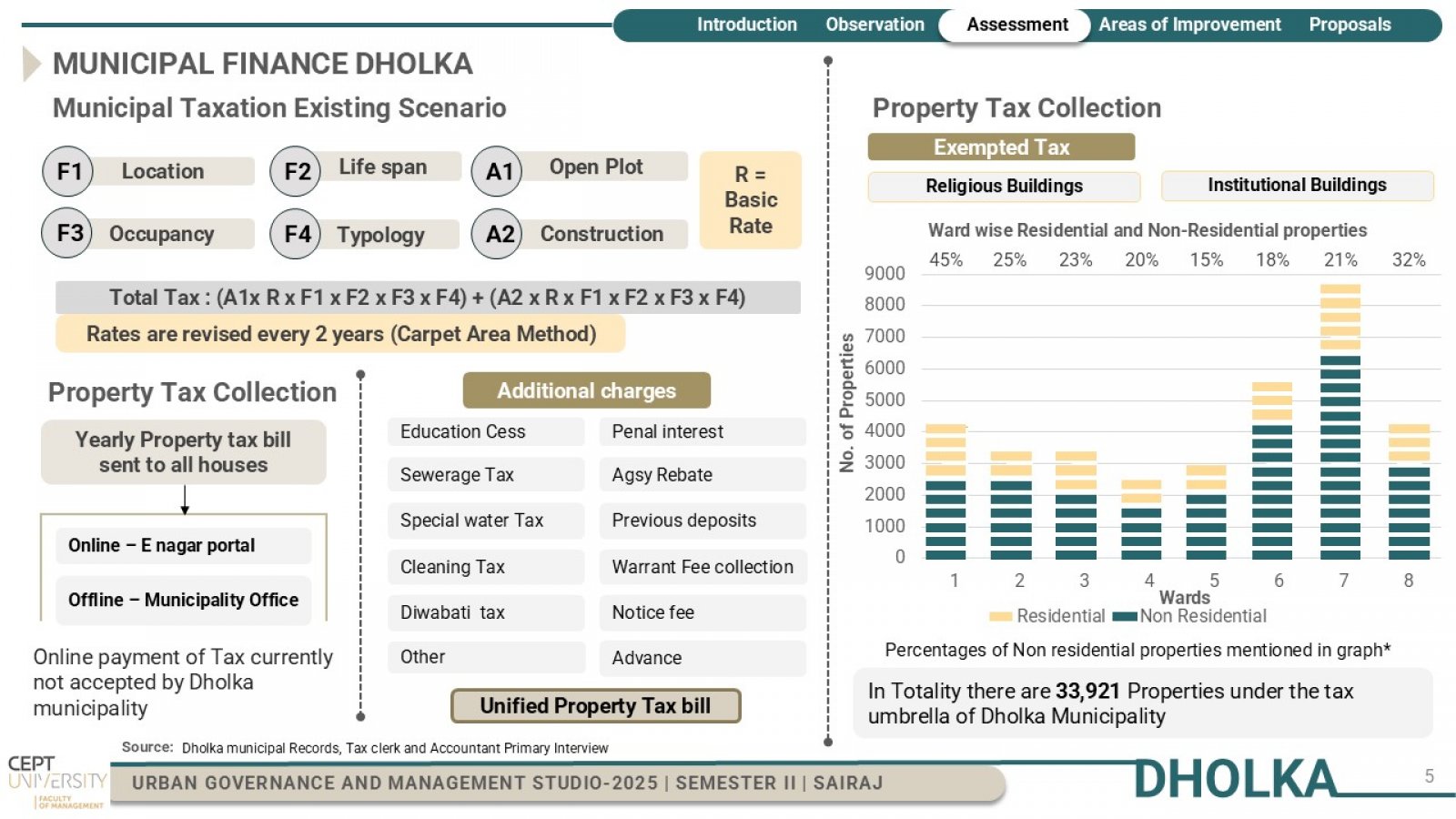

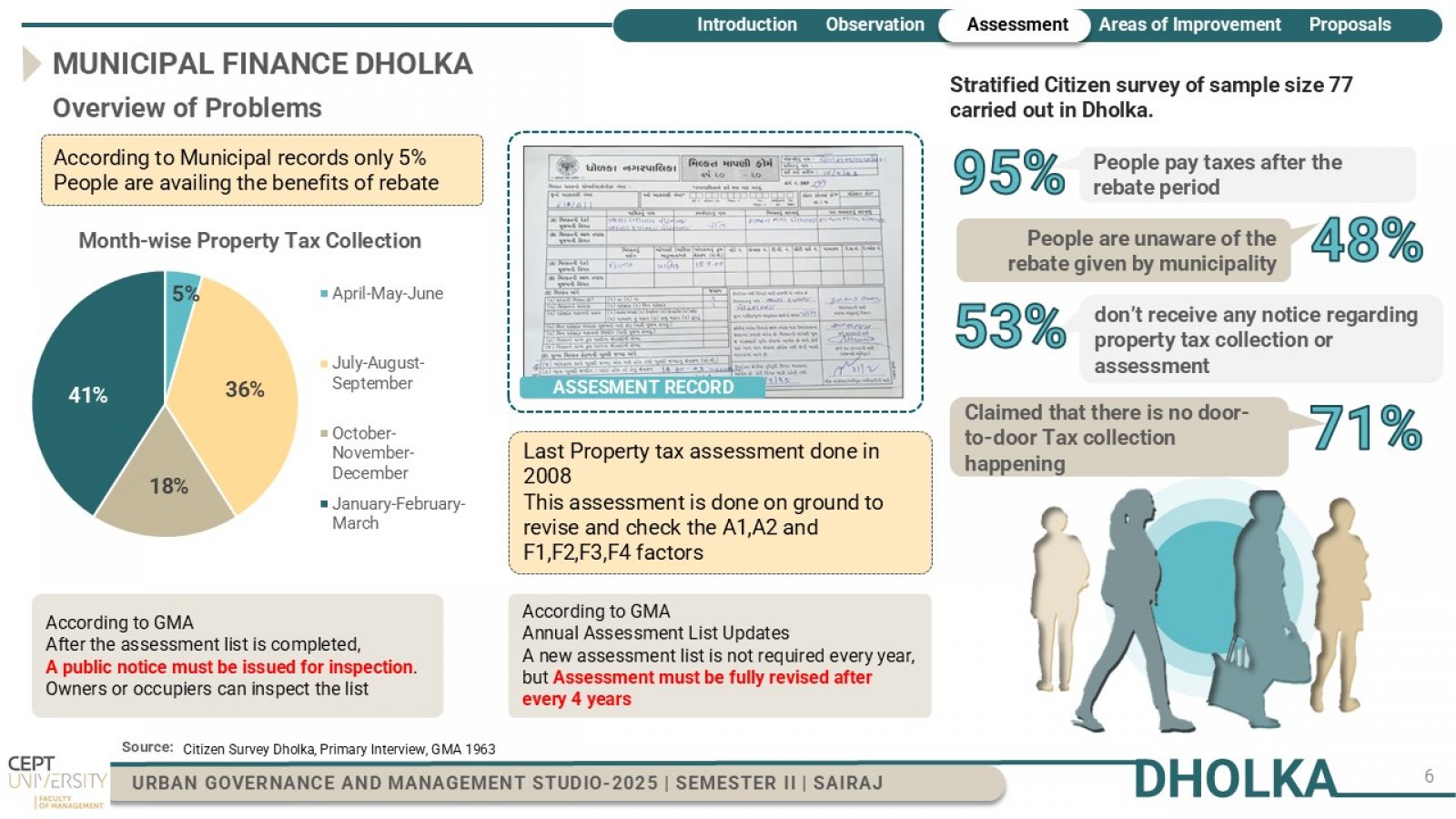

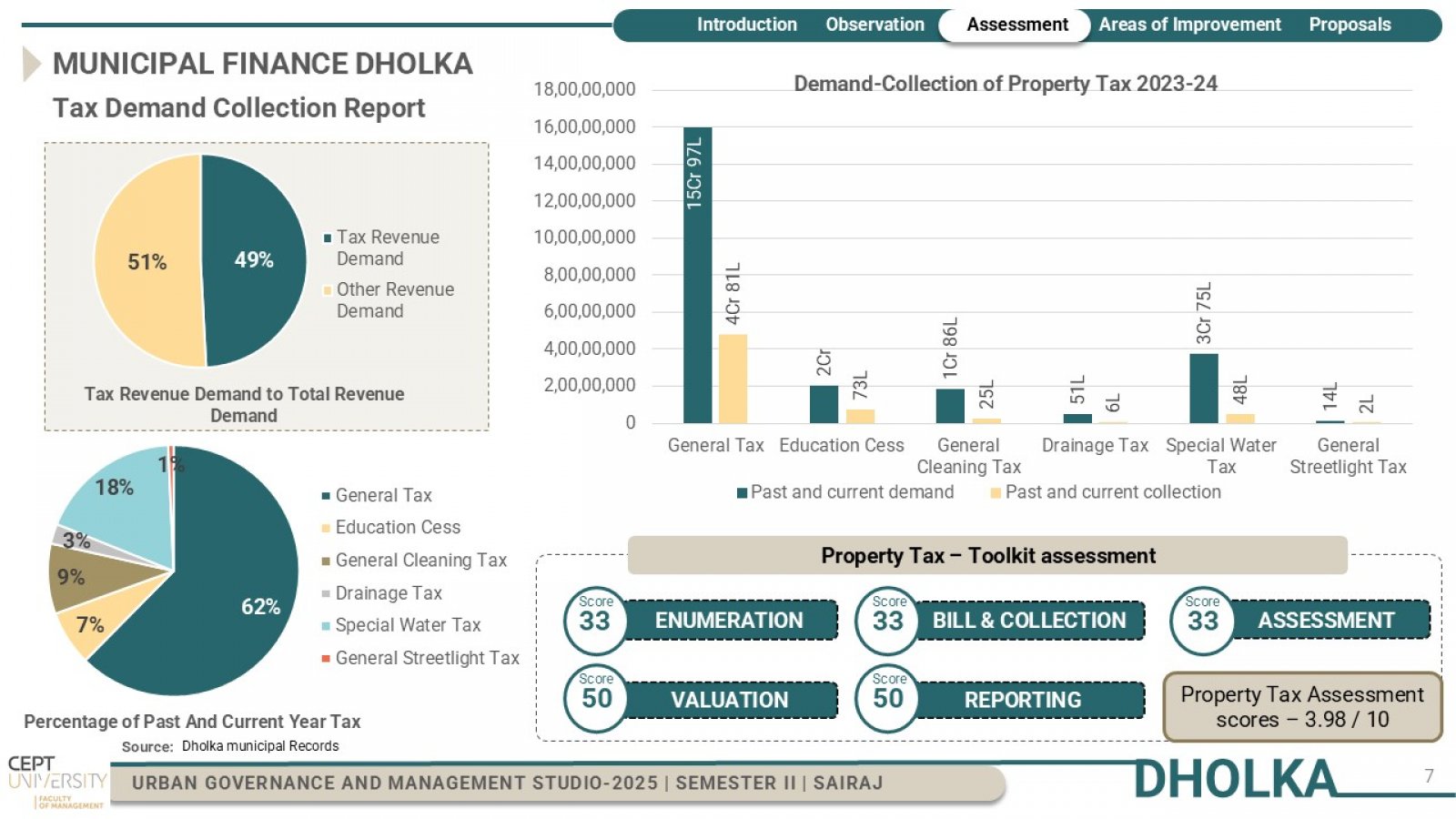

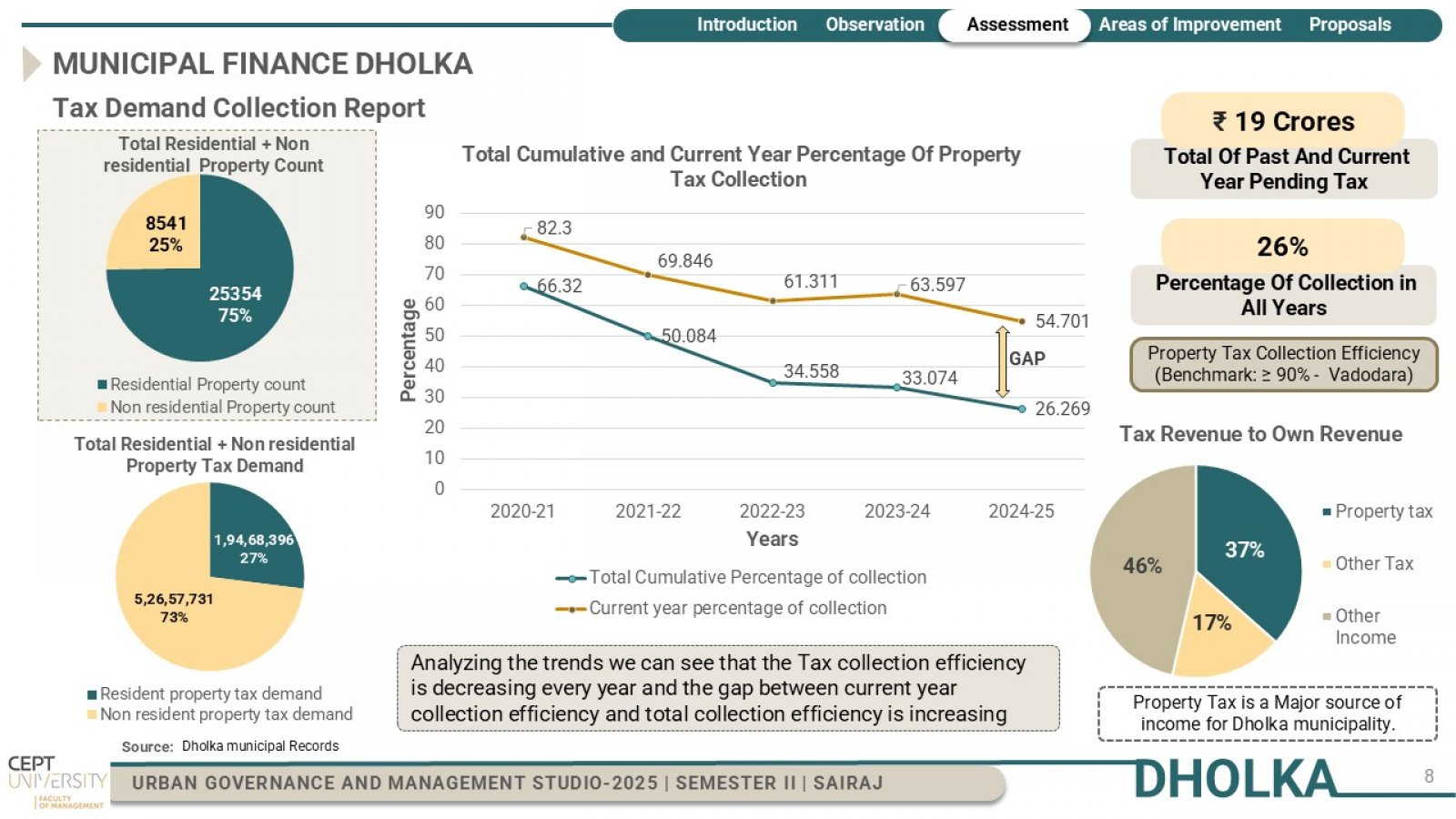

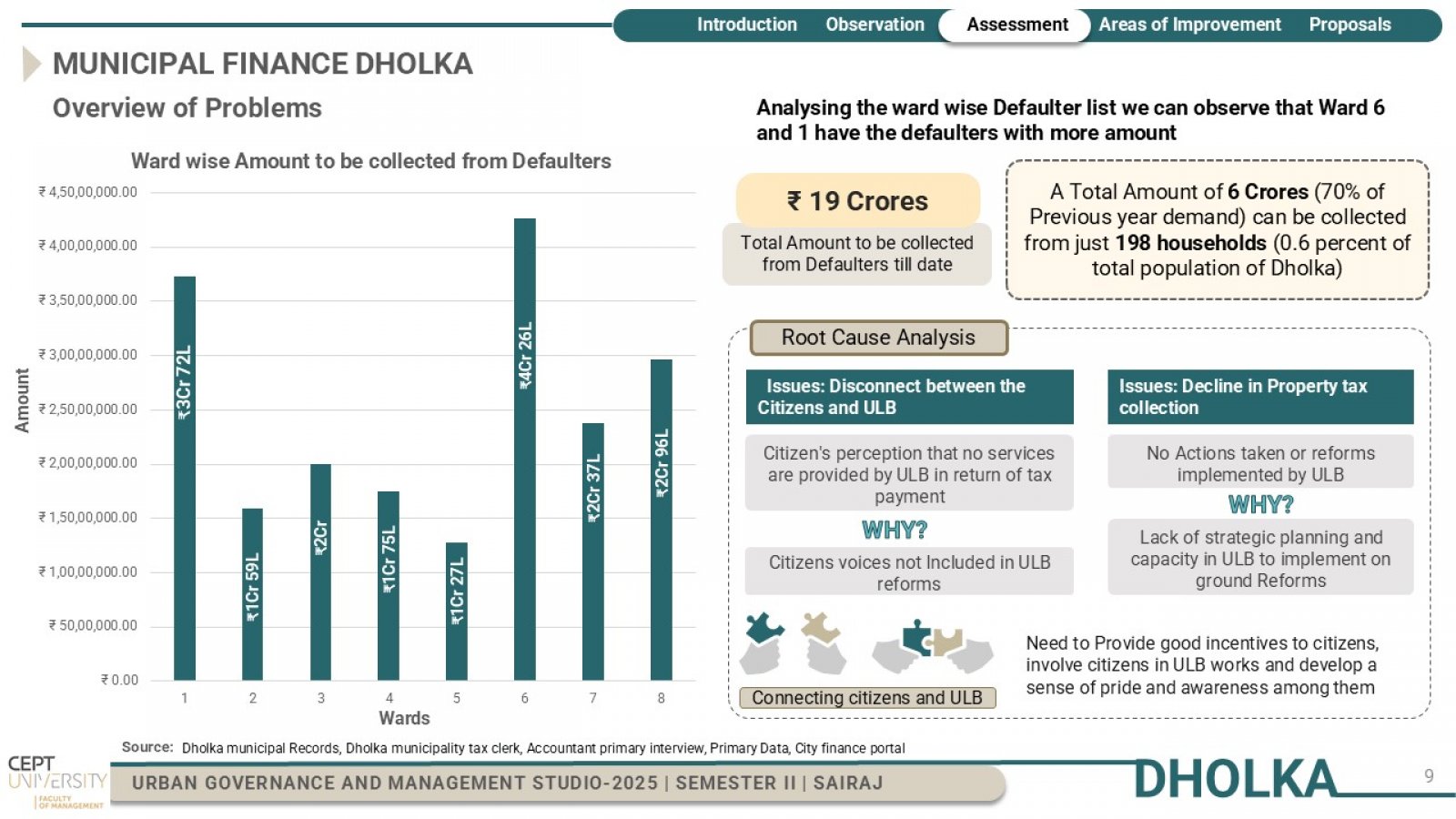

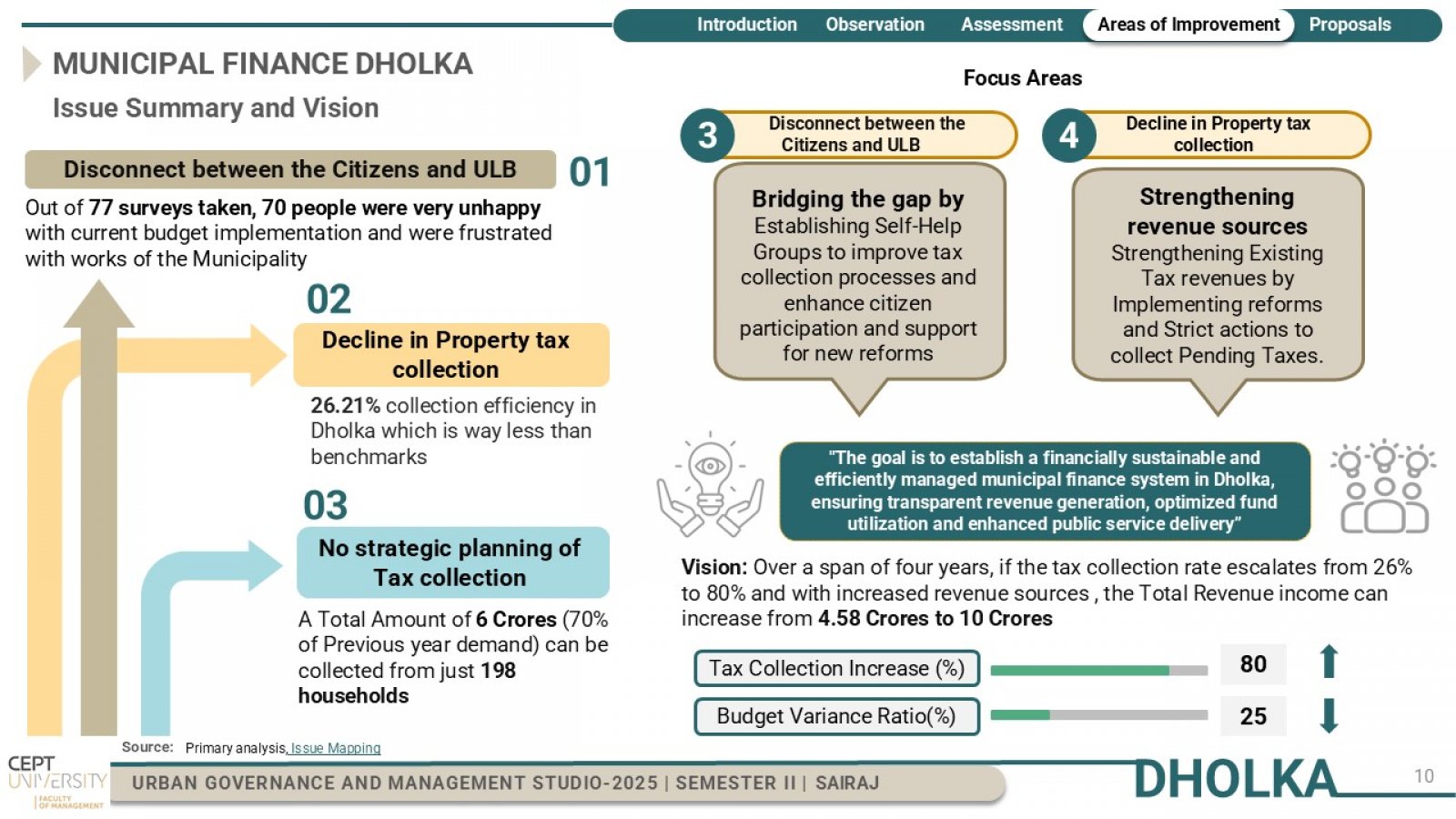

The Municipal Finance system of Dholka Municipality —an evolving Class A municipality—was studied to assess its institutional structure, Taxation practices, and financial planning. The project aimed to understand operational roles, revenue mechanisms, and the overall fiscal health of the municipality. The study examined budget documents, digital finance platforms, and departmental workflows, while field consultations provided insights into administrative challenges and service delivery gaps. Field visits and stakeholder consultations were conducted to study property tax collection, expenditure practices, and grant management. The studio also examined service-level benchmarks and financial indicators to assess the municipality’s fiscal performance over recent years. Through this, a comprehensive understanding of Dholka’s financial management system and its alignment with governance frameworks was developed.